How To Raise Your Credit Score While In Chapter 13

How To Raise Your Credit Score While In Chapter 13 - Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge; Ad use self's credit builder account program to establish payment history & build credit. Check your court or the website of the chapter 13. I'm almost three years into my ch. Web improving credit while still in chapter 13? Web pros & cons highlights the average credit score of those ages 18 and 25 was 679 in 2022, the lowest of all age brackets, according to experian data. Web there are 5 primary steps for rebuilding credit during chapter 13: Depending on which type of bankruptcy you file — chapter 7 (discharge debts) or chapter 13 (reorganize debts; Web legally reviewed by attorney andrea wimmer updated august 11, 2023 table of contents 7 steps to improve your credit score after filing bankruptcy (1) keep up with any debts that survived the. Web assuming that you successfully complete a repayment plan under chapter 13, you will get a discharge that will show that debts covered by the bankruptcy have been removed.

Web after your bankruptcy case ends and you receive your discharge (the order that wipes out qualifying debt balances), finding credit isn't impossible even with a chapter 13 case on your credit report, as long as you're. If you do, the bankruptcy should come off your credit report after seven years. Web pros & cons highlights the average credit score of those ages 18 and 25 was 679 in 2022, the lowest of all age brackets, according to experian data. Get on a payment plan) — you’re likely to see your score plummet. Web raise your fico® score instantly with experian boost™ experian can help raise your fico® score based on bill payment like your phone, utilities and popular streaming services. Web monitor your credit score. Most courts require that you get prior authorization for new credit. Web how does bankruptcy effect your credit score? Web fico, the credit score company, requires that you have a minimum of one credit account that's been open for six months or more and at least one account with activity that's been reported to the. Get a savings plan that builds credit.

Web this much is certain: Young adults and teenagers often lag behind. Web legally reviewed by attorney andrea wimmer updated august 11, 2023 table of contents 7 steps to improve your credit score after filing bankruptcy (1) keep up with any debts that survived the. Web pros & cons highlights the average credit score of those ages 18 and 25 was 679 in 2022, the lowest of all age brackets, according to experian data. Web fico, the credit score company, requires that you have a minimum of one credit account that's been open for six months or more and at least one account with activity that's been reported to the. Pay all of your bills on time, especially bills that get. Some districts provide general guidelines for new credit approval. Web a personal bankruptcy filing will affect your credit report for a certain amount of time depending on how you file: I'm almost three years into my ch. Ad use self's credit builder account program to establish payment history & build credit.

3 Tips to Raise your Credit Score Fire Your Landlord®

Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge; Web assuming that you successfully complete a repayment plan under chapter 13, you will get a discharge that will show that debts covered by the bankruptcy have been removed. Web pros & cons highlights the average credit score of those ages 18 and 25 was 679.

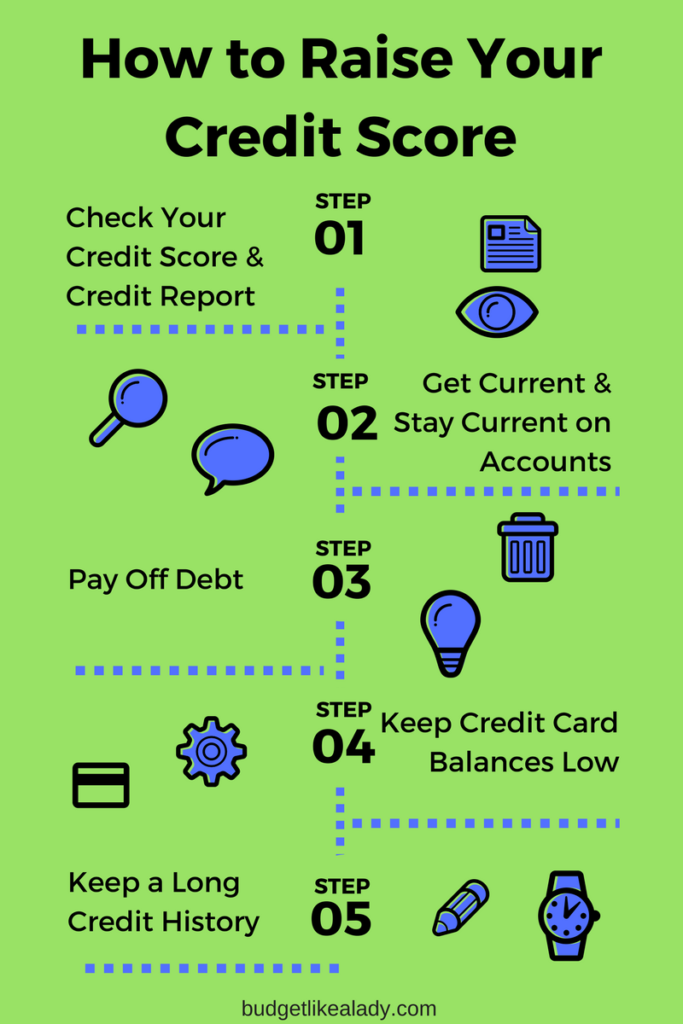

Infographic How to raise your credit score fast PrimeRates

Individuals can get one free credit report from each of the three main credit bureaus (equifax, experian, and transunion). Ad use self's credit builder account program to establish payment history & build credit. Chapter 7 bankruptcy stays on your credit. Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge; Web this much is certain:

7 Steps to Raise Your Credit Score ULearning

Web this much is certain: Get on a payment plan) — you’re likely to see your score plummet. You should be able to get new credit at this. Most courts require that you get prior authorization for new credit. Web some steps to take consist of:

How to Raise Your Credit Score like a Boss Budget Like a Lady

If you do, the bankruptcy should come off your credit report after seven years. Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge; Ad use self's credit builder account program to establish payment history & build credit. Web some steps to take consist of: Chapter 7 bankruptcy stays on your credit.

Raise Credit Score Workloo

Your payment history is the most important factor in determining your credit score, and filing bankruptcy means that you won’t be paying covered debts in. Chapter 7 bankruptcy stays on your credit. Pay all of your bills on time, especially bills that get. Open two credit builder cards (payment history is 35% of your score) open one credit builder loan.

How to Raise Your Credit Score in 30 Days Living like Leila

Web assuming that you successfully complete a repayment plan under chapter 13, you will get a discharge that will show that debts covered by the bankruptcy have been removed. Your payment history is the most important factor in determining your credit score, and filing bankruptcy means that you won’t be paying covered debts in. Web improving credit while still in.

How Can I Raise My Credit Score?

Web monitor your credit score. Some districts provide general guidelines for new credit approval. Your payment history is the most important factor in determining your credit score, and filing bankruptcy means that you won’t be paying covered debts in. Web how does bankruptcy effect your credit score? Individuals can get one free credit report from each of the three main.

7 Tips To Raise Your Credit Score Bank Deal Guy

Your payment history is the most important factor in determining your credit score, and filing bankruptcy means that you won’t be paying covered debts in. Web some steps to take consist of: If you do, the bankruptcy should come off your credit report after seven years. Web assuming that you successfully complete a repayment plan under chapter 13, you will.

Raise Credit Score Instantly

Pay all of your bills on time, especially bills that get. Web how does bankruptcy effect your credit score? Web monitor your credit score. Web there are 5 primary steps for rebuilding credit during chapter 13: I'm almost three years into my ch.

Raise Your Credit Score Fast with 10 Tips Life but Simplified

Web a personal bankruptcy filing will affect your credit report for a certain amount of time depending on how you file: Web raise your fico® score instantly with experian boost™ experian can help raise your fico® score based on bill payment like your phone, utilities and popular streaming services. Individuals can get one free credit report from each of the.

Get On A Payment Plan) — You’re Likely To See Your Score Plummet.

Get a savings plan that builds credit. Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge; You should be able to get new credit at this. Chapter 7 bankruptcy stays on your credit.

Pay All Of Your Bills On Time, Especially Bills That Get.

I'm almost three years into my ch. Web legally reviewed by attorney andrea wimmer updated august 11, 2023 table of contents 7 steps to improve your credit score after filing bankruptcy (1) keep up with any debts that survived the. Your payment history is the most important factor in determining your credit score, and filing bankruptcy means that you won’t be paying covered debts in. Web a personal bankruptcy filing will affect your credit report for a certain amount of time depending on how you file:

Web This Much Is Certain:

Web some steps to take consist of: Young adults and teenagers often lag behind. Ad use self's credit builder account program to establish payment history & build credit. My credit score was in the low 500's when.

Most Courts Require That You Get Prior Authorization For New Credit.

Web how does bankruptcy effect your credit score? Checking your credit report throughout the. Web this much is certain: Depending on which type of bankruptcy you file chapter 7 or chapter 13 youre likely to see your score plummet between 160 and 240 points.