Idaho Form 41 Instructions

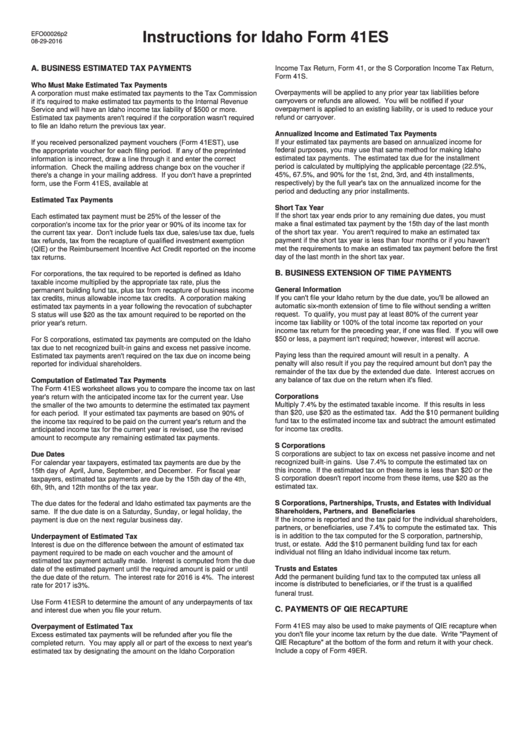

Idaho Form 41 Instructions - An s corporation must provide each shareholder with an. 2) incomes, additions, and subtractions; Estimated tax payment/extension of time payment business income tax and. Net business income apportioned to idaho. Web complete and attach form 42. Minimum $20 for each corporation (see instructions). Web instructions for idaho form 41es a. Web form 41s — instructions s corporation income tax return 2021 instructions are for lines not fully explained on the form. 1) rounding, heading, and amended returns; Web show sources > form 41es is an idaho corporate income tax form.

Web 11 rows s corporation income tax return and instructions. Web how it works open the idaho 41 and follow the instructions easily sign the 2022 idaho efo00025 with your finger send filled & signed idaho 41 tax or save rate the idaho 41. Web form 41s — instructions s corporation income tax 2020 instructions are for lines not fully explained on the form. An s corporation must provide each shareholder with an. Estimated tax payment/extension of time payment business income tax and. Web the form includes instructions providing explanations for: Minimum $20 for each corporation (see instructions). Credit for contributions to idaho educational entities. Payment of estimated business income tax instructions with worksheet 2022. Web forms for tax preparers.

Use get form or simply click on the template preview to open it in the editor. Web form 41 — instructions corporation income tax 2019 instructions are for lines not fully explained on the form. You’re doing business in idaho. Web form 41s — instructions s corporation income tax return 2022 instructions are for lines not fully explained on the form. Web 11 rows s corporation income tax return and instructions. Heading file the 2019 return for calendar year 2019 or a fiscal. Web forms for tax preparers. Minimum $20 for each corporation (see instructions). Web show sources > form 41s is an idaho corporate income tax form. An s corporation must provide each shareholder with an.

1+ Idaho Offer to Purchase Real Estate Form Free Download

Be sure the information you fill in. Business income tax forms (current) business income tax forms (archive) cigarette. Web multiply line 37 by 7.4%. Getting a authorized professional, creating a scheduled appointment and coming to the business office for a personal conference. Web show sources > form 41s is an idaho corporate income tax form.

Idaho Sales Tax Exemption Form St 133 20202021 Fill and Sign

You’re doing business in idaho. Web instructions for idaho form 41es a. Web complete and attach form 42. Web form 41s — instructions s corporation income tax 2020 instructions are for lines not fully explained on the form. Web by signing this form, i certify that the statements i made on this form are true and correct.

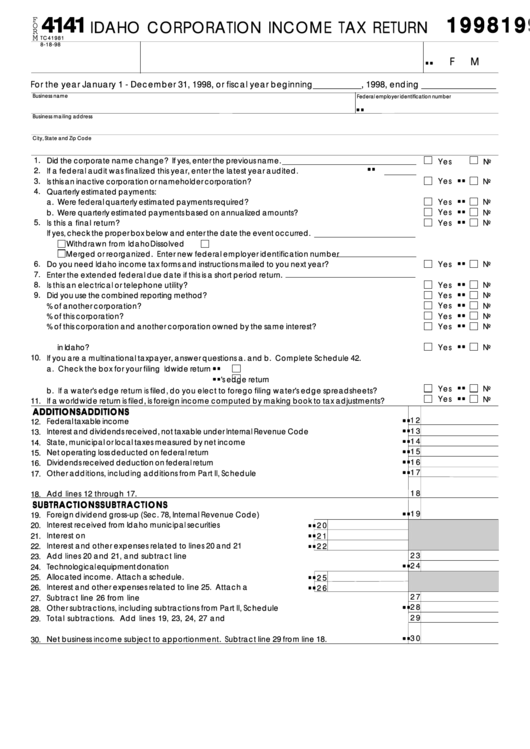

Fillable Form 41 Idaho Corporation Tax Return 1998 printable

Business income tax forms (current) business income tax forms (archive) cigarette. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Payment of estimated business income tax instructions with worksheet 2022. Web 11 rows s corporation income tax return and instructions. Sign it in a few clicks draw your signature, type.

Instructions For Idaho Form 41es printable pdf download

Business income tax forms (current) business income tax forms (archive) cigarette. Web form 41 — instructions corporation income tax 2019 instructions are for lines not fully explained on the form. Use get form or simply click on the template preview to open it in the editor. Web form 41s — instructions s corporation income tax return 2021 instructions are for.

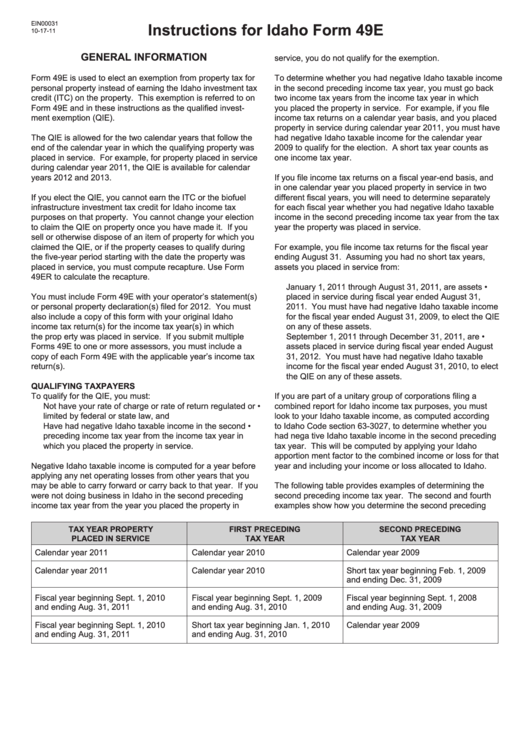

Instructions For Idaho Form 49e printable pdf download

Enter the apportionment factor from form 42, part i, line 21. Web instructions for idaho form 41es a. Edit your idaho form 41 2018 online type text, add images, blackout confidential details, add comments, highlights and more. 1) rounding, heading, and amended returns; Multiply line 32 by the percent.

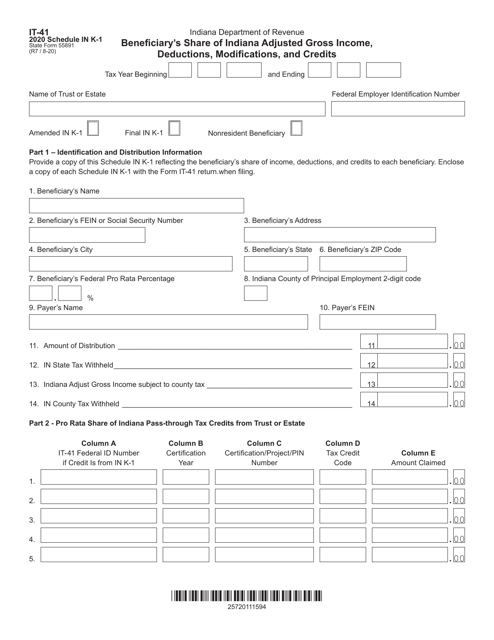

Form IT41 (State Form 55891) Schedule IN K1 Download Fillable PDF or

Edit your idaho form 41 2018 online type text, add images, blackout confidential details, add comments, highlights and more. Web multiply line 37 by 7.4%. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. 2) incomes, additions, and subtractions; Web the form includes instructions providing explanations for:

Idaho Form 910 Fill Out and Sign Printable PDF Template signNow

Getting a authorized professional, creating a scheduled appointment and coming to the business office for a personal conference. Sign it in a few clicks draw your signature, type. Web complete and attach form 42. Web by signing this form, i certify that the statements i made on this form are true and correct. I know that submitting false information can.

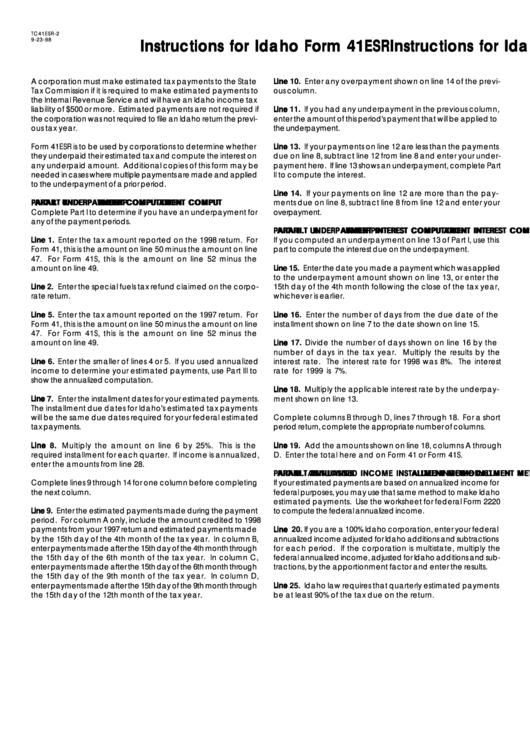

Instructions For Idaho Form 41esr State Tax Commission printable pdf

Enter the apportionment factor from form 42, part i, line 21. Web form 41s — instructions s corporation income tax return 2022 instructions are for lines not fully explained on the form. 2) incomes, additions, and subtractions; Web complete and attach form 42. Web the form includes instructions providing explanations for:

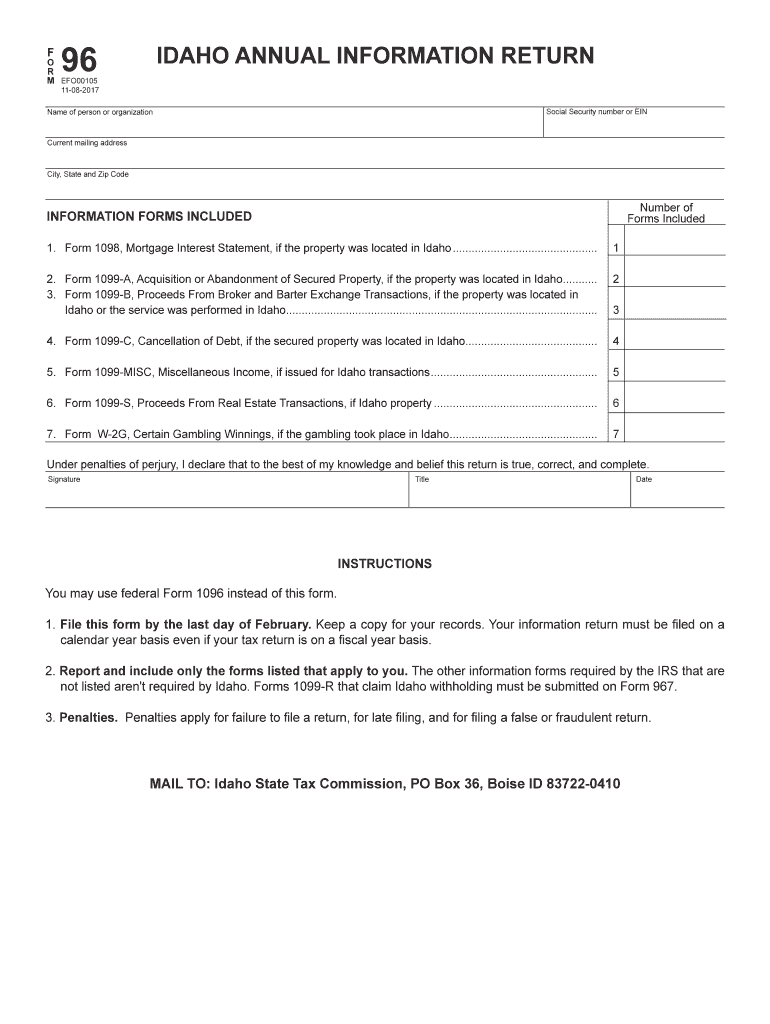

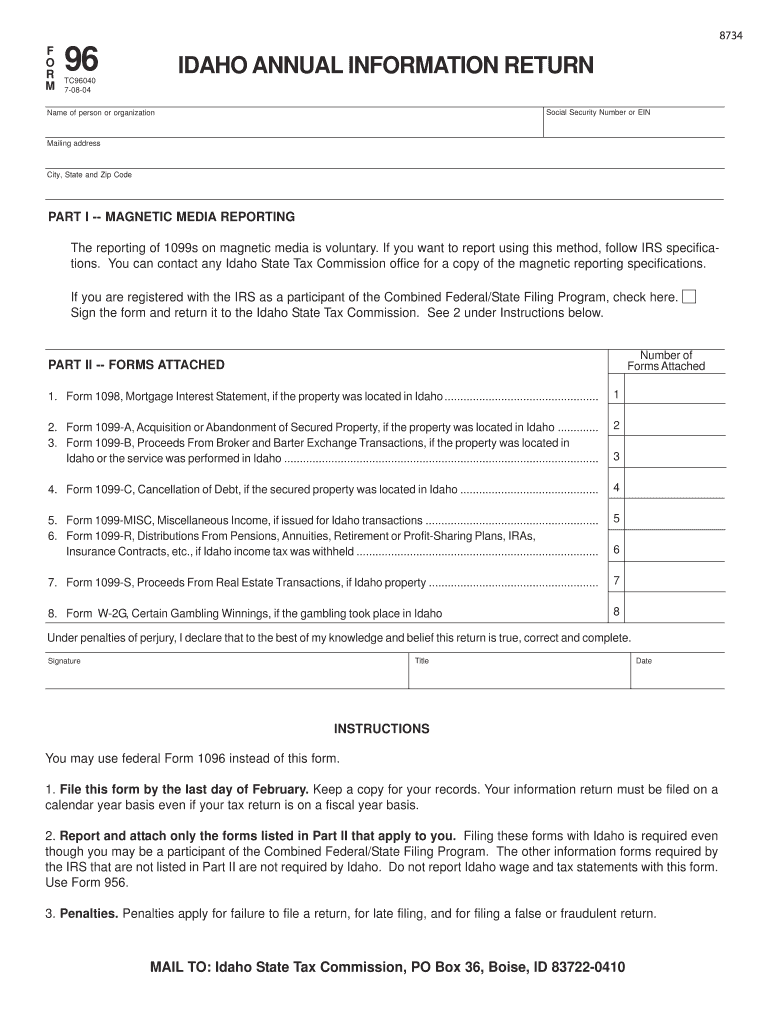

Idaho Form 96 Fill Out and Sign Printable PDF Template signNow

Be sure the information you fill in. Sign it in a few clicks draw your signature, type. Web a corporation filing as an s corporation for federal income tax purposes must file idaho form 41s if either of the following are true: 2) incomes, additions, and subtractions; An s corporation must provide each shareholder with an.

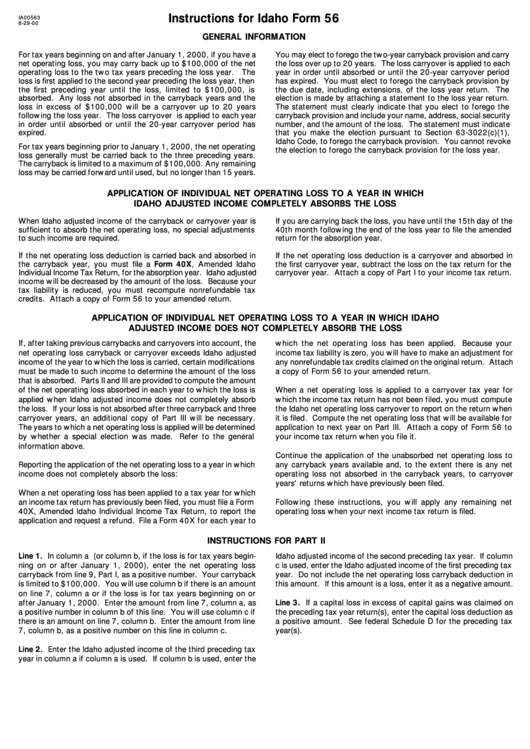

Instructions For Idaho Form 56 printable pdf download

Web forms for tax preparers. Corporate estimated tax payments who must ake estimated tax payments a corporation must make estimated tax payments to the tax. Web form 41s — instructions s corporation income tax return 2022 instructions are for lines not fully explained on the form. 1) rounding, heading, and amended returns; Business income tax forms (current) business income tax.

An S Corporation Must Provide Each Shareholder With An.

An s corporation must provide each shareholder with an. Web multiply line 37 by 7.4%. Web the form includes instructions providing explanations for: Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the.

Business Income Tax Forms (Current) Business Income Tax Forms (Archive) Cigarette.

Web instructions for idaho form 41es a. Multiply line 32 by the percent. Corporate estimated tax payments who must ake estimated tax payments a corporation must make estimated tax payments to the tax. Credit for contributions to idaho educational entities.

Web Click On The Get Form Option To Begin Enhancing.

Web follow the simple instructions below: Minimum $20 for each corporation (see instructions). Web complete and attach form 42. Edit your idaho form 41 2018 online type text, add images, blackout confidential details, add comments, highlights and more.

Web Forms For Tax Preparers.

Web form 41 — instructions corporation income tax 2019 instructions are for lines not fully explained on the form. Web form 41s — instructions s corporation income tax 2020 instructions are for lines not fully explained on the form. Web a corporation filing as an s corporation for federal income tax purposes must file idaho form 41s if either of the following are true: Sign it in a few clicks draw your signature, type.