Irs 8919 Form

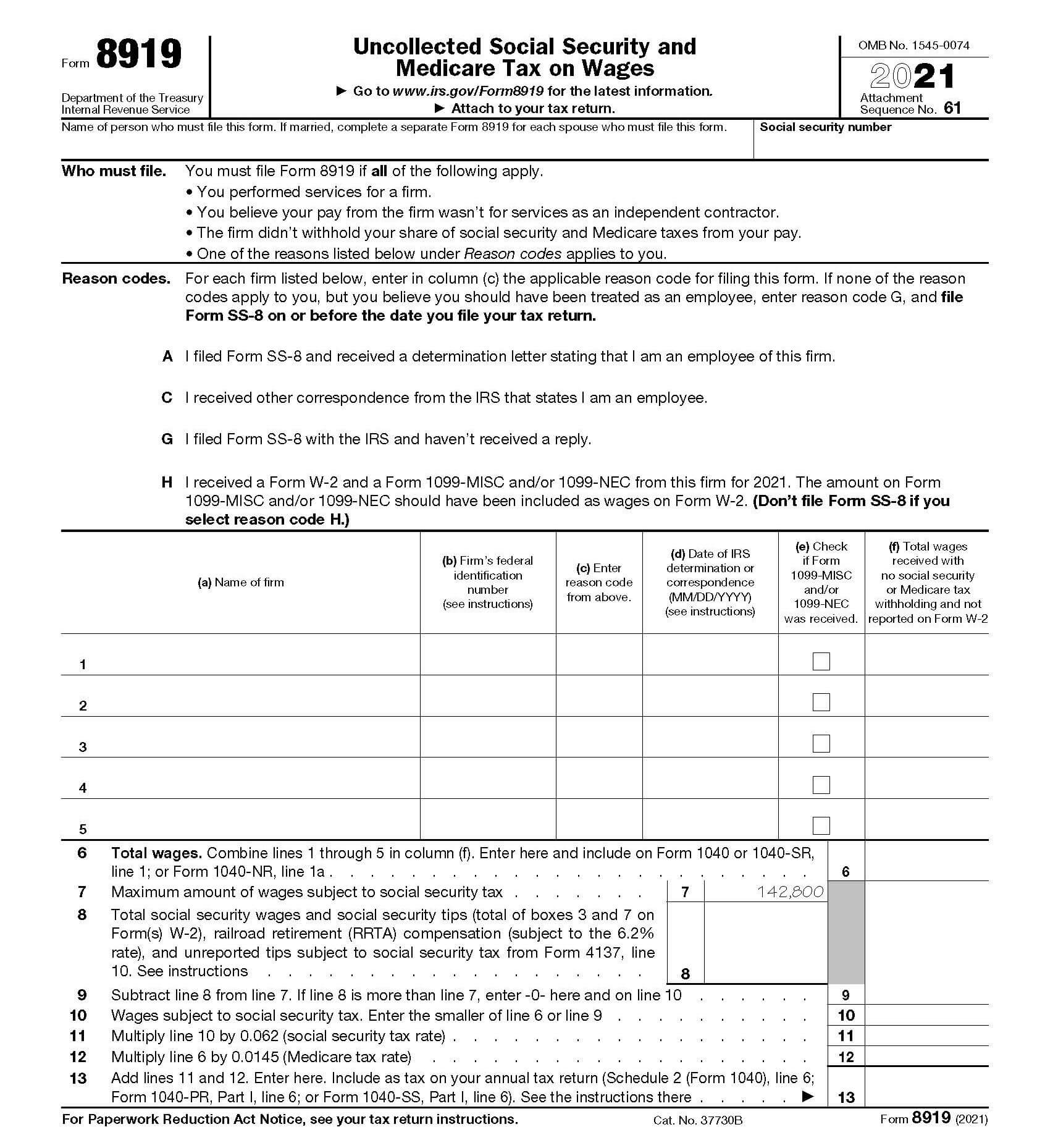

Irs 8919 Form - Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. Web form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their. Web go to www.irs.gov/form8919 for the latest information. Attach to your tax return. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web search for 8919 and then click the jump to 8919 link (if you are just logging into your account, make sure you click the take me to my return button before. Uncollected social security and medicare tax on wages : You performed services for a firm. Web the irs form 8919, or uncollected social security and medicare tax on wages, is an important document utilized by employed individuals who were wrongly. 61 name of person who must file this form.

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. It’s essential for workers who believe they have been misclassified. Per irs form 8919, you must file this form if all of the following apply. Employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8919, a document issued by the internal revenue service (irs), plays a crucial role in the u.s. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Attach to your tax return. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes.

Web irs form 8919 and the employee’s responsibilities. Web the date you file form 8919. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. It’s essential for workers who believe they have been misclassified. 61 name of person who must file this form. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. Web form 8919, a document issued by the internal revenue service (irs), plays a crucial role in the u.s. The taxpayer performed services for an individual or a firm. Employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest.

How to Generate 2011 IRS Schedule D and Form 8949 using www.form8949

Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Web irs form 8919 and the employee’s responsibilities. A 0.9% additional medicare tax. Web the date you file form 8919. Uncollected social security and medicare tax on wages :

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. Per irs form 8919, you must file this form if all of the following apply. Uncollected social security and medicare tax on wages : You performed services for a firm. Web form 8919 is the form.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: You performed services for a firm. Web form 8919, a document issued by the internal revenue service (irs), plays a crucial role in the u.s. Per irs form 8919, you must file this form if all of.

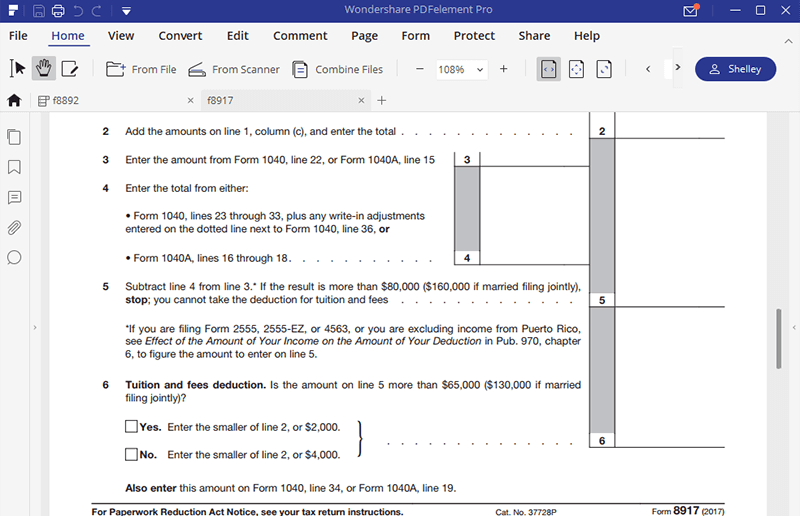

for How to Fill in IRS Form 8917

Per irs form 8919, you must file this form if all of the following apply. Web the date you file form 8919. Web the irs form 8919, or uncollected social security and medicare tax on wages, is an important document utilized by employed individuals who were wrongly. Web irs form 8819, uncollected social security and medicare tax on wages, is.

Fill Free fillable F8919 Accessible 2019 Form 8919 PDF form

You performed services for a firm. 61 name of person who must file this form. 61 name of person who must file this form. Web irs form 8919 and the employee’s responsibilities. It’s essential for workers who believe they have been misclassified.

When to Use IRS Form 8919

Web search for 8919 and then click the jump to 8919 link (if you are just logging into your account, make sure you click the take me to my return button before. Web the date you file form 8919. Form 8959, additional medicare tax. Use form 8919 to figure and report your. 61 name of person who must file this.

how to fill out form 8919 Fill Online, Printable, Fillable Blank

Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. 61 name of person who must file this form. It’s essential for workers who believe they have been misclassified. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax.

1040x2.pdf Irs Tax Forms Social Security (United States)

Employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Web go to www.irs.gov/form8919 for the latest information. Web form 8919 is used by certain employees to report uncollected.

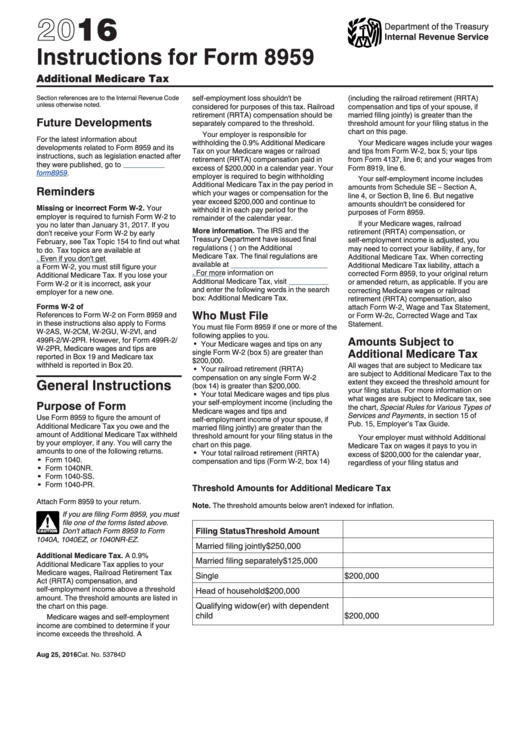

Instructions For Form 8959 2016 printable pdf download

61 name of person who must file this form. Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. Per irs form 8919, you must file this form if all of the following apply. Form 8959, additional medicare tax. Web form 8919.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: The taxpayer performed services for an individual or a firm. 61 name of person who must file this form. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers.

Web Form 8919 Is The Form For Those Who Are Employee But Their Employer Treated Them As An Independent Contractor, Then They Must Calculate And Report Their.

Web search for 8919 and then click the jump to 8919 link (if you are just logging into your account, make sure you click the take me to my return button before. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. Web go to www.irs.gov/form8919 for the latest information. Use form 8919 to figure and report your.

Uncollected Social Security And Medicare Tax On Wages :

The taxpayer performed services for an individual or a firm. Web the date you file form 8919. Web the irs form 8919, or uncollected social security and medicare tax on wages, is an important document utilized by employed individuals who were wrongly. Web form 8919, a document issued by the internal revenue service (irs), plays a crucial role in the u.s.

Web Form 8919, Uncollected Social Security And Medicare Tax On Wages, Will Need To Be Filed If All Of The Following Are True:

Web irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like independent contractors by their. Employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages ago to www.irs.gov/form8919 for the latest. 61 name of person who must file this form.

It’s Essential For Workers Who Believe They Have Been Misclassified.

Per irs form 8919, you must file this form if all of the following apply. Web form 8919 is a solution for independent contractors who have suffered from an employer’s misclassification and now face uncollected social security and medicare. Web we last updated the uncollected social security and medicare tax on wages in december 2022, so this is the latest version of form 8919, fully updated for tax year 2022. A 0.9% additional medicare tax.