How To File Form 1042 S

How To File Form 1042 S - Ad don't leave it to the last minute. If you are a withholding agent,. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Source income to a nonresident. Additionally, a withholding agent may use the extended due date for filing a form 1042 to. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Get ready for tax season deadlines by completing any required tax forms today. Source income of foreign persons, via modernized e. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Person or company that makes payments of u.s.

Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Get irs approved instant schedule 1 copy. Source of income that is subject to withholdings. Source income to a nonresident. File your form 2290 online & efile with the irs. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Get ready for tax season deadlines by completing any required tax forms today. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Additionally, a withholding agent may use the extended due date for filing a form 1042 to. Complete, edit or print tax forms instantly.

Electronic filing is required if there are 250 or more forms from the withholding agent. If you are a withholding agent,. Get irs approved instant schedule 1 copy. Get ready for tax season deadlines by completing any required tax forms today. Source of income that is subject to withholdings. Source income to a nonresident. File your form 2290 online & efile with the irs. File your form 2290 today avoid the rush. Additionally, a withholding agent may use the extended due date for filing a form 1042 to. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are.

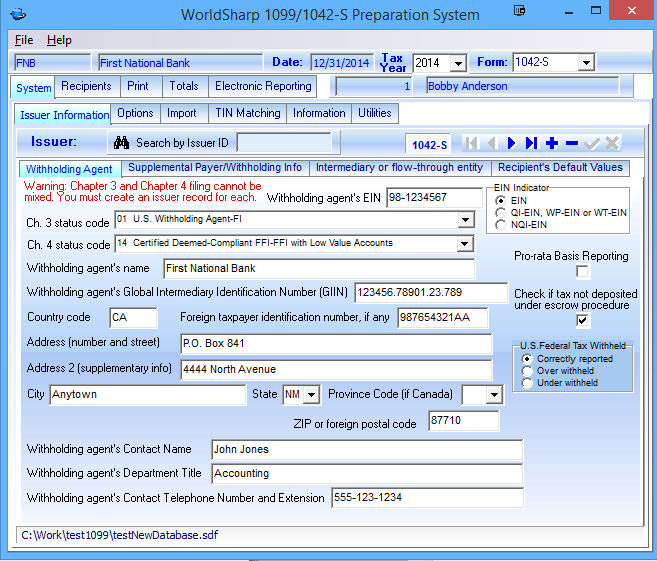

1042S Software WorldSharp 1099/1042S Software features

Get ready for tax season deadlines by completing any required tax forms today. Source income to a nonresident. Complete, edit or print tax forms instantly. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Source income subject to withholding is used to.

1042 S Form slideshare

Ad don't leave it to the last minute. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Source income to a nonresident. Additionally, a withholding agent may use the extended due date for filing a form 1042 to.

Form 1042S USEReady

Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. File your form 2290 online & efile with the irs. File your form 2290 today avoid the rush. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Web easy.

Form 1042S Efile Diagnostics Ref. 47040 47039 and 47310 Accountants

Source of income that is subject to withholdings. Additionally, a withholding agent may use the extended due date for filing a form 1042 to. Source income of foreign persons, via modernized e. Electronic filing is required if there are 250 or more forms from the withholding agent. File your form 2290 online & efile with the irs.

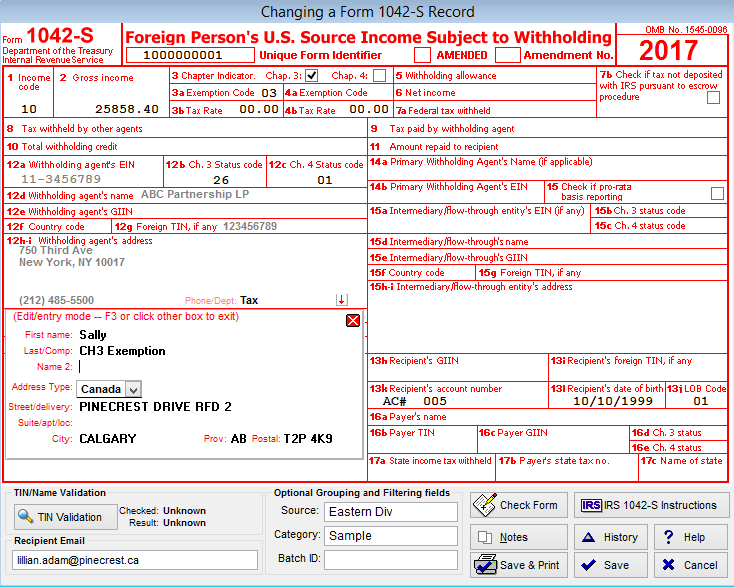

1042S 2018 Public Documents 1099 Pro Wiki

Get ready for tax season deadlines by completing any required tax forms today. For example, the 2019 form 1042. File your form 2290 online & efile with the irs. Get irs approved instant schedule 1 copy. Source income to a nonresident.

EFile Form 1042S 1099Prep

Get irs approved instant schedule 1 copy. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Ad don't leave it to the last minute. If you are a withholding agent,. File your form 2290 online & efile with the irs.

IRS Form 1042s What It is & 1042s Instructions Tipalti

Additionally, a withholding agent may use the extended due date for filing a form 1042 to. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Source of income that is subject to withholdings. File your form 2290 today avoid the rush. If you are a.

1042S Software, 1042S eFile Software & 1042S Reporting

File your form 2290 online & efile with the irs. Person or company that makes payments of u.s. If you are a withholding agent,. Get irs approved instant schedule 1 copy. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s.

Instructions for IRS Form 1042S How to Report Your Annual

Complete, edit or print tax forms instantly. Additionally, a withholding agent may use the extended due date for filing a form 1042 to. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Person or company that makes payments of u.s. Ad don't leave it to the last.

Understanding Form 1042S

Source income to a nonresident. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. File your form 2290 today avoid the rush. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign).

Complete, Edit Or Print Tax Forms Instantly.

Source income of foreign persons, via modernized e. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Person or company that makes payments of u.s. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient.

If You Are A Withholding Agent,.

For example, the 2019 form 1042. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Get ready for tax season deadlines by completing any required tax forms today. Ad don't leave it to the last minute.

Source Of Income That Is Subject To Withholdings.

Source income to a nonresident. Electronic filing is required if there are 250 or more forms from the withholding agent. File your form 2290 today avoid the rush. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are.

Additionally, A Withholding Agent May Use The Extended Due Date For Filing A Form 1042 To.

Get irs approved instant schedule 1 copy. File your form 2290 online & efile with the irs.