How To Fill Out A 982 Tax Form

How To Fill Out A 982 Tax Form - (if not already open.) once you are. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Complete, edit or print tax forms instantly. Knott 14k subscribers join subscribe 661 share 17k. Web download or print the 2022 federal form 982 (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) for free from the. Download or email irs 982 & more fillable forms, register and subscribe now! Web the easiest way to find/file form 982 in turbotax online is to go to: While a trust or estate does not have to issue a payment,. Web part ii of form 982 refers to a reduction of tax attributes.

Individual income tax return, for the tax year in which your debt was forgiven. While a trust or estate does not have to issue a payment,. Web part ii of form 982 refers to a reduction of tax attributes. Web how do i file form 982 for a bankruptcy reduction in income? Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained below). Upload, modify or create forms. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Fill out the form which will give you the amount of insolvency at the end on line 7. Click other income in the federal quick q&a topics menu to expand, then click cancellation of.

Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. Web part ii of form 982 refers to a reduction of tax attributes. Fill out the form which will give you the amount of insolvency at the end on line 7. This means that when you exclude a cancelled debt from income you are not allowed to get an additional. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. To enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040). Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained below). Turbotax does not have an interview for form 982 and it is also not possible to import this form. Upload, modify or create forms. Web download or print the 2022 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2022) and other income tax forms.

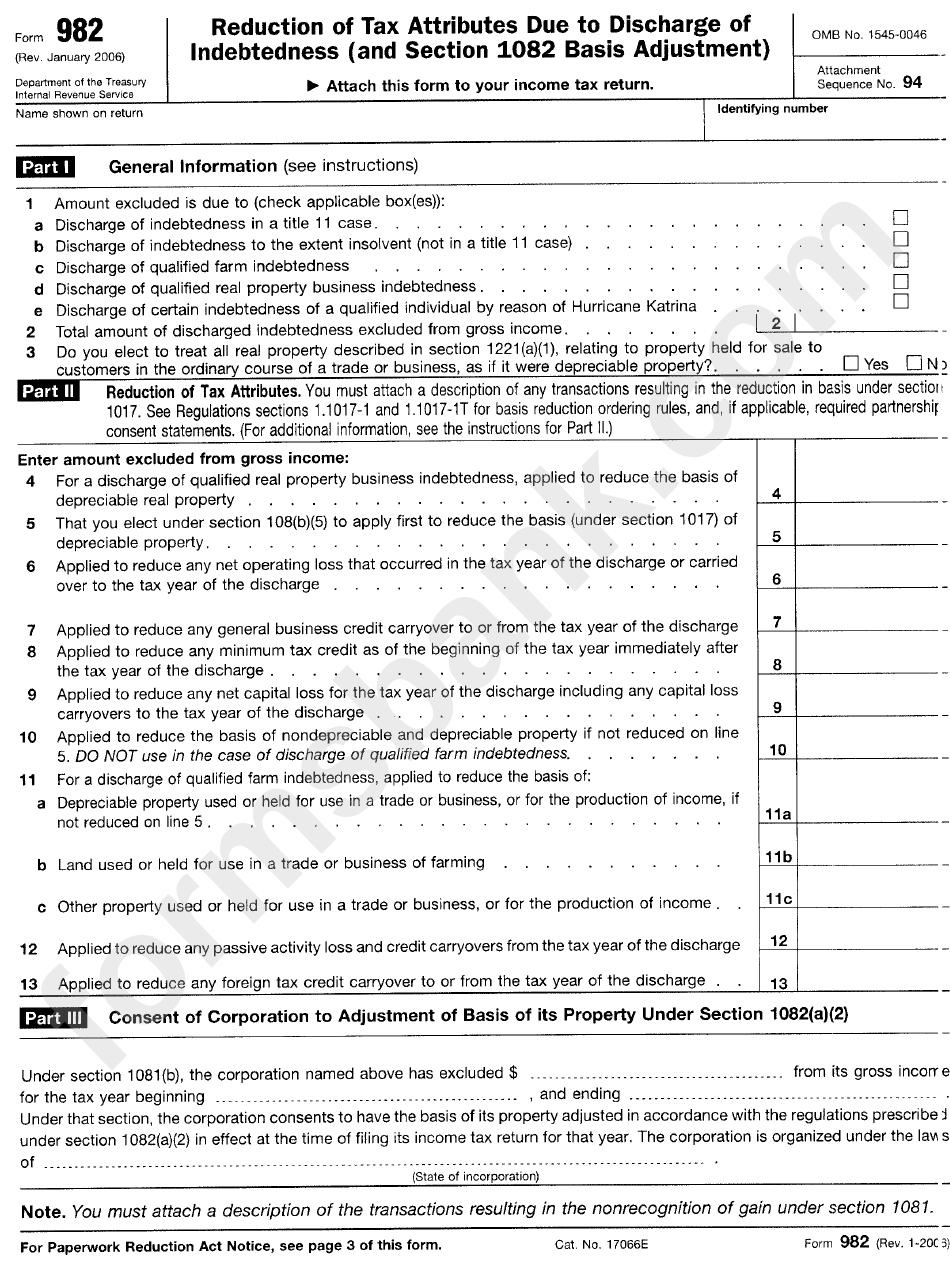

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. March 2018) department of the treasury internal revenue service. Web part ii of.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

I'm using turbotax online, currently it keeps telling me my income is taxable. Use irs form 982 to reduce taxes on cod income jason d. Individual income tax return, for the tax year in which your debt was forgiven. Turbotax does not have an interview for form 982 and it is also not possible to import this form. Knott 14k.

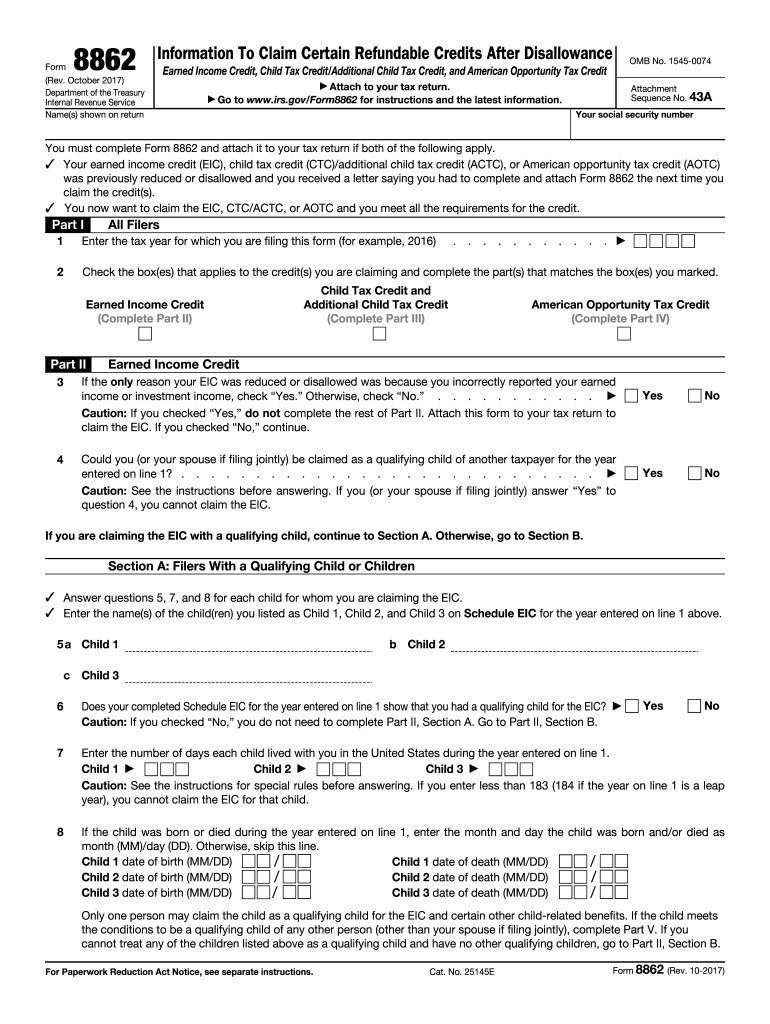

IRS 8862 2017 Fill and Sign Printable Template Online US Legal Forms

Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Web part ii of form 982 refers to a reduction of tax attributes. I'm using turbotax online, currently it keeps telling me my income is taxable. Upload, modify or create forms. Web you must file form 982 to report the exclusion and the reduction of certain tax.

Tax Form 982 Insolvency Worksheet —

Turbotax does not have an interview for form 982 and it is also not possible to import this form. Use irs form 982 to reduce taxes on cod income jason d. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. While.

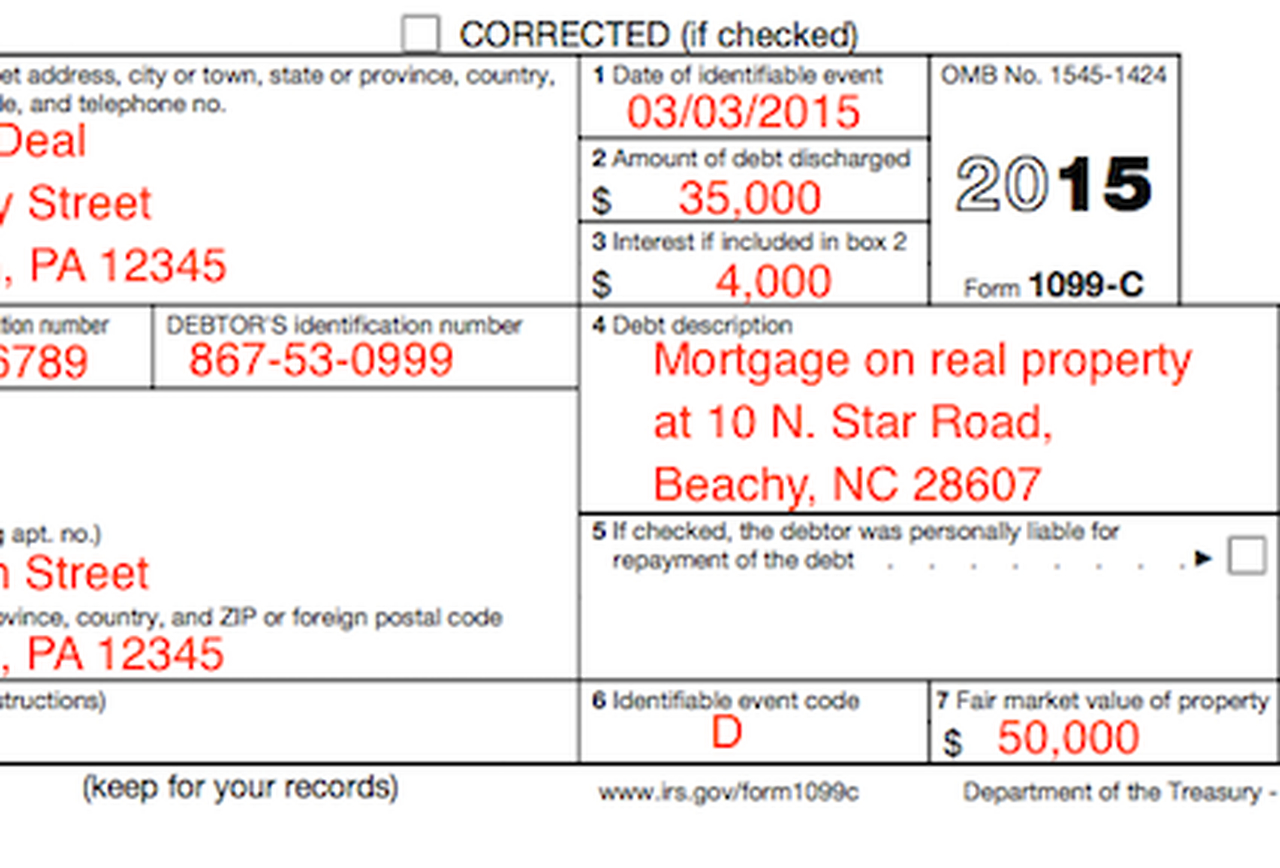

Irs Tax Form For Debt Form Resume Examples xM8ppWm8Y9

Web 1 best answer. Include the amount of canceled qualified real property business debt (but. June 5, 2019 3:37 pm. Sign into turbotax online and click take me to my return. Use irs form 982 to reduce taxes on cod income jason d.

Debt Irs Form 982 Form Resume Examples 0g27K7n2Pr

Knott 14k subscribers join subscribe 661 share 17k. I'm using turbotax online, currently it keeps telling me my income is taxable. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar.

Student Loan 2022

Knott 14k subscribers join subscribe 661 share 17k. Web select the form that pops up and click open form. While a trust or estate does not have to issue a payment,. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web attach form 982 to your federal income tax return for.

IRS Form 982 How to Fill it Right

Sign into turbotax online and click take me to my return. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web the easiest way to find/file form 982 in turbotax online is to go to: Ad download or email irs.

Instructions for IRS Form 982 Reduction of Tax Attributes Due to

Web select the form that pops up and click open form. March 2018) department of the treasury internal revenue service. Include the amount of canceled qualified real property business debt (but. While a trust or estate does not have to issue a payment,. Web 0:00 / 9:00 cancelled debt income is taxable!

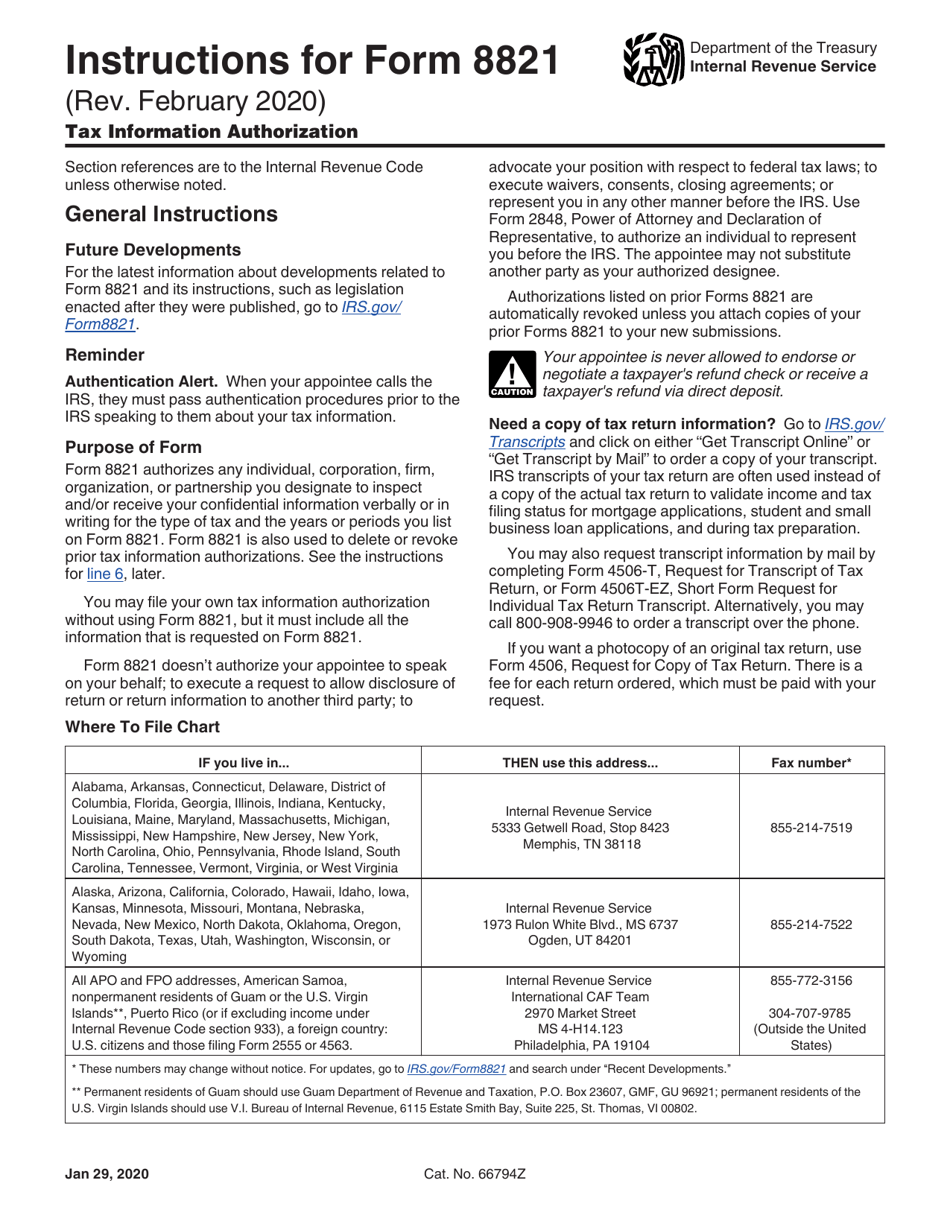

Download Instructions for IRS Form 8821 Tax Information Authorization

Tip certain declared federal disaster events may be. Individual income tax return, for the tax year in which your debt was forgiven. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. (if not already open.) once you are. Include the amount.

Tip Certain Declared Federal Disaster Events May Be.

(if not already open.) once you are. I'm using turbotax online, currently it keeps telling me my income is taxable. Individual income tax return, for the tax year in which your debt was forgiven. Fill out the form which will give you the amount of insolvency at the end on line 7.

June 5, 2019 3:37 Pm.

Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. Web the easiest way to find/file form 982 in turbotax online is to go to: Include the amount of canceled qualified real property business debt (but. Web download or print the 2022 federal form 982 (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) for free from the.

Web How Do I File Form 982 For A Bankruptcy Reduction In Income?

Web common questions about form 982 reduction of tax attributes due to discharge of indebtness in lacerte. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Sign into turbotax online and click take me to my return. To enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040).

Knott 14K Subscribers Join Subscribe 661 Share 17K.

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). This means that when you exclude a cancelled debt from income you are not allowed to get an additional. Web 1 best answer. While a trust or estate does not have to issue a payment,.