How Much Does It Cost To File Form 2290

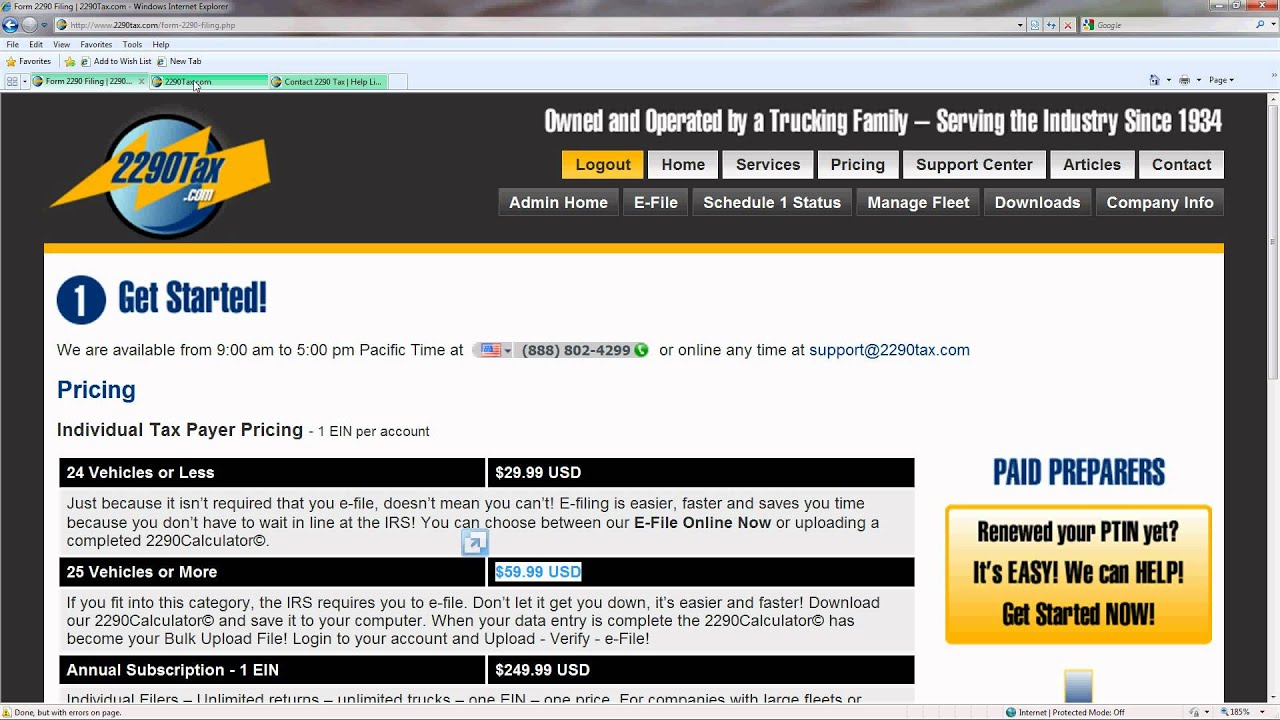

How Much Does It Cost To File Form 2290 - For 24 vehicles or less, you don't. Figure and pay the tax due on a vehicle for. Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. File your 2290 online & get schedule 1 in minutes. Let’s talk about truck tax form 2290 tax. Irs form 8849 (sch.6 other claims) we offer form 8849 efiling for $24.99. Web frequently asked questions what if i miss my deadline? Easy2290.com charges a minimal amount as the service fee. If you do your due diligence, you will find that easy2290.com has the lowest cost and the best service. Please make the necessary payment to complete the filing process and to transmit the prepared.

For 24 vehicles or less, you don't. Web medium fleet (25 to 100 vehicles) $ 89.90. You simply enter your credit card. Need help with irs form 2290 tax filing? You must use one of the participating commercial software. Web frequently asked questions what if i miss my deadline? Unlimited form 2290 tax filing (file an unlimited. Figure and pay the tax due on a vehicle for. Easy, fast, secure & free to try. Web pay per filing choose this option to pay by credit card for each filing performed, depending on the number of vehicles on each form 2290.

How long does it take to receive my stamped what is the cost of filing form 2290 with expresstrucktax? Web pay per filing choose this option to pay by credit card for each filing performed, depending on the number of vehicles on each form 2290. This pricing is for each return and not for monthly or yearly. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,. Enterprise (> 500 vehicles) $ 229.90. File your 2290 online & get schedule 1 in minutes. Electronic filing is required for each return reporting 25 or more vehicles. For 24 vehicles or less, you don't. Need help with irs form 2290 tax filing? Web frequently asked questions what if i miss my deadline?

4 Things You Need to Know When Filing Your 202021 HVUT Form 2290

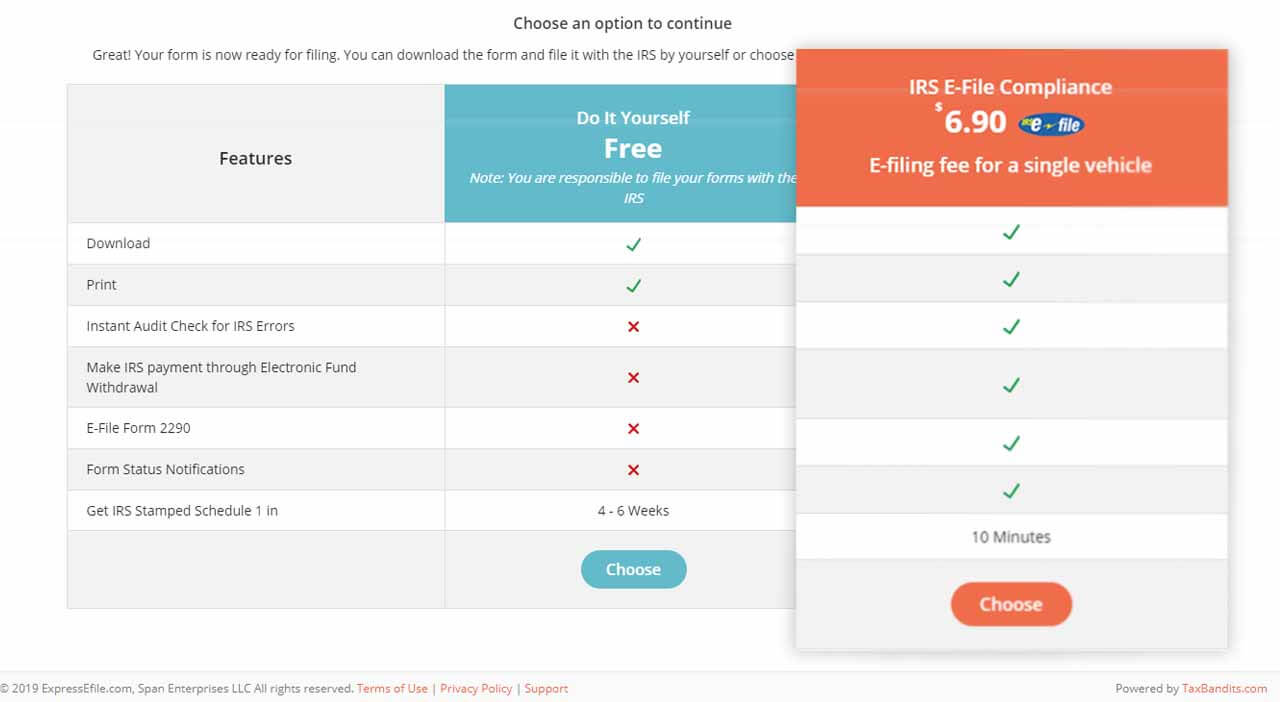

Web frequently asked questions what if i miss my deadline? Electronic filing is required for each return reporting 25 or more vehicles. Get expert assistance with simple 2290 @ $6.95 Do your truck tax online & have it efiled to the irs! You must use one of the participating commercial software.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

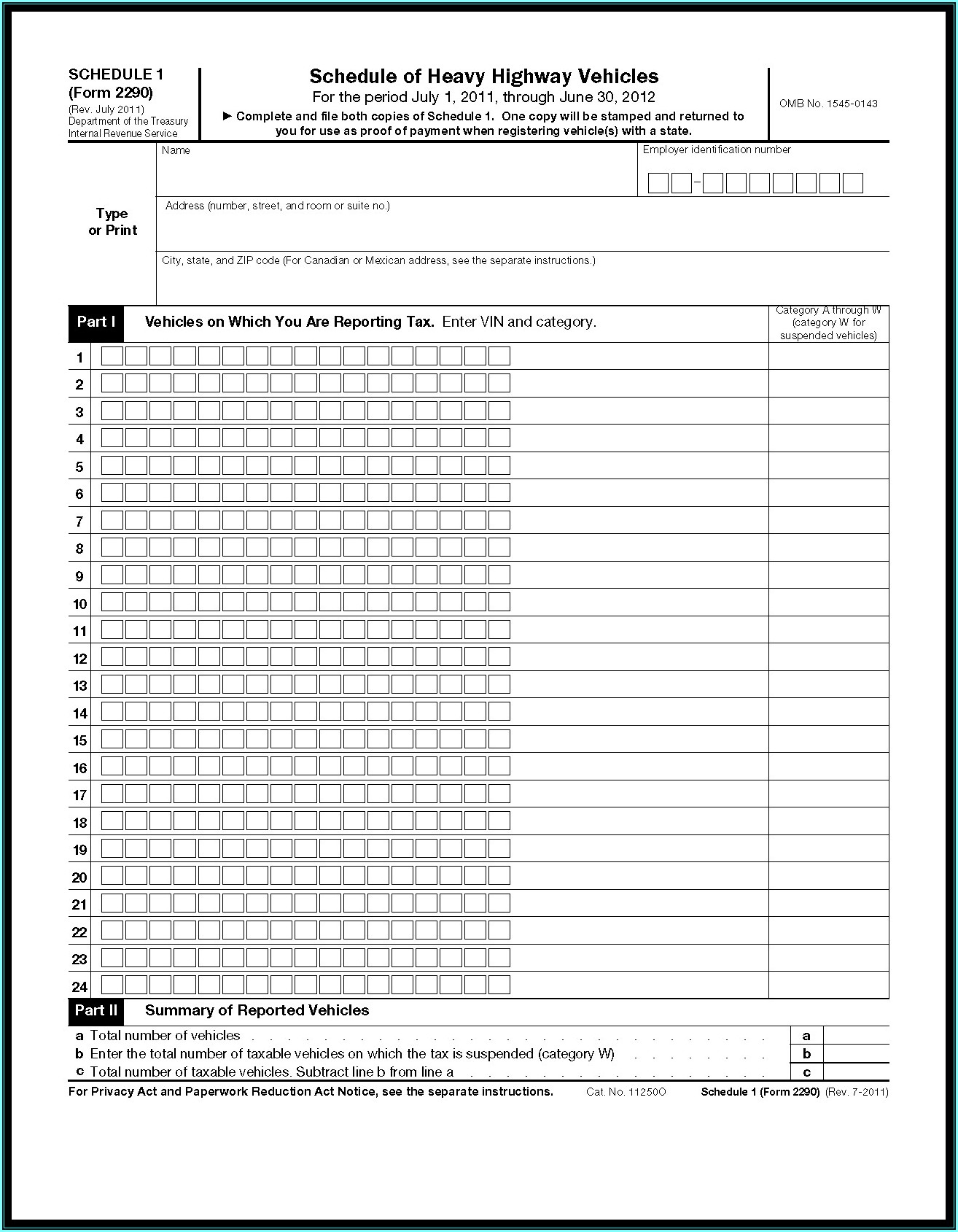

Ad upload, modify or create forms. Web frequently asked questions what if i miss my deadline? You must use one of the participating commercial software. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,. Web complete.

How Much Does it Cost to efile Form 2290? YouTube

You must use one of the participating commercial software. Let’s talk about truck tax form 2290 tax. Web complete and file both copies of schedule 1. Get expert assistance with simple 2290 @ $6.95 If you do your due diligence, you will find that easy2290.com has the lowest cost and the best service.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

Web pay per filing choose this option to pay by credit card for each filing performed, depending on the number of vehicles on each form 2290. One copy will be stamped and returned to you for use as proof of payment when registering your vehicle(s) with a state. Large fleet (101 to 500 vehicles) $ 149.90. Web 24 vehicles or.

How to Download or EFile Form 2290 using ExpressEfile?

Unlimited form 2290 tax filing (file an unlimited. Web pay per filing choose this option to pay by credit card for each filing performed, depending on the number of vehicles on each form 2290. Ad upload, modify or create forms. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1,.

What Happens If You Don't File HVUT Form 2290 Driver Success

You simply enter your credit card. Need help with irs form 2290 tax filing? Get started with your form 2290 highway tax online. Easy, fast, secure & free to try. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for.

File IRS 2290 Form Online for 20222023 Tax Period

From filing amendments to reporting suspended vehicles, you can trust. Electronic filing is required for each return reporting 25 or more vehicles. Do your truck tax online & have it efiled to the irs! Please make the necessary payment to complete the filing process and to transmit the prepared. With 2290 online, you can file your heavy vehicle use tax.

E File Form 2290 Irs Form Resume Examples Wk9yzrvY3D

Large fleet (101 to 500 vehicles) $ 149.90. With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Irs form 8849 (sch.6 other claims) we offer form 8849 efiling for $24.99. Annual subscription (1 ein, unlimited forms and unlimited trucks): Web how much does it cost to file form 2290?

Ssurvivor Form 2290 Irs Pdf

With 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Web complete and file both copies of schedule 1. Web how much does it cost to file form 2290? From filing amendments to reporting suspended vehicles, you can trust. Get ready for tax season deadlines by completing any required tax forms today.

10 Easy steps to efile form 2290 online for the TY 202122 Precise

Web medium fleet (25 to 100 vehicles) $ 89.90. Web easy2290.com charges $6.95 for filing form 2290. Web frequently asked questions what if i miss my deadline? One copy will be stamped and returned to you for use as proof of payment when registering your vehicle(s) with a state. Annual subscription (1 ein, unlimited forms and unlimited trucks):

Web Services Offered And Fees Charged Differ By Provider.

Easy, fast, secure & free to try. You must use one of the participating commercial software. Web with expresstrucktax, you can file your form 2290 for a single vehicle at just $14.90 for a return. Get ready for tax season deadlines by completing any required tax forms today.

For 24 Vehicles Or Less, You Don't.

Web frequently asked questions what if i miss my deadline? Please make the necessary payment to complete the filing process and to transmit the prepared. Do your truck tax online & have it efiled to the irs! Web how much does it cost to file form 2290?

How Do I Pay My Heavy Duty Tax?

And to file for one truck, it’s $14.90, again one of the lowest in the industry. One copy will be stamped and returned to you for use as proof of payment when registering your vehicle(s) with a state. You simply enter your credit card. Electronic filing is required for each return reporting 25 or more vehicles.

Annual Subscription (1 Ein, Unlimited Forms And Unlimited Trucks):

Ad upload, modify or create forms. Let’s talk about truck tax form 2290 tax. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,. Web medium fleet (25 to 100 vehicles) $ 89.90.