How To File Form 1041 Electronically

How To File Form 1041 Electronically - Web the personal representative must request an employer identification number (ein) to use for filing purposes on form 1041. We recommend that preparers transmit electronic files to thomson reuters at least one hour before the filing deadline. This option is available if using pin. Income tax return for estates and trusts can be electronically filed starting with tax year 2011. If they do, these assets can avoid probate and be paid directly to the beneficiary. Of the estate or trust; Web information about form 1041, u.s. Income, deductions, gains, losses, etc. Web how do i file form 1041 for an estate or trust? You'll need turbotax business to file form 1041, as the personal versions of turbotax don't support this form.

Web form 1041, u.s. This option is available if using pin. Web the personal representative must request an employer identification number (ein) to use for filing purposes on form 1041. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Income income earned by the estate or trust is. Income that is either accumulated or held for future distribution or distributed currently to the beneficiaries; Web how do i file form 1041 for an estate or trust? We recommend that preparers transmit electronic files to thomson reuters at least one hour before the filing deadline. The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic irs estates and trusts (form 1041 mef) returns. If they do, these assets can avoid probate and be paid directly to the beneficiary.

Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. This option is available if using pin. Web the personal representative must request an employer identification number (ein) to use for filing purposes on form 1041. Of the estate or trust; The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic irs estates and trusts (form 1041 mef) returns. Estate beneficiaries many assets, like a life insurance policy or a brokerage account, list a beneficiary. Payments can be made using the phone or through the internet and can be scheduled up to a year in advance. Web information about form 1041, u.s. Income that is either accumulated or held for future distribution or distributed currently to the beneficiaries; Web if you file form 1041 electronically, you may sign the return electronically by using a personal identification number (pin).

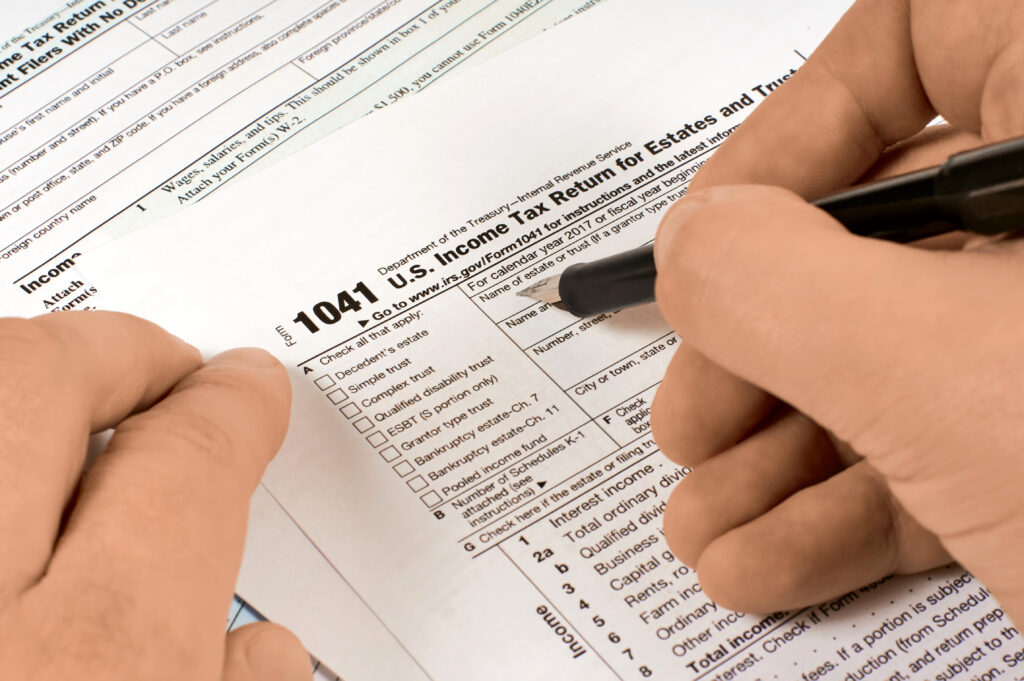

U.S. Tax Return for Estates and Trusts, Form 1041

Turbotax business is available for windows on cd or as a download. Web if you file form 1041 electronically, you may sign the return electronically by using a personal identification number (pin). We recommend that preparers transmit electronic files to thomson reuters at least one hour before the filing deadline. This option is available if using pin. Of the estate.

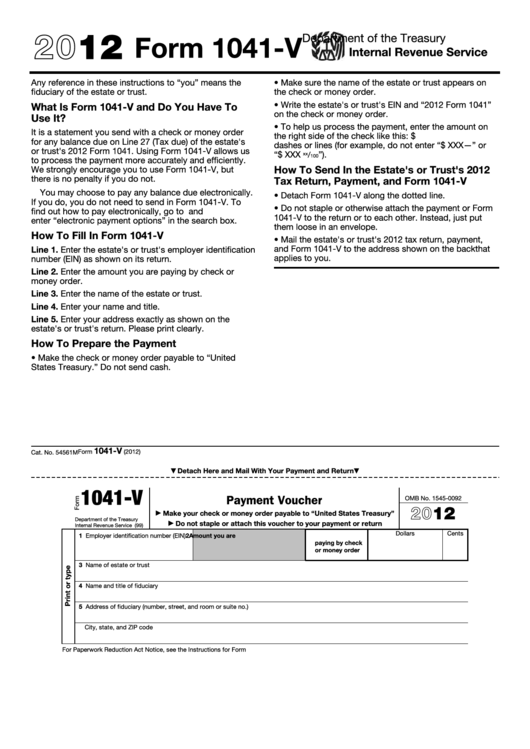

Fillable Form 1041V Payment Voucher 2012 printable pdf download

Income that is either accumulated or held for future distribution or distributed currently to the beneficiaries; Web how do i file form 1041 for an estate or trust? Turbotax business is available for windows on cd or as a download. Income tax return for estates and trusts pdf, is used by the fiduciary of a domestic decedent’s estate, trust, or.

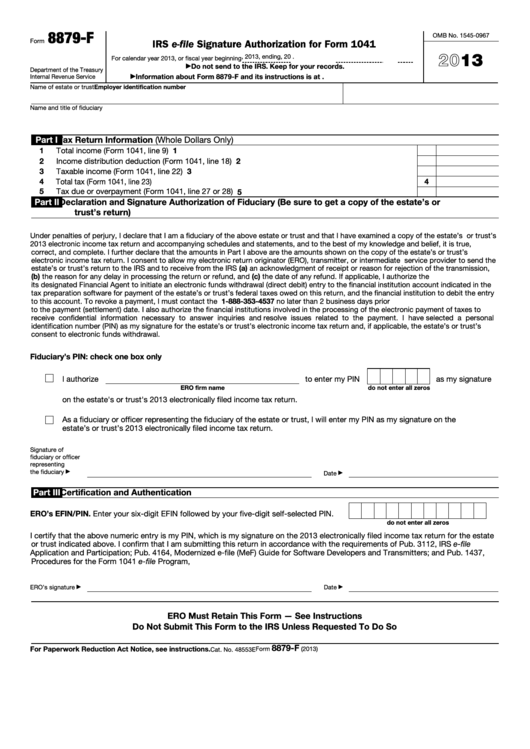

Form 8879F IRS efile Signature Authorization for Form 1041 (2015

We recommend that preparers transmit electronic files to thomson reuters at least one hour before the filing deadline. Web form 1041, u.s. If they do, these assets can avoid probate and be paid directly to the beneficiary. Solved•by turbotax•2428•updated january 13, 2023. You'll need turbotax business to file form 1041, as the personal versions of turbotax don't support this form.

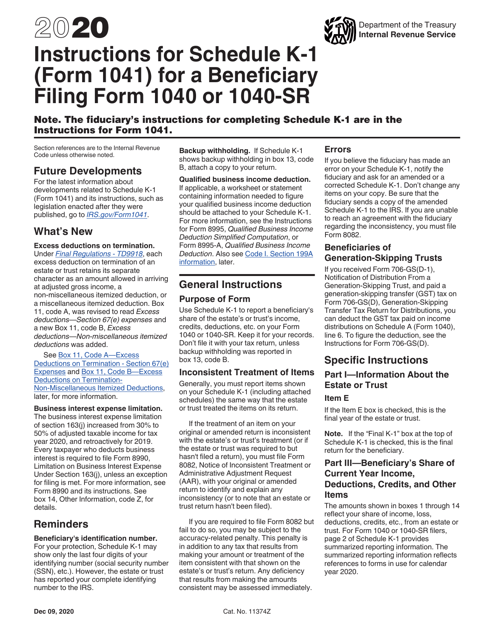

Download Instructions for IRS Form 1041 Schedule K1 Beneficiary's

Web if you file form 1041 electronically, you may sign the return electronically by using a personal identification number (pin). Web the personal representative must request an employer identification number (ein) to use for filing purposes on form 1041. Web information about form 1041, u.s. Estate beneficiaries many assets, like a life insurance policy or a brokerage account, list a.

Fillable Form 8879F 2013 Irs EFile Signature Authorization For Form

Income tax return for estates and trusts can be electronically filed starting with tax year 2011. Income, deductions, gains, losses, etc. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements.

2016 Form IRS 1041ES Fill Online, Printable, Fillable, Blank pdfFiller

Income tax return for estates and trusts pdf, is used by the fiduciary of a domestic decedent’s estate, trust, or bankruptcy estate to report: Of the estate or trust; Income, deductions, gains, losses, etc. We recommend that preparers transmit electronic files to thomson reuters at least one hour before the filing deadline. This option is available if using pin.

Filing Taxes for Deceased with No Estate H&R Block

Income, deductions, gains, losses, etc. Estate beneficiaries many assets, like a life insurance policy or a brokerage account, list a beneficiary. Income income earned by the estate or trust is. You'll need turbotax business to file form 1041, as the personal versions of turbotax don't support this form. Form 1041 is used by a fiduciary to file an income tax.

1041US ELF Form 8948 Paper filing exception

This option is available if using pin. Web if you file form 1041 electronically, you may sign the return electronically by using a personal identification number (pin). Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. For instructions on electronically filing business returns, click here. Web information about form 1041, u.s.

blog11112014Form 1041 Filing Instructions and Requirements

Solved•by turbotax•2428•updated january 13, 2023. Income, deductions, gains, losses, etc. For instructions on electronically filing business returns, click here. You'll need turbotax business to file form 1041, as the personal versions of turbotax don't support this form. Estate beneficiaries many assets, like a life insurance policy or a brokerage account, list a beneficiary.

Form 941 Online Filing for 2021 Express941

For instructions on electronically filing business returns, click here. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Payments can be made using the phone or through the internet and can be scheduled up to a year in advance. Turbotax business is available for windows on cd or as a download..

Turbotax Business Is Available For Windows On Cd Or As A Download.

Income tax return for estates and trusts can be electronically filed starting with tax year 2011. Web how do i file form 1041 for an estate or trust? Payments can be made using the phone or through the internet and can be scheduled up to a year in advance. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file.

Web If You File Form 1041 Electronically, You May Sign The Return Electronically By Using A Personal Identification Number (Pin).

For instructions on electronically filing business returns, click here. We recommend that preparers transmit electronic files to thomson reuters at least one hour before the filing deadline. This option is available if using pin. Income, deductions, gains, losses, etc.

Application For Employer Identification Number.

The following links provide information on the companies that have passed the internal revenue service (irs) assurance testing system (ats) requirements for software developers of electronic irs estates and trusts (form 1041 mef) returns. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Estate beneficiaries many assets, like a life insurance policy or a brokerage account, list a beneficiary. Web information about form 1041, u.s.

Solved•By Turbotax•2428•Updated January 13, 2023.

If they do, these assets can avoid probate and be paid directly to the beneficiary. Web form 1041, u.s. Web the personal representative must request an employer identification number (ein) to use for filing purposes on form 1041. Income tax return for estates and trusts pdf, is used by the fiduciary of a domestic decedent’s estate, trust, or bankruptcy estate to report: