Instructions Form 1045

Instructions Form 1045 - They tell you who must file form 945, how to complete it line by line, and when and where to file it. Upload, modify or create forms. Web see the instructions for form 1045. Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. Try it for free now! Use this form 1045 for the earliest within 90 days from the later. The irs will process your application for the applicable tax year. Web the line numbers for prior years can be found in the irs instructions for form 1045. If line 1 is a negative amount, you may have an nol. Complete, edit or print tax forms instantly.

The irs will process your application for the applicable tax year. Upload, modify or create forms. Save or instantly send your ready documents. Use this worksheet for figuring your nol:. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. They tell you who must file form 945, how to complete it line by line, and when and where to file it. Web these instructions give you some background information about form 945. Web if you have certain net operating losses, tax overpayments, or business credits that you can carryback to prior tax years, you may be able to apply for a quick. Ad access irs tax forms. Web the irs uses form 1045 to process tentative refunds for individual taxpayers.

Web form 1045 2022 application for tentative refund department of the treasury internal revenue service for individuals, estates, or trusts. Web if you have certain net operating losses, tax overpayments, or business credits that you can carryback to prior tax years, you may be able to apply for a quick. Refer to irs instructions for form 1045 for additional information about where. Web the line numbers for prior years can be found in the irs instructions for form 1045. The irs will process your application for the applicable tax year. Complete, edit or print tax forms instantly. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. Don't include form 1045 in. Web see the instructions for form 1045. If the taxpayer did not itemize deductions in the carryback year, enter his or.

Instructions For Form 1045 2003 printable pdf download

Web the irs uses form 1045 to process tentative refunds for individual taxpayers. Complete, edit or print tax forms instantly. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¸ · » ¼ application for tentative refund »æ·èêã»äê å¼ ê¾» è»·éëèï äê»èä·â »ì»äë» »è쿹» Web form 1045 2022 application for tentative refund department of the treasury internal revenue service for individuals, estates, or trusts..

Form 1045, page 1

Web these instructions give you some background information about form 945. Don't include form 1045 in. Try it for free now! Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. Web the irs uses form 1045 to process tentative refunds for individual.

Form 1045 Application for Tentative Refund (2014) Free Download

Most entries will be manual. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. Use this worksheet for figuring your nol:. If line 1 is a negative amount, you may have an nol. The irs will.

Instructions For Form 1045 Application For Tentative Refund 2002

Web these instructions give you some background information about form 945. Use this form 1045 for the earliest within 90 days from the later. Complete, edit or print tax forms instantly. If the taxpayer did not itemize deductions in the carryback year, enter his or. Web file form 1045 with the internal revenue service center for the place where you.

Instructions For Form 1045 Application For Tentative Refund 2017

Web see the instructions for form 1045. Easily fill out pdf blank, edit, and sign them. Most entries will be manual. This form is to request a refund of overpayment of tax liability, and must file. Web form 1045 2022 application for tentative refund department of the treasury internal revenue service for individuals, estates, or trusts.

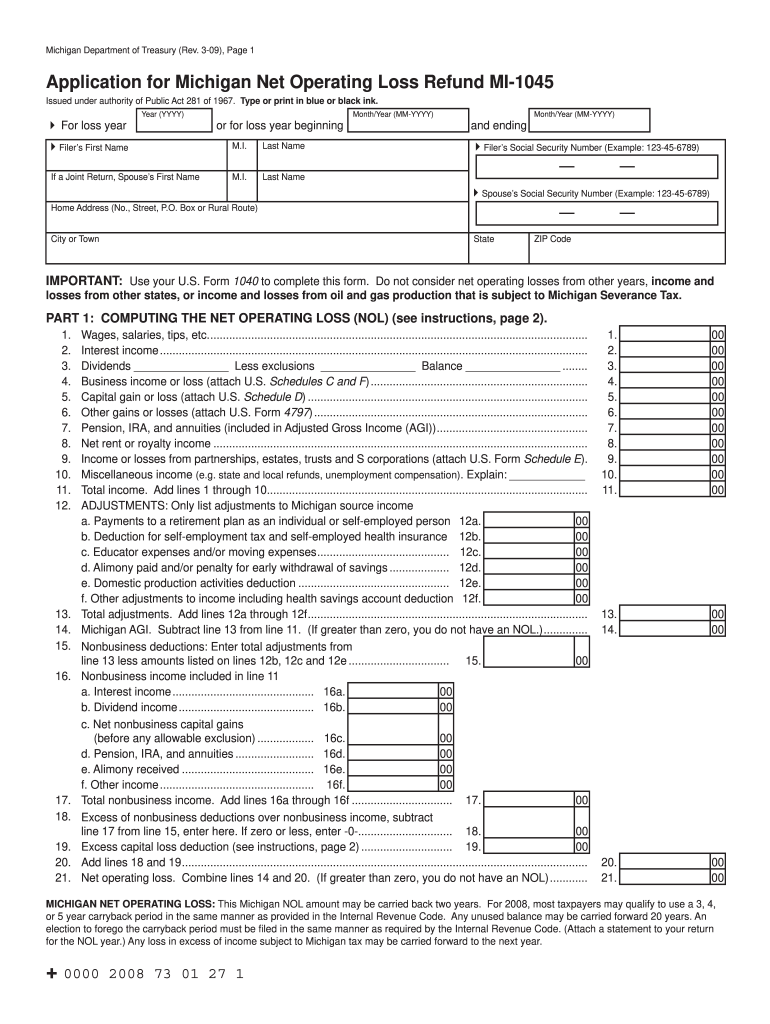

Mi 1045 Fill Online, Printable, Fillable, Blank pdfFiller

Web these instructions give you some background information about form 945. Complete, edit or print tax forms instantly. Ad access irs tax forms. Upload, modify or create forms. Use this worksheet for figuring your nol:.

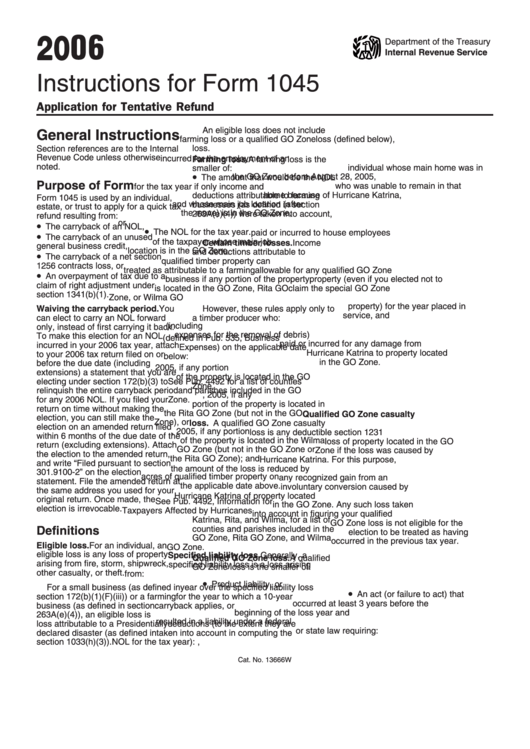

Instructions For Form 1045 Application For Tentative Refund 2006

Try it for free now! Web these instructions give you some background information about form 945. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. Upload, modify or create forms. If the taxpayer did not itemize deductions in the carryback year, enter his or.

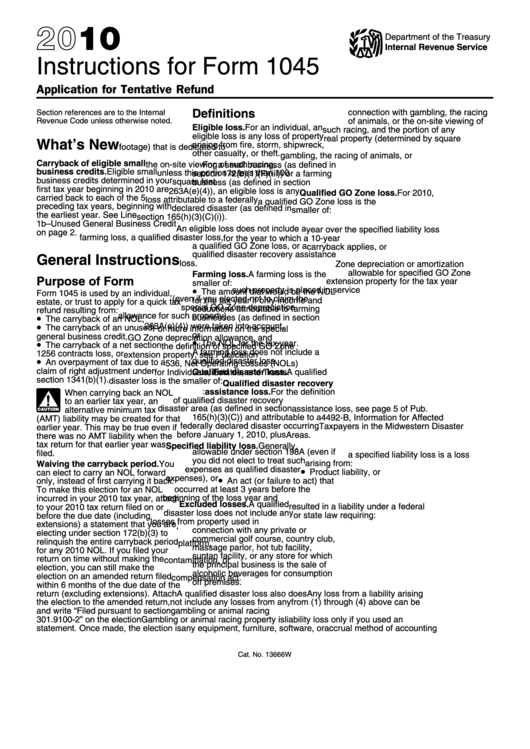

Instructions For Form 1045 Application For Tentative Refund 2010

Save or instantly send your ready documents. The irs will process your application for the applicable tax year. Try it for free now! Web generally, you must file form 1045 within 1 year after the end of the year in which an nol, unused credit, net section 1256 contracts loss, or claim of right adjustment. Web these instructions give you.

1040x instructions for 2016

Use this worksheet for figuring your nol:. Use this form 1045 for the earliest within 90 days from the later. This form is to request a refund of overpayment of tax liability, and must file. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. The irs will process your application.

Instructions for Form 1045 (2017) Internal Revenue Service

Web generally, you must file form 1045 within 1 year after the end of the year in which an nol, unused credit, net section 1256 contracts loss, or claim of right adjustment. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. The irs will process your application for the applicable.

Save Or Instantly Send Your Ready Documents.

Try it for free now! Web proseries doesn't automatically generate form 1045. Generally, you must file form 1045 on or after the date you file your tax return for the nol year, but not later than one year after the end of the nol year. Upload, modify or create forms.

Form 1045, Net Operating Loss Worksheet.

The irs will process your application for the applicable tax year. Web see the instructions for form 1045. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web if you have certain net operating losses, tax overpayments, or business credits that you can carryback to prior tax years, you may be able to apply for a quick.

They Tell You Who Must File Form 945, How To Complete It Line By Line, And When And Where To File It.

Use this worksheet for figuring your nol:. Web schedule a on only one form 1045. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¸ · » ¼ application for tentative refund »æ·èêã»äê å¼ ê¾» è»·éëèï äê»èä·â »ì»äë» »è쿹» This form is to request a refund of overpayment of tax liability, and must file.

Don't Include Form 1045 In.

Easily fill out pdf blank, edit, and sign them. If the taxpayer did not itemize deductions in the carryback year, enter his or. Web these instructions give you some background information about form 945. Web form 1045 2022 application for tentative refund department of the treasury internal revenue service for individuals, estates, or trusts.