How To Amend Form 2290

How To Amend Form 2290 - Web certain instances are listed below: File form 2290 easily with eform2290.com. Web you can amend your irs tax form 2290 online at yourtrucktax.com. When the mileage utility limit exceeds. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web how to efile form 2290 amendment online? 2290 amendment august 3, 2020 it is a fact that all details provided to irs should be accurate and truthful. Amendments can be done for the following reasons: File form 2290 easily with eform2290.com. Choose your tax year & first used month.

2290 amendment august 3, 2020 it is a fact that all details provided to irs should be accurate and truthful. These are the only two reasons to file. Login to your eform2290.com account step 2: Web filing an amended 2290 return to report the exceeded mileage will produce an update stamped schedule 1. How to report changes with form 2290 amendment? Select 2290 amendment on the dashboard step 3: Web how to make an amendment on 2290 form? You must file a paper form to report other changes. Web how to file form 2290 online. You can go on to your dashboard and efile a 2290 amendment.

Select 2290 amendment on the dashboard step 3: Use coupon code get20b & get 20% off. Enter your business information step 4: These are the only two reasons to file. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web how to make an amendment on 2290 form? Amendments can be done for the following reasons: If you expect to use your vehicle for 5,000 miles or less during the tax period, your vehicle status will change from taxable vehicle to suspended. When the mileage utility limit exceeds. Web the irs lets the taxpayer correct the errors made on the irs form 2290 by filing a 2290 amendment.

Irs amendments 2290

Web you can amend your irs tax form 2290 online at yourtrucktax.com. Web how to file form 2290 online. Login to your eform2290.com account step 2: July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. How to report changes with form 2290 amendment?

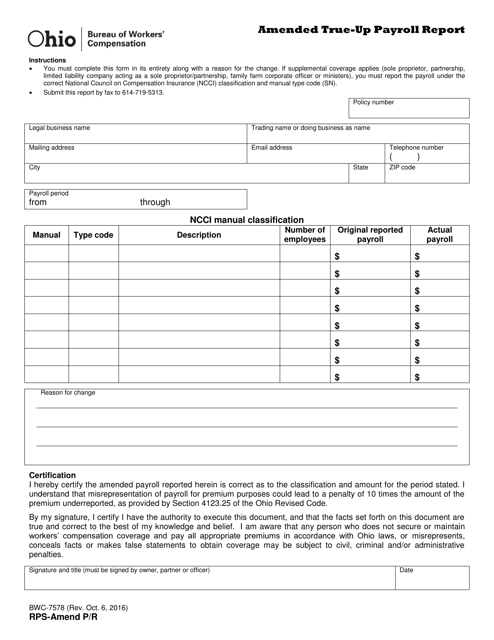

Form RPSAMEND P/R (BWC7578) Download Printable PDF or Fill Online

Web create your 2290 amendment form. If you expect to use your vehicle for 5,000 miles or less during the tax period, your vehicle status will change from taxable vehicle to suspended. An increase in the gross taxable weight of the vehicle. You can go on to your dashboard and efile a 2290 amendment. Amendments can be done for the.

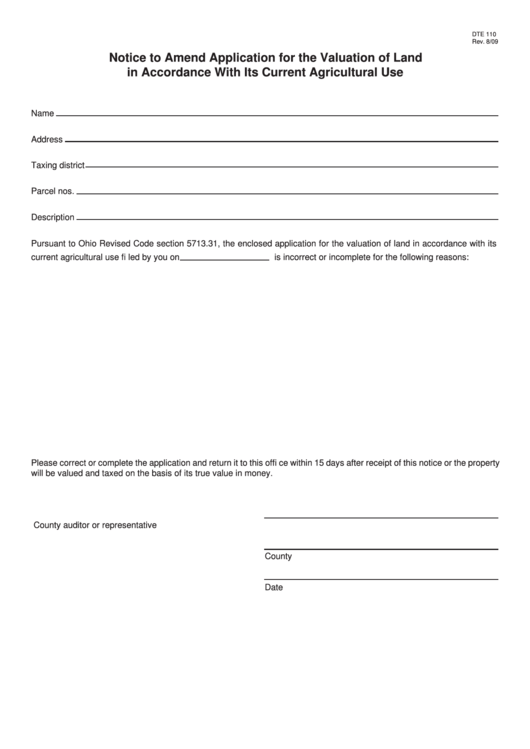

Fillable Form Dte 110 Notice To Amend Application For The Valuation

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Filing the amendment will also waive any late. Irs accepts this 2290 amendment electronically. Web when the gross taxable weight of the vehicle increases. 2290 amendment august 3, 2020 it is a fact that all details provided to.

Amend a Device

Web certain instances are listed below: Easy, fast, secure & free to try. File form 2290 easily with eform2290.com. An increase in the gross taxable weight of the vehicle. Choose your tax year & first used month.

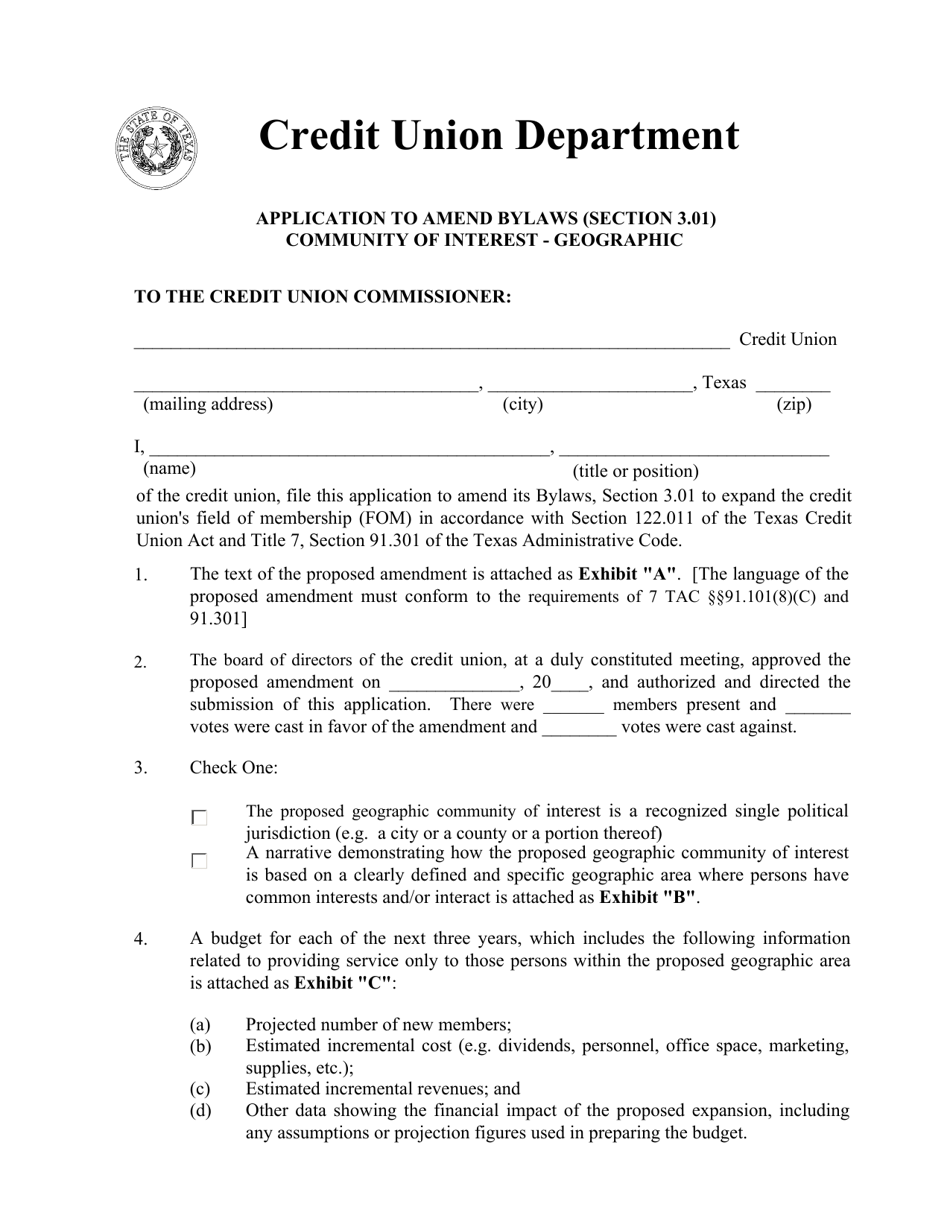

Texas Application to Amend Bylaws (Section 3.01) Community of Interest

When the mileage utility limit exceeds. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Filing the amendment will also waive any late. Do your truck tax online & have it efiled to the irs! Web certain instances are listed below:

Use Form 1040X to Fix and Amend Your JustFiled Tax Return

Web create your 2290 amendment form. Web how to efile form 2290 amendment online? Vin correction increase in taxable gross. Web how to file form 2290 online. 2290 amendment august 3, 2020 it is a fact that all details provided to irs should be accurate and truthful.

Motion To Amend Pretrial Order (Sample) PDF Witness Complaint

Web how to efile form 2290 amendment online? On your dashboard, select “start new return”. You can go on to your dashboard and efile a 2290 amendment. Filing the amendment will also waive any late. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

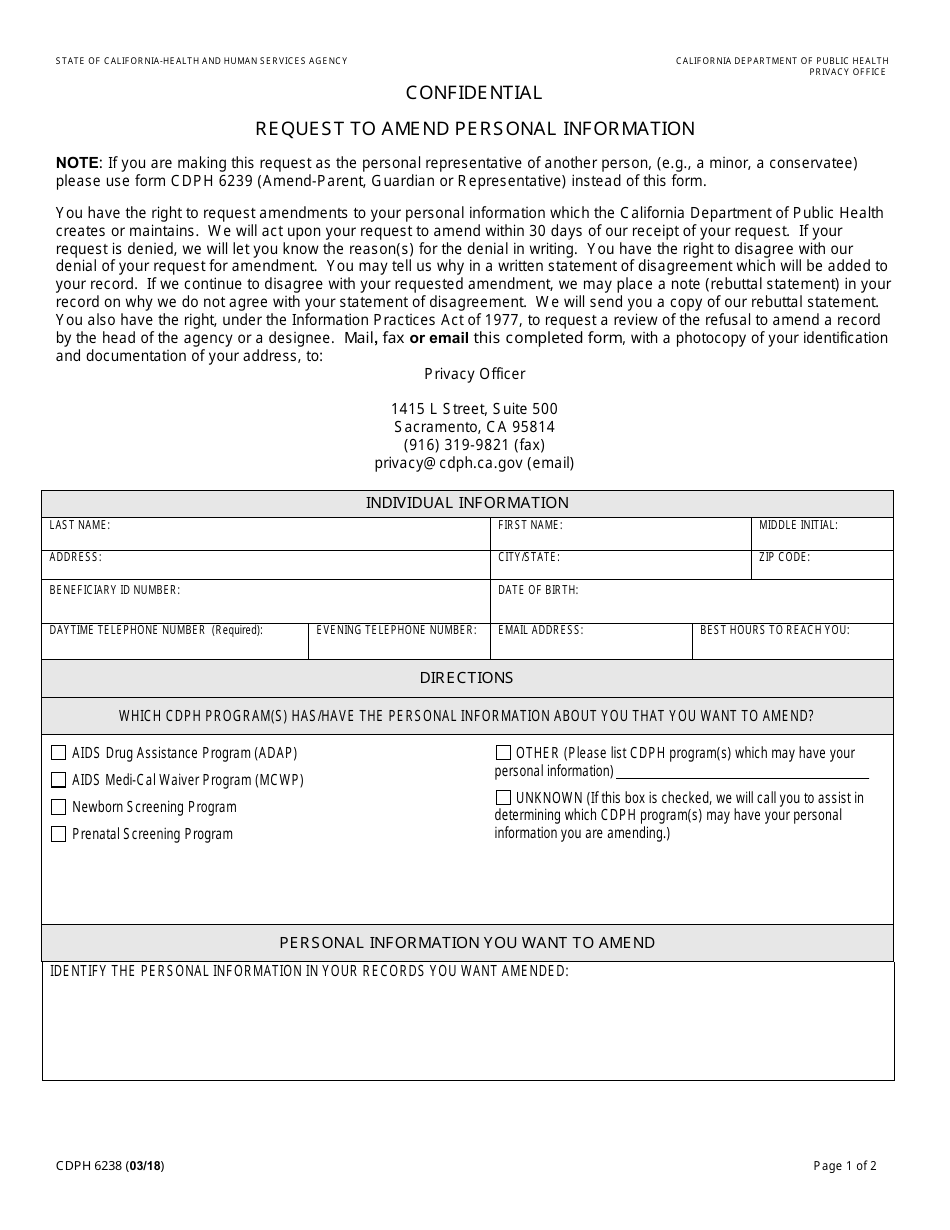

Form CDPH6238 Download Fillable PDF or Fill Online Request to Amend

Select 2290 amendment on the dashboard step 3: Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Changes can be made to the following sections of form 2290: Sign up here to create your ez2290 account for free. Vin correction increase in taxable gross.

How to File the Form 2290 Weight Increase Amendment YouTube

You must file a paper form to report other changes. Use coupon code get20b & get 20% off. Vin correction increase in taxable gross. Web log in to your expresstrucktax account. Web create your 2290 amendment form.

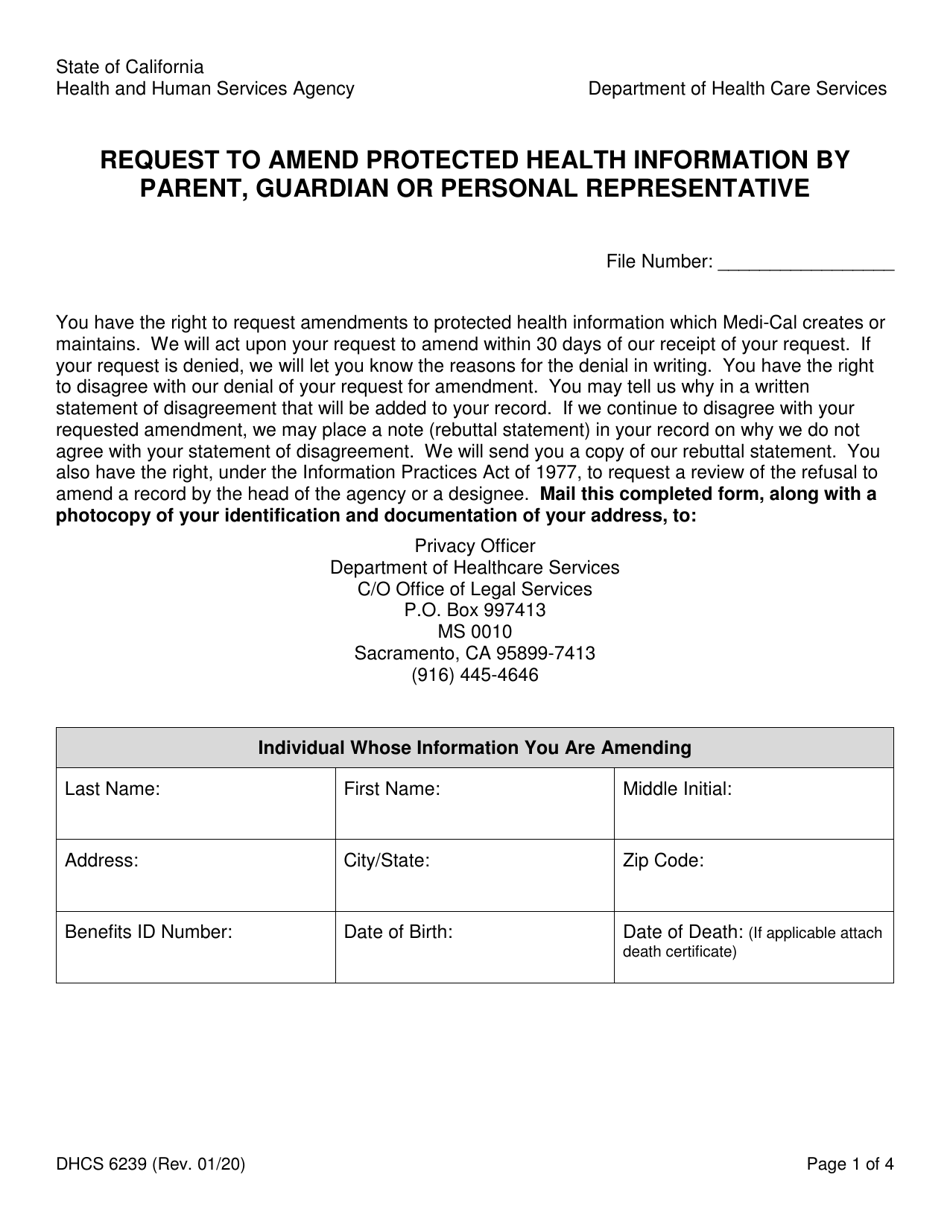

Form DHCS6239 Download Fillable PDF or Fill Online Request to Amend

Click “form 2290 amendments” and then “start form 2290 amendment”. These are the only two reasons to file. Web the irs lets the taxpayer correct the errors made on the irs form 2290 by filing a 2290 amendment. Choose your tax year & first used month. Easy, fast, secure & free to try.

Vin Correction Increase In Taxable Gross.

Web when the gross taxable weight of the vehicle increases. Changes can be made to the following sections of form 2290: Web certain instances are listed below: Login to your eform2290.com account step 2:

Sign Up Here To Create Your Ez2290 Account For Free.

2290 amendment august 3, 2020 it is a fact that all details provided to irs should be accurate and truthful. Filing the amendment will also waive any late. Irs accepts this 2290 amendment electronically. You can go on to your dashboard and efile a 2290 amendment.

On Your Dashboard, Select “Start New Return”.

Do your truck tax online & have it efiled to the irs! Web you can amend your irs tax form 2290 online at yourtrucktax.com. Easy, fast, secure & free to try. Click “form 2290 amendments” and then “start form 2290 amendment”.

Enter Your Business Information Step 4:

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. You must file a paper form to report other changes. Web how to efile form 2290 amendment online? File form 2290 easily with eform2290.com.