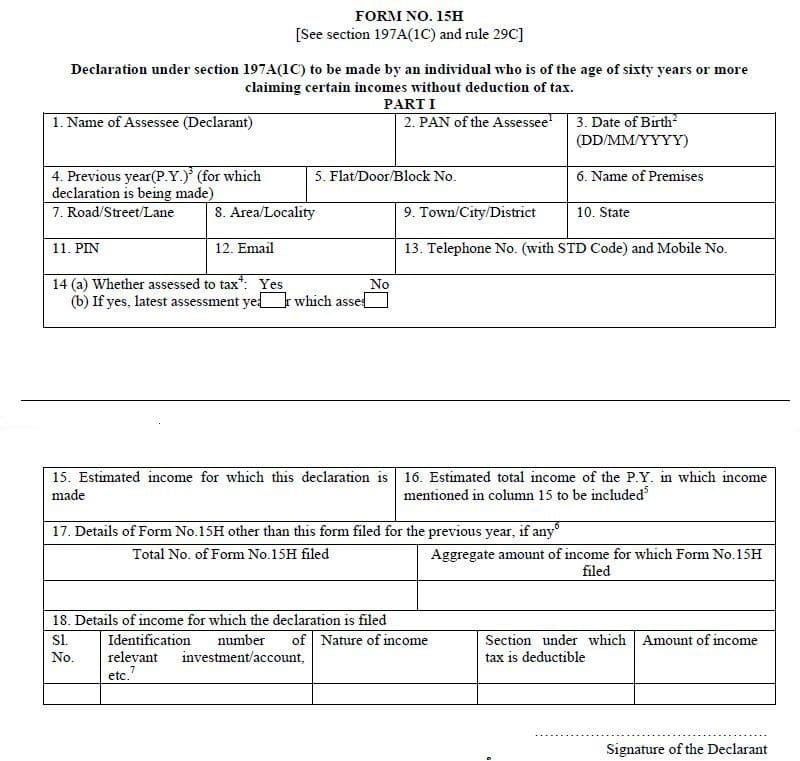

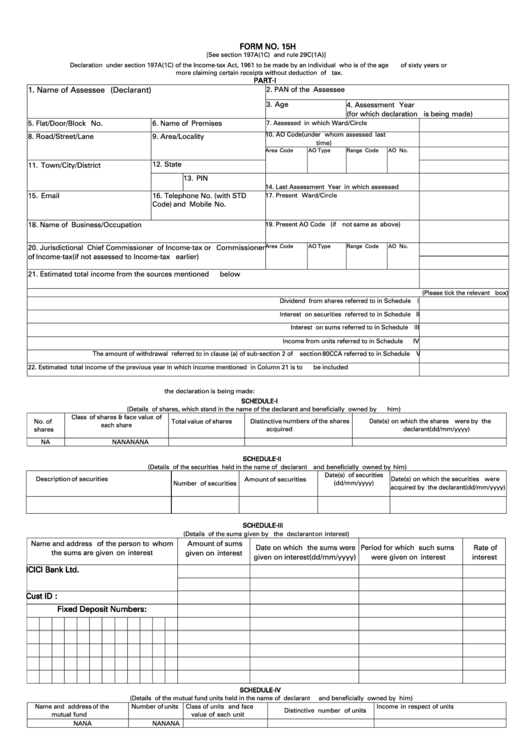

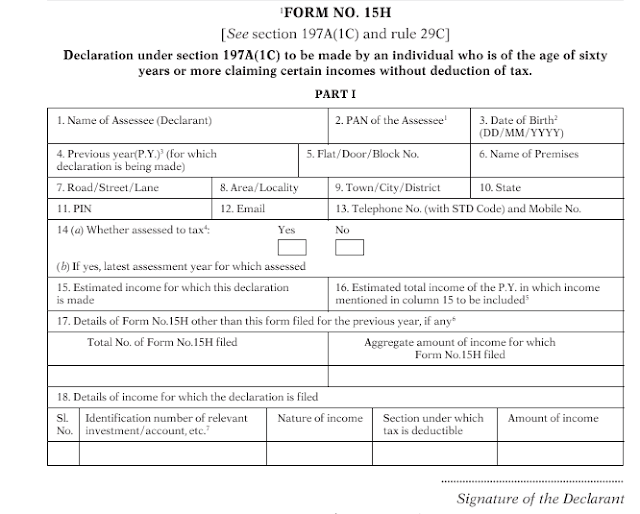

Income Tax Form 15H

Income Tax Form 15H - Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. These forms are used to declare that an individual's income is. Quarterly payroll and excise tax returns normally due on may 1. Fill out the application below. 13844 (january 2018) application for reduced user fee for installment agreements. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. Web low income home energy assistance program (liheap) how to apply for liheap 1. Form 15h is a very popular form among investors and taxpayers. Updated on 30 sep, 2022. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a.

Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. It is to be filed every financial year at the beginning of the year. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. This is a request to reduce the tds burden on interest earned on recurring deposits or. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. 13844 (january 2018) application for reduced user fee for installment agreements. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Fill out the application below. Form 15h is a very popular form among investors and taxpayers. Web low income home energy assistance program (liheap) how to apply for liheap 1.

Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. Web low income home energy assistance program (liheap) how to apply for liheap 1. These forms are used to declare that an individual's income is. Quarterly payroll and excise tax returns normally due on may 1. Fill out the application below. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. 13844 (january 2018) application for reduced user fee for installment agreements. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. This is a request to reduce the tds burden on interest earned on recurring deposits or. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty.

15h Form Fill Online, Printable, Fillable, Blank pdfFiller

Updated on 30 sep, 2022. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. For each section, read the instructions carefully, answer every. 13844 (january 2018) application for reduced user fee for installment agreements. Resolving individual income tax notices.

How to fill new FORM 15G or New FORM No.15H?

Fill out the application below. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. Resolving individual income tax notices. Web form 15h is a declaration form that can be submitted to the income tax department of india by a.

Form No. 15h Declaration Under Section 197a(1c) Of The Act

This is a request to reduce the tds burden on interest earned on recurring deposits or. Updated on 30 sep, 2022. Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. Resolving individual income tax notices. For each section, read the instructions carefully, answer every.

Download New 15G 15 H Forms

Quarterly payroll and excise tax returns normally due on may 1. This is a request to reduce the tds burden on interest earned on recurring deposits or. Updated on 30 sep, 2022. Fill out the application below. For each section, read the instructions carefully, answer every.

Form 15H (Save TDS on Interest How to Fill & Download

Form 15h is a very popular form among investors and taxpayers. 13844 (january 2018) application for reduced user fee for installment agreements. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. Resolving individual income tax notices. For each section, read.

Form 15G and Form 15H in Tax

Web low income home energy assistance program (liheap) how to apply for liheap 1. This is a request to reduce the tds burden on interest earned on recurring deposits or. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more..

New FORM 15H Applicable PY 201617 Government Finances Payments

For each section, read the instructions carefully, answer every. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. Resolving individual income tax notices. 13844 (january 2018) application for reduced user fee for installment agreements. 15h [see section 197a(1c), and.

Form 15g Fillable Format Printable Forms Free Online

Resolving individual income tax notices. Updated on 30 sep, 2022. Quarterly payroll and excise tax returns normally due on may 1. For each section, read the instructions carefully, answer every. It is to be filed every financial year at the beginning of the year.

Form 15G & 15H What is Form 15G? How to Fill Form 15G for PF Withdrawal

Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Fill out the application below. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by.

Form 15H Declaration Download and Fill to Save Tax

15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. Web form 15h is mandatory, if the.

15H [See Section 197A(1C) And Rule 29C(1A)] Part‐I Declaration Under Section 197A(1C) Of The Income‐Tax Act, 1961 To Be Made By An Individual Who Is Of The Age Of.

13844 (january 2018) application for reduced user fee for installment agreements. For each section, read the instructions carefully, answer every. These forms are used to declare that an individual's income is. It is to be filed every financial year at the beginning of the year.

Resolving Individual Income Tax Notices.

Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. Fill out the application below. Updated on 30 sep, 2022. Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above.

Quarterly Payroll And Excise Tax Returns Normally Due On May 1.

Web low income home energy assistance program (liheap) how to apply for liheap 1. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. This is a request to reduce the tds burden on interest earned on recurring deposits or. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty.