How Do I Get Form 8862

How Do I Get Form 8862 - Use get form or simply click on the template preview to open it in the editor. Ad download or email irs 8862 & more fillable forms, try for free now! Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web install turbotax desktop Ad access irs tax forms. Credit for qualified retirement savings contributions. Complete irs tax forms online or print government tax documents. Ad download or email irs 8862 & more fillable forms, register and subscribe now! File an extension in turbotax online before the deadline to avoid a late filing penalty. Get ready for tax season deadlines by completing any required tax forms today.

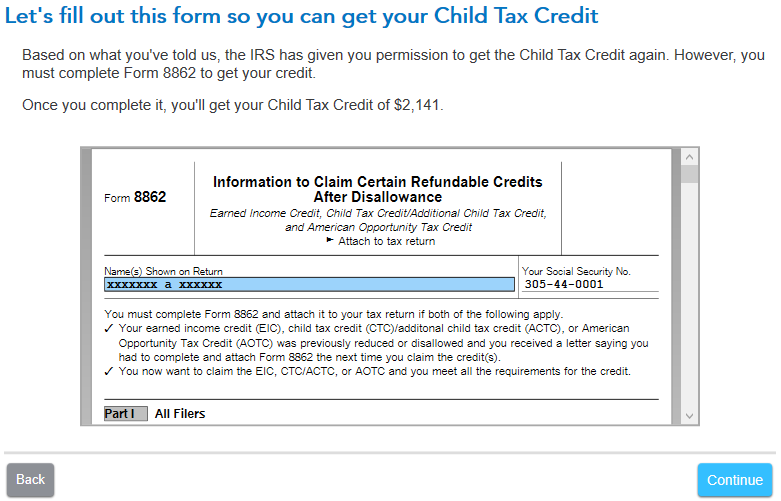

Web here's how to file form 8862 in turbotax. Complete irs tax forms online or print government tax documents. Web how do i file an irs extension (form 4868) in turbotax online? Web taxpayers complete form 8862 and attach it to their tax return if: Web if the irs rejected one or more of these credits: Use get form or simply click on the template preview to open it in the editor. Complete irs tax forms online or print government tax documents. You need to fill out this form under certain conditions if you. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Complete, edit or print tax forms instantly.

Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Credit for qualified retirement savings contributions. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web 1 7 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Start completing the fillable fields and. When you should file form 8862 and when you. Information to claim certain refundable credits. If you wish to take the credit in a. Web how do i file an irs extension (form 4868) in turbotax online?

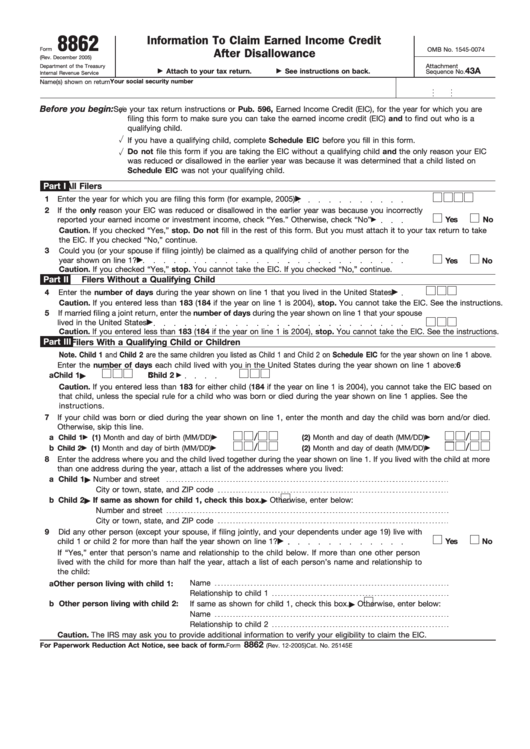

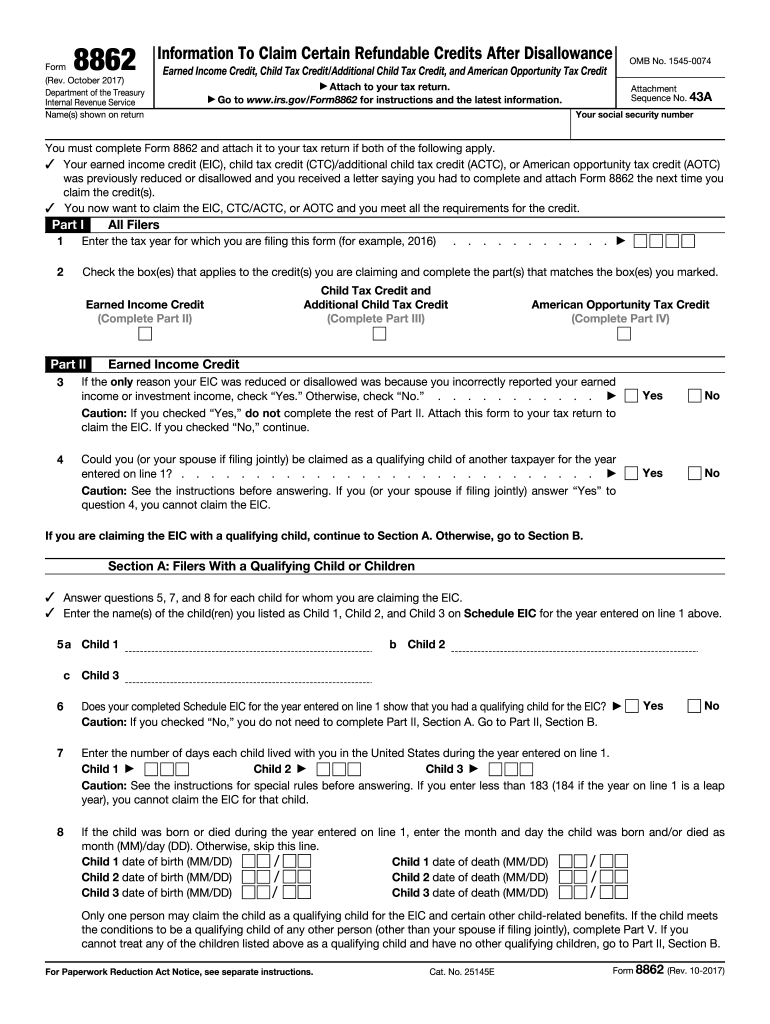

Form 8862 Information to Claim Earned Credit After

Information to claim certain refundable credits. Web sign in to efile.com. Complete, edit or print tax forms instantly. Irs form 8862 information to claim certain refundable credits after disallowance is used if your earned income credit (eic) was. Web if the irs rejected one or more of these credits:

how do i add form 8862 TurboTax® Support

Web how can i get a copy of my form 8962? Ad download or email irs 8862 & more fillable forms, try for free now! Ad download or email irs 8862 & more fillable forms, register and subscribe now! If you wish to take the credit in a. Complete irs tax forms online or print government tax documents.

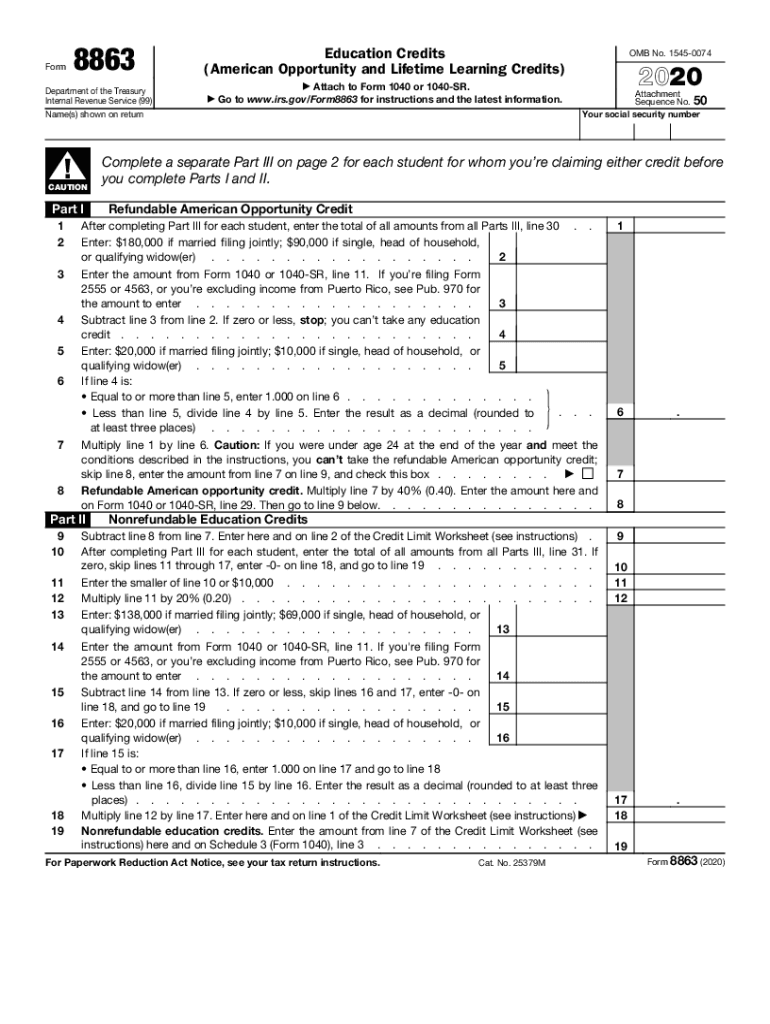

2020 Form IRS 8863 Fill Online, Printable, Fillable, Blank pdfFiller

Get ready for tax season deadlines by completing any required tax forms today. Turbotax self employed online posted june 7, 2019 4:11 pm last updated june 07, 2019 4:11 pm 0 51 52,615 bookmark. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Web form 8862 is required to be filed with.

Form 8862 Information To Claim Earned Credit After

Web 1 7 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Use get form or simply click on the template preview to open it in the editor. Web for the latest information about developments related to form 8862 and its instructions,.

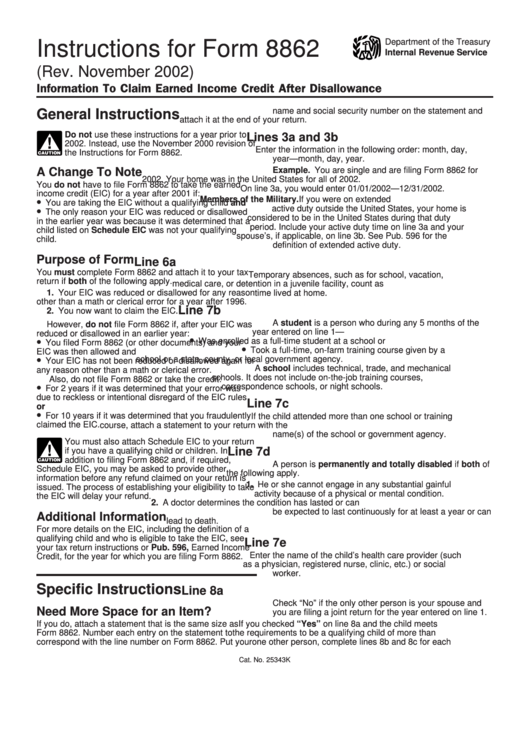

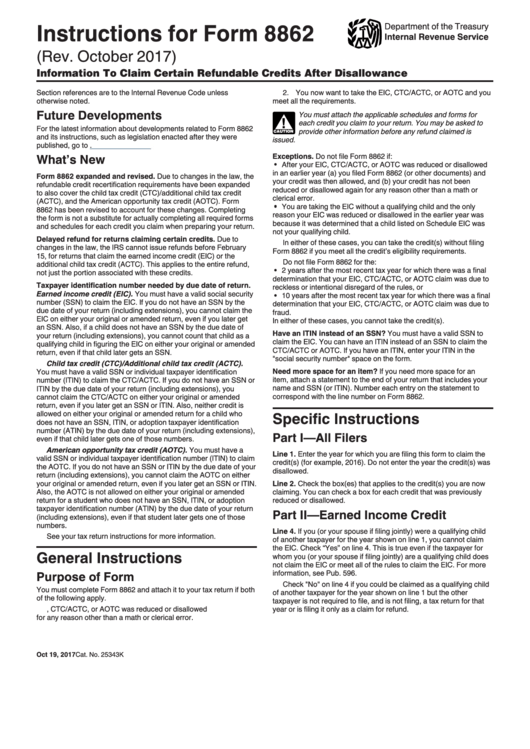

Instructions For Form 8862 Information To Claim Earned Credit

Ad download or email irs 8862 & more fillable forms, try for free now! Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another. Web how can i get a copy of my form 8962? Complete irs tax forms online or print.

Irs Form 8862 Printable Master of Documents

Ad access irs tax forms. Complete irs tax forms online or print government tax documents. Ad download or email irs 8862 & more fillable forms, try for free now! Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Click the green button to add information to claim a certain credit after disallowance.

Form 8862 Information to Claim Earned Credit After

Use get form or simply click on the template preview to open it in the editor. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits; Start completing the fillable fields and. Ad download or.

IRS Form 8862 2017 Fill Out and Sign Printable PDF Template signNow

Ad download or email irs 8862 & more fillable forms, register and subscribe now! Complete irs tax forms online or print government tax documents. What types of tax credits you may claim with this form. Irs form 8862 information to claim certain refundable credits after disallowance is used if your earned income credit (eic) was. Web 1 7 1,468 reply.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Irs form 8862 information to claim certain refundable credits after disallowance is used if your earned income credit (eic) was. Turbotax self employed online posted june 7, 2019 4:11 pm last updated june 07, 2019 4:11 pm 0 51 52,615 bookmark. Start completing the fillable fields and. Ad access irs tax forms. Ad download or email irs 8862 & more.

Top 14 Form 8862 Templates free to download in PDF format

Credit for qualified retirement savings contributions. Complete, edit or print tax forms instantly. If you wish to take the credit in a. Ad download or email irs 8862 & more fillable forms, try for free now! File an extension in turbotax online before the deadline to avoid a late filing penalty.

If You Wish To Take The Credit In A.

Web taxpayers complete form 8862 and attach it to their tax return if: Use get form or simply click on the template preview to open it in the editor. Get ready for tax season deadlines by completing any required tax forms today. You need to fill out this form under certain conditions if you.

Web If The Irs Rejected One Or More Of These Credits:

Complete irs tax forms online or print government tax documents. Start completing the fillable fields and. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Click the green button to add information to claim a certain credit after disallowance.

Ad Access Irs Tax Forms.

Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web 1 7 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Complete, edit or print tax forms instantly. File an extension in turbotax online before the deadline to avoid a late filing penalty.

Complete, Edit Or Print Tax Forms Instantly.

When you should file form 8862 and when you. This form is for income earned in tax year 2022, with tax returns due in april. Information to claim certain refundable credits. Web sign in to efile.com.