How To Fill Out Form 7203

How To Fill Out Form 7203 - Web in this part of the form, you will figure out your business’s current excise tax liability. Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. Web form 7203 is generated for a 1040 return when: Taxpayers need to report any type of income on their tax forms. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Computing stock basis in computing stock. Typically, this amount is limited to their basis, or. Your basis calculation represents the value of the stock you own. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203.

Once you finish part three, you will know whether you need to pay more in excise. Basis is handled as follows: Web in this part of the form, you will figure out your business’s current excise tax liability. Your basis calculation represents the value of the stock you own. Web generate form 7203, s corporation shareholder stock and debt basis limitations. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. To enter basis limitation info in the individual return: Web form 7203 is generated for a 1040 return when: I have read all of the instructions for form 7203,. Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis.

Once you finish part three, you will know whether you need to pay more in excise. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Learn more about what will be covered in this webinar. Go to screen 20.2, s corporation. Your basis calculation represents the value of the stock you own. Web form 7203 is generated for a 1040 return when: Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Typically, this amount is limited to their basis, or. I have read all of the instructions for form 7203,.

How to complete IRS Form 720 for the PatientCentered Research

Go to screen 20.2, s corporation. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis. Web in this part.

More Basis Disclosures This Year for S corporation Shareholders Need

Web form 7203 is generated for a 1040 return when: Web in this part of the form, you will figure out your business’s current excise tax liability. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Basis is handled as follows: Taxpayers need to report any type of income on their.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web you must complete and file form 7203 if you’re an s corporation shareholder and you: To enter basis limitation info in the individual return: Taxpayers need to report any type of income on their tax forms. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other.

IRS Issues New Form 7203 for Farmers and Fishermen

Web if one of these requirements applies, then form 7203 is required. Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. Typically, this amount is limited to their basis, or. Web in this part of the form, you.

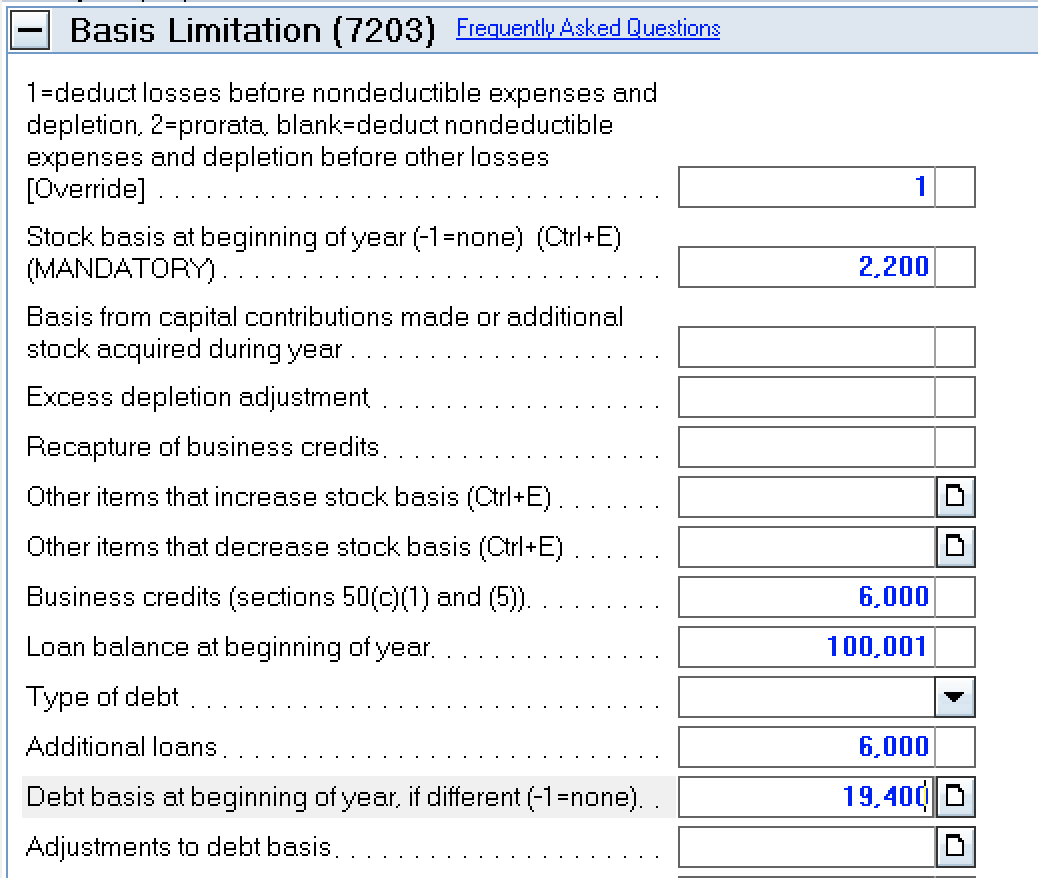

How to complete Form 7203 in Lacerte

Web form 7203 is generated for a 1040 return when: Web if one of these requirements applies, then form 7203 is required. Learn more about what will be covered in this webinar. Go to screen 20.2, s corporation. Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis.

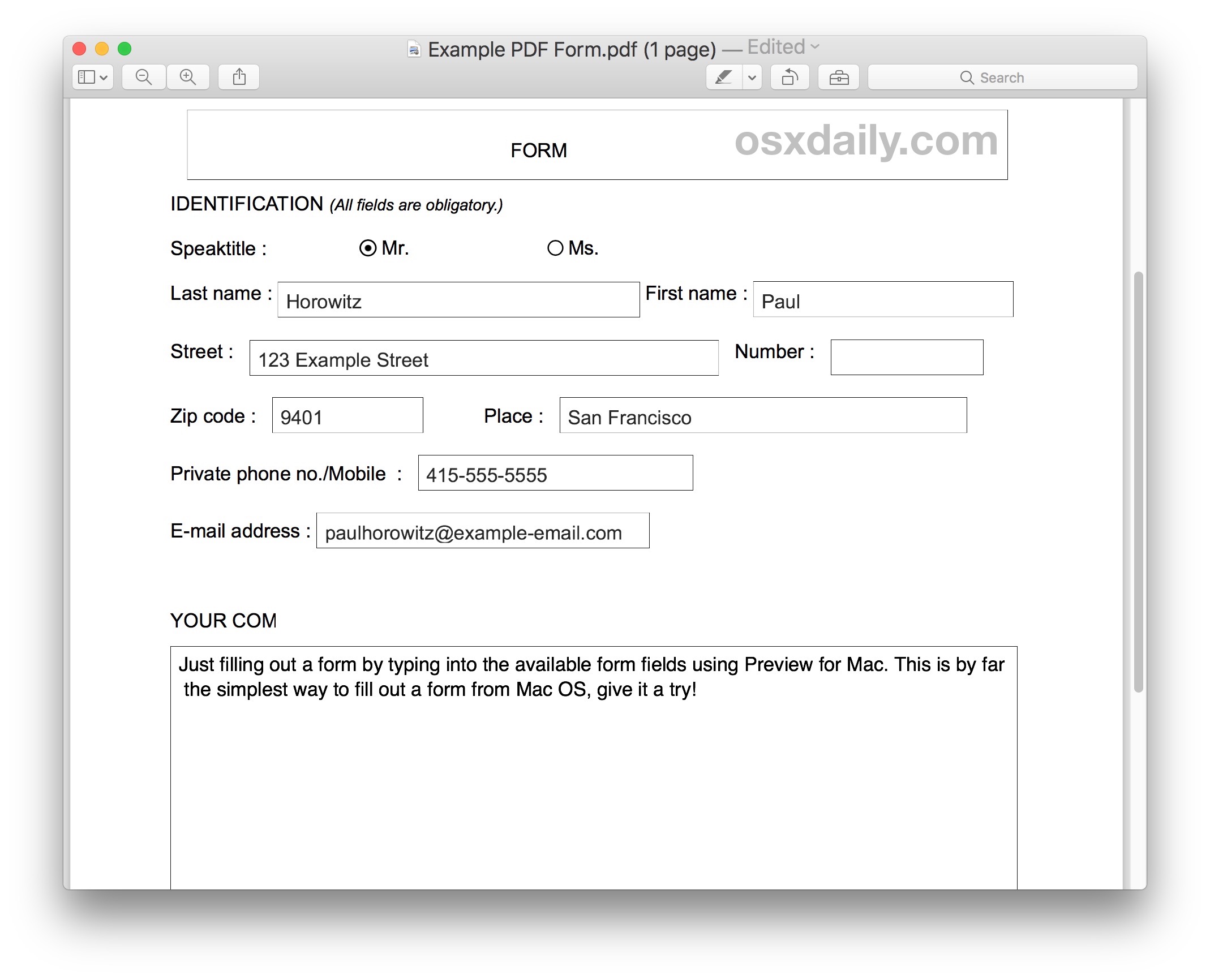

How to Fill Out PDF Forms and Documents on Mac

Learn more about what will be covered in this webinar. Typically, this amount is limited to their basis, or. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Computing stock basis in computing stock.

Peerless Turbotax Profit And Loss Statement Cvp

Learn more about what will be covered in this webinar. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Web bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers: Web 1 best answer julies expert alumni if you.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Press f6 to bring up open forms. Web form 7203, s corporation shareholder stock and debt.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that. Web bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers: Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web you must complete.

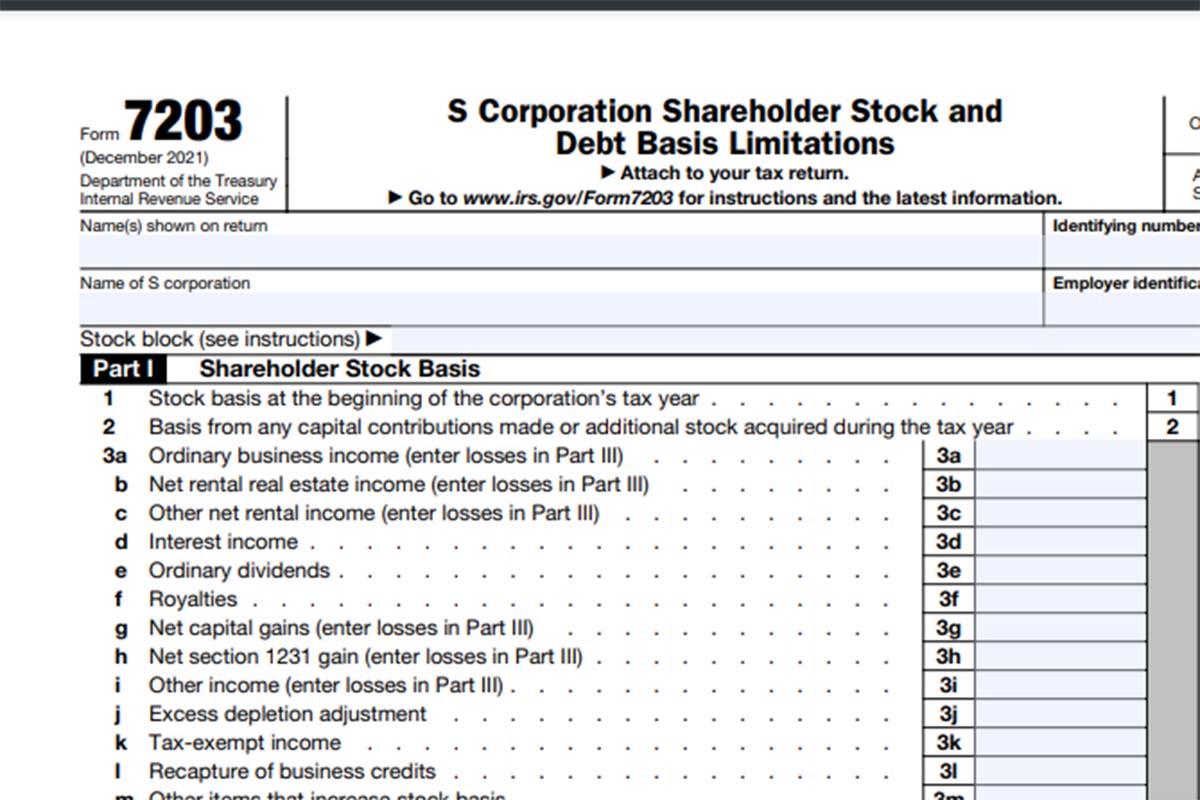

Form7203PartI PBMares

Web if one of these requirements applies, then form 7203 is required. Computing stock basis in computing stock. Web generate form 7203, s corporation shareholder stock and debt basis limitations. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that. Web bookmark icon aliciap1 expert.

Taxpayers Need To Report Any Type Of Income On Their Tax Forms.

To enter basis limitation info in the individual return: Web generate form 7203, s corporation shareholder stock and debt basis limitations. The irs will take the w2, which lists income from wages and salaries. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their.

Your Basis Calculation Represents The Value Of The Stock You Own.

Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Basis is handled as follows: December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203.

Web 1 Best Answer Julies Expert Alumni If You Have An Entry For Distributions On Line 16 D, You Are Required To Complete Form 7203, Even If You Believe The Distributions.

Web if one of these requirements applies, then form 7203 is required. Typically, this amount is limited to their basis, or. Web form 7203 is generated for a 1040 return when: Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be.

Web Bookmark Icon Aliciap1 Expert Alumni I'll Answer Your Questions By Your Numbers:

Press f6 to bring up open forms. Learn more about what will be covered in this webinar. Once you finish part three, you will know whether you need to pay more in excise. Computing stock basis in computing stock.