How To Form An Esop

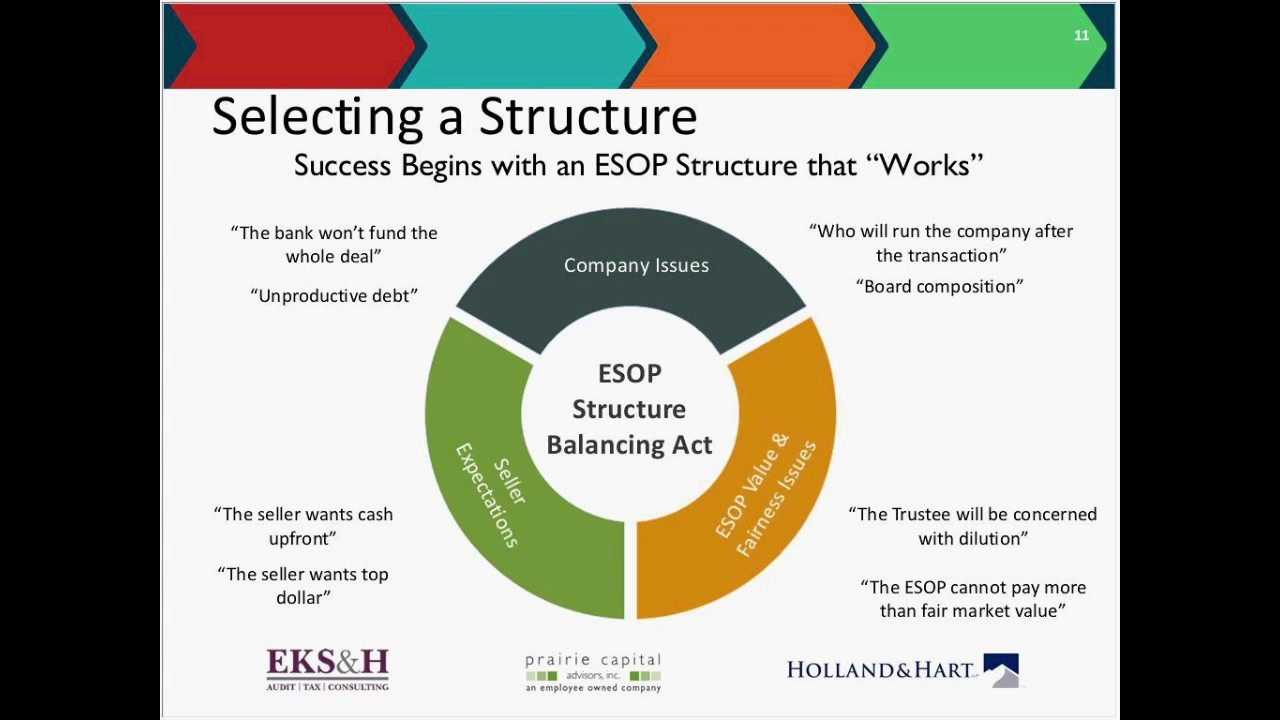

How To Form An Esop - Unlike most retirement plans, esops:. A feasibility study, which can. A company interested in establishing an employee stock ownership plan. Web an esop will let you implement a plan for employees to acquire some or all of your company's stock. Web how to set up an esop • if all owners of a company are willing to either sell shares or dilute their shares, then the next step is a feasibility study. Web updated december 18, 2022 what is an employee stock ownership plan (esop)? Web in order to establish an esop, a company first sets up a trust fund into which it deposits either shares of the company or money to buy them. This may seem like an obvious issue, but sometimes people take several. Web an employee stock ownership plan (esop) is a retirement benefit that makes workers part owners of the company. Web an employee stock ownership plan (esop) is a retirement plan in which the company contributes its stock (or money to buy its stock) to the plan for the benefit of the.

Web buy shares at a discounted rate at the time of exercising the esops, employees usually pay a nominal amount to buy the shares allotted to them. An employee stock ownership plan (esop) is an employee benefit plan that offers advantages to business. Web an employee stock ownership plan (esop) is an irc section 401(a) qualified defined contribution plan which allows employees to own stock in the company for which they. Web how to establish an esop. Web an employee stock ownership plan (esop) is an irc section 401 (a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/ money purchase plan. Web issuance esops are the least common form of esop. Web this is how it works. A company interested in establishing an employee stock ownership plan. Web an esop will let you implement a plan for employees to acquire some or all of your company's stock. Web updated december 18, 2022 what is an employee stock ownership plan (esop)?

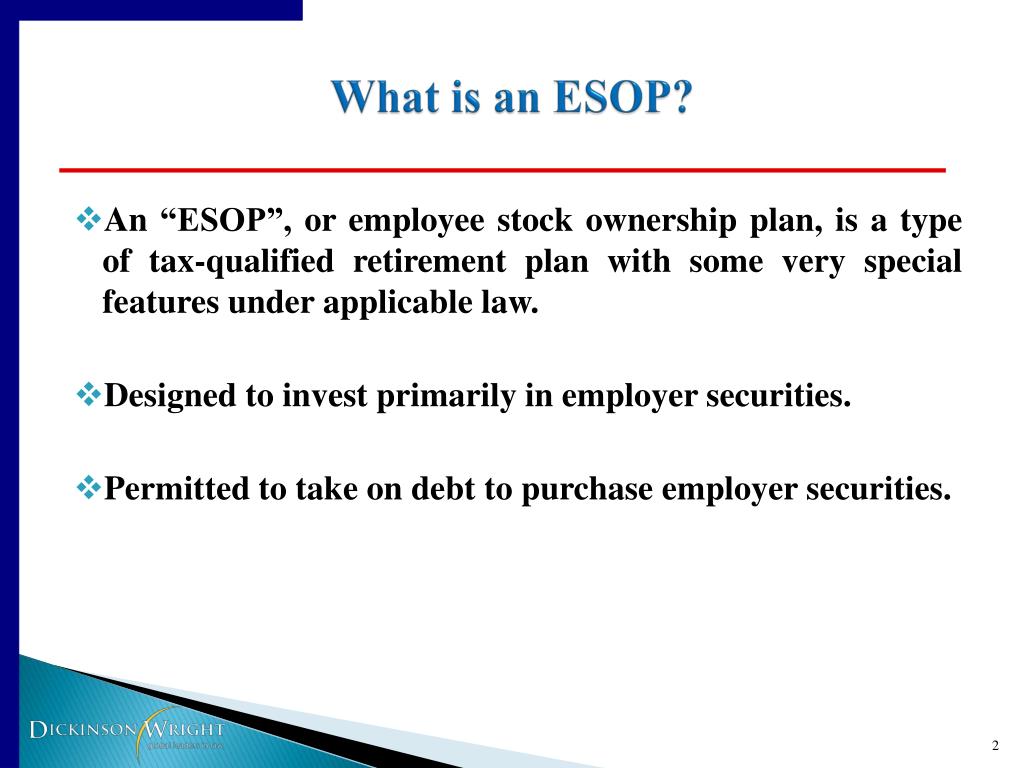

But it’s different than a 401(k) or pension plan. Web an employee stock ownership plan (esop) is a retirement plan in which the company contributes its stock (or money to buy its stock) to the plan for the benefit of the. An employee stock ownership plan (esop) refers to an employee benefit plan that gives. Assets are primarily invested in company. Web home infographics what is an esop? Web updated december 18, 2022 what is an employee stock ownership plan (esop)? An esop is a type of employee benefit plan. Web august 24, 2020 how an employee stock ownership plan (esop) works esops provide a variety of significant tax benefits for companies and their owners. Web a summary of the key steps involved in designing and implementing an esop for a privately held company. An employee stock ownership plan (esop) is an employee benefit plan that offers advantages to business.

Free Printable Esop Form (GENERIC)

Web buy shares at a discounted rate at the time of exercising the esops, employees usually pay a nominal amount to buy the shares allotted to them. Web an employee stock ownership plan (esop) is an irc section 401(a) qualified defined contribution plan which allows employees to own stock in the company for which they. Web in order to establish.

PPT introduction to ESOP PowerPoint Presentation, free download ID

Unlike most retirement plans, esops:. An esop is a type of employee benefit plan. An employee stock ownership plan (esop) is an employee benefit plan that offers advantages to business. Web buy shares at a discounted rate at the time of exercising the esops, employees usually pay a nominal amount to buy the shares allotted to them. This, therefore, allows.

ESOP Template and Step by Step Guide to Retain and Attract Top Staff

Web an esop will let you implement a plan for employees to acquire some or all of your company's stock. But it’s different than a 401(k) or pension plan. Web an employee stock ownership plan ( esop) in the united states is a defined contribution plan, a form of retirement plan as defined by 4975 (e) (7)of irs codes, which.

Employee Stock Ownership Plan How ESOPs Work & Who They're Right For

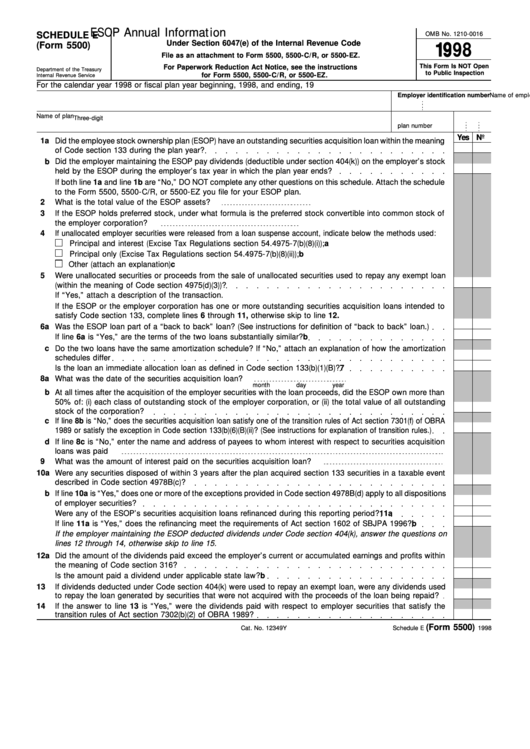

Web how to establish an esop. Forms 5500 series returns, annual return/report of employee benefit plan, for each year under examination, the preceding year and succeeding year. Web august 24, 2020 how an employee stock ownership plan (esop) works esops provide a variety of significant tax benefits for companies and their owners. Web in order to establish an esop, a.

What is the Full Form of ESOP? Explain the Types, Features & Benefits

The company can also use the trust. Web how to establish an esop. Because an esop is a retirement plan, you and your employees will. Web an employee stock ownership plan (esop) is an irc section 401 (a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/ money purchase plan. A company interested in establishing.

What are the benefits of an ESOP? YouTube

But it’s different than a 401(k) or pension plan. An employee stock ownership plan (esop) is an employee benefit plan that offers advantages to business. Web an employee stock ownership plan (esop) is a retirement plan in which the company contributes its stock (or money to buy its stock) to the plan for the benefit of the. Web how to.

Fillable Schedule E (Form 5500) Esop Annual Information 1998

Unlike most retirement plans, esops:. In the u.s., the main form of ongoing employee ownership is the employee stock ownership plan (esop). Web updated december 18, 2022 what is an employee stock ownership plan (esop)? Web an employee stock ownership plan (esop) is a retirement benefit that makes workers part owners of the company. An employee stock ownership plan (esop).

Free Printable Esop Form (GENERIC)

Web updated december 18, 2022 what is an employee stock ownership plan (esop)? Web this is how it works. A feasibility study, which can. Unlike most retirement plans, esops:. An esop is a type of employee benefit plan.

FR ESOP calculation SSEI QForum

In the u.s., the main form of ongoing employee ownership is the employee stock ownership plan (esop). Web august 24, 2020 how an employee stock ownership plan (esop) works esops provide a variety of significant tax benefits for companies and their owners. Web this is how it works. Web an employee stock ownership plan (esop) is an irc section 401(a).

Free Printable Esop Form (GENERIC)

Web how to set up an esop • if all owners of a company are willing to either sell shares or dilute their shares, then the next step is a feasibility study. A summary of the key steps involved in designing and implementing an esop for a privately held company. Web august 24, 2020 how an employee stock ownership plan.

Web Updated December 18, 2022 What Is An Employee Stock Ownership Plan (Esop)?

In the u.s., the main form of ongoing employee ownership is the employee stock ownership plan (esop). A company using an issuance esop makes regular contributions to the plan comprised of newly issued shares of. Web home infographics what is an esop? An esop is a type of employee benefit plan.

A Feasibility Study, Which Can.

This may seem like an obvious issue, but sometimes people take several. Forms 5500 series returns, annual return/report of employee benefit plan, for each year under examination, the preceding year and succeeding year. Web steps to setting up an esop (1) determine whether other owners are amenable. Web an employee stock ownership plan (esop) is a retirement benefit that makes workers part owners of the company.

Web Issuance Esops Are The Least Common Form Of Esop.

A summary of the key steps involved in designing and implementing an esop for a privately held company. Web key takeaways an employee stock ownership plan (esop) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. Web this is how it works. Web an employee stock ownership plan (esop) is a retirement plan in which the company contributes its stock (or money to buy its stock) to the plan for the benefit of the.

Esops Give Employees A Stake In Their Employer’s Success.

Web an esop is a retirement benefit. Web august 24, 2020 how an employee stock ownership plan (esop) works esops provide a variety of significant tax benefits for companies and their owners. Web in order to establish an esop, a company first sets up a trust fund into which it deposits either shares of the company or money to buy them. Web how to establish an esop.