How To Fill Out Form 5695 For Solar Panels

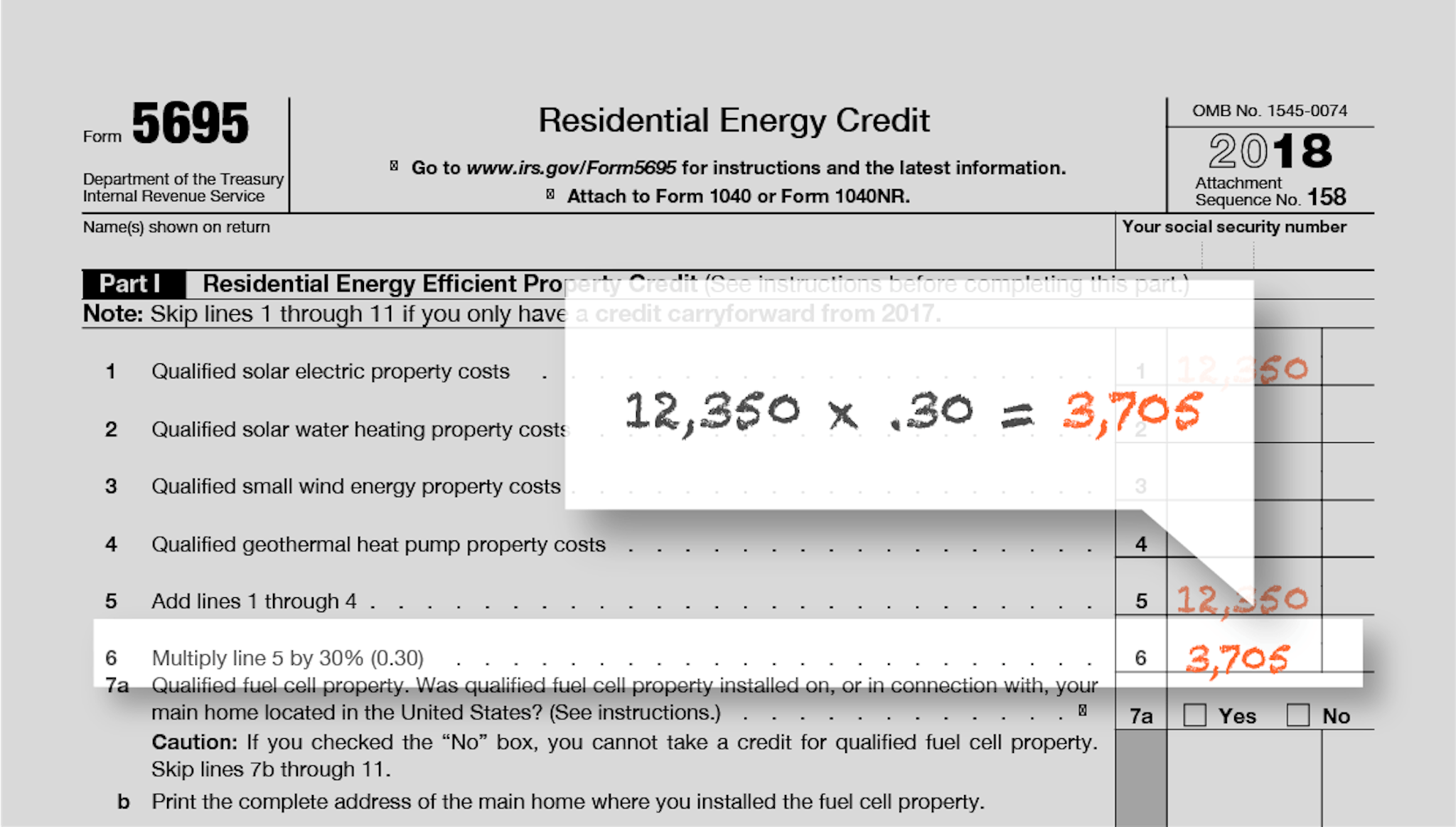

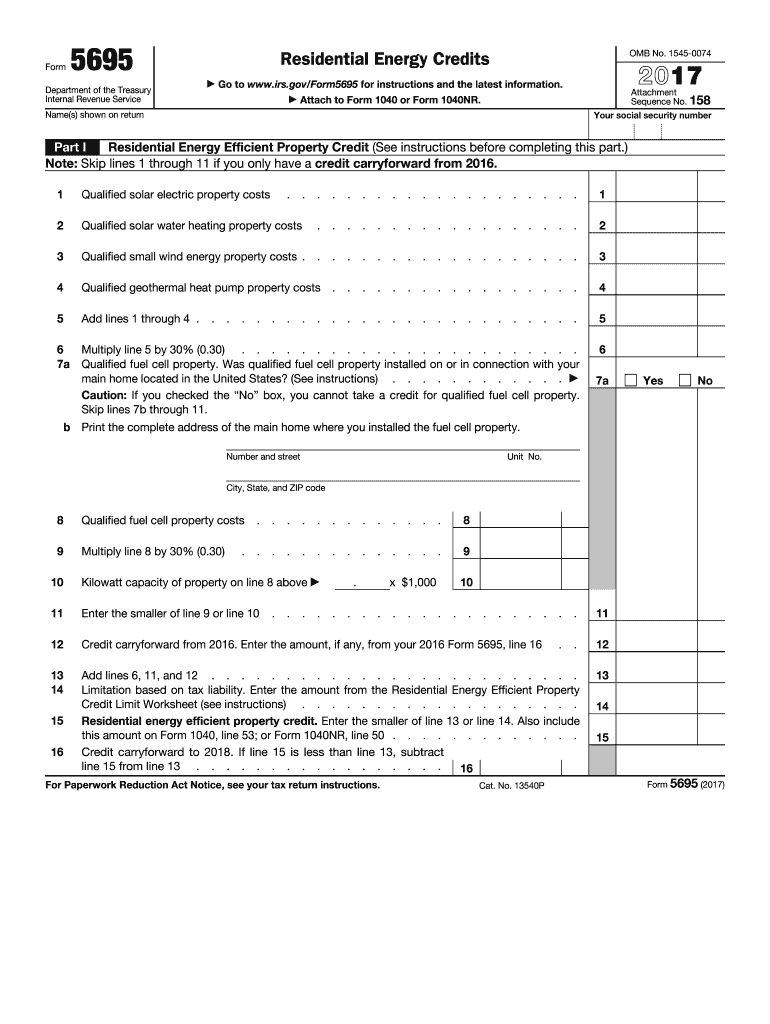

How To Fill Out Form 5695 For Solar Panels - Once you’ve downloaded the irs form, import it into a document editor or print, to begin. Web these items include: Open (continue) your tax return in. How to claim the solar tax credit on your. Receipts from your solar panels and/or battery backup installation irs form 1040 (pdf) irs form 5695 (pdf) irs form 5695 worksheet. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property,. For tax years 2006 through 2017 it was also used to calculate the nonbusiness. Department of the treasury internal revenue service. Web 7 9,008 reply bookmark icon critter level 15 to enter your residential energy credits (form 5695) in turbotax online: Luckily the form provides a checklist to help homeowners.

Web home forms and instructions about form 5695, residential energy credits about form 5695, residential energy credits use form 5695 to figure and take your. How to claim the solar tax credit on your. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water. Once you’ve downloaded the irs form, import it into a document editor or print, to begin. The total system costs of the solar power system for your home is the gross (total). Web energy efficient home improvement credit. Web 7 9,008 reply bookmark icon critter level 15 to enter your residential energy credits (form 5695) in turbotax online: Luckily the form provides a checklist to help homeowners. Web how to fill out form 5695 for solar panels the most important step in filling out form 5695 is to confirm eligibility. Receipts from your solar panels and/or battery backup installation irs form 1040 (pdf) irs form 5695 (pdf) irs form 5695 worksheet.

You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property,. Web a were the qualified energy efficiency improvements or residential energy property costs for your main home located in the united states? Web form 5695 can be used to claim energy efficient credits summarized below: Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Web home forms and instructions about form 5695, residential energy credits about form 5695, residential energy credits use form 5695 to figure and take your. Web for qualified fuel cell property, see lines 7a and 7b, later. The nonbusiness energy property credit is now the energy efficient home improvement credit. Department of the treasury internal revenue service. Web 7 9,008 reply bookmark icon critter level 15 to enter your residential energy credits (form 5695) in turbotax online: Receipts from your solar panels and/or battery backup installation irs form 1040 (pdf) irs form 5695 (pdf) irs form 5695 worksheet.

Ev Federal Tax Credit Form

The credit is extended to property placed. Web home forms and instructions about form 5695, residential energy credits about form 5695, residential energy credits use form 5695 to figure and take your. Web for qualified fuel cell property, see lines 7a and 7b, later. The total system costs of the solar power system for your home is the gross (total)..

Form 5695 Instructions Information On Form 5695 —

Web it’s easy to fill out and you don’t need a tax professional to do it. Web how to fill out form 5695 for solar panels the most important step in filling out form 5695 is to confirm eligibility. The credit is extended to property placed. Department of the treasury internal revenue service. For updates on the 2022 versions of.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

The nonbusiness energy property credit is now the energy efficient home improvement credit. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water. How to claim the solar tax credit on your. The credit is extended to property placed. Web irs form 5695 instructions step 1:.

Instructions for filling out IRS Form 5695 Everlight Solar

Once you’ve downloaded the irs form, import it into a document editor or print, to begin. Open (continue) your tax return in. The residential energy efficient property credit, and part ii: How to claim the solar tax credit on your. Web these items include:

What Is Form 5695 Residential Energy Credits?

Add any additional energy improvement costs, if any, on. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water. The residential energy efficient property credit, and part ii: Open (continue) your tax return in. Web for qualified fuel cell property, see lines 7a and 7b, later.

How To Claim The Solar Tax Credit IRS Form 5695

Receipts from your solar panels and/or battery backup installation irs form 1040 (pdf) irs form 5695 (pdf) irs form 5695 worksheet. Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Add any additional energy improvement costs, if any, on. The total system costs of the solar power system for your home is the gross.

Image tagged in scumbag,old fashioned Imgflip

Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Department of the treasury internal revenue service. Add any additional energy improvement costs, if any, on. Web form 5695 can be used to claim energy efficient credits summarized below: Luckily the form provides a checklist to help homeowners.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water. Once you’ve downloaded the irs form, import it into a document editor or print, to begin. Open (continue) your tax return in. Web form 5695 can be used to claim energy efficient credits summarized below: Department of the.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Luckily the form provides a checklist to help homeowners. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water. Web these items include: Web it’s easy to fill out and you don’t need a tax professional to do it. How to claim the solar tax credit on your.

5695 form Fill out & sign online DocHub

Web these items include: How to fill out irs form 5695. The credit is extended to property placed. Web 7 9,008 reply bookmark icon critter level 15 to enter your residential energy credits (form 5695) in turbotax online: Web how to fill out form 5695 for solar panels the most important step in filling out form 5695 is to confirm.

Web Irs Form 5695 Instructions Step 1:.

Web it’s easy to fill out and you don’t need a tax professional to do it. Open (continue) your tax return in. The 3 steps to claim the solar tax credit. Web for qualified fuel cell property, see lines 7a and 7b, later.

The Total System Costs Of The Solar Power System For Your Home Is The Gross (Total).

You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property,. Web these items include: For tax years 2006 through 2017 it was also used to calculate the nonbusiness. How to fill out irs form 5695.

The Nonbusiness Energy Property Credit Is Now The Energy Efficient Home Improvement Credit.

The residential energy efficient property credit, and part ii: Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Receipts from your solar panels and/or battery backup installation irs form 1040 (pdf) irs form 5695 (pdf) irs form 5695 worksheet. Once you’ve downloaded the irs form, import it into a document editor or print, to begin.

For Updates On The 2022 Versions Of Form 5695, See The Following Playlist:

Web 7 9,008 reply bookmark icon critter level 15 to enter your residential energy credits (form 5695) in turbotax online: Department of the treasury internal revenue service. Web energy efficient home improvement credit. Add any additional energy improvement costs, if any, on.