How To File An Extension For Form 1065

How To File An Extension For Form 1065 - Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Provide your basic business details such as business name, address, and tin choose the form code for the. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. If the partnership's principal business, office, or agency is located in: Continue with the interview process to enter information. Web form 7004 is used to request an automatic extension to file the certain returns. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Web table of contents 1. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of.

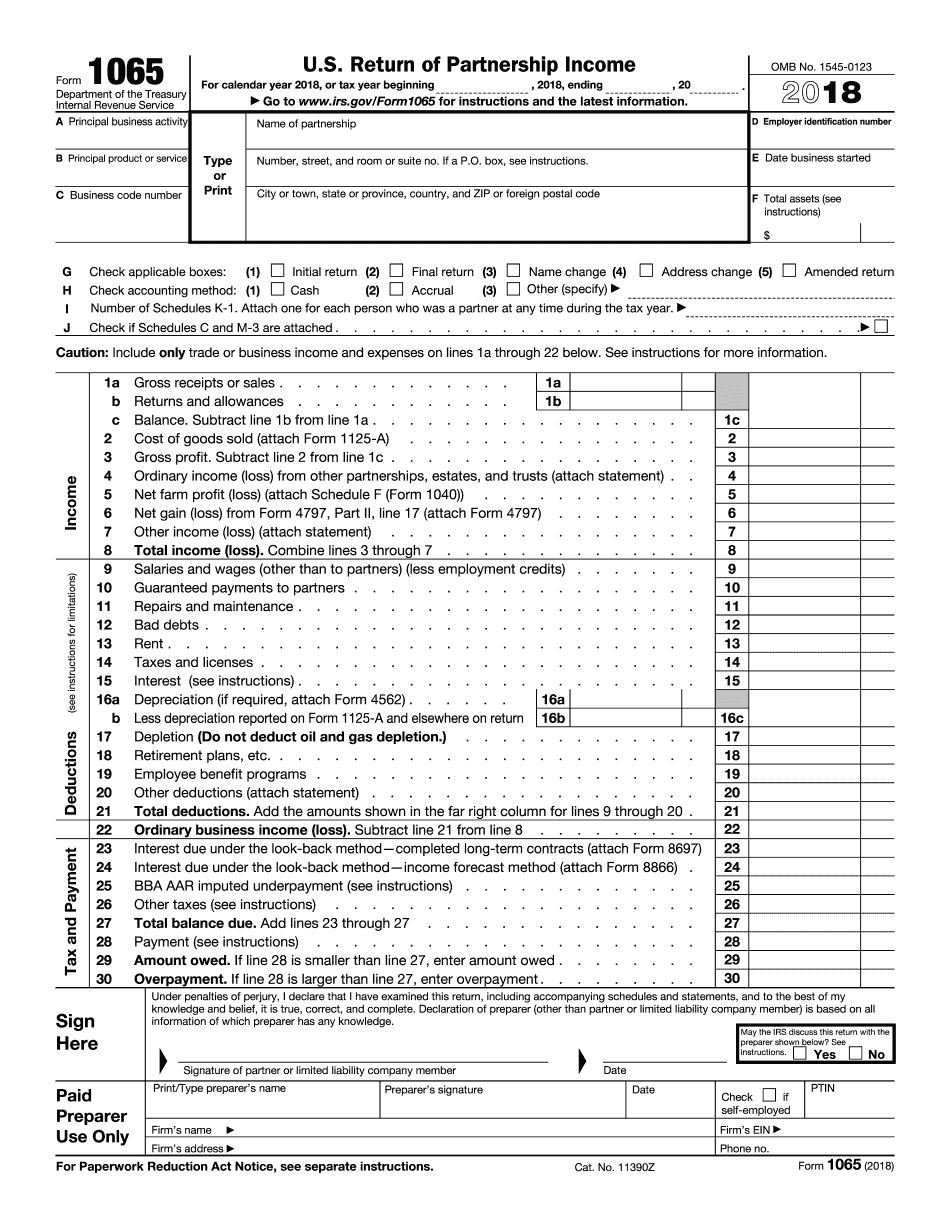

Web 1 min read to file for an llc extension, file form 7004: Return of partnership income, including recent updates, related forms and instructions on how to file. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web for calendar year partnerships, the due date is march 15. Can partnerships elected as a business extend the. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Web form 7004 is used to request an automatic extension to file the certain returns. Web how to file form 1065? Web information about form 1065, u.s.

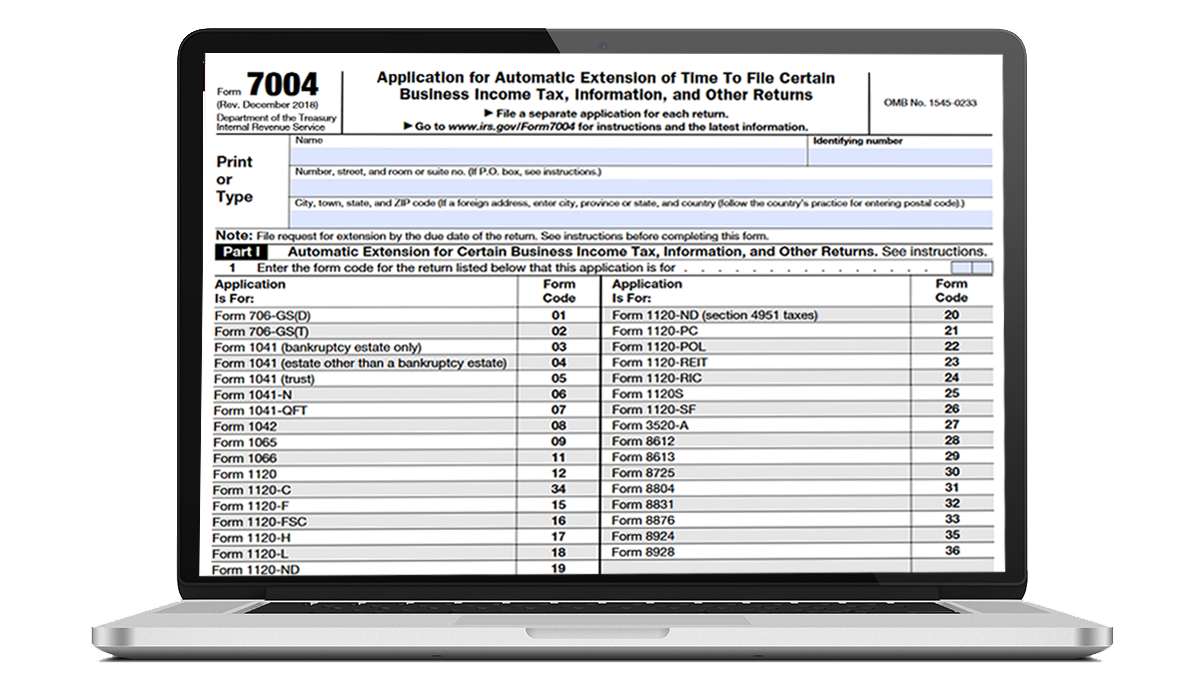

Application for automatic extension of time to file certain business income tax information, and other returns. Return of partnership income by the 15th day of the third month following the date its tax year ended (as shown at the. Who must file form 1065? Ad file partnership and llc form 1065 fed and state taxes with taxact® business. If the partnership's principal business, office, or agency is located in: Web information about form 1065, u.s. The partnership may choose to file for an automatic six month extension by filing form 7004 by the regular due date of. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Once the form 7004 is accepted by the irs, the partnership is granted up to 6. Web find irs mailing addresses by state to file form 1065.

File Form 1065 Extension Online Partnership Tax Extension

Web there are several ways to submit form 4868. Provide your basic business details such as business name, address, and tin choose the form code for the. Web for calendar year partnerships, the due date is march 15. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Application for automatic.

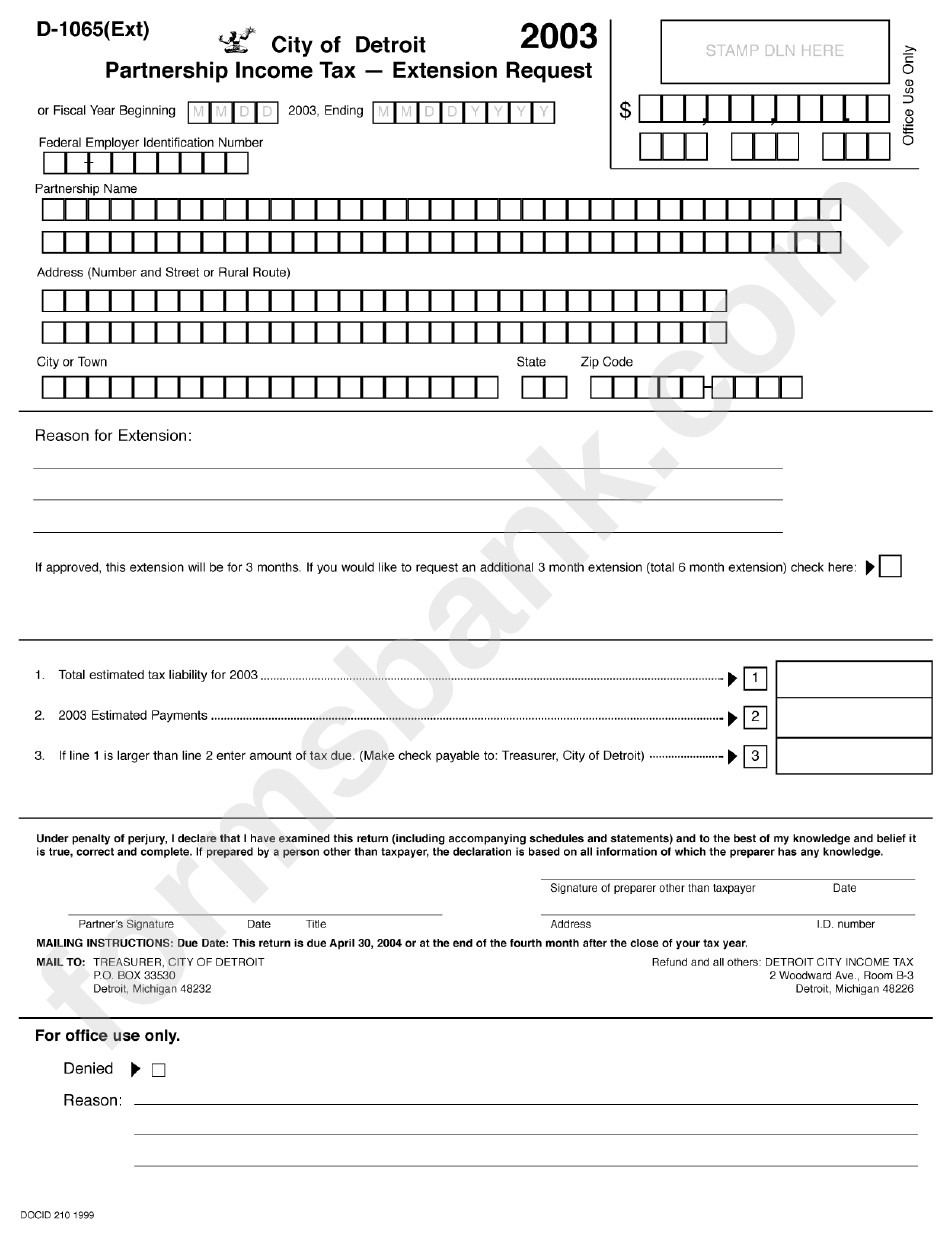

Form D1065 Partnership Tax Extension Request 2003

Web how to file an extension: Web for calendar year partnerships, the due date is march 15. Can partnerships elected as a business extend the. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The partnership may choose to file for an automatic six month extension by filing form 7004 by the regular due date.

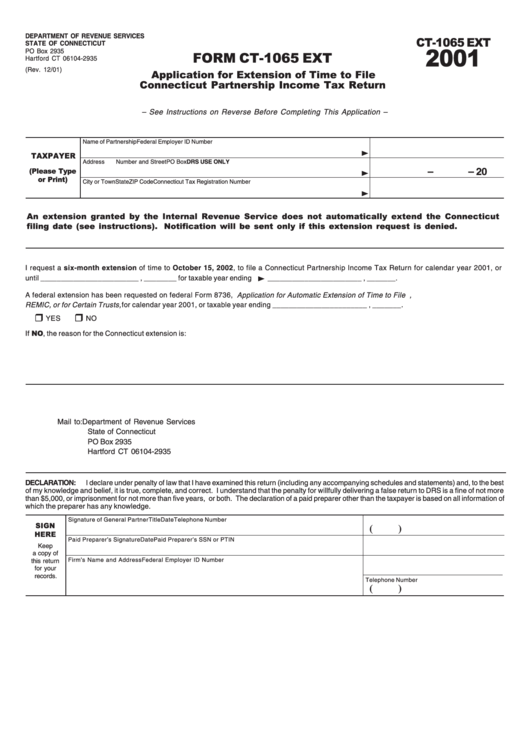

Form Ct1065 Ext Application For Extension Of Time To File

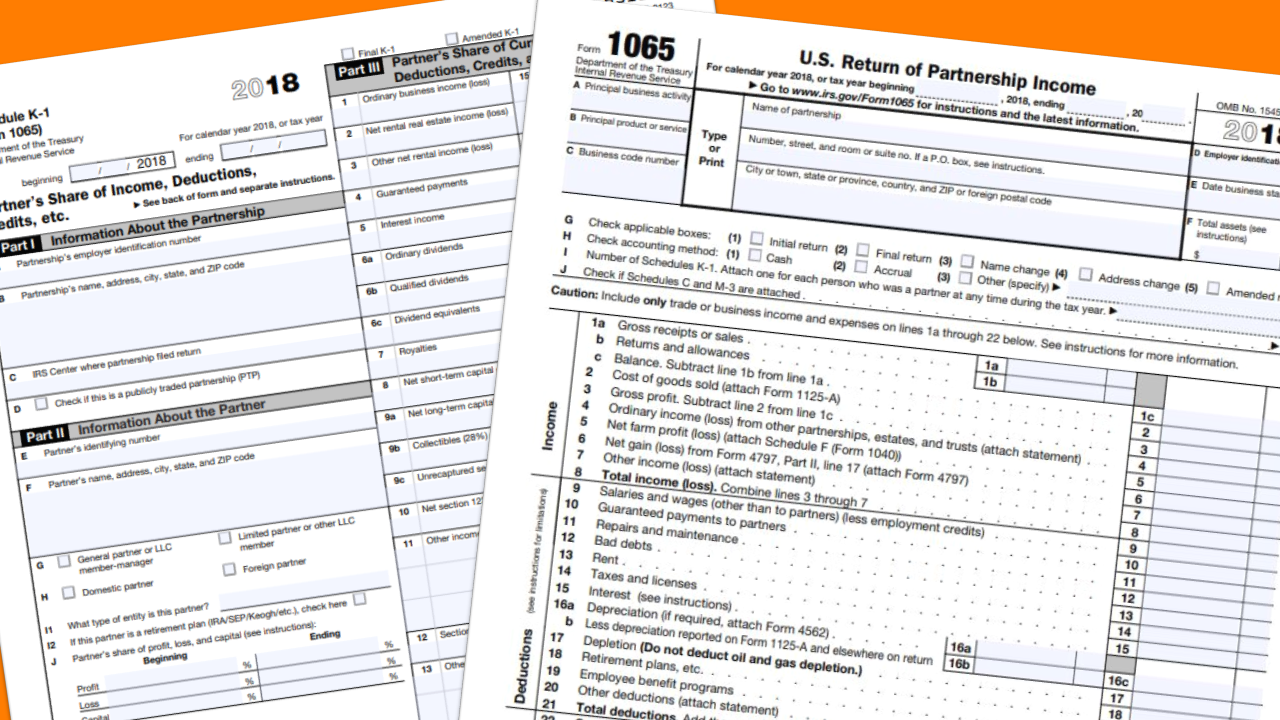

Return of partnership income, including recent updates, related forms and instructions on how to file. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Form 1065 is used to report the income of. Web how to file an extension: When is the deadline to file form 1065?

1065 tax return turbo tax welllasopa

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave feedback if you need to extend a return, taxing agencies may waive certain penalties if. Return of partnership income by the 15th day of the third month following the date its.

File Form 1065 Extension Online Partnership Tax Extension

Application for automatic extension of time to file certain business income tax information, and other returns. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Continue with the interview process to enter information. Who must file form 1065? If the partnership's principal business, office, or agency is located in:

Eligible Partnerships Granted Extension to File Form 1065 and Schedules K1

Return of partnership income, including recent updates, related forms and instructions on how to file. Can partnerships elected as a business extend the. Web form 7004 is used to request an automatic extension to file the certain returns. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Continue with the interview process to enter information.

What is a 1065 tax form used for lockqmonitor

When is the deadline to file form 1065? Web extension of time to file. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web information about form 1065, u.s. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to.

1065 Extension 2021 2022 IRS Forms Zrivo

Once the form 7004 is accepted by the irs, the partnership is granted up to 6. Return of partnership income by the 15th day of the third month following the date its tax year ended (as shown at the. And the total assets at the end of the. The partnership may choose to file for an automatic six month extension.

Form 1065 E File Requirements Universal Network

Web how to file an extension: This deadline applies to any individual or small business seeking to file their taxes with the. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web file a separate form 8736 for each return for which you are requesting an extension of time to file. Partnerships are required to.

Extension to file 1065 tax form asrposii

Partnerships are required to file form 1065 by the 15th day of the 3rd month following the date the tax year ended unless an extension is. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain. Web for calendar year partnerships, the.

Web There Are Several Ways To Submit Form 4868.

Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. Who must file form 1065? Web for calendar year partnerships, the due date is march 15.

Web File A Separate Form 8736 For Each Return For Which You Are Requesting An Extension Of Time To File.

Web how to file an extension: If the partnership's principal business, office, or agency is located in: This extension will apply only to the specific return checked on line 1. Return of partnership income by the 15th day of the third month following the date its tax year ended (as shown at the.

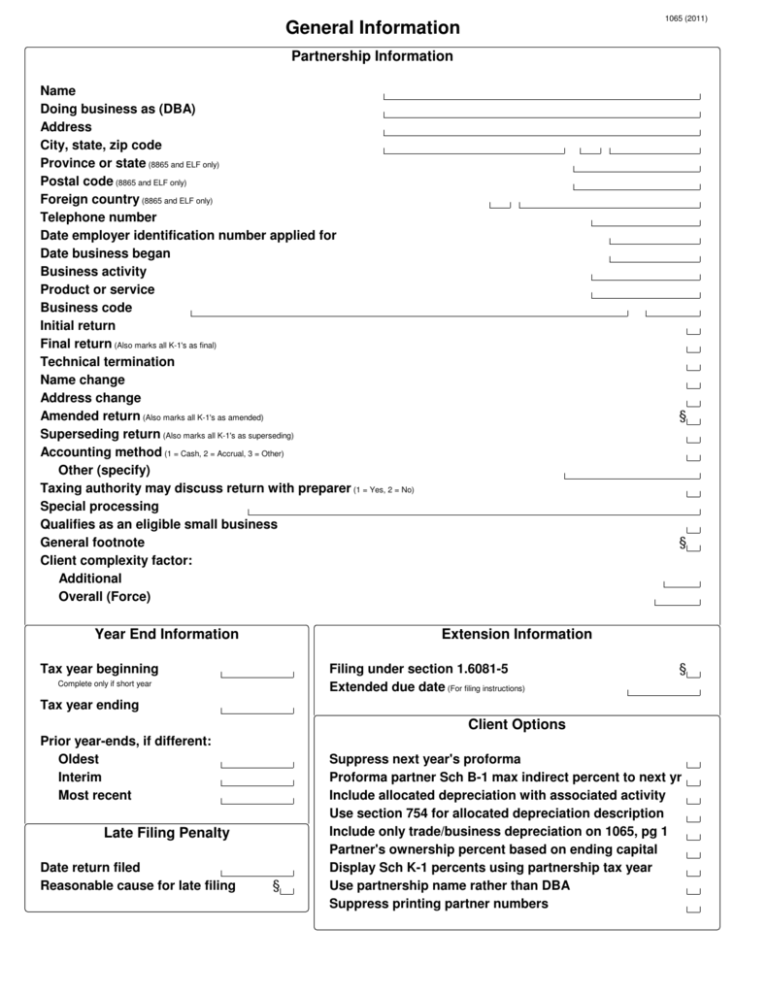

Enter Demographic Information On Screen 1, At Least The Name, Address, City, State, Zip And Ein.

Can partnerships elected as a business extend the. Web how to file form 1065? Web generally, a domestic partnership must file form 1065 u.s. Web what are the information required to file 1065 extension?

Web If You Need More Time To File Form 1065, You May Request An Extension Through Filing Form 7004, Application For Automatic Extension Of Time To File Certain.

Web find irs mailing addresses by state to file form 1065. Application for automatic extension of time to file certain business income tax information, and other returns. Provide your basic business details such as business name, address, and tin choose the form code for the. Web extension of time to file.