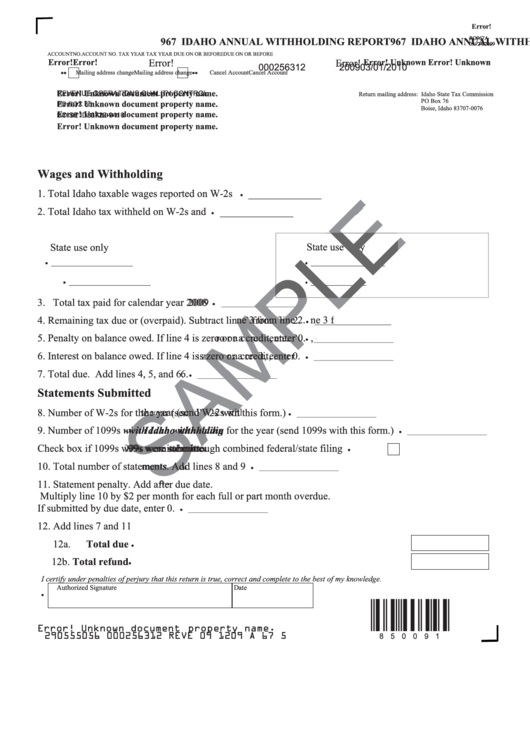

Idaho Form 967

Idaho Form 967 - Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. This form is for income earned in tax year 2022, with tax returns due in april 2023. Sign the return if you’re filing on paper. If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. This is the fastest way to submit the information. Contact us if you have questions that aren't answered on this website. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. Web friday january 14, 2022. Please make sure to choose the correct tax type before entering your information.

Sign the return if you’re filing on paper. Web this form is to help you estimate your penalty and interest. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. This is the fastest way to submit the information. Please make sure to choose the correct tax type before entering your information. The deadline for filing the form 967, idaho annual withholding report is january 31. Contact us if you have questions that aren't answered on this website.

Sign the return if you’re filing on paper. This is the fastest way to submit the information. Web this form is to help you estimate your penalty and interest. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. Contact us if you have questions that aren't answered on this website. Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). The deadline for filing the form 967, idaho annual withholding report is january 31. Web friday january 14, 2022. If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros.

Form 967 Idaho Annual Withholding Report Instructions printable pdf

Sign the return if you’re filing on paper. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. Web friday january 14,.

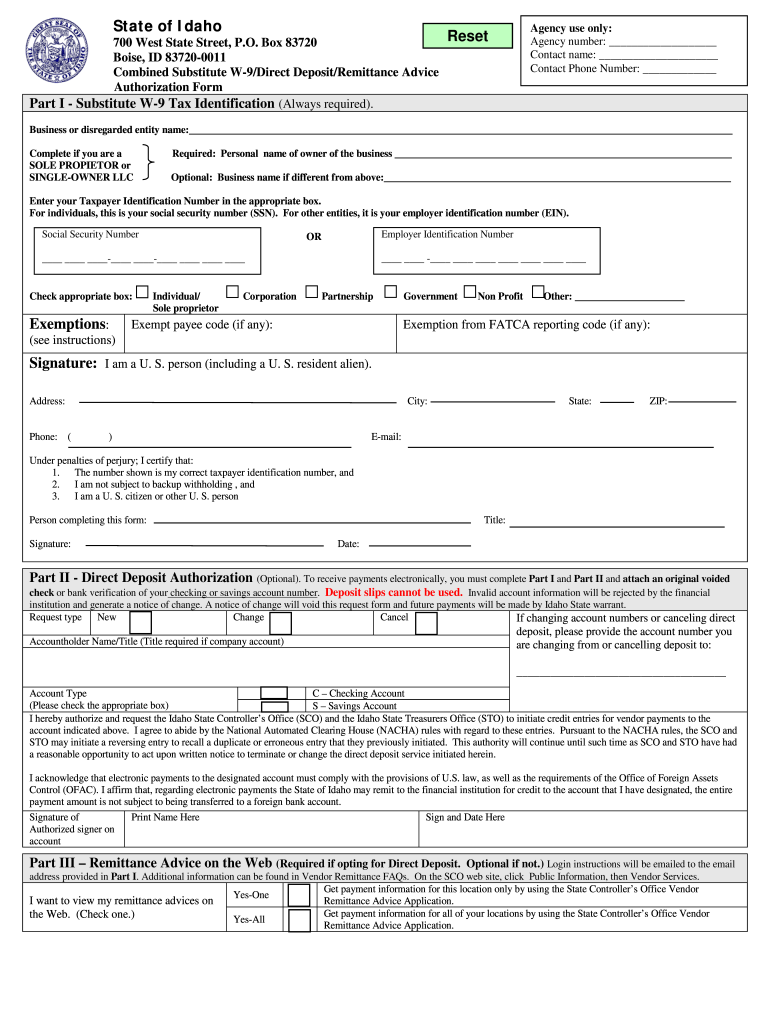

Idaho W9 Form Fill Out and Sign Printable PDF Template signNow

The deadline for filing the form 967, idaho annual withholding report is january 31. Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. Please make sure to choose the correct tax type before entering your information. Web this form is.

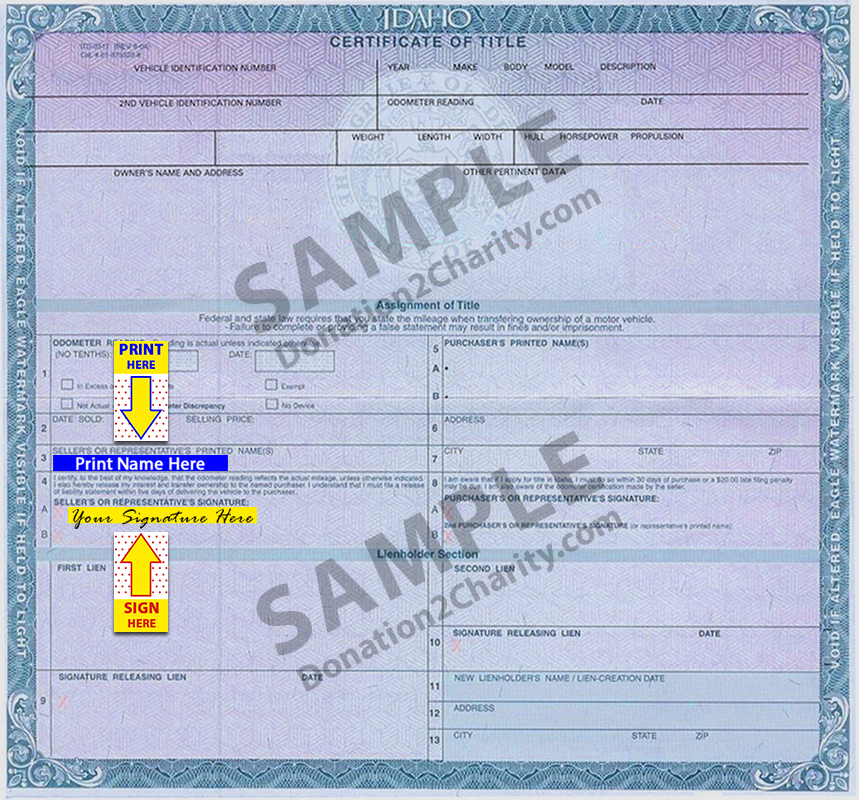

Idaho Donation2Charity

Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. Please make sure to choose the correct tax type before entering your information. Contact us if you have questions that.

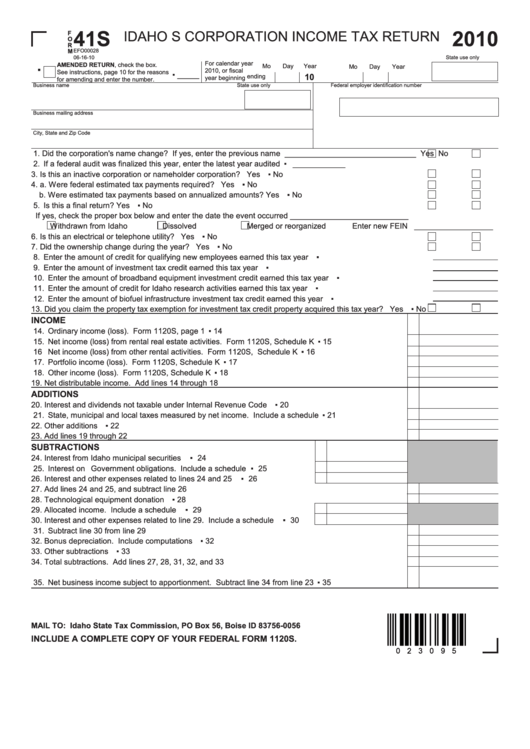

Form 41s Idaho S Corporation Tax Return,form Id K1 Partner

This is the fastest way to submit the information. Web friday january 14, 2022. Web this form is to help you estimate your penalty and interest. Contact us if you have questions that aren't answered on this website. The deadline for filing the form 967, idaho annual withholding report is january 31.

W 9 Idaho Fill Online, Printable, Fillable, Blank pdfFiller

Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. This form is for income earned in tax year.

Idaho Form 967 Fill and Sign Printable Template Online US Legal Forms

Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. The deadline for filing the form 967, idaho annual withholding report is january 31. Web form 967 — instructions annual withholding report available.

Form Ro967a 967 Idaho Annual Withholding Report 2009 printable pdf

Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. Web this form is to help you estimate your penalty and interest. If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you.

1+ Idaho POLST Form Free Download

We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. This is the fastest way to submit the information. Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). Contact us if you have questions that aren't.

1+ Idaho Offer to Purchase Real Estate Form Free Download

This form is for income earned in tax year 2022, with tax returns due in april 2023. Please make sure to choose the correct tax type before entering your information. If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. Web form 967 — instructions annual withholding report.

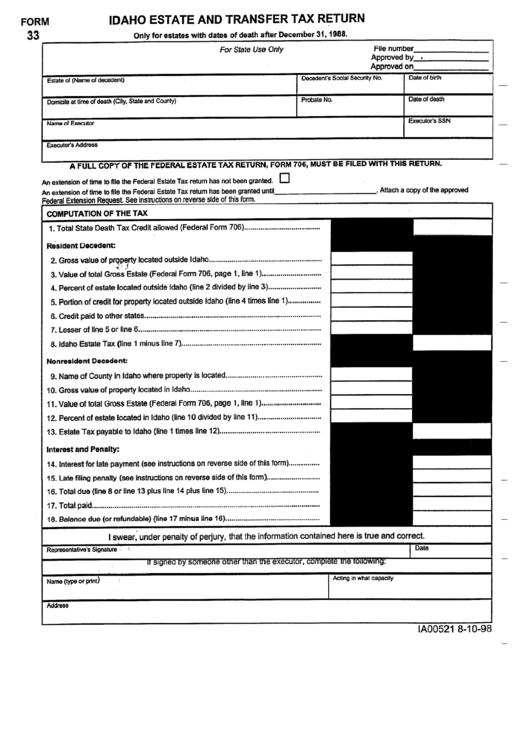

Form 33 Idaho Estate And Transfer Tax Return printable pdf download

Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. If you withheld idaho income tax or have an active withholding account, you must include form 967 with the.

Web We Last Updated Idaho Form 967 In February 2023 From The Idaho State Tax Commission.

Sign the return if you’re filing on paper. Please make sure to choose the correct tax type before entering your information. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government.

This Is The Fastest Way To Submit The Information.

If you withheld idaho income tax or have an active withholding account, you must include form 967 with the file you upload. Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. Contact us if you have questions that aren't answered on this website. The deadline for filing the form 967, idaho annual withholding report is january 31.

Web Friday January 14, 2022.

Web this form is to help you estimate your penalty and interest. Report only the withholding amounts from the 1099s included in the file on the form 967 (rv record). Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding.