Instructions For Form 8839

Instructions For Form 8839 - Do not file draft forms. Web this morning it was feb. 10 minutes watch video learn about the process know your options. Web to generate form 8839 to receive the adoption credit: Children if you made more than one attempt to adopt one eligible u.s. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer's qualified expenses. Web overview the internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility. I actually called 4 different tax preparer companies and they all said the form was not ready. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless.

Children if you made more than one attempt to adopt one eligible u.s. Web to generate form 8839 to receive the adoption credit: Not sure exactly when it will be. You can claim both the credit and. Web follow these steps to generate form 8839: 10 minutes watch video learn about the process know your options. Web form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer's qualified expenses. Qualified adoption expenses qualified adoption expenses. Web solved • by intuit • 7 • updated february 23, 2023. Child, combine the amounts you spent.

Web follow these steps to generate form 8839: Not sure exactly when it will be. Once completed you can sign your. Child, combine the amounts you spent. Web irs form 8839 instructions by forrest baumhover march 24, 2023 reading time: Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Web overview the internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility. To override the adoption credit how do i enter this credit information in the program? I actually called 4 different tax preparer companies and they all said the form was not ready. Enter the adopted child's personal information under the eligible children.

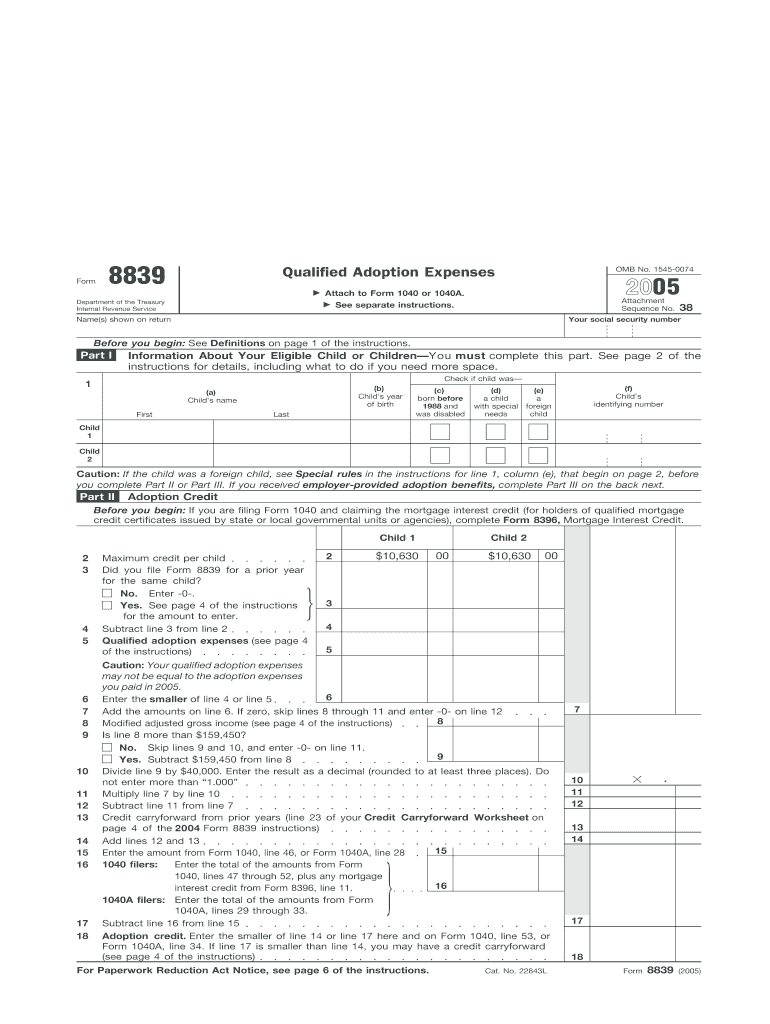

Form 8839 Qualified Adoption Expenses (2015) Free Download

Below are the most popular resources associated with form 8839: Web the instructions for form 8839 state: Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is.

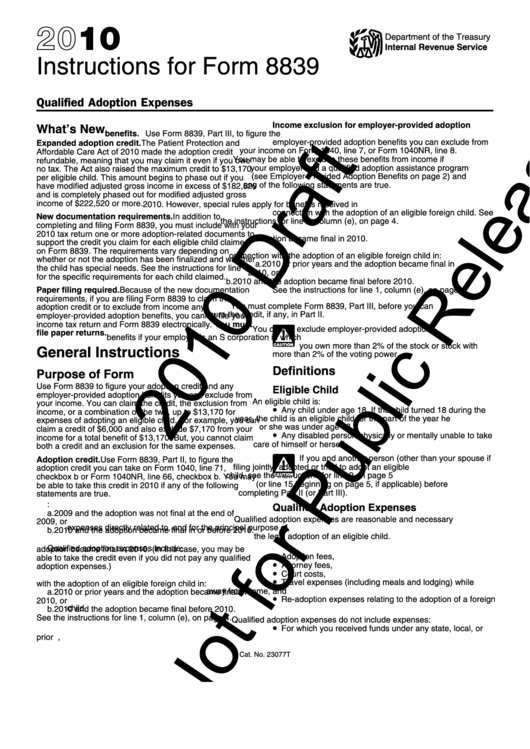

Draft Instructions For Form 8839 Qualified Adoption Expenses 2010

Do not file draft forms. Once completed you can sign your. Not sure exactly when it will be. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless. Web to generate form 8839 to receive the adoption credit:

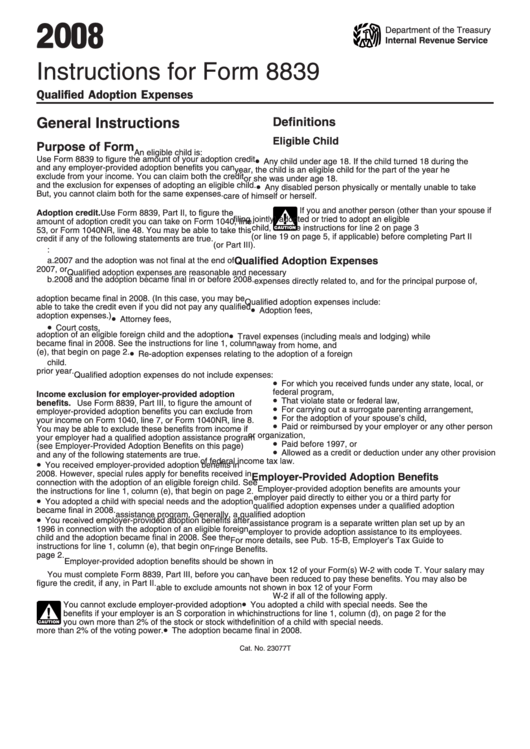

Instructions For Form 8839 2008 printable pdf download

Web overview the internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility. Enter the adopted child's personal information under the eligible children. 10 minutes watch video learn about the process know your options. Do not file draft forms. Not sure exactly when it will.

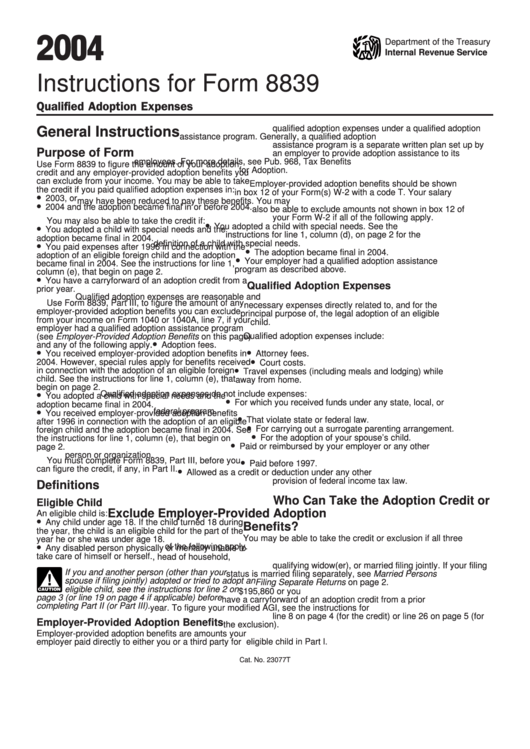

Instructions For Form 8839 Qualified Adoption Expenses 2004

Not sure exactly when it will be. Go to screen 37, adoption credit (8839). Web the instructions for form 8839 state: Use fill to complete blank online irs pdf forms for free. 10 minutes watch video learn about the process know your options.

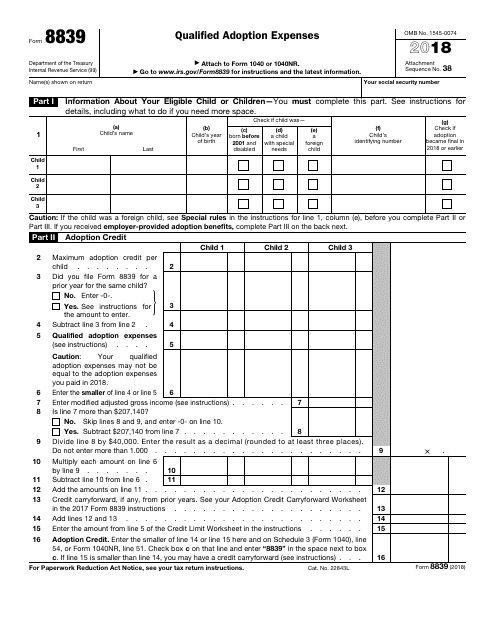

IRS Form 8839 2018 Fill Out, Sign Online and Download Fillable PDF

Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Web solved • by intuit • 7 • updated february 23, 2023. Once completed you can sign your. Below are the most popular resources associated with form 8839: Web to generate form 8839 to receive.

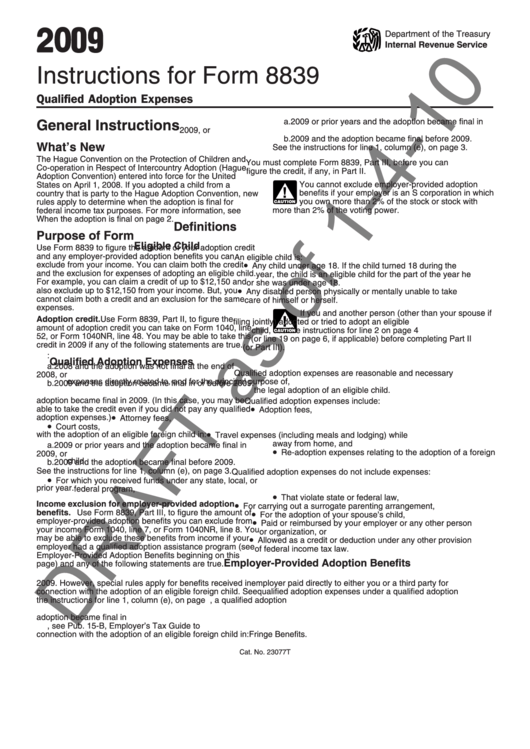

Instructions For Form 8839 Draft 2009 printable pdf download

Not sure exactly when it will be. Web solved • by intuit • 7 • updated february 23, 2023. Web form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer's qualified expenses. Once completed you can sign your. Web to generate form 8839 to receive the adoption credit:

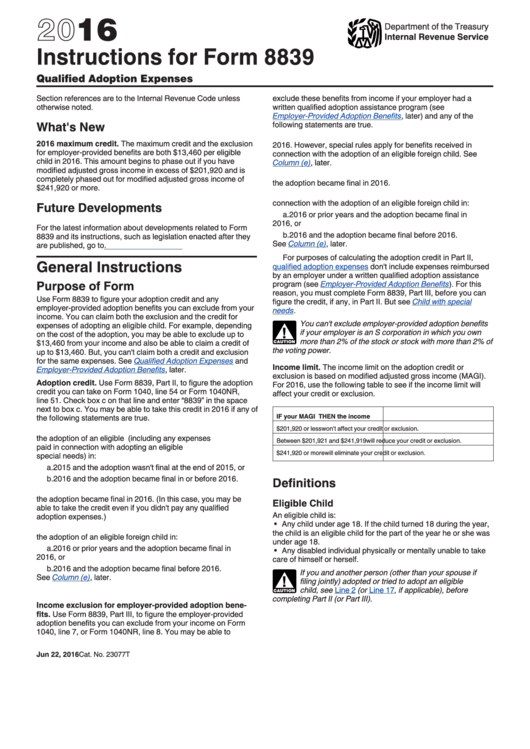

2016 Instructions For Form 8839 printable pdf download

Web solved • by intuit • 7 • updated february 23, 2023. Web to generate form 8839 to receive the adoption credit: Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Child, combine the amounts you spent. Web fill online, printable, fillable, blank f8839 2019 form.

How to Take Adoption Tax Credit for Failed Adoption Pocket Sense

Qualified adoption expenses qualified adoption expenses. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless. Enter the adopted child's personal information under the eligible children. Web follow these steps to generate form 8839: You can claim both the credit and.

Irs Form 8839 Instructions Fill Out and Sign Printable PDF Template

Enter the adopted child's personal information under the eligible children. Web overview the internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility. You can claim both the credit and. Web to generate form 8839 to receive the adoption credit: Once completed you can sign.

Form 8839Qualified Adoption Expenses

Below are the most popular resources associated with form 8839: Web solved • by intuit • 7 • updated february 23, 2023. Enter the adopted child's personal information under the eligible children. Web this morning it was feb. Children if you made more than one attempt to adopt one eligible u.s.

Do Not File Draft Forms.

10 minutes watch video learn about the process know your options. Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Enter the adopted child's personal information under the eligible children. Web this morning it was feb.

Qualified Adoption Expenses Qualified Adoption Expenses.

Children if you made more than one attempt to adopt one eligible u.s. You can claim both the credit and. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless. Web to generate form 8839 to receive the adoption credit:

Web Follow These Steps To Generate Form 8839:

Web solved • by intuit • 7 • updated february 23, 2023. Web irs form 8839 instructions by forrest baumhover march 24, 2023 reading time: Web the instructions for form 8839 state: Not sure exactly when it will be.

Once Completed You Can Sign Your.

Use fill to complete blank online irs pdf forms for free. Go to screen 37, adoption credit (8839). Web form 8839 is used to calculate the allowable credit of an eligible child based on the taxpayer's qualified expenses. I actually called 4 different tax preparer companies and they all said the form was not ready.