How To File Form 8832

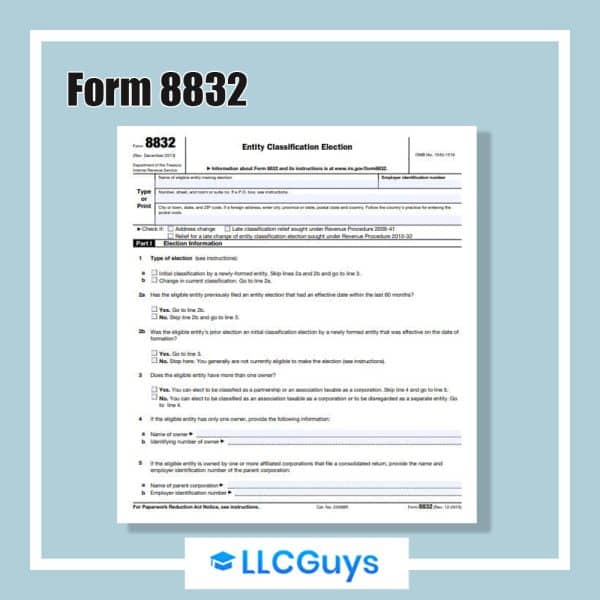

How To File Form 8832 - In this section, you will need to check one of two boxes. Web if classifying your business as a different type of entity would be advantageous, you’ll need to file form 8832 with the irs. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Why would i change my tax classification? Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Fill out your basic information. The location you send the form depends on the state or country your business calls home. Before you rush to hand in form 8832, make sure you know about form. Complete part 1, election information. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years).

Web llcs can file form 8832, entity classification election to elect their business entity classification. Form 8832 is divided into two parts: In this section, you will need to check one of two boxes. Depending on your financial situation, changing your tax classification could lower your total tax bill. Other tax election forms to know about. Fill out your basic information. That’s because different entities are taxed in different ways. Web the first page looks like this: Complete part 1, election information. Web if classifying your business as a different type of entity would be advantageous, you’ll need to file form 8832 with the irs.

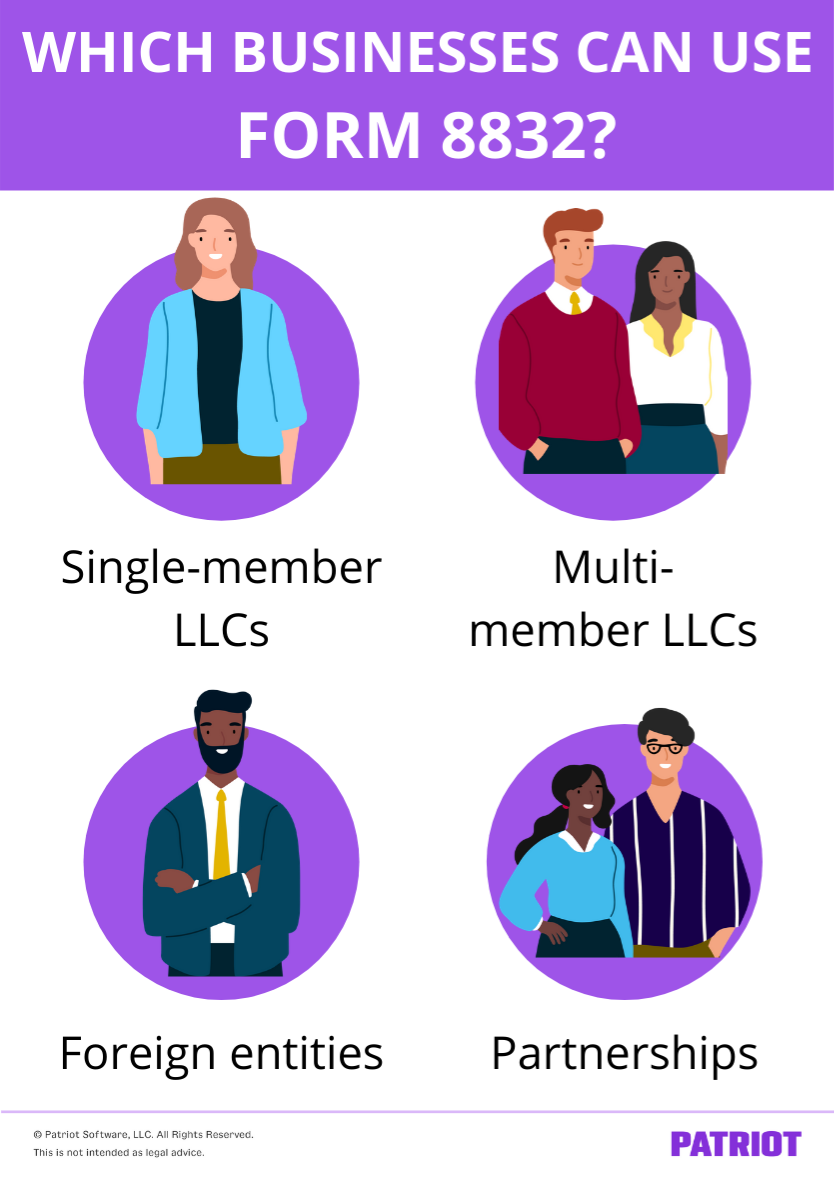

Form 8832 is divided into two parts: Web where to file form 8832: Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). The irs form lists two addresses to mail in your form. Web llcs can file form 8832, entity classification election to elect their business entity classification. Part 1 of irs form 8832 asks a series of questions regarding your tax. Web if classifying your business as a different type of entity would be advantageous, you’ll need to file form 8832 with the irs. Web the first page looks like this: Web the entity failed to qualify as a corporation solely because form 8832 was not timely filed; Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership.

IRS Form 8832 Instructions and FAQs for Business Owners NerdWallet

Web the first page looks like this: The irs form lists two addresses to mail in your form. The location you send the form depends on the state or country your business calls home. Web the entity failed to qualify as a corporation solely because form 8832 was not timely filed; In this section, you will need to check one.

Form 8832 All About It and How to File It?

Web where to file form 8832: Depending on your financial situation, changing your tax classification could lower your total tax bill. In our simple guide, we’ll walk you through form 8832 instructions. If the entity qualifies and files timely in accordance with rev. Web the entity failed to qualify as a corporation solely because form 8832 was not timely filed;

Using Form 8832 to Change Your LLC’s Tax Classification

Web irs form 8832 instructions: You can find irs form 8832 on the irs website the first page of the form has. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). Web where to file form 8832: Web how to fill out form 8832 in 9 steps 1.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Web llcs can file form 8832, entity classification election to elect their business entity classification. Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years). Web how to fill out form 8832 in 9 steps 1. And the entity timely filed all required federal tax returns consistent with its requested classification.

Form 8832 All About It and How to File It?

That’s because different entities are taxed in different ways. Web how to fill out form 8832 in 9 steps 1. Form 8832 is divided into two parts: ~7 hours (irs estimate) turnaround: Lines 2a and 2b ask whether you’ve filed to change your status within the last 60 months (5 years).

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web where to file form 8832: The irs form lists two addresses to mail in your form. The location you send the form depends on the state or country your business calls home. Web the first page looks like this:

What is Form 8832 and How Do I File it?

Web where to file form 8832: The irs form lists two addresses to mail in your form. Just as you would on any tax document, fill in your business’s name, address, and. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Fill out your basic information.

Do I Need to File IRS Form 8832 for My Business? The Handy Tax Guy

The location you send the form depends on the state or country your business calls home. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. You can find irs form 8832 on the irs website the first page of the form has. Other tax election forms to know about. Web how to.

Form 8832 and Changing Your LLC Tax Status Bench Accounting

Depending on your financial situation, changing your tax classification could lower your total tax bill. Web if classifying your business as a different type of entity would be advantageous, you’ll need to file form 8832 with the irs. Web llcs can file form 8832, entity classification election to elect their business entity classification. In this section, you will need to.

What Is IRS Form 8832? Definition, Deadline, & More

Depending on your financial situation, changing your tax classification could lower your total tax bill. Web llcs can file form 8832, entity classification election to elect their business entity classification. The irs form lists two addresses to mail in your form. Choose the proper type of election. Fill out your basic information.

The Location You Send The Form Depends On The State Or Country Your Business Calls Home.

Fill out your basic information. Web the entity failed to qualify as a corporation solely because form 8832 was not timely filed; Before you rush to hand in form 8832, make sure you know about form. In this section, you will need to check one of two boxes.

Lines 2A And 2B Ask Whether You’ve Filed To Change Your Status Within The Last 60 Months (5 Years).

Web the first page looks like this: Complete part 1, election information. You will receive acknowledgment and approval from the irs. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership.

Web Llcs Can File Form 8832, Entity Classification Election To Elect Their Business Entity Classification.

Web how to fill out form 8832 in 9 steps 1. Other tax election forms to know about. The irs form lists two addresses to mail in your form. Part 1 of irs form 8832 asks a series of questions regarding your tax.

Just As You Would On Any Tax Document, Fill In Your Business’s Name, Address, And.

If the entity qualifies and files timely in accordance with rev. That’s because different entities are taxed in different ways. In our simple guide, we’ll walk you through form 8832 instructions. Form 8832 is divided into two parts: