How To Fill Out It-2104 Form 2022 Single

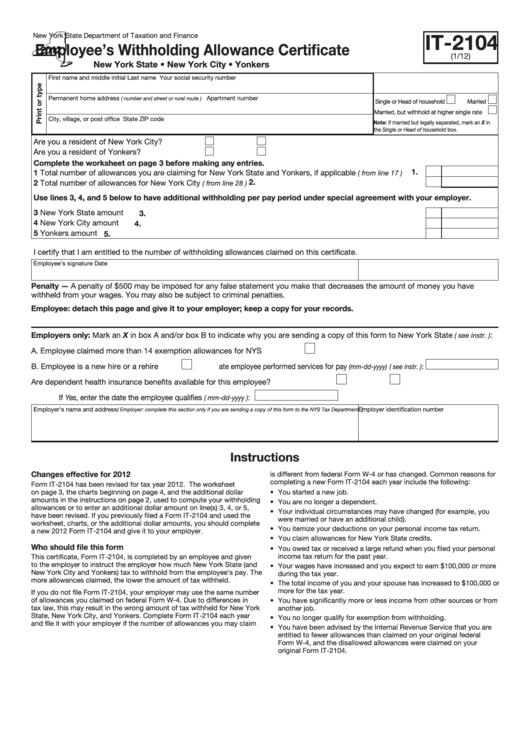

How To Fill Out It-2104 Form 2022 Single - Answered in 1 minute by: Web how to fill out the nys form it 2104 2016 on the internet: 1 = less taxes withheld. Single taxpayers with one job and zero dependents, enter 1 on lines 1 and 2 (if applicable). 0 = more taxes withheld; Web new york’s 2022 withholding certificate was released jan. However, if you claim more than 14 allowances, you must complete the withholding. Or • more than $1,616,450, and who are head of household. 12 by the state department of taxation and finance. Every employee must complete two withholding forms:

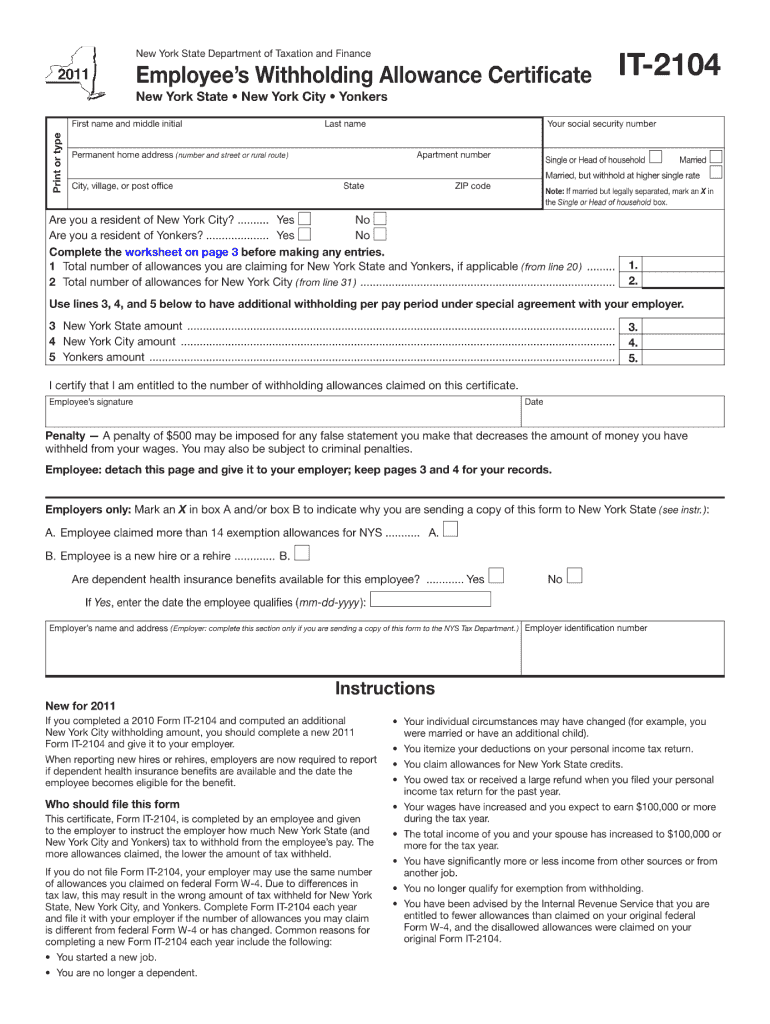

Married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in. New york state withholding exemption certificate for military service personnel: Answered in 1 minute by: First name and middle initial last name your social security number permanent home address (number and street or rural route)apartment number &lw\ yloodjh rusrvwr fh 6wdwh. Otal number of allowances you are claiming for new york state and yonkers, if ap. Every employee must complete two withholding forms: I am single/head of household and have no idea what to put for this: Web • more than $1,077,550, and who are single or married filing separately; The label on your submit button should make sense with the rest of the content; Sign online button or tick the preview image of the document.

12 by the state department of taxation and finance. The label on your submit button should make sense with the rest of the content; Ask your own tax question. Sign online button or tick the preview image of the document. • you started a new job. Single taxpayers with one job and zero dependents, enter 1 on lines 1 and 2 (if applicable). To start the blank, use the fill camp; However, if you claim more than 14 allowances, you must complete the withholding. Otal number of allowances you are claiming for new york state and yonkers, if ap. Or • more than $1,616,450, and who are head of household.

Cornell Cooperative Extension Required Paperwork for New Employees

If you do not, your default ny state status will. Web new york’s 2022 withholding certificate was released jan. Annuitant's request for income tax withholding: She should fill it out by accurately answering the questions on the worksheet, similar to the process she used for the w4. New york state withholding exemption certificate for military service personnel:

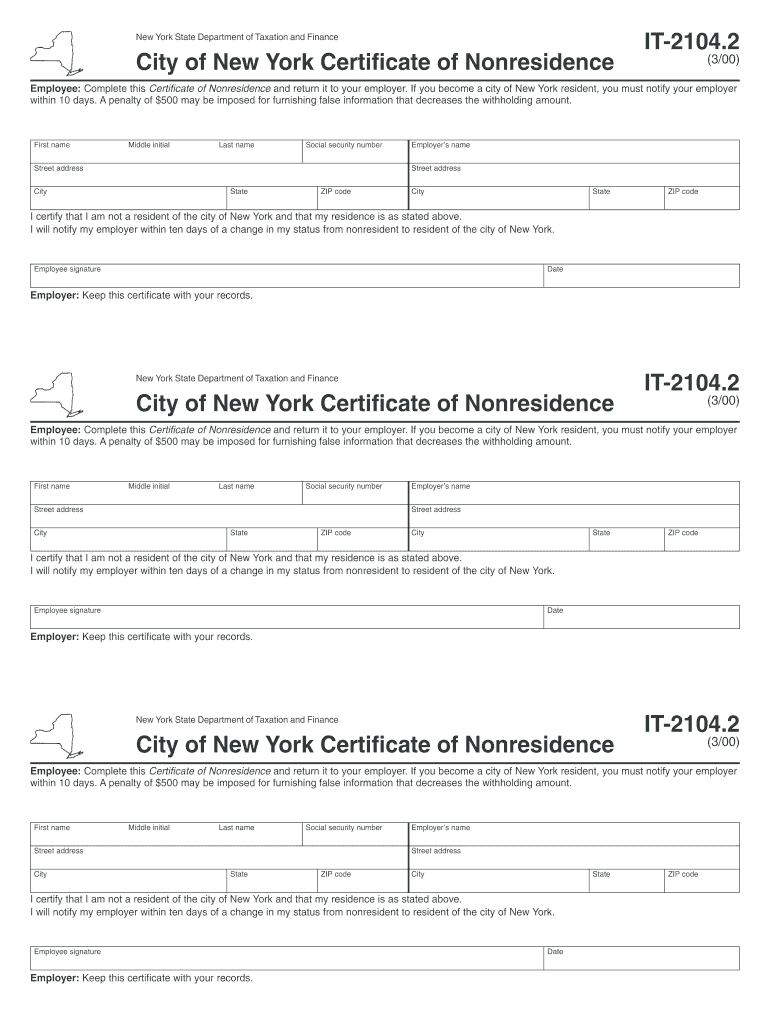

It 2104 Fill Out and Sign Printable PDF Template signNow

What is this form for? Web • more than $1,077,550, and who are single or married filing separately; If you do not, your default ny state status will. Otal number of allowances you are claiming for new york state and yonkers, if ap. Web how to fill out the nys form it 2104 2016 on the internet:

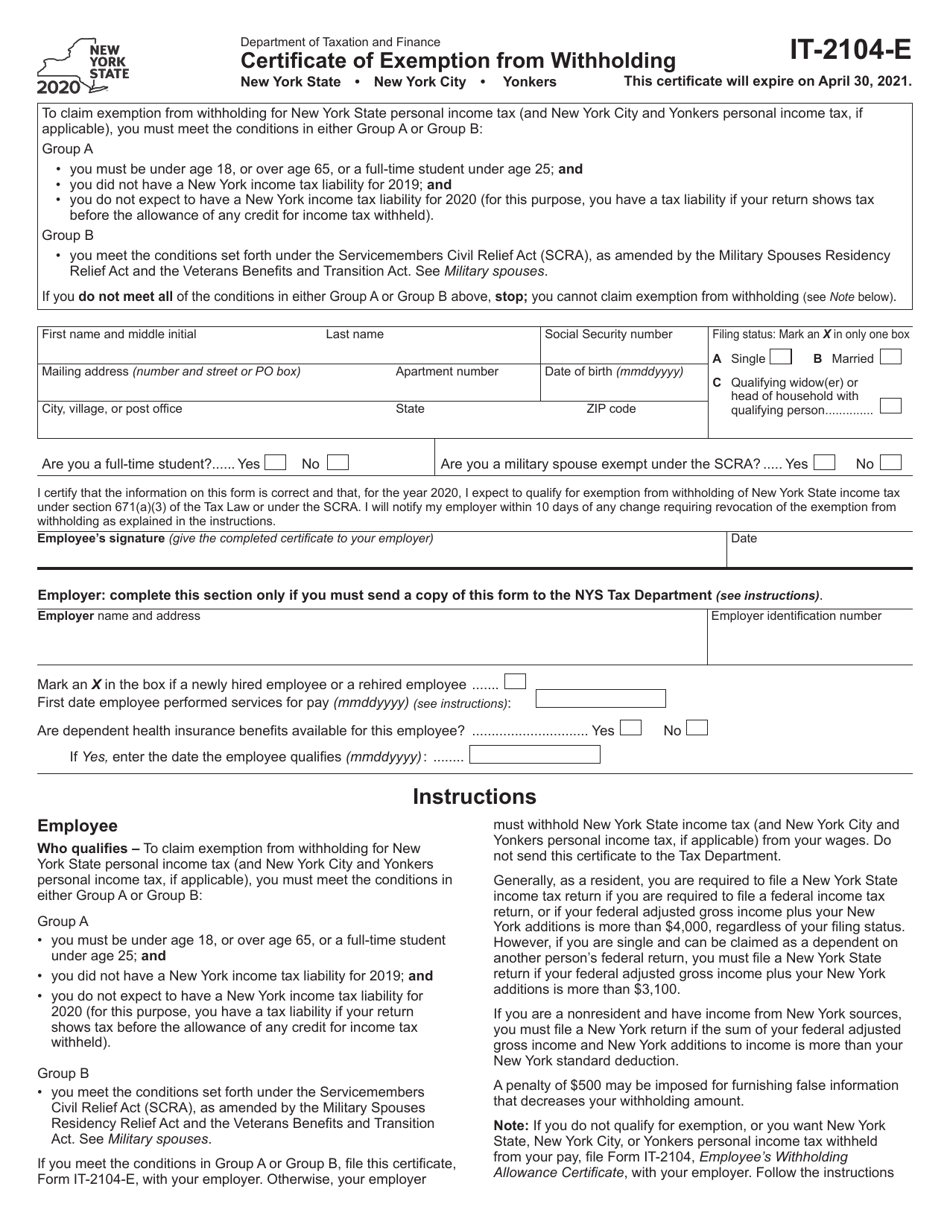

Form IT2104E Download Fillable PDF or Fill Online Certificate of

She should fill it out by accurately answering the questions on the worksheet, similar to the process she used for the w4. What is this form for? Answered in 1 minute by: If you do not, your default ny state status will. 12 by the state department of taxation and finance.

Best Answer How To Fill Out It2104 New York Single? [The Right Answer

Web • more than $1,077,550, and who are single or married filing separately; Otal number of allowances you are claiming for new york state and yonkers, if ap. • you started a new job. Every employee must complete two withholding forms: For example, if you have a registration.

New York City Allowances IT2104 Baron Payroll

The label on your submit button should make sense with the rest of the content; Web how to fill out the nys form it 2104 2016 on the internet: Every employee must complete two withholding forms: If you do not, your default ny state status will. New york state withholding exemption certificate for military service personnel:

How To Fill Out It 2104 Form WebSelfEdit

First name and middle initial last name your social security number permanent home address (number and street or rural route)apartment number &lw\ yloodjh rusrvwr fh 6wdwh. If you do not, your default ny state status will. I am single/head of household and have no idea what to put for this: New york state withholding exemption certificate for military service personnel:.

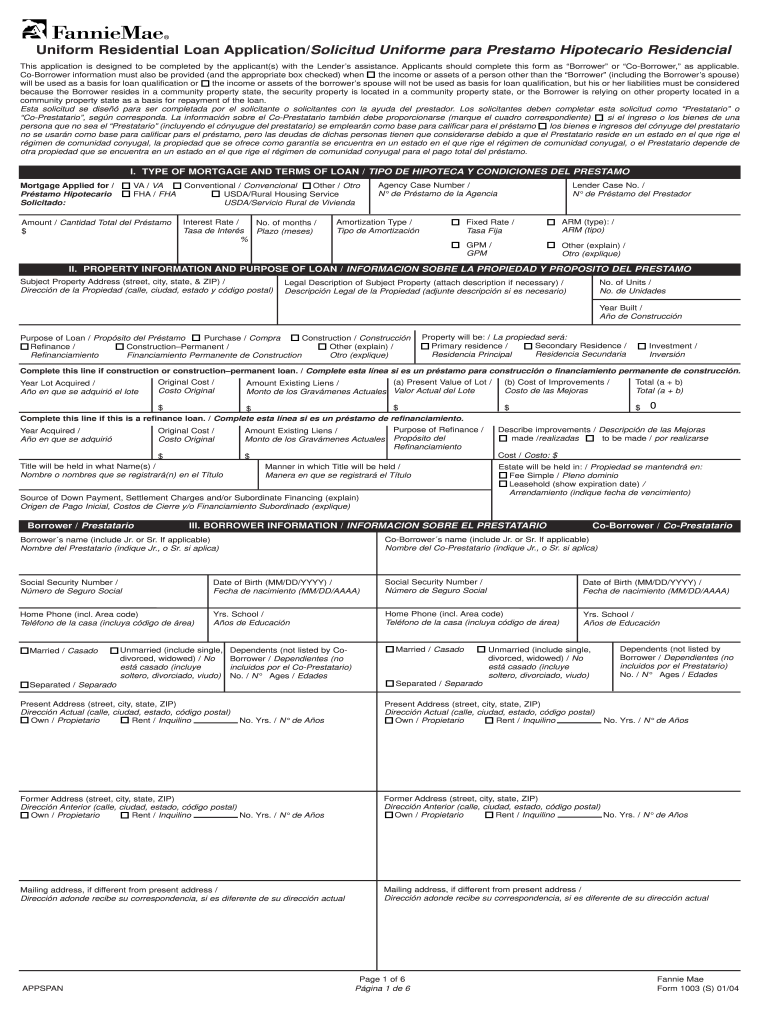

Form 1003 in spanish Fill out & sign online DocHub

Sign online button or tick the preview image of the document. Last but not least, renaming your submit button is a small, but important final touch on your form. 1 = less taxes withheld. Every employee must complete two withholding forms: Annuitant's request for income tax withholding:

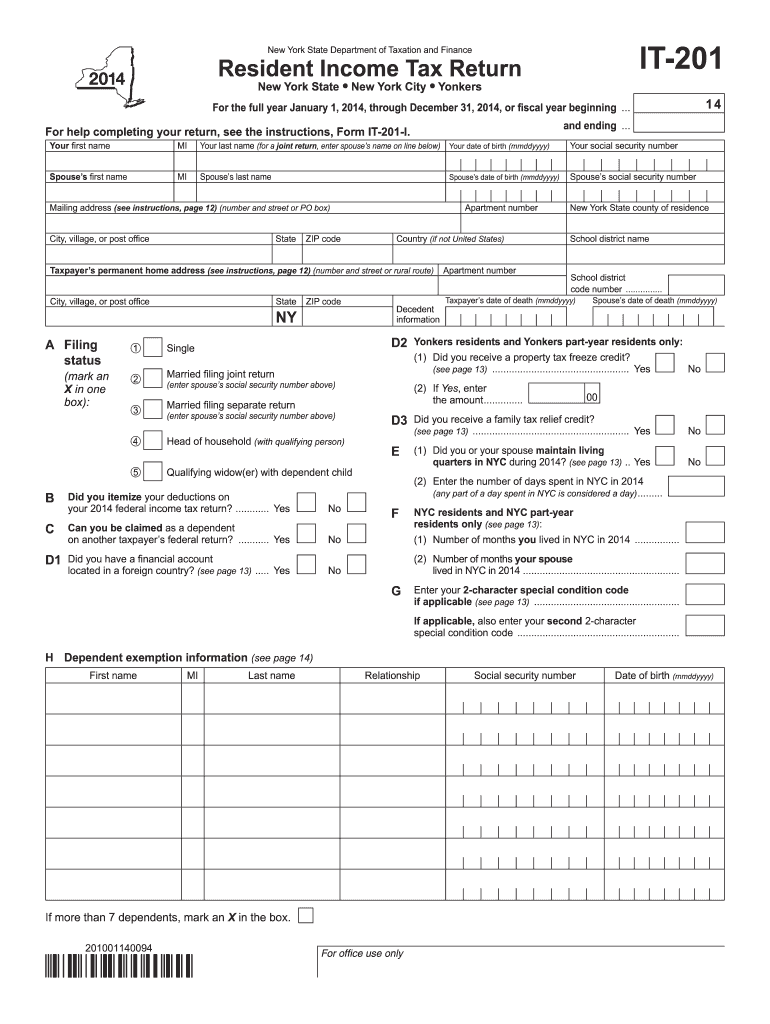

2014 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

I am single/head of household and have no idea what to put for this: 0 = more taxes withheld; Web this answer was rated: Last but not least, renaming your submit button is a small, but important final touch on your form. Web new york’s 2022 withholding certificate was released jan.

Employee's Withholding Allowance Certificate Form 2022 2023

• you started a new job. Annuitant's request for income tax withholding: Web • more than $1,077,550, and who are single or married filing separately; The label on your submit button should make sense with the rest of the content; Ask your own tax question.

Fillable Form It2104 Employee'S Withholding Allowance Certificate

Web • more than $1,077,550, and who are single or married filing separately; Every employee must complete two withholding forms: • you started a new job. Ask your own tax question. New york state withholding exemption certificate for military service personnel:

Every Employee Must Complete Two Withholding Forms:

The label on your submit button should make sense with the rest of the content; Web • more than $1,077,550, and who are single or married filing separately; Married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in. Or • more than $1,616,450, and who are head of household.

Annuitant's Request For Income Tax Withholding:

What is this form for? Web this answer was rated: If you do not, your default ny state status will. 1 = less taxes withheld.

For Example, If You Have A Registration.

She should fill it out by accurately answering the questions on the worksheet, similar to the process she used for the w4. Annuitant's request for income tax withholding: New york state withholding exemption certificate for military service personnel: The advanced tools of the editor will guide you through the editable pdf template.

Ask Your Own Tax Question.

Otal number of allowances you are claiming for new york state and yonkers, if ap. Answered in 1 minute by: To start the blank, use the fill camp; 12 by the state department of taxation and finance.