How To Form S Corp In California

How To Form S Corp In California - Choosing a company name is the first and most important step in starting your llc in california. Zenbusiness can help.” mark cuban, spokesperson play video excellent 12,647 reviews × create a california s corp start an s corp let our experts file your business paperwork quickly and accurately, guaranteed! For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809. Corporations can be taxed 2 different ways. When a corporation elects federal s corporation status it automatically becomes an s. Web overview a corporation is an entity that is owned by its shareholders (owners). Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or directly by an entrepreneur. Forms for the most common types of articles of incorporation are available on our forms, samples and fees webpage. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income you should use the below guidelines to file your state income taxes: Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is:

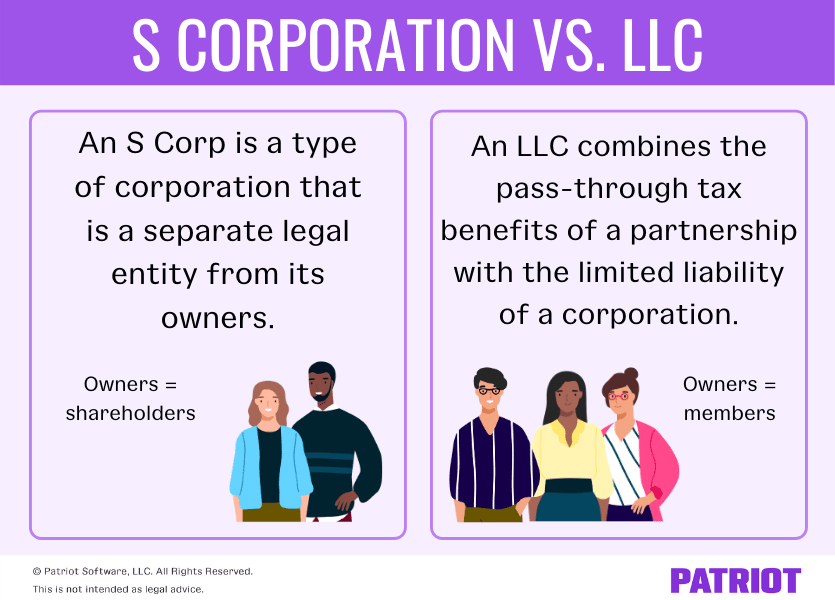

C corporation generally taxed on their income and the owners are taxed on these earnings when distributed as payments or when the shareholder sells stock s corporation Box address of the agent. Web steps to form an llc and elect s corp tax status in california. Choosing a company name is the first and most important step in starting your llc in california. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Choose your california registered agent. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. Forms for the most common types of articles of incorporation are available on our forms, samples and fees webpage. You may use the form or prepare your own statutorily compliant document. Corporations can be taxed 2 different ways.

Choose your california registered agent. When a corporation elects federal s corporation status it automatically becomes an s. Web a small business corporation elects federal s corporation status by filing federal form 2553 (election by a small business corporation) with the internal revenue service. Be sure to choose a name that. C corporation generally taxed on their income and the owners are taxed on these earnings when distributed as payments or when the shareholder sells stock s corporation Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Corporations can be taxed 2 different ways. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income you should use the below guidelines to file your state income taxes: Zenbusiness can help.” mark cuban, spokesperson play video excellent 12,647 reviews × create a california s corp start an s corp let our experts file your business paperwork quickly and accurately, guaranteed! Box address of the agent.

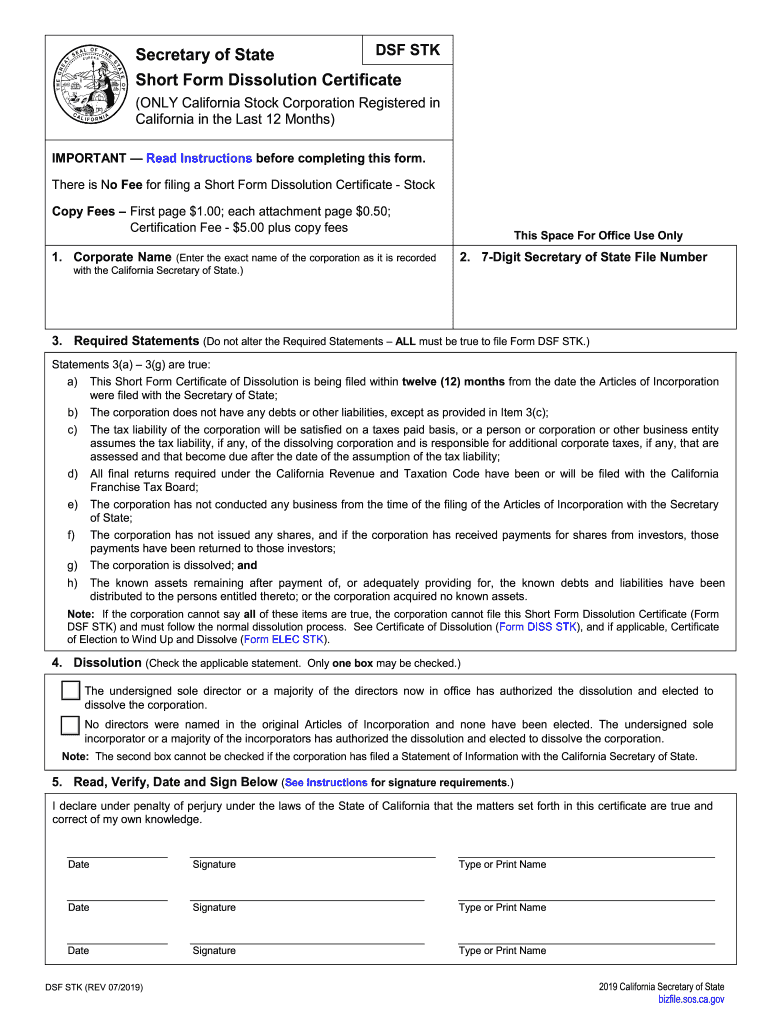

20192022 Form CA DSF STK Fill Online, Printable, Fillable, Blank

Web steps to form an llc and elect s corp tax status in california. Corporations can be taxed 2 different ways. The details of this filing include: Forms for the most common types of articles of incorporation are available on our forms, samples and fees webpage. Over 140 business filings, name reservations, and orders for certificates of status and certified.

How to Start an S Corp in California California S Corp TRUiC

Web steps to form an llc and elect s corp tax status in california. You'll also need to include the number of shares the corporation has authorized. Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or directly by an entrepreneur. Web to form a corporation in california, articles of incorporation.

Best Form Editor Company Tax Return

For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809. Web to form your corporation, the articles of incorporation must be filed with the california secretary of state. Choosing a company name is the first and most important step in starting your llc in california. You may use the form or prepare your own statutorily compliant.

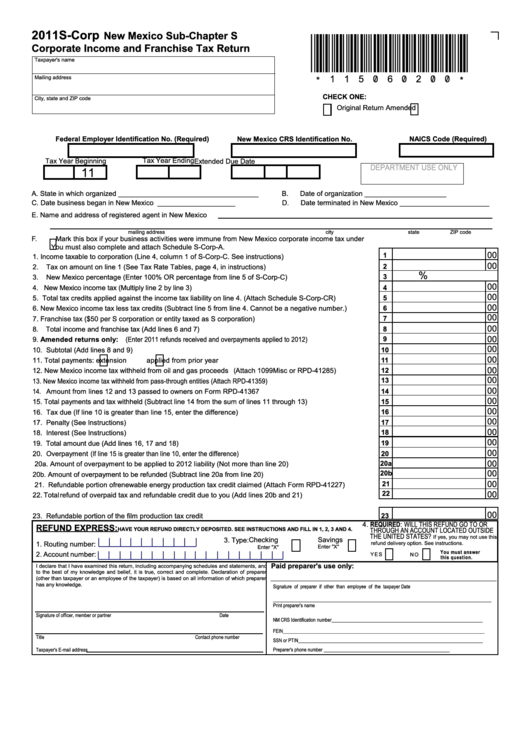

Form SCorp New Mexico SubChapter S Corporate And Franchise

Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or directly by an entrepreneur. Choose your california registered agent. C corporation generally taxed on their income and the owners are taxed on these.

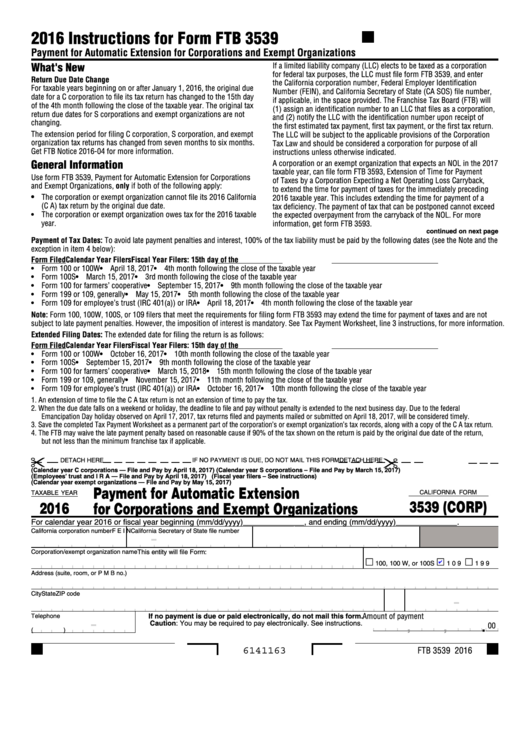

Fillable California Form 3539 (Corp) Payment For Automatic Extension

Corporations can be taxed 2 different ways. File by mail or in person Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or directly by an entrepreneur. Be sure to choose a name that. Forms for the most common types of articles of incorporation are available on our forms, samples and.

LLC vs S Corp California

Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. You'll also need to include the number of shares the corporation has authorized. Web.

California LLC vs. S Corp A Complete Guide Windes

The #1 rated service by When a corporation elects federal s corporation status it automatically becomes an s. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. File by mail or in person Forms for the most common types of articles.

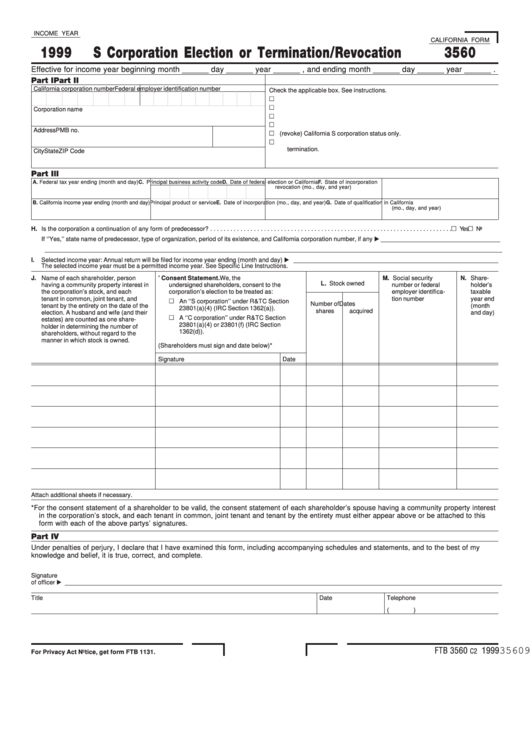

California Form 3560 S Corporation Election Or Termination/revocation

Web a small business corporation elects federal s corporation status by filing federal form 2553 (election by a small business corporation) with the internal revenue service. The details of this filing include: The #1 rated service by Web to form your corporation, the articles of incorporation must be filed with the california secretary of state. For more information, get form.

How to Form an SCorp in California? Think Legal

Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or directly by an entrepreneur. Be sure to choose a name that. Zenbusiness can help.” mark cuban, spokesperson play video excellent 12,647 reviews × create a california s corp start an s corp let our experts file your business paperwork quickly and.

S Corp vs. LLC Q&A, Pros & Cons of Each, & More

Web to form a corporation in california, articles of incorporation must be filed with the california secretary of state’s office. When a corporation elects federal s corporation status it automatically becomes an s. Choose your california registered agent. Box address of the agent. File by mail or in person

Box Address Of The Agent.

Choosing a company name is the first and most important step in starting your llc in california. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. When a corporation elects federal s corporation status it automatically becomes an s. Web overview a corporation is an entity that is owned by its shareholders (owners).

Web To Form A Corporation In California, Articles Of Incorporation Must Be Filed With The California Secretary Of State’s Office.

Corporations can be taxed 2 different ways. Web a small business corporation elects federal s corporation status by filing federal form 2553 (election by a small business corporation) with the internal revenue service. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income you should use the below guidelines to file your state income taxes: Web to form your corporation, the articles of incorporation must be filed with the california secretary of state.

Web Steps To Form An Llc And Elect S Corp Tax Status In California.

The #1 rated service by You'll also need to include the number of shares the corporation has authorized. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. C corporation generally taxed on their income and the owners are taxed on these earnings when distributed as payments or when the shareholder sells stock s corporation

For More Information, Get Form Ftb 3805Z, Form Ftb 3807, Or Form Ftb 3809.

Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Be sure to choose a name that. Choose your california registered agent. Forms for the most common types of articles of incorporation are available on our forms, samples and fees webpage.