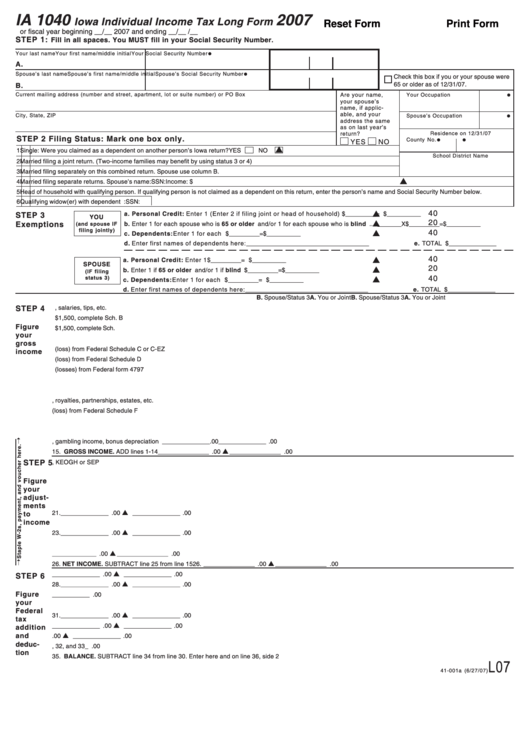

Ia 1040 Form

Ia 1040 Form - We last updated iowa form ia 1040 in february 2023 from the iowa. Use fill to complete blank online state of iowa. Web completing the 2022 iowa 1040 form filing deadline is may 1, 2023 if… you are single, and you worked only in iowa during 2022, and you earned only wages and. Department of the treasury—internal revenue service. Web use schedule a (form 1040) to figure your itemized deductions. Web the fillable ia 1040 does the math for you and automatically creates a computer generated barcode on the return. Web if you live in iowa. Tab through the fields to enter your name, address (use “ia” for iowa), and social security number in the spaces. Web the steps listed below correspond to the ia 1040 form. And you are filing a form.

Form 1040 is used by citizens or residents. This form is for income earned in tax year 2022, with tax returns due in april 2023. Married filing a joint return. Web the steps listed below correspond to the ia 1040 form. And you are enclosing a payment, then use this. Web use schedule a (form 1040) to figure your itemized deductions. Consider using the fillable version. Web the fillable ia 1040 does the math for you and automatically creates a computer generated barcode on the return. Web iowa income tax forms iowa printable income tax forms 44 pdfs iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa. Irs use only—do not write or staple in this.

For fiscal year beginning:_____ __/__ _____ __ /_____ ___ and ending:_____ ___/_____/ _____ ____ step 1 fill in all. Married filing a joint return. Request for taxpayer identification number (tin) and. Web use schedule a (form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard. Department of the treasury—internal revenue service. The barcode allows the return to process faster than a. Web the steps listed below correspond to the ia 1040 form. Individual tax return form 1040 instructions; And you are enclosing a payment, then use this.

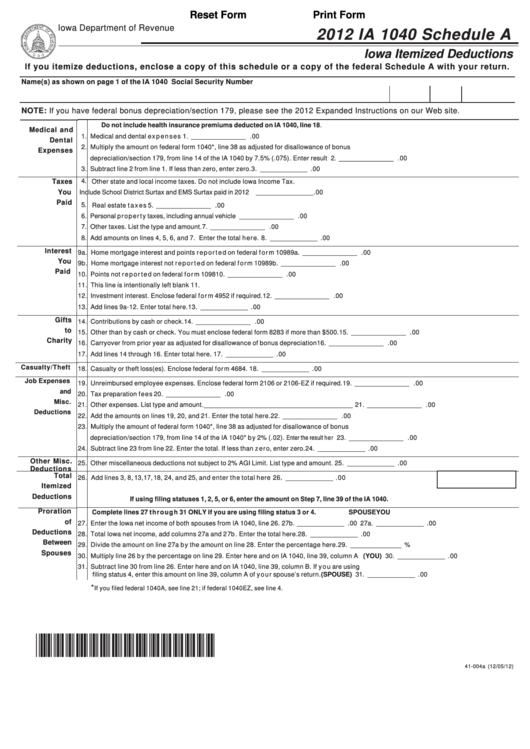

Fillable Form Ia 1040 Schedule A Iowa Itemized Deductions 2012

Web completing the 2022 iowa 1040 form filing deadline is may 1, 2023 if… you are single, and you worked only in iowa during 2022, and you earned only wages and. And you are not enclosing a payment, then use this address. Web if you live in iowa. For fiscal year beginning:_____ __/__ _____ __ /_____ ___ and ending:_____ ___/_____/.

Form IA 1040 Iowa Individual Tax Form YouTube

And you are filing a form. Individual income tax return, including recent updates, related forms and instructions on how to file. Use fill to complete blank online state of iowa. Web use schedule a (form 1040) to figure your itemized deductions. The barcode allows the return to process faster than a.

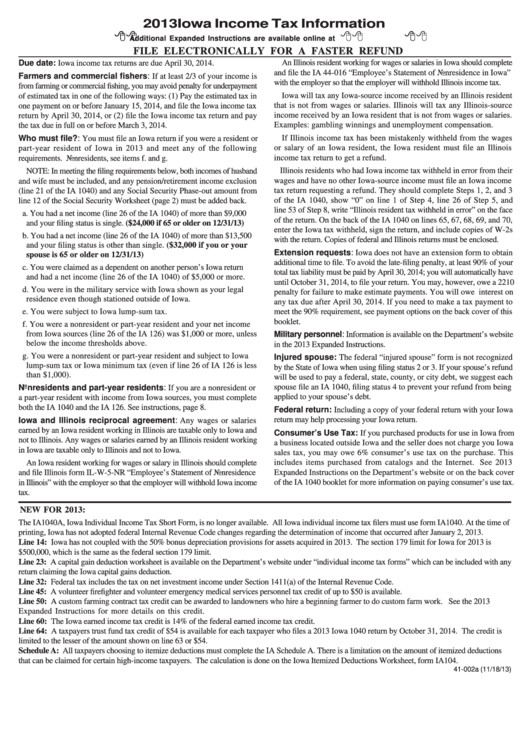

Instructions For Form Ia 1040 Iowa Individual Tax Form 2013

For fiscal year beginning:_____ __/__ _____ __ /_____ ___ and ending:_____ ___/_____/ _____ ____ step 1 fill in all. Married filing a joint return. Web use schedule a (form 1040) to figure your itemized deductions. Tab through the fields to enter your name, address (use “ia” for iowa), and social security number in the spaces. Use fill to complete blank.

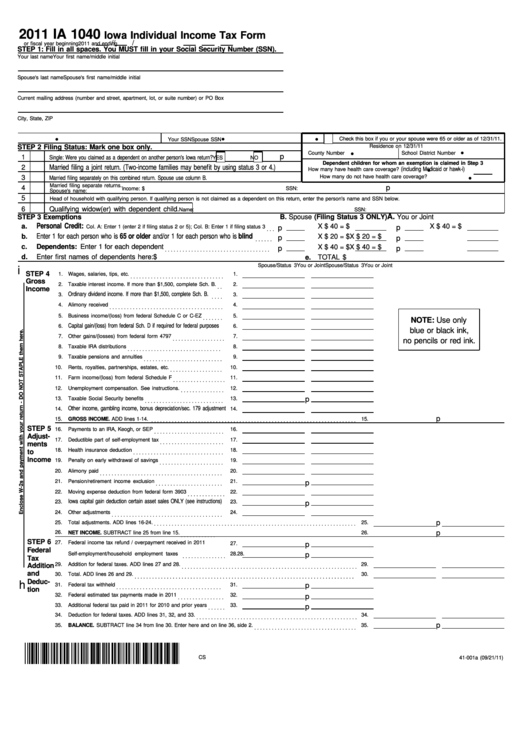

Form Ia 1040 Iowa Individual Tax Form 2011 printable pdf

And you are enclosing a payment, then use this. Form 1040 is used by citizens or residents. Use fill to complete blank online state of iowa. Married filing a joint return. Web information about form 1040, u.s.

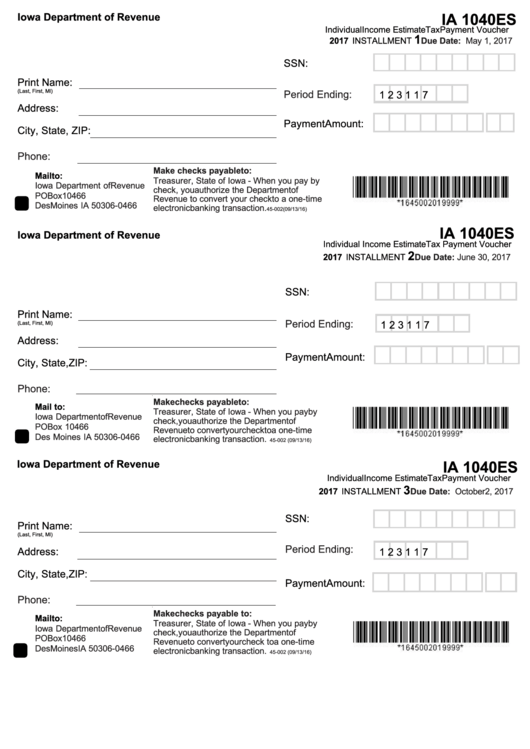

Top 17 Iowa Form Ia 1040es Templates free to download in PDF format

And you are enclosing a payment, then use this. Web completing the 2022 iowa 1040 form filing deadline is may 1, 2023 if… you are single, and you worked only in iowa during 2022, and you earned only wages and. For fiscal year beginning:_____ __/__ _____ __ /_____ ___ and ending:_____ ___/_____/ _____ ____ step 1 fill in all. Form.

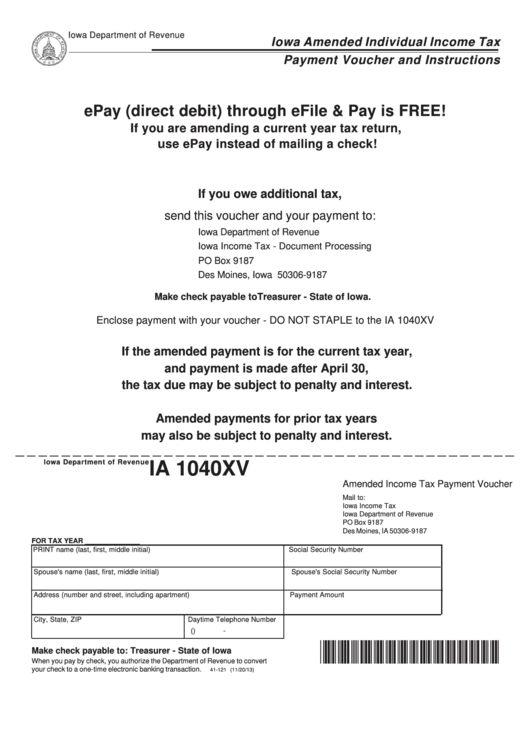

Top Iowa Form Ia 1040xv Templates free to download in PDF format

Department of the treasury—internal revenue service. For fiscal year beginning:_____ __/__ _____ __ /_____ ___ and ending:_____ ___/_____/ _____ ____ step 1 fill in all. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web iowa income tax forms iowa printable income tax forms 44 pdfs iowa has a state income tax.

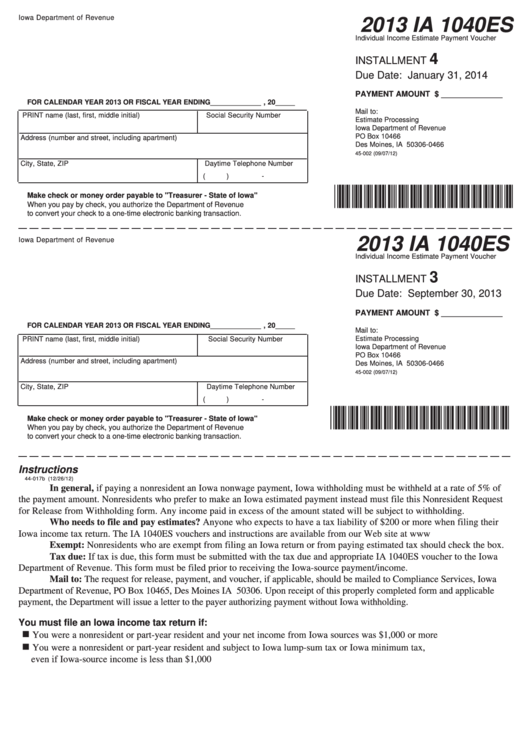

Form Ia 1040es Individual Estimate Payment Voucher 2013

We last updated iowa form ia 1040 in february 2023 from the iowa. Individual income tax return, including recent updates, related forms and instructions on how to file. Web use schedule a (form 1040) to figure your itemized deductions. And you are not enclosing a payment, then use this address. Form 1040 is used by citizens or residents.

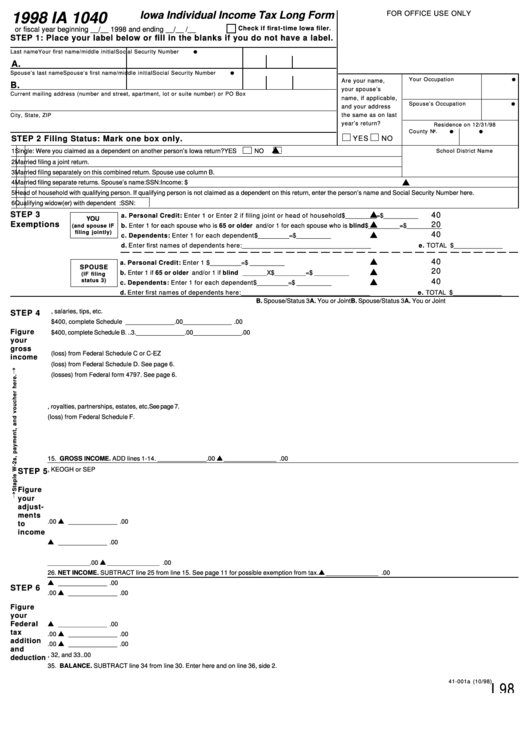

Fillable Form Ia 1040 Iowa Individual Tax Long Form 1998

Married filing a joint return. Department of the treasury—internal revenue service. Web iowa income tax forms iowa printable income tax forms 44 pdfs iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa. Web information about form 1040, u.s. Request for taxpayer identification number (tin) and.

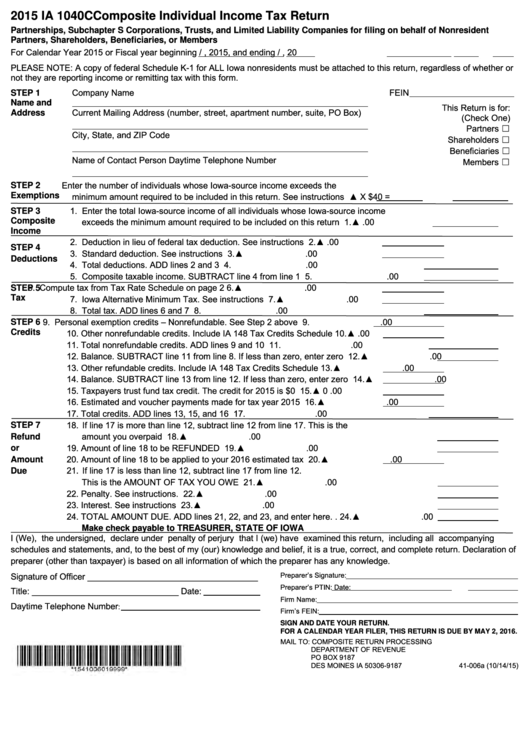

Top 26 Iowa Form Ia 1040c Templates free to download in PDF format

Individual tax return form 1040 instructions; Form 1040 is used by citizens or residents. Web completing the 2022 iowa 1040 form filing deadline is may 1, 2023 if… you are single, and you worked only in iowa during 2022, and you earned only wages and. And you are not enclosing a payment, then use this address. Web iowa income tax.

Fillable Form Ia 1040 Iowa Individual Tax Long 2021 Tax Forms

Tab through the fields to enter your name, address (use “ia” for iowa), and social security number in the spaces. We last updated iowa form ia 1040 in february 2023 from the iowa. Department of the treasury—internal revenue service. Web the steps listed below correspond to the ia 1040 form. Use fill to complete blank online state of iowa.

Individual Income Tax Return, Including Recent Updates, Related Forms And Instructions On How To File.

Web if you live in iowa. Web information about form 1040, u.s. Form 1040 is used by citizens or residents. Web iowa income tax forms iowa printable income tax forms 44 pdfs iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa.

And You Are Not Enclosing A Payment, Then Use This Address.

Individual tax return form 1040 instructions; The barcode allows the return to process faster than a. Request for taxpayer identification number (tin) and. Web use schedule a (form 1040) to figure your itemized deductions.

We Last Updated Iowa Form Ia 1040 In February 2023 From The Iowa.

Web the steps listed below correspond to the ia 1040 form. And you are enclosing a payment, then use this. Web the fillable ia 1040 does the math for you and automatically creates a computer generated barcode on the return. Tab through the fields to enter your name, address (use “ia” for iowa), and social security number in the spaces.

For Fiscal Year Beginning:_____ __/__ _____ __ /_____ ___ And Ending:_____ ___/_____/ _____ ____ Step 1 Fill In All.

Use fill to complete blank online state of iowa. Irs use only—do not write or staple in this. Department of the treasury—internal revenue service. Married filing a joint return.