I Forgot To File A Tax Form

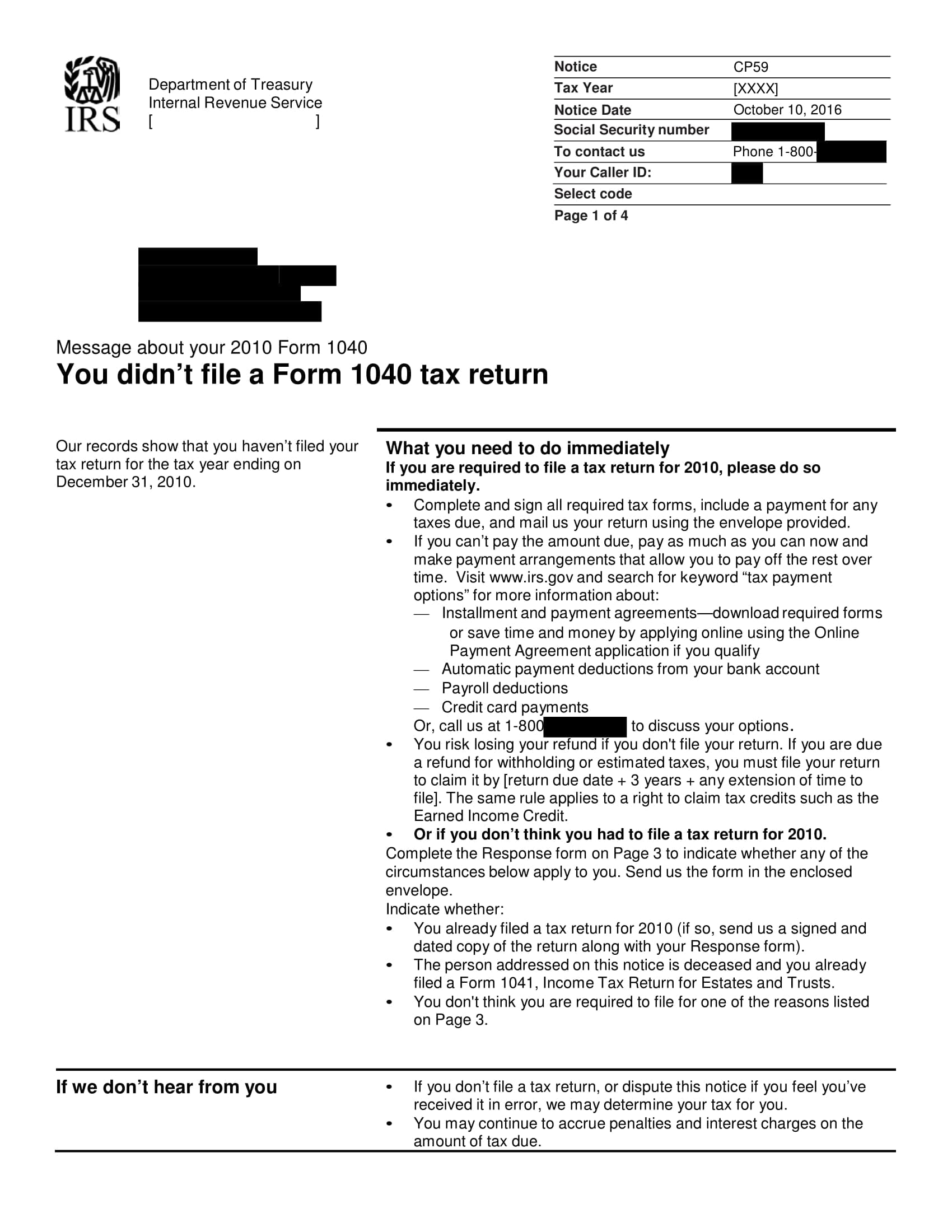

I Forgot To File A Tax Form - Web what happens when someone forgets to file a 1099 on their tax return? The first step of filing itr is to collect all the documents related to the process. But there's no need to wait. Online prior year tax prep makes it easy. Web filing a late tax return might save you tax penalties. Web time limitations time is of the essence in refiling your amended form. Individual income tax return, to correct their tax return. To validate and successfully submit. Web the gift tax return is a separate tax return. On the irs website, we can download the q1.

There is no way to estimate the. While taxpayers can use software to. The first step of filing itr is to collect all the documents related to the process. Web even if you forgot to file your income tax return for previous years in the u.s., you can and should file them now. Ensure you present the right. Web if you've overlooked submitting rent receipts to your employer, fret not. A 1099 form is an informational form you receive—not a tax. To validate and successfully submit. That's why the q1of 941 form is not generating within your company file. You will need to contact your past employers to obtain any payroll.

A 1099 form is an informational form you receive—not a tax. That's why the q1of 941 form is not generating within your company file. Web what happens when someone forgets to file a 1099 on their tax return? There is no way to estimate the. While taxpayers can use software to. Tax forms image by chad mcdermott from fotolia.com. Web time limitations time is of the essence in refiling your amended form. Individual income tax return, to correct their tax return. Web if you haven’t filed your federal income tax return for this year or for previous years, you should file your return as soon as possible regardless of your reason for not. You have only two years to file the amended tax form to reclaim cash if you didn't file the original form on.

What If You To File Taxes Last Year

Web filing a late tax return might save you tax penalties. On the irs website, we can download the q1. Premium 2021 tax software for late tax returns. Web documents needed to file itr; Tax forms image by chad mcdermott from fotolia.com.

To Verify Your Tax Return (ITR) File Condonation of

An individual having salary income should collect. Online prior year tax prep makes it easy. Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. Individual income tax return, to correct their tax return. Typically, if your income is.

E File Tax Form 7004 Universal Network

Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. Web what happens when someone forgets to file a 1099 on their tax return? An individual having salary income should collect. A 1099 form is an informational form you receive—not a tax..

To File Your NJ Taxes? Here's What You Should Do Now

Web what happens when someone forgets to file a 1099 on their tax return? Premium 2021 tax software for late tax returns. Web some people haven't filed a 2021 tax return because they're still waiting on their 2020 tax return to be processed. Web documents needed to file itr; Individual income tax return, to correct their tax return.

Paper calculations 20 of Americans are making this tax filing mistake

A 1099 form is an informational form you receive—not a tax. An individual having salary income should collect. Web anyone who didn't file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest. Web the gift tax return is a separate tax return. Web even if.

Tax Q&A What to do if you a tax payment

On the irs website, we can download the q1. A 1099 form is an informational form you receive—not a tax. To validate and successfully submit. There is no way to estimate the. Typically, if your income is.

Tax efiling password? Recover in new method YouTube

Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. If you forgot to file your tax return, the internal. Typically, if your income is. Individual income tax return, to correct their tax return. A 1099 form is an informational form you.

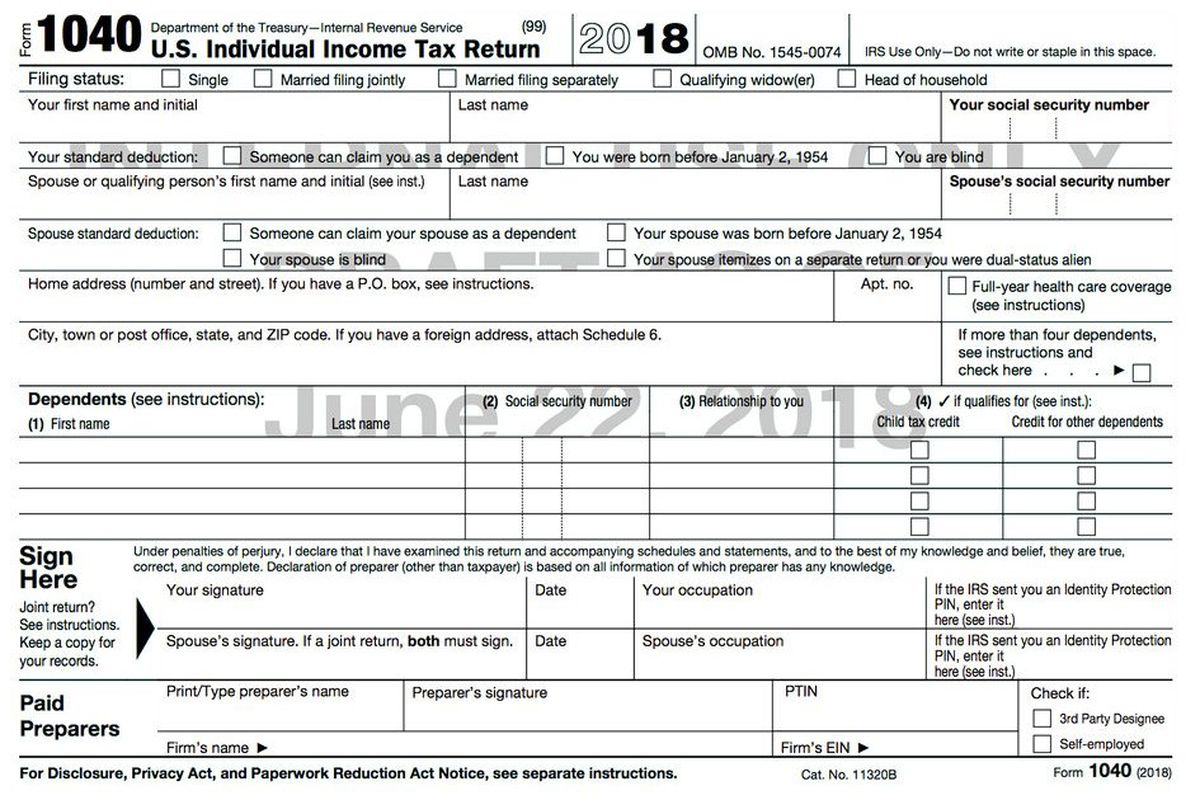

The IRS Shrinks The 1040 Tax Form But The Workload Stays 1040 Form

While taxpayers can use software to. Web what happens when someone forgets to file a 1099 on their tax return? Typically, if your income is. To validate and successfully submit. Web documents needed to file itr;

I to file my tax return. Did I commit tax evasion

Tax forms image by chad mcdermott from fotolia.com. On the irs website, we can download the q1. Web time limitations time is of the essence in refiling your amended form. While taxpayers can use software to. The first step of filing itr is to collect all the documents related to the process.

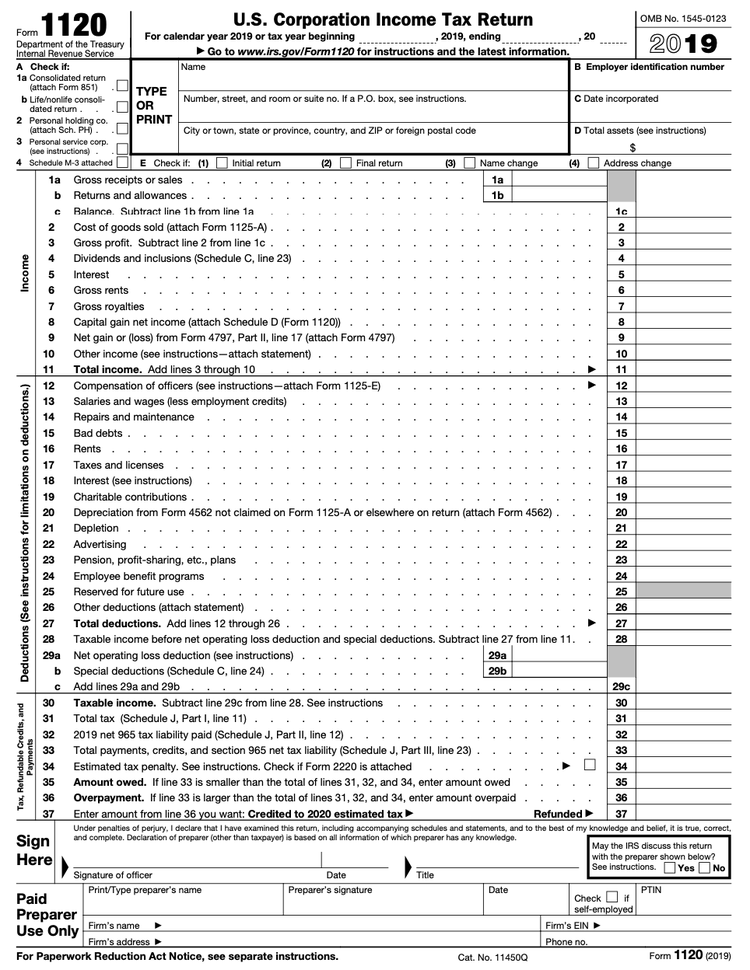

How to File Tax Form 1120 for Your Small Business (2023)

Free federal filing, state only $17.99. Individual income tax return, to correct their tax return. You can claim hra while filing your income tax return (itr)[7]. Web anyone who didn't file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest. Web even if you forgot.

Web The Gift Tax Return Is A Separate Tax Return.

Ensure you present the right. Online prior year tax prep makes it easy. Web time limitations time is of the essence in refiling your amended form. Web some people haven't filed a 2021 tax return because they're still waiting on their 2020 tax return to be processed.

Web If You've Overlooked Submitting Rent Receipts To Your Employer, Fret Not.

You have only two years to file the amended tax form to reclaim cash if you didn't file the original form on. You can claim hra while filing your income tax return (itr)[7]. Individual income tax return, to correct their tax return. To validate and successfully submit.

Tax Forms Image By Chad Mcdermott From Fotolia.com.

Typically, if your income is. But there's no need to wait. That's why the q1of 941 form is not generating within your company file. While taxpayers can use software to.

Web As This Irs Tip Sheet Says, You Can Call The Irs, Who Will Then Contact Your Employer Or Other Financial Entity To Get The Information You Need.

Web anyone who didn't file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest. Free federal filing, state only $17.99. Ad file late 2021 federal taxes 100% free. An individual having salary income should collect.