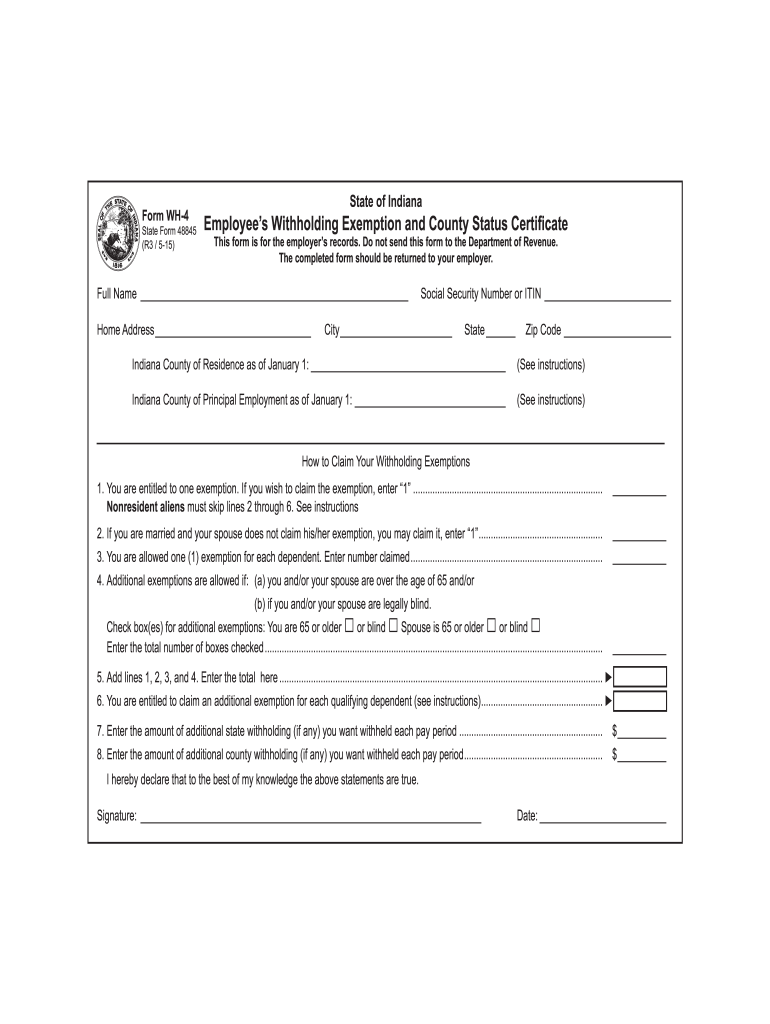

Indiana Wh4 Form

Indiana Wh4 Form - Register and file this tax online via intime. Show details we are not affiliated with any brand or entity on this. The first question is 1. These are state and county taxes that. If too little is withheld, you will generally owe tax when you file your tax return. Underpayment of indiana withholding filing. You can also download it, export it or print it out. If too little is withheld, you will generally owe tax when you file your tax return. Web register and file this tax online via intime. Web prior year tax forms can be found in the indiana state prior year tax forms webpage.

Web register and file this tax online via intime. Register and file this tax online via intime. Choose the correct version of the editable pdf form. If you have employees working at your business, you’ll need to collect withholding taxes. Show details we are not affiliated with any brand or entity on this. Not seeing the form you need? Underpayment of indiana withholding filing. Web send wh 4 form 2019 via email, link, or fax. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return.

Web send wh 4 form 2019 via email, link, or fax. If too little is withheld, you will generally owe tax when you file your tax return. You are entitled to one exemption. The first question is 1. Choose the correct version of the editable pdf form. Show details we are not affiliated with any brand or entity on this. Edit your 2019 indiana state withholding form online. You can also download it, export it or print it out. Register and file this tax online via intime. Web prior year tax forms can be found in the indiana state prior year tax forms webpage.

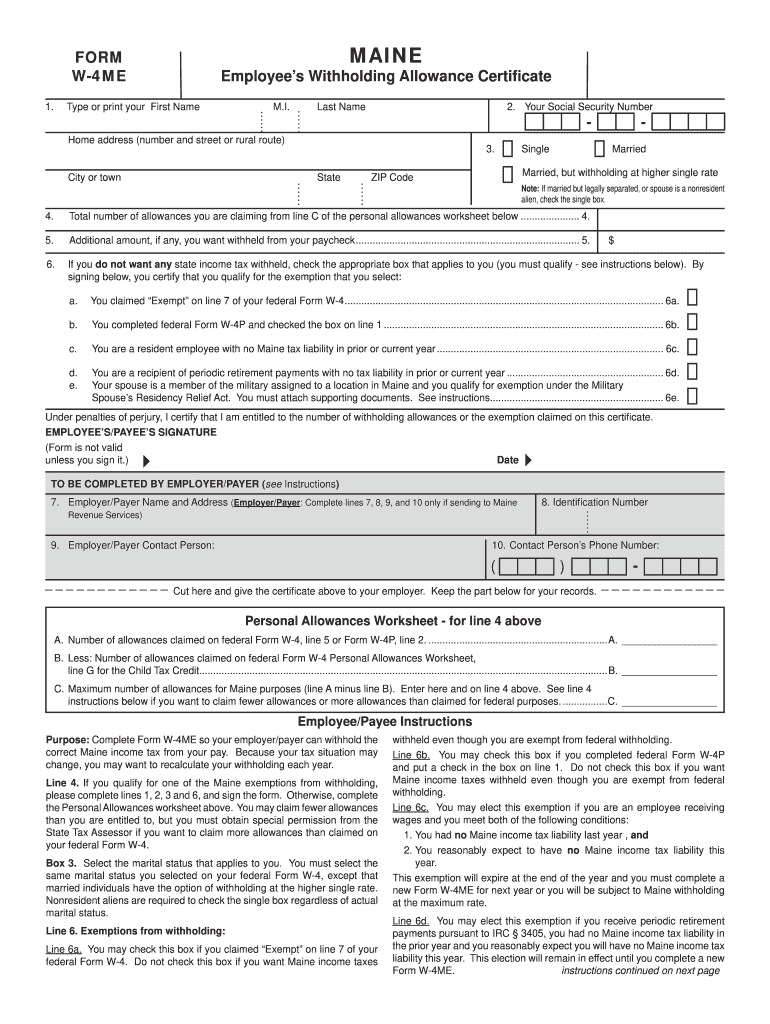

W4me 20202021 Fill and Sign Printable Template Online US Legal Forms

Not seeing the form you need? Edit your 2019 indiana state withholding form online. Web send wh 4 form 2019 via email, link, or fax. Register and file this tax online via intime. Web find and fill out the correct indiana wh 4 1999 form.

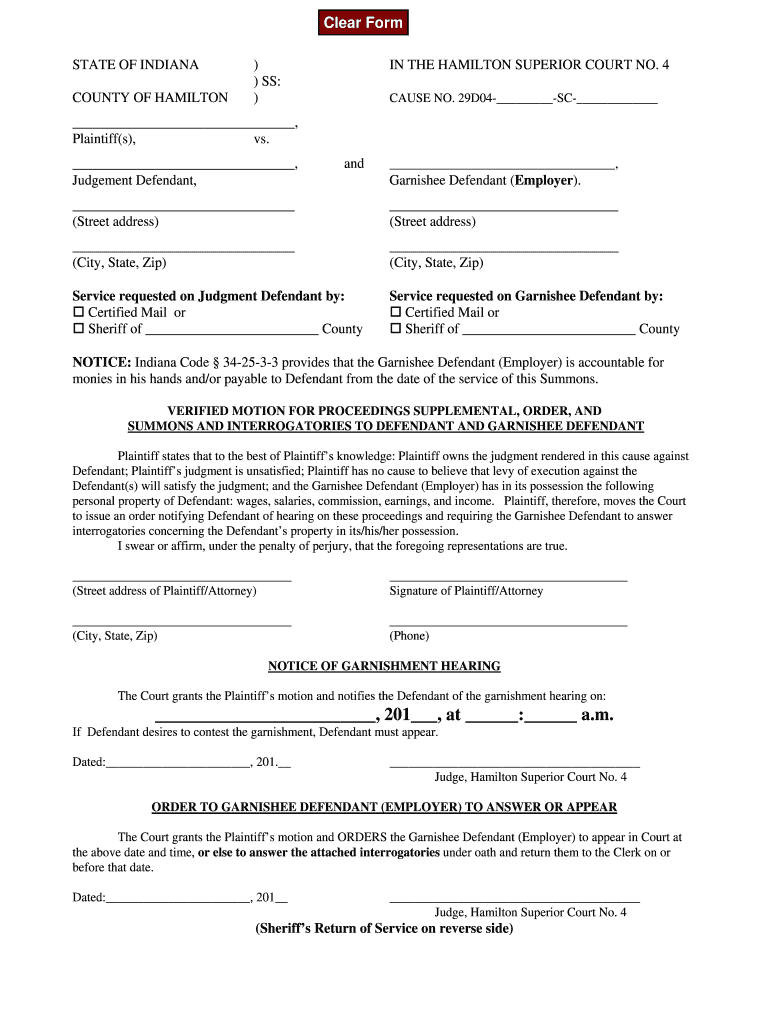

Motion For Proceedings Supplemental Indiana Form Fill Online

These are state and county taxes that. Edit your 2019 indiana state withholding form online. Web send wh 4 form 2019 via email, link, or fax. If too little is withheld, you will generally owe tax when you file your tax return. Web register and file this tax online via intime.

1996 IN Form 46800 Fill Online, Printable, Fillable, Blank pdfFiller

Underpayment of indiana withholding filing. Register and file this tax online via intime. If too little is withheld, you will generally owe tax when you file your tax return. You are entitled to one exemption. If you have employees working at your business, you’ll need to collect withholding taxes.

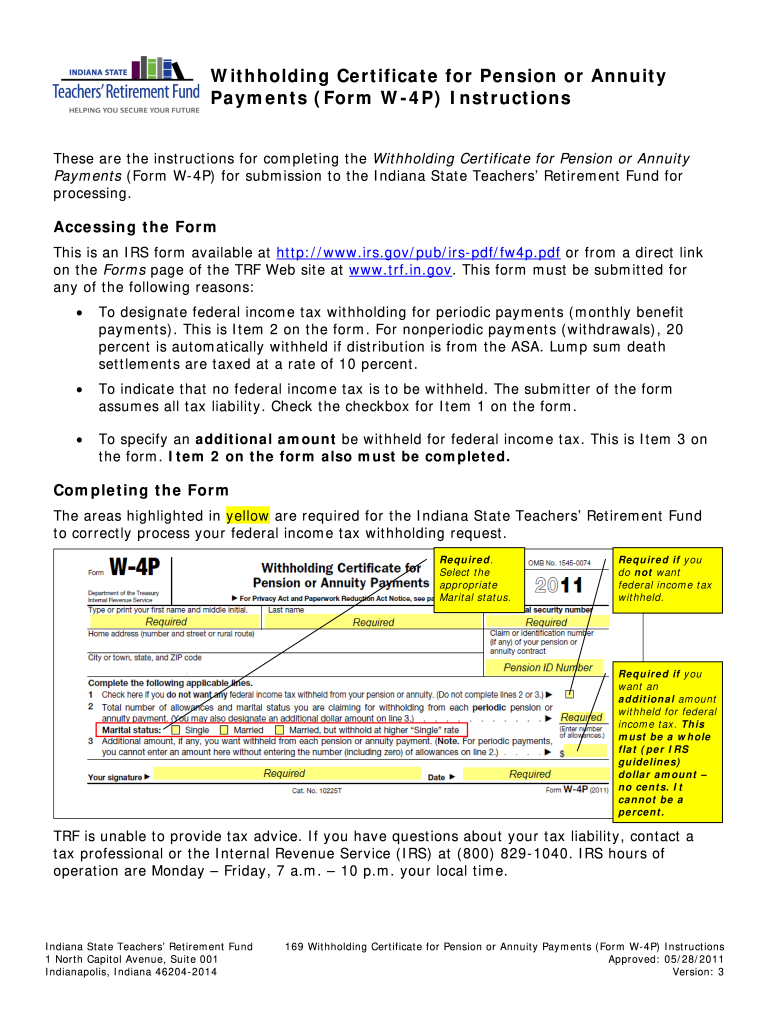

2011 Form IN SF 39530 Fill Online, Printable, Fillable, Blank pdfFiller

You are entitled to one exemption. When completed correctly, this form ensures that. Web find and fill out the correct indiana wh 4 1999 form. Web prior year tax forms can be found in the indiana state prior year tax forms webpage. Not seeing the form you need?

WH4 YouTube

Web prior year tax forms can be found in the indiana state prior year tax forms webpage. Underpayment of indiana withholding filing. These are state and county taxes that. If too little is withheld, you will generally owe tax when you file your tax return. Web find and fill out the correct indiana wh 4 1999 form.

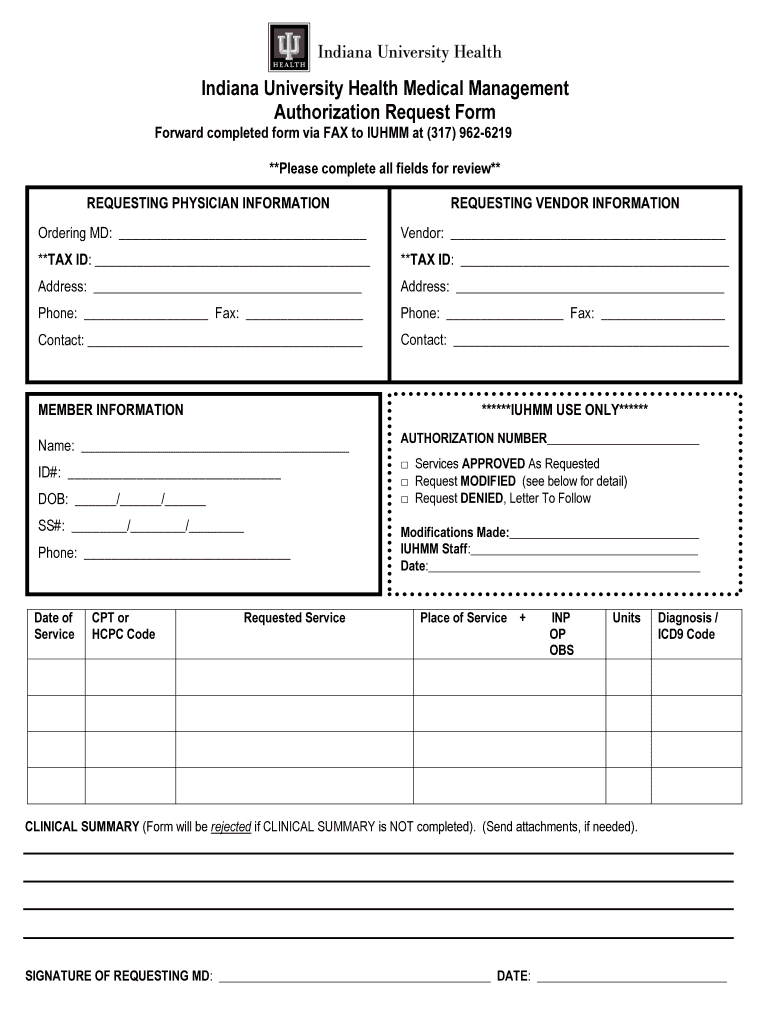

Indiana University Health Form Fill Online, Printable, Fillable

Register and file this tax online via intime. Web register and file this tax online via intime. When completed correctly, this form ensures that. Show details we are not affiliated with any brand or entity on this. If you have employees working at your business, you’ll need to collect withholding taxes.

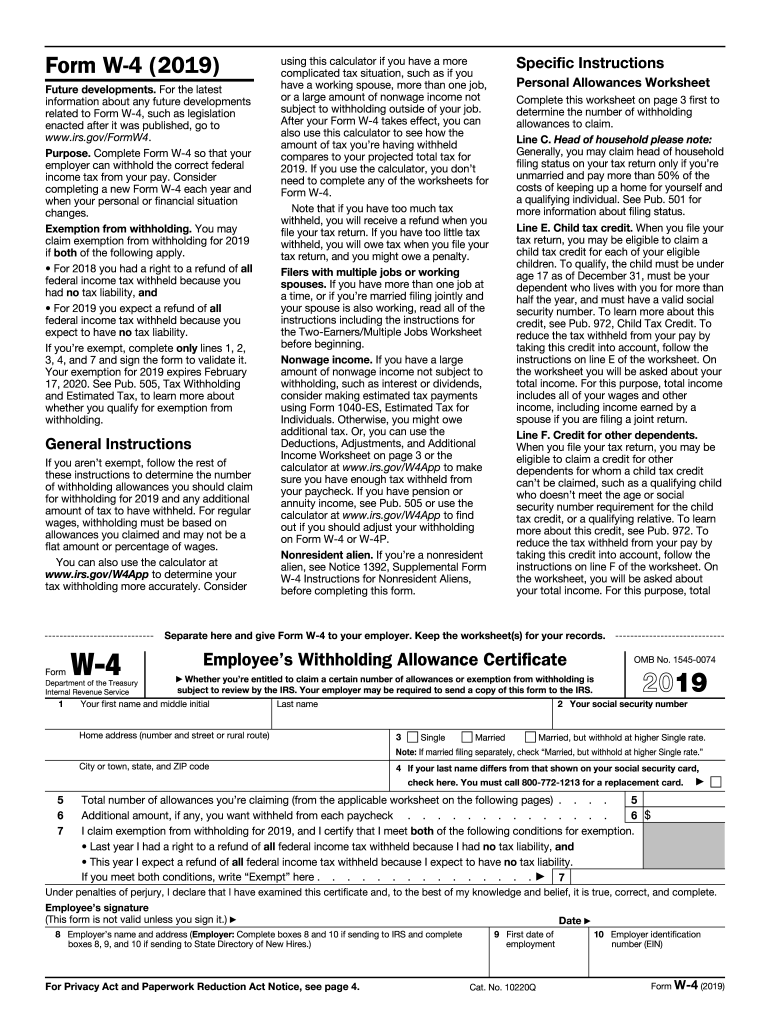

IRS W4 2020 Fill and Sign Printable Template Online US Legal Forms

Register and file this tax online via intime. You are entitled to one exemption. Web find and fill out the correct indiana wh 4 1999 form. These are state and county taxes that. When completed correctly, this form ensures that.

Indiana W4 Fill Out and Sign Printable PDF Template signNow

If you have employees working at your business, you’ll need to collect withholding taxes. These are state and county taxes that. Web send wh 4 form 2019 via email, link, or fax. You can also download it, export it or print it out. When completed correctly, this form ensures that.

Indiana wh4 form Fill out & sign online DocHub

Web prior year tax forms can be found in the indiana state prior year tax forms webpage. You can also download it, export it or print it out. Register and file this tax online via intime. If too little is withheld, you will generally owe tax when you file your tax return. Not seeing the form you need?

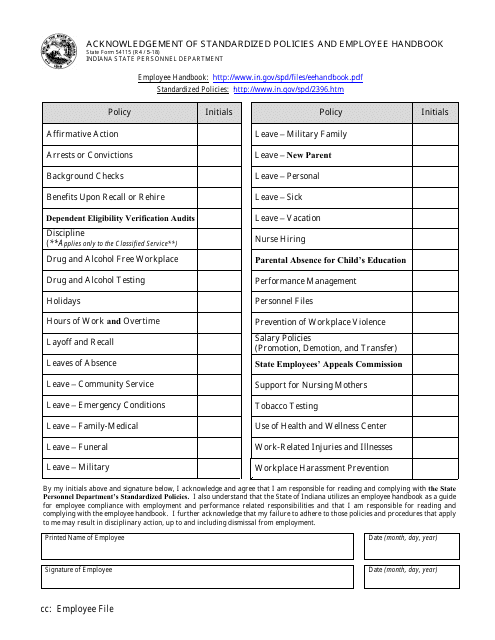

State Form 54115 Download Printable PDF or Fill Online Acknowledgement

If too little is withheld, you will generally owe tax when you file your tax return. Web find and fill out the correct indiana wh 4 1999 form. Underpayment of indiana withholding filing. Show details we are not affiliated with any brand or entity on this. Choose the correct version of the editable pdf form.

Web Find And Fill Out The Correct Indiana Wh 4 1999 Form.

These are state and county taxes that. Register and file this tax online via intime. Web register and file this tax online via intime. If you have employees working at your business, you’ll need to collect withholding taxes.

Web Send Wh 4 Form 2019 Via Email, Link, Or Fax.

If too little is withheld, you will generally owe tax when you file your tax return. Not seeing the form you need? Edit your 2019 indiana state withholding form online. Choose the correct version of the editable pdf form.

When Completed Correctly, This Form Ensures That.

You are entitled to one exemption. Web prior year tax forms can be found in the indiana state prior year tax forms webpage. The first question is 1. You can also download it, export it or print it out.

Underpayment Of Indiana Withholding Filing.

If too little is withheld, you will generally owe tax when you file your tax return. Show details we are not affiliated with any brand or entity on this.