Illinois Form 1040 Es

Illinois Form 1040 Es - This form is for income earned. Enter the total exemption amount. Estimated tax is the method used to pay tax on income that is not. Web illinois department of revenue. 2023 estimated income tax payments for individuals. Web up to $40 cash back fill fillable illinois 1040, edit online. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Paying online is quick and easy! Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. You expect your withholding and refundable credits to be less than.

Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Request for transcript of tax return form. Go to service provided by. 2022 estimated income tax payments for individuals. Paying online is quick and easy! Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Enter the total exemption amount. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Estimated tax is the method used to pay tax on income that is not. 2023 estimated income tax payments for individuals.

Web illinois income tax forms & instructions. Request for transcript of tax return form. 2023 estimated income tax payments for individuals. You expect to owe at least $1,000 in tax for 2023, after subtracting your withholding and refundable credits. Filing online is quick and easy! This form is for income earned. You expect your withholding and refundable credits to be less than. This form is used by illinois residents who file an individual income tax return. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Enter the illinois base income you expect to receive in 2021.

1040 Es Spreadsheet 1 Printable Spreadshee 1040es spreadsheet.

2023 estimated income tax payments for individuals. Web illinois services 1040 es payment inquiry view estimated payment details for your individual income tax return with mytax illinois. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Estimated tax is the method used to pay tax on income that isn’t subject.

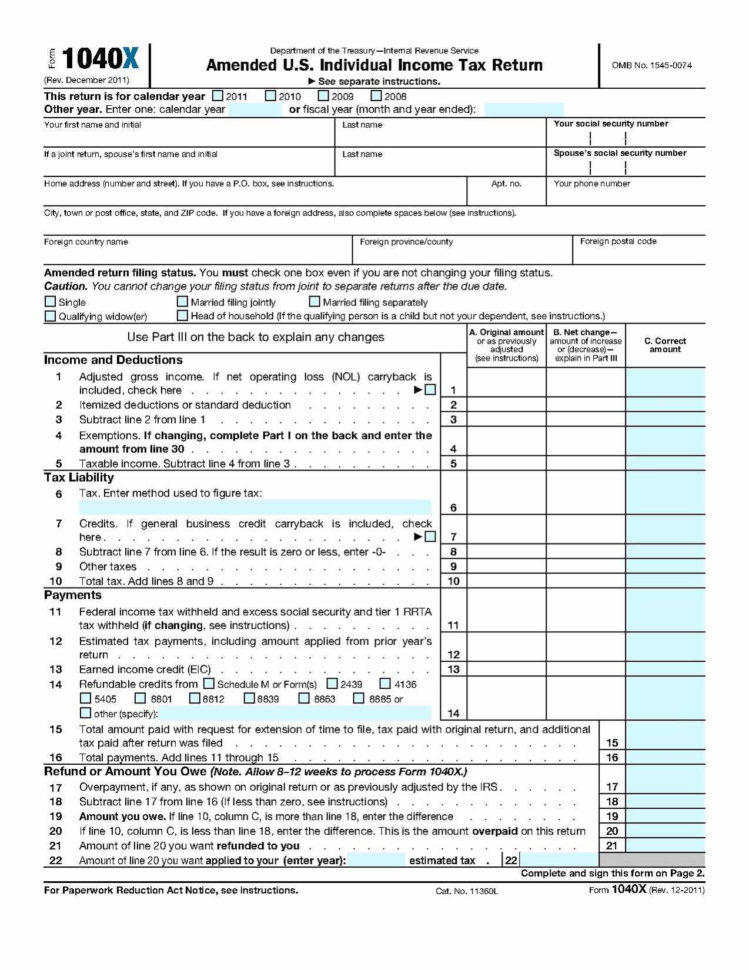

Irs Fillable Form 1040 / Irs Fillable Form 1040a MBM Legal The

This form is for income earned. Estimated tax is the method used to pay tax on income that is not. 2022 estimated income tax payments for individuals. Web illinois department of revenue. Web illinois income tax forms & instructions.

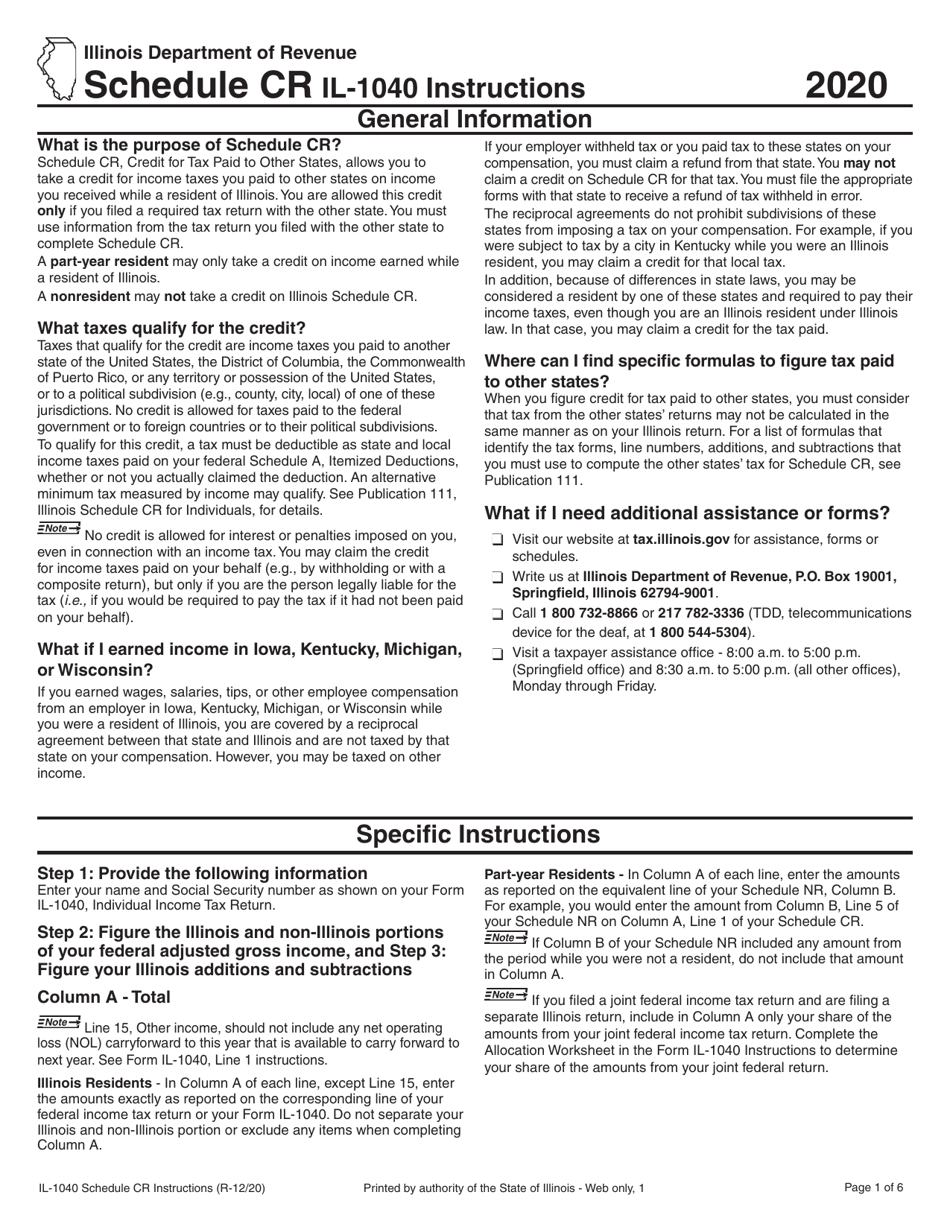

Download Instructions for Form IL1040 Schedule CR Credit for Tax Paid

This form is used by illinois residents who file an individual income tax return. Request for transcript of tax return form. Web illinois income tax forms & instructions. Web and you are enclosing a payment, then use this address. Web illinois department of revenue.

Irs Fillable Form 1040 il1040es 2019 Fill Online, Printable

You expect your withholding and refundable credits to be less than. 2023 estimated income tax payments for individuals. You expect to owe at least $1,000 in tax for 2023, after subtracting your withholding and refundable credits. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. 2022 estimated income tax payments.

New draft 1040 form released by the IRS Cryptotaxation Gautron

Go to service provided by. Web and you are enclosing a payment, then use this address. Enter the total exemption amount. Web illinois services 1040 es payment inquiry view estimated payment details for your individual income tax return with mytax illinois. This form is used by illinois residents who file an individual income tax return.

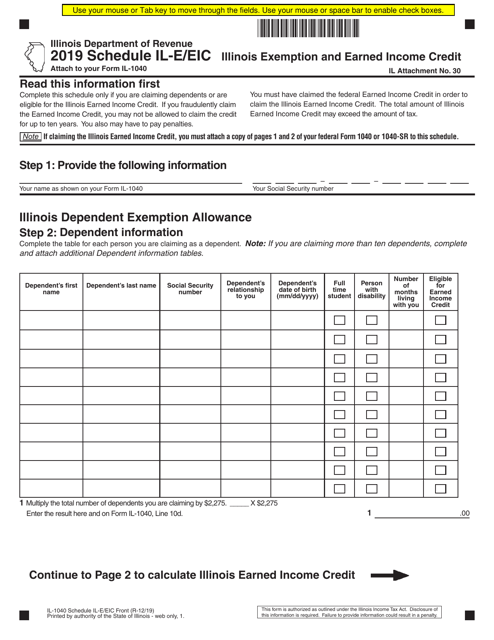

Form IL1040 Schedule ILE/EIC Download Fillable PDF or Fill Online

Request for transcript of tax return form. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Web illinois income tax forms & instructions. Estimated tax is the method used to pay tax on income that is not. Estimated tax is the method used to pay tax on income that isn’t.

illinois 1040 es The Biggest Contribution Of Illinois 11 Es

Information see the instructions for line 5 and. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. You expect to owe at least $1,000 in tax for 2023, after subtracting your withholding and refundable credits. Paying online is quick and easy! Web illinois department of revenue.

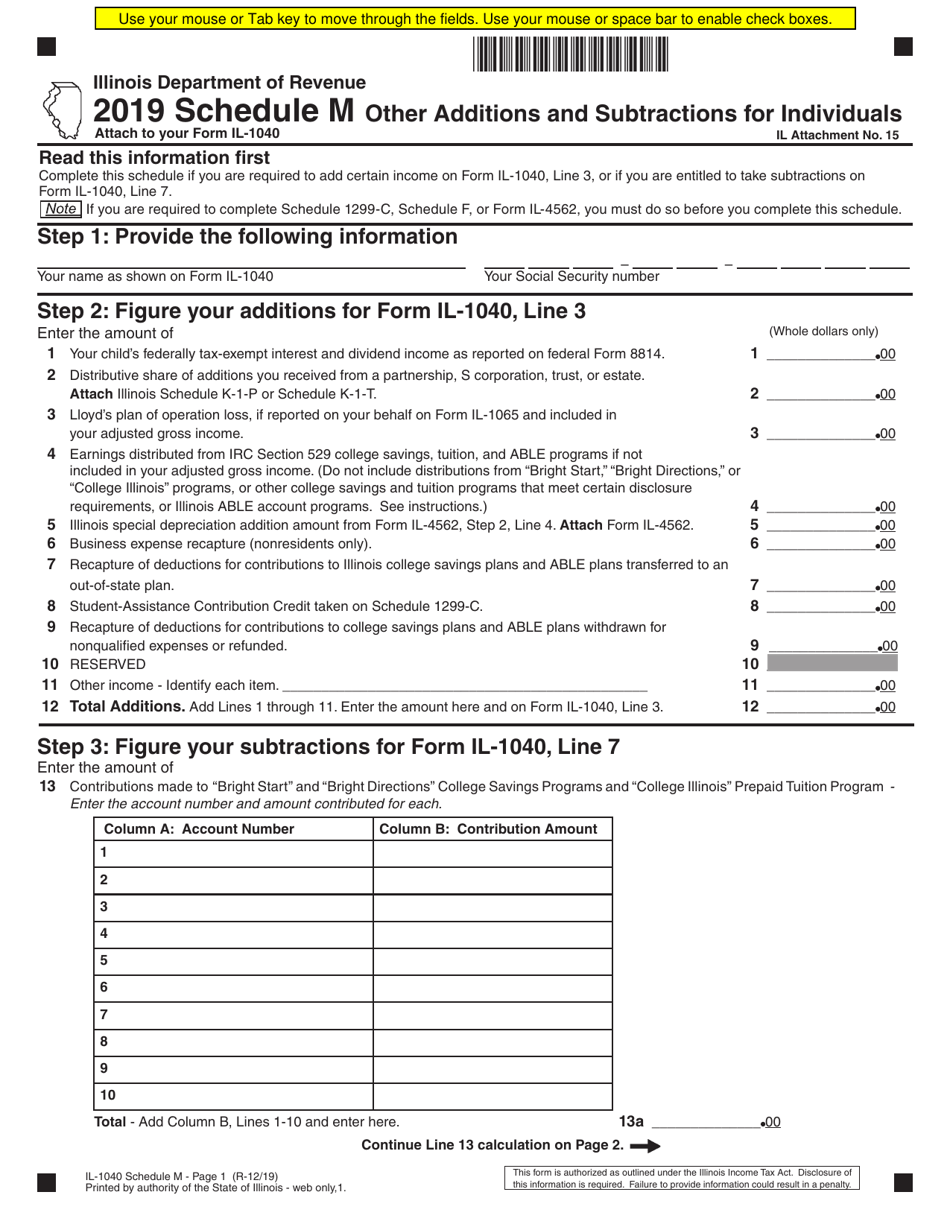

Form IL1040 Schedule M Download Fillable PDF or Fill Online Other

This form is used by illinois residents who file an individual income tax return. This form is for income earned. 2023 estimated income tax payments for individuals. Estimated tax is the method used to pay tax on income that is not. Web illinois department of revenue.

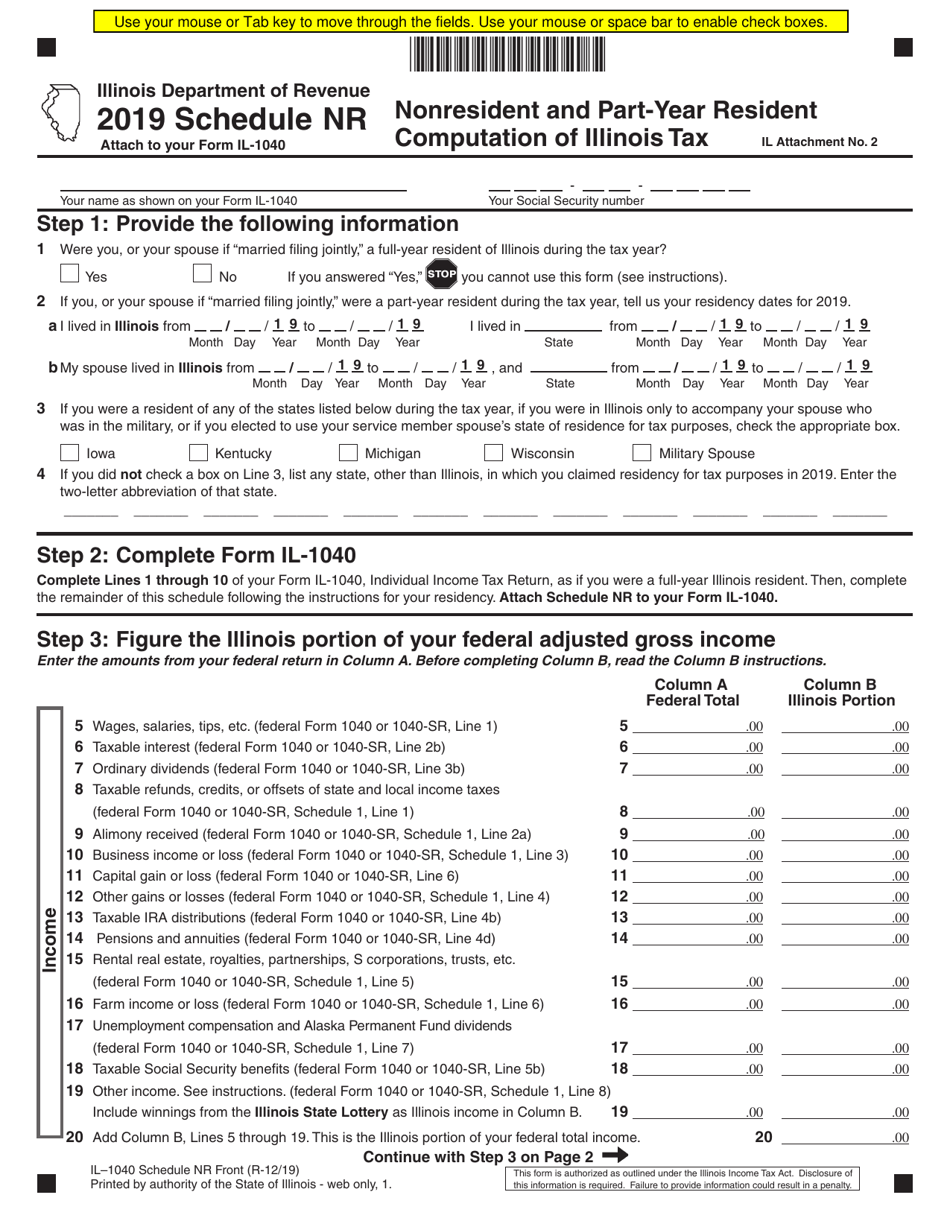

Form IL1040 Schedule NR Download Fillable PDF or Fill Online

This form is used by illinois residents who file an individual income tax return. Web up to $40 cash back fill fillable illinois 1040, edit online. You expect to owe at least $1,000 in tax for 2023, after subtracting your withholding and refundable credits. Use this form for payments that are due on april 18, 2022, june 15, 2022, september.

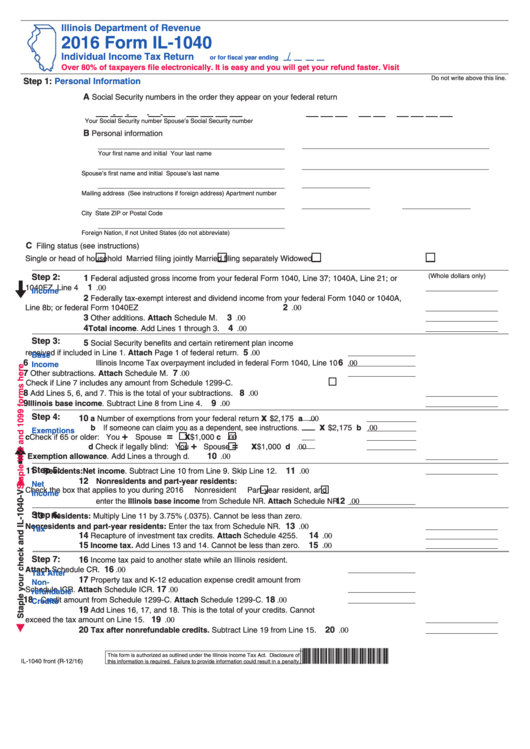

Form Il1040 Individual Tax Return 2016 printable pdf download

Web illinois income tax forms & instructions. Paying online is quick and easy! Enter the total exemption amount. This form is used by illinois residents who file an individual income tax return. 2022 estimated income tax payments for individuals.

Enter The Illinois Base Income You Expect To Receive In 2021.

Web illinois services 1040 es payment inquiry view estimated payment details for your individual income tax return with mytax illinois. Go to service provided by. Web illinois department of revenue. This form is for income earned.

2023 Estimated Income Tax Payments For Individuals.

You expect to owe at least $1,000 in tax for 2023, after subtracting your withholding and refundable credits. You expect your withholding and refundable credits to be less than. Paying online is quick and easy! Request for transcript of tax return form.

2022 Estimated Income Tax Payments For Individuals.

This form is used by illinois residents who file an individual income tax return. Estimated tax is the method used to pay tax on income that is not. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Information see the instructions for line 5 and.

Sign, Fax And Printable From Pc, Ipad, Tablet Or Mobile With Pdffiller Instantly.

Enter the total exemption amount. Web illinois income tax forms & instructions. Web up to $40 cash back fill fillable illinois 1040, edit online. Web and you are enclosing a payment, then use this address.