How To File Form 8379

How To File Form 8379 - Yes, you can file form 8379 electronically with your tax return. If you’re filing with h&r block, you won’t need to complete this form on your. From within your taxact return ( online or desktop) click federal (on smaller devices, click in the top left corner of your screen,. By itself, after filing your tax return. Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. Complete, edit or print tax forms instantly. Web eligibility requirements to be eligible to file form 8370, the injured spouse must have reported their own income on the joint tax return that they filed with their. Upload, modify or create forms. Most state programs available in january; Download or email irs 8379 & more fillable forms, register and subscribe now!

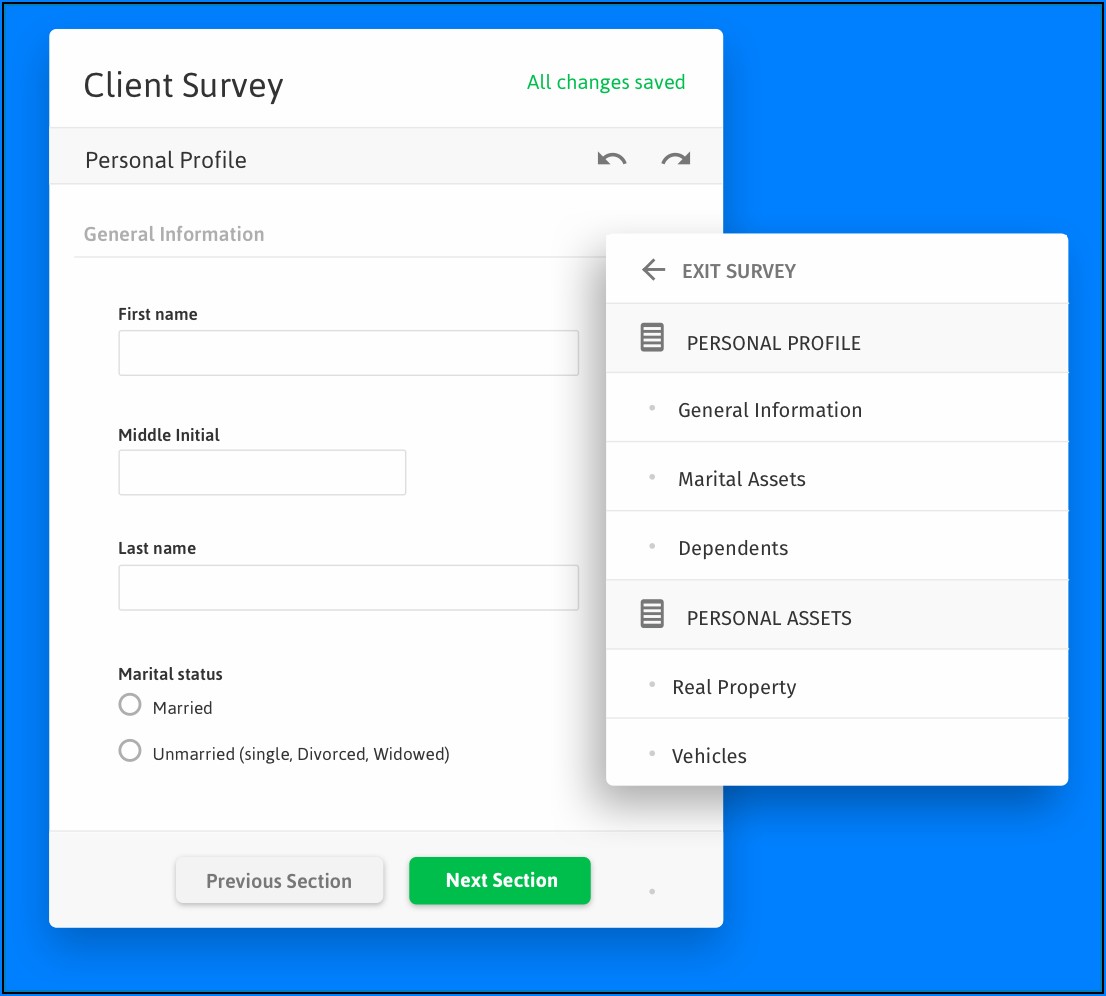

Complete, edit or print tax forms instantly. Web you may complete the injured spouse form, form 8379 within the program. Web how do i file form 8379? Try it for free now! Upload, modify or create forms. An injured spouse form is only filed. Download or email irs 8379 & more fillable forms, register and subscribe now! Continue with the interview process to enter all of the appropriate. Yes, you can file form 8379 electronically with your tax return. Web open (continue) your return in turbotax online.

If you have already filed the joint tax return, mail form 8379 by itself to the internal revenue service center for the place where you lived when you filed. Web instructions for form 8379. Ad access irs tax forms. Upload, modify or create forms. Try it for free now! Download or email irs 8379 & more fillable forms, register and subscribe now! Answer the following questions for that year. Federal section miscellaneous forms injured spouse allocation, reported on form 8379 please. Try it for free now! Complete, edit or print tax forms instantly.

File Isf Form Form Resume Examples Vj1yGL43yl

Complete, edit or print tax forms instantly. File form 8379 with form 1040x. Try it for free now! Web to complete form 8379 in your taxact program: Web instructions for form 8379.

Injured Spouse Form Fill Out and Sign Printable PDF Template signNow

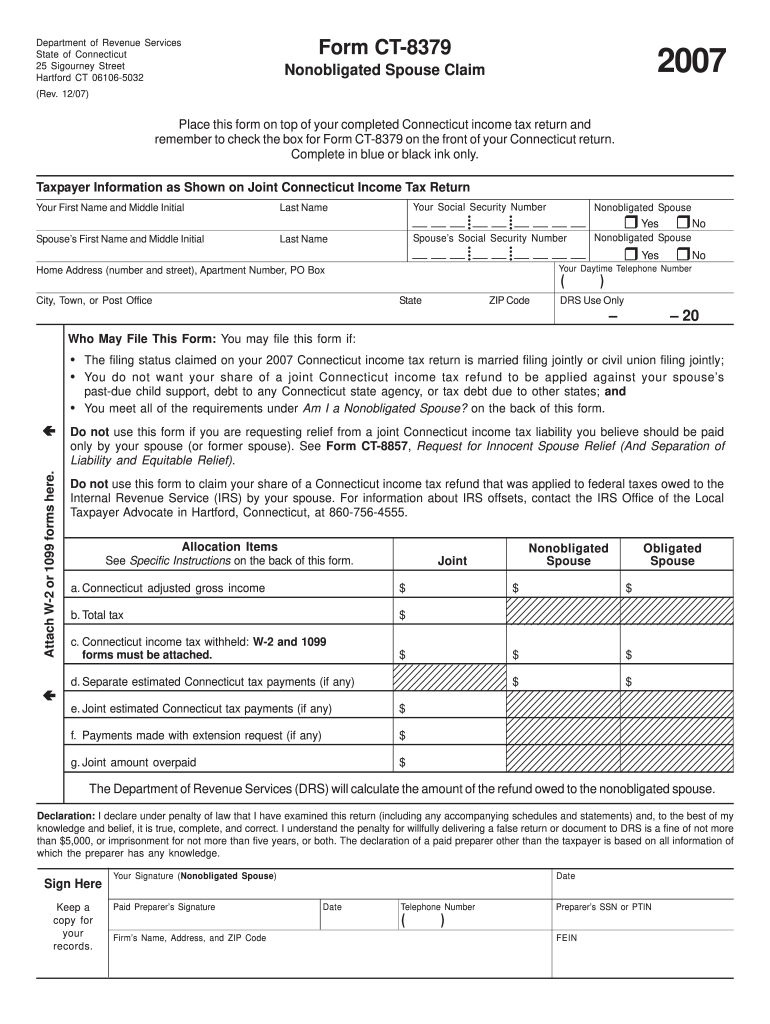

Web you can file form 8379 with your joint tax return or amended joint tax return (form 1040x), or you can file it afterwards by itself. If you are married filing jointly and you filed an injured spouse claim with your 2019 tax return (or. Web to file as an injured spouse, you’ll need to complete form 8379: Web a.

Fill Free fillable form 8379 injured spouse allocation 2016 PDF form

Complete, edit or print tax forms instantly. Federal section miscellaneous forms injured spouse allocation, reported on form 8379 please. Web to complete form 8379 in your taxact program: From within your taxact return ( online or desktop) click federal (on smaller devices, click in the top left corner of your screen,. Web you may complete the injured spouse form, form.

Can File Form 8379 Electronically hqfilecloud

An injured spouse form is only filed. Yes, you can file form 8379 electronically with your tax return. Try it for free now! Web you can file form 8379 with your joint tax return or amended joint tax return (form 1040x), or you can file it afterwards by itself. If you’re filing with h&r block, you won’t need to complete.

How to stop child support from taking tax refund

Ad access irs tax forms. Download or email irs 8379 & more fillable forms, register and subscribe now! If you file form 8379 with a joint return electronically, the time needed to. Form 8379 is used by injured. Continue with the interview process to enter all of the appropriate.

Form 8379 E File Form Resume Examples 1ZV8aBeo23

If you are married filing jointly and you filed an injured spouse claim with your 2019 tax return (or. Complete, edit or print tax forms instantly. Form 8379 is used by injured. Web 1 enter the tax year for which you are filing this form 2 did you (or will you) file a joint return? Complete, edit or print tax.

Fill Out Form 8379 Online easily airSlate

Upload, modify or create forms. Most state programs available in january; Federal section miscellaneous forms injured spouse allocation, reported on form 8379 please. Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. Web 1 enter.

What Is Form 8379 Injured Spouse Allocation? Definition

Web open (continue) your return in turbotax online. Complete, edit or print tax forms instantly. Web 1 enter the tax year for which you are filing this form 2 did you (or will you) file a joint return? Form 8379 is used by injured. Web eligibility requirements to be eligible to file form 8370, the injured spouse must have reported.

Form 8379 E File Form Resume Examples 1ZV8aBeo23

To file your taxes as an injured spouse, follow the steps below: Federal section miscellaneous forms injured spouse allocation, reported on form 8379 please. Injured spouse claim and allocation. Upload, modify or create forms. By itself, after filing your tax return.

E File Form 7004 Turbotax Universal Network

Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. Complete, edit or print tax forms instantly..

File Form 8379 With Form 1040X.

Web to file as an injured spouse, you’ll need to complete form 8379: Complete, edit or print tax forms instantly. Try it for free now! Download or email irs 8379 & more fillable forms, register and subscribe now!

Web You Can File Form 8379 With Your Joint Tax Return Or Amended Joint Tax Return (Form 1040X), Or You Can File It Afterwards By Itself.

Continue with the interview process to enter all of the appropriate. Injured spouse claim and allocation. If you have already filed the joint tax return, mail form 8379 by itself to the internal revenue service center for the place where you lived when you filed. By itself, after filing your tax return.

Complete, Edit Or Print Tax Forms Instantly.

Web eligibility requirements to be eligible to file form 8370, the injured spouse must have reported their own income on the joint tax return that they filed with their. If you’re filing with h&r block, you won’t need to complete this form on your. Upload, modify or create forms. Answer the following questions for that year.

Web Information About Form 8379, Injured Spouse Allocation, Including Recent Updates, Related Forms, And Instructions On How To File.

If you file form 8379 with a joint return electronically, the time needed to. Web click + add form 8379 to create a new copy of the form or click edit to review a form already created. Most state programs available in january; Yes, you can file form 8379 electronically with your tax return.

:max_bytes(150000):strip_icc()/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)