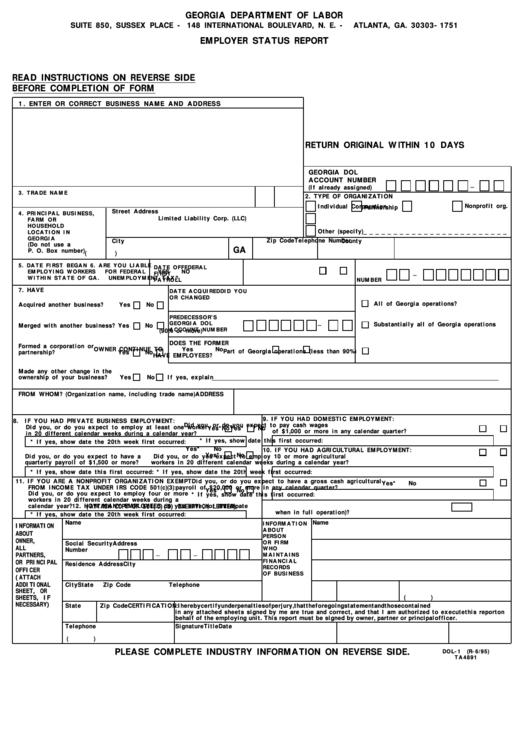

Georgia Form Dol 1A

Georgia Form Dol 1A - You can access and download a blank form on the gdol website, which you must fill out and return to the gdol via mail. Then, each quarter, use form dol 4n to report on wages and pay the ui taxes. Who is liable for unemployment tax? If you are subject to the federal unemployment tax act, and are required to file federal form 940, answer this. Unlike other states, in georgia, you can't register for a ui tax account online. How it works browse for the dol 1a customize and esign georgia employer send out signed georgia labor employer or print it rate the georgia dol 1a 4.6 satisfied 158 votes Submit the completed form by fax to 404.232.3285. You can also download it, export it or print it out. Edit your form dol 1a online. Physical location of business, farm or household in georgia if different than 1.

Type text, add images, blackout confidential details, add comments, highlights and more. This government document is issued by department of labor for use in georgia add to favorites file details: This is a georgia form and can be use in department of labor statewide. You can also download it, export it or print it out. Sign it in a few clicks. Web send georgia employer via email, link, or fax. Web agencies department of labor application for gdol tax. Please include telephone number with area code. Edit your form dol 1a online. How it works browse for the dol 1a customize and esign georgia employer send out signed georgia labor employer or print it rate the georgia dol 1a 4.6 satisfied 158 votes

Including federal and state tax rates, withholding forms, and payroll tools. Office of the secretary of state corporations division suite 315, flag west tower #2 martin luther king, jr. Physical location of business, farm or household in georgia if different than 1. Then, each quarter, use form dol 4n to report on wages and pay the ui taxes. You can access and download a blank form on the gdol website, which you must fill out and return to the gdol via mail. This government document is issued by department of labor for use in georgia add to favorites file details: Web agencies department of labor application for gdol tax. If you are subject to the federal unemployment tax act, and are required to file federal form 940, answer this. Who is liable for unemployment tax? If your llc will sell goods to customers in georgia, you will need to collect and pay.

Unemployment Status

Including federal and state tax rates, withholding forms, and payroll tools. Physical location of business, farm or household in georgia if different than 1. Annual registration form due date: Who is liable for unemployment tax? This government document is issued by department of labor for use in georgia add to favorites file details:

Form Dol13b Download Printable Pdf Or Fill Online Employee Leasing

You can also download it, export it or print it out. Enter the first date of employment in georgia and the first date of georgia payroll. Including federal and state tax rates, withholding forms, and payroll tools. Unlike other states, in georgia, you can't register for a ui tax account online. Show details we are not affiliated with any brand.

Form DOL4A Download Fillable PDF or Fill Online Annual Tax and Wage

Edit your form dol 1a online. Web agencies department of labor application for gdol tax. Unlike other states, in georgia, you can't register for a ui tax account online. Please include telephone number with area code. Enter the first date of employment in georgia and the first date of georgia payroll.

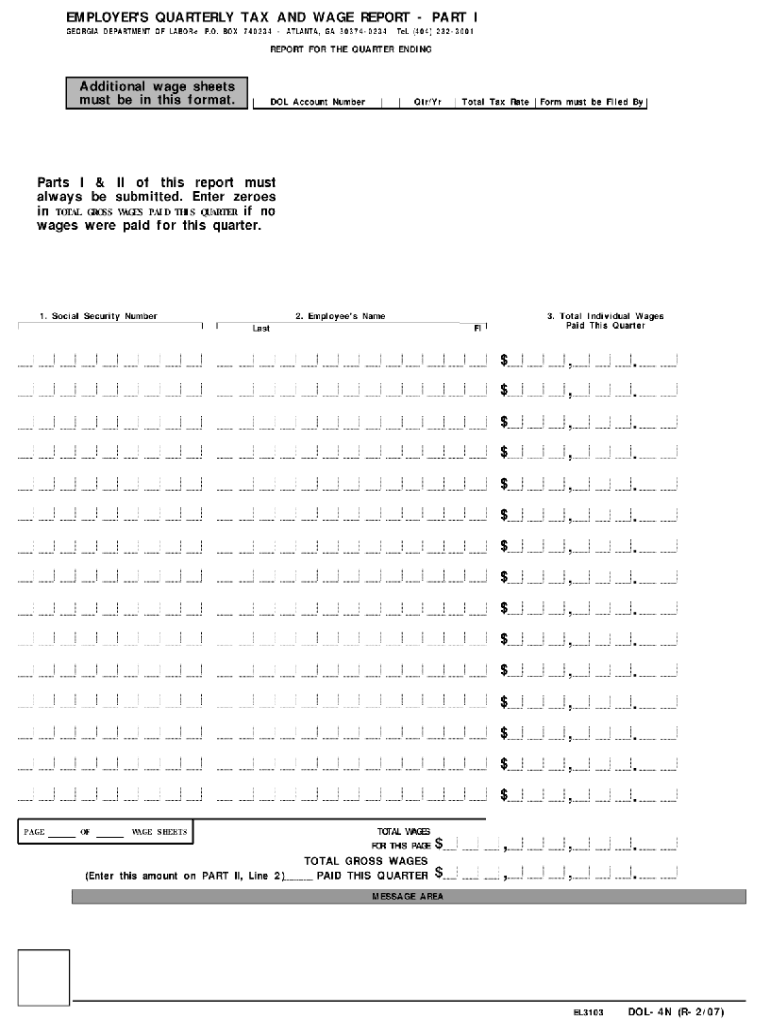

form dol 4 Oker.whyanything.co

Web send georgia employer via email, link, or fax. Annual registration form due date: If you are subject to the federal unemployment tax act, and are required to file federal form 940, answer this. This is a georgia form and can be use in department of labor statewide. Sign it in a few clicks.

form dol 4 Oker.whyanything.co

Web agencies department of labor application for gdol tax. Please include telephone number with area code. Physical location of business, farm or household in georgia if different than 1. Submit the completed form by fax to 404.232.3285. Web your free and reliable georgia payroll and tax resource.

20052021 Form GA DOL1a Fill Online, Printable, Fillable, Blank

Annual registration form due date: Enter the first date of employment in georgia and the first date of georgia payroll. Submit the completed form by fax to 404.232.3285. Edit your form dol 1a online. Who is liable for unemployment tax?

Form dol 4n fillable Fill out & sign online DocHub

Then, each quarter, use form dol 4n to report on wages and pay the ui taxes. If you are subject to the federal unemployment tax act, and are required to file federal form 940, answer this. Submit the completed form by fax to 404.232.3285. Web agencies department of labor application for gdol tax. Enter the first date of employment in.

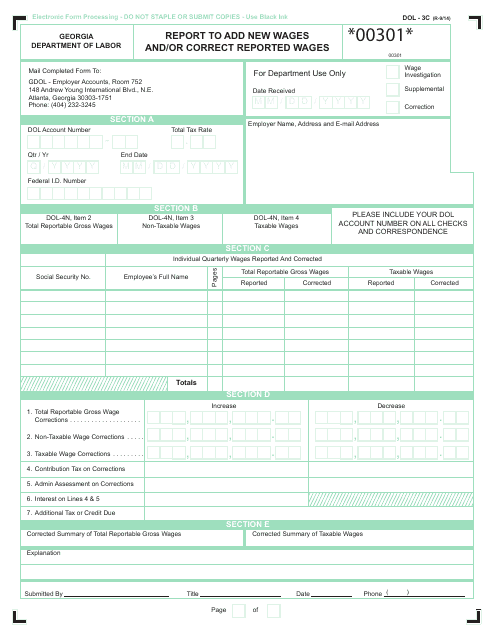

Form DOL3C Download Printable PDF or Fill Online Report to Add New

If your llc will sell goods to customers in georgia, you will need to collect and pay. If you are subject to the federal unemployment tax act, and are required to file federal form 940, answer this. Enter the first date of employment in georgia and the first date of georgia payroll. Show details we are not affiliated with any.

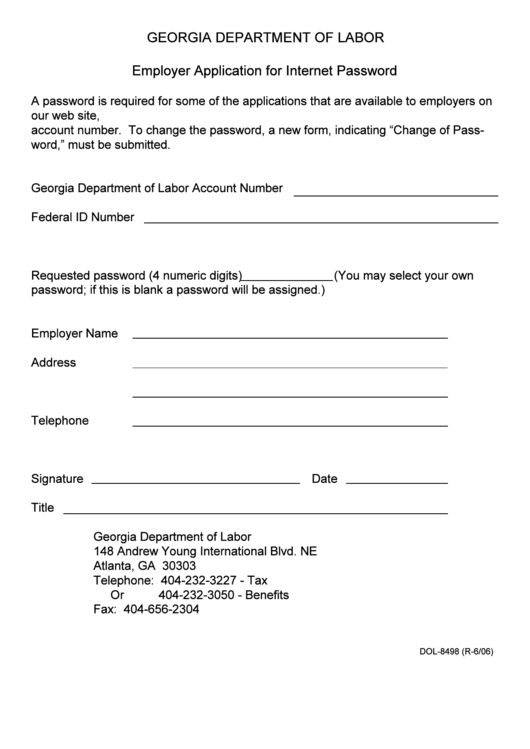

Form Dol8498 Employer Application For Password

Submit the completed form by fax to 404.232.3285. This government document is issued by department of labor for use in georgia add to favorites file details: You can access and download a blank form on the gdol website, which you must fill out and return to the gdol via mail. Please include telephone number with area code. Office of the.

2001 Form GA DOL1a Fill Online, Printable, Fillable, Blank pdfFiller

Annual registration form due date: Unlike other states, in georgia, you can't register for a ui tax account online. Web georgia secretary of state. You can access and download a blank form on the gdol website, which you must fill out and return to the gdol via mail. Who is liable for unemployment tax?

Office Of The Secretary Of State Corporations Division Suite 315, Flag West Tower #2 Martin Luther King, Jr.

You can also download it, export it or print it out. This government document is issued by department of labor for use in georgia add to favorites file details: Enter the first date of employment in georgia and the first date of georgia payroll. You can access and download a blank form on the gdol website, which you must fill out and return to the gdol via mail.

Edit Your Form Dol 1A Online.

Physical location of business, farm or household in georgia if different than 1. Including federal and state tax rates, withholding forms, and payroll tools. Please include telephone number with area code. Unlike other states, in georgia, you can't register for a ui tax account online.

This Is A Georgia Form And Can Be Use In Department Of Labor Statewide.

Web your free and reliable georgia payroll and tax resource. Web agencies department of labor application for gdol tax. Sign it in a few clicks. Who is liable for unemployment tax?

Then, Each Quarter, Use Form Dol 4N To Report On Wages And Pay The Ui Taxes.

Submit the completed form by fax to 404.232.3285. If you are subject to the federal unemployment tax act, and are required to file federal form 940, answer this. Type text, add images, blackout confidential details, add comments, highlights and more. How it works browse for the dol 1a customize and esign georgia employer send out signed georgia labor employer or print it rate the georgia dol 1a 4.6 satisfied 158 votes