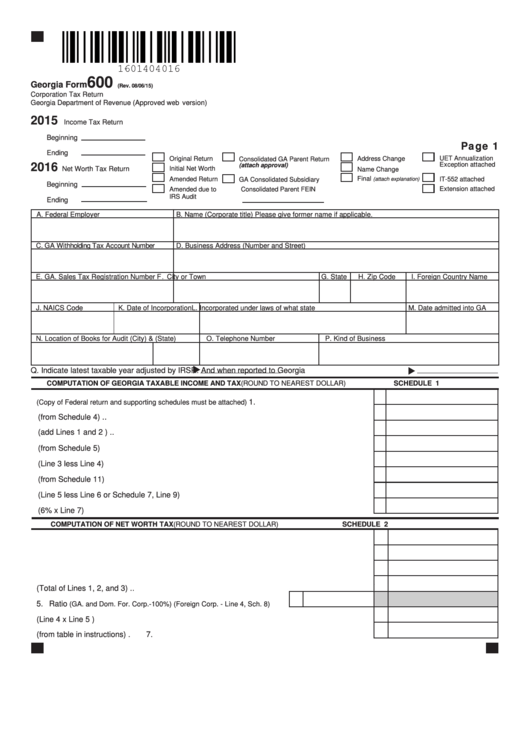

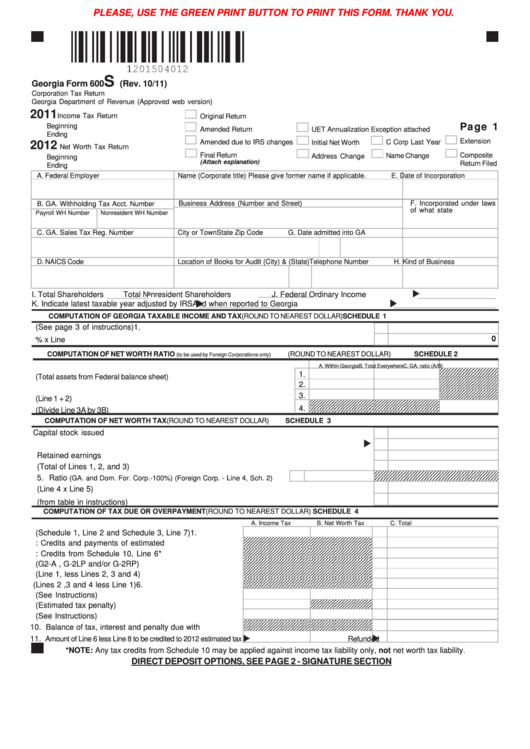

Georgia Form 600

Georgia Form 600 - Web complete, save and print the form online using your browser. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. This form is for income earned in tax year 2022, with tax returns due in april 2023. Name (corporate title) please give former name if applicable. Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022. 07/20/22) corporation tax return 1. Interest on obligations of united states (must be reduced by direct and indirect interest expense) 1. Federal taxable income (copy of federal return and supporting schedules must be attached). Georgia taxable income (enter also on schedule 1, line 7). We will update this page with a new version of the form for 2024 as soon as it is made available by the georgia government.

Additions to federal taxable income (round to nearest dollar) schedule 4. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. See page 3 signature section for direct deposit options. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web georgia department of revenue (approved web2 version) 2022 income tax return 2023 net nworth tax return beginning ending 1. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Computation of tax due or overpayment (round to nearest dollar) schedule 3. Web complete, save and print the form online using your browser. We will update this page with a new version of the form for 2024 as soon as it is made available by the georgia government.

You can print other georgia tax forms here. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. See page 3 signature section for direct deposit options. Page 2 (corporation) name fein. Web complete, save and print the form online using your browser. Computation of tax due or overpayment (round to nearest dollar) schedule 3. Federal employer id number b. We will update this page with a new version of the form for 2024 as soon as it is made available by the georgia government. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Georgia form 600/2020 apportionment of income schedule 6 subtractions from federal taxable income (round to nearest dollar) schedule 5 1.

Fillable Form 600 Corporation Tax Return 2015 printable pdf

Page 2 (corporation) name fein. See page 3 signature section for direct deposit options. Web georgia department of revenue (approved web2 version) 2022 income tax return 2023 net nworth tax return beginning ending 1. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. This form is for income earned in tax year 2022,.

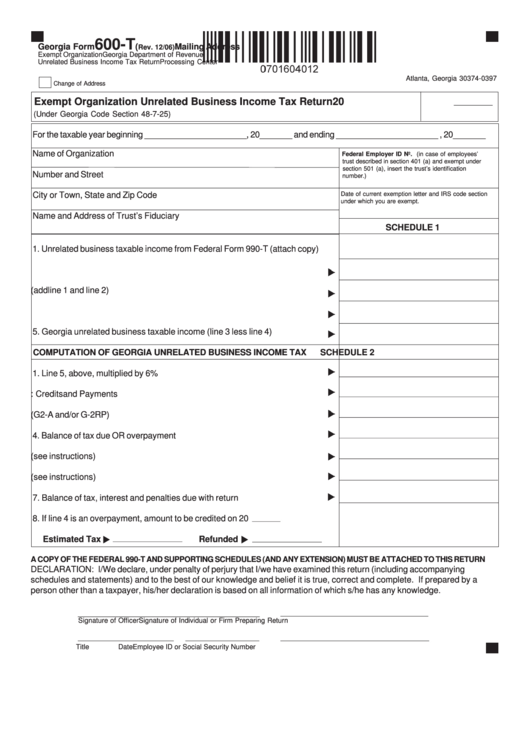

Form 600T Exempt Organization Unrelated Business Tax

Name (corporate title) please give former name if applicable. Computation of tax due or overpayment (round to nearest dollar) schedule 3. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Georgia form 600/2020 apportionment of income schedule 6 subtractions from federal taxable income (round to nearest dollar) schedule 5 1. Business street.

Entertainment & Film Credits Investor FAQ Churchill Stateside Group

Georgia taxable income (enter also on schedule 1, line 7). This form is for income earned in tax year 2022, with tax returns due in april 2023. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. To successfully complete the form, you must.

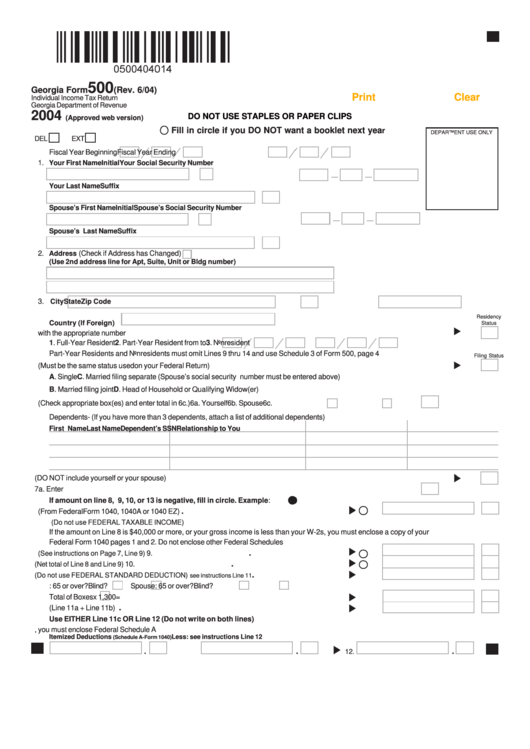

Fillable Form 500 Individual Tax Return 2004

Interest on obligations of united states (must be reduced by direct and indirect interest expense) 1. Georgia taxable income (enter also on schedule 1, line 7). This form is for income earned in tax year 2022, with tax returns due in april 2023. Georgia form 600/2020 apportionment of income schedule 6 subtractions from federal taxable income (round to nearest dollar).

2005 Form GA DoR 600S Fill Online, Printable, Fillable, Blank pdfFiller

07/20/22) corporation tax return 1. Interest on obligations of united states (must be reduced by direct and indirect interest expense) 1. Computation of tax due or overpayment (round to nearest dollar) schedule 3. You can print other georgia tax forms here. Name (corporate title) please give former name if applicable.

Get The Form T 22c 20202022 Fill and Sign Printable Template

Page 2 (corporation) name fein. To successfully complete the form, you must download and use the current version of adobe acrobat reader. To successfully complete the form, you must download and use the current version of adobe acrobat reader. This form is for income earned in tax year 2022, with tax returns due in april 2023. Name (corporate title) please.

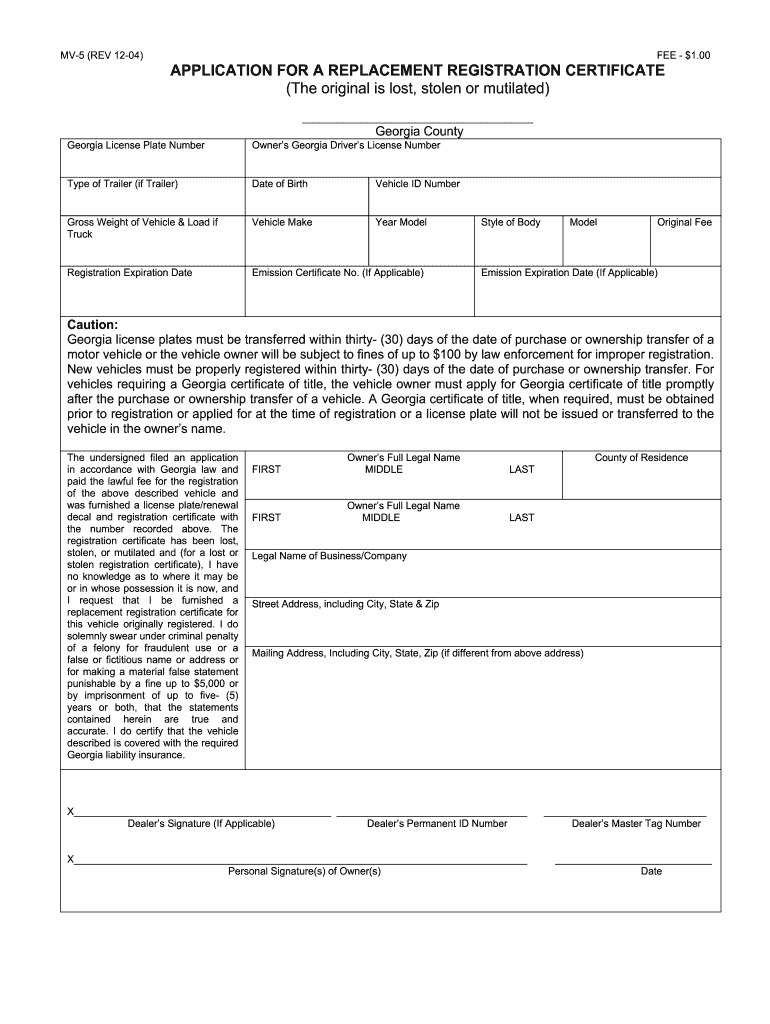

Mv 5 Form Fill Out and Sign Printable PDF Template signNow

Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Georgia taxable income (enter also on schedule 1, line 7). You can print other georgia tax forms here. Federal taxable income (copy of federal return and supporting schedules must be attached). This form is for income earned in tax year 2022, with tax returns.

Fillable Form 600s Corporation Tax Return printable pdf download

Additions to federal taxable income (round to nearest dollar) schedule 4. Georgia form 600/2020 apportionment of income schedule 6 subtractions from federal taxable income (round to nearest dollar) schedule 5 1. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Web complete, save.

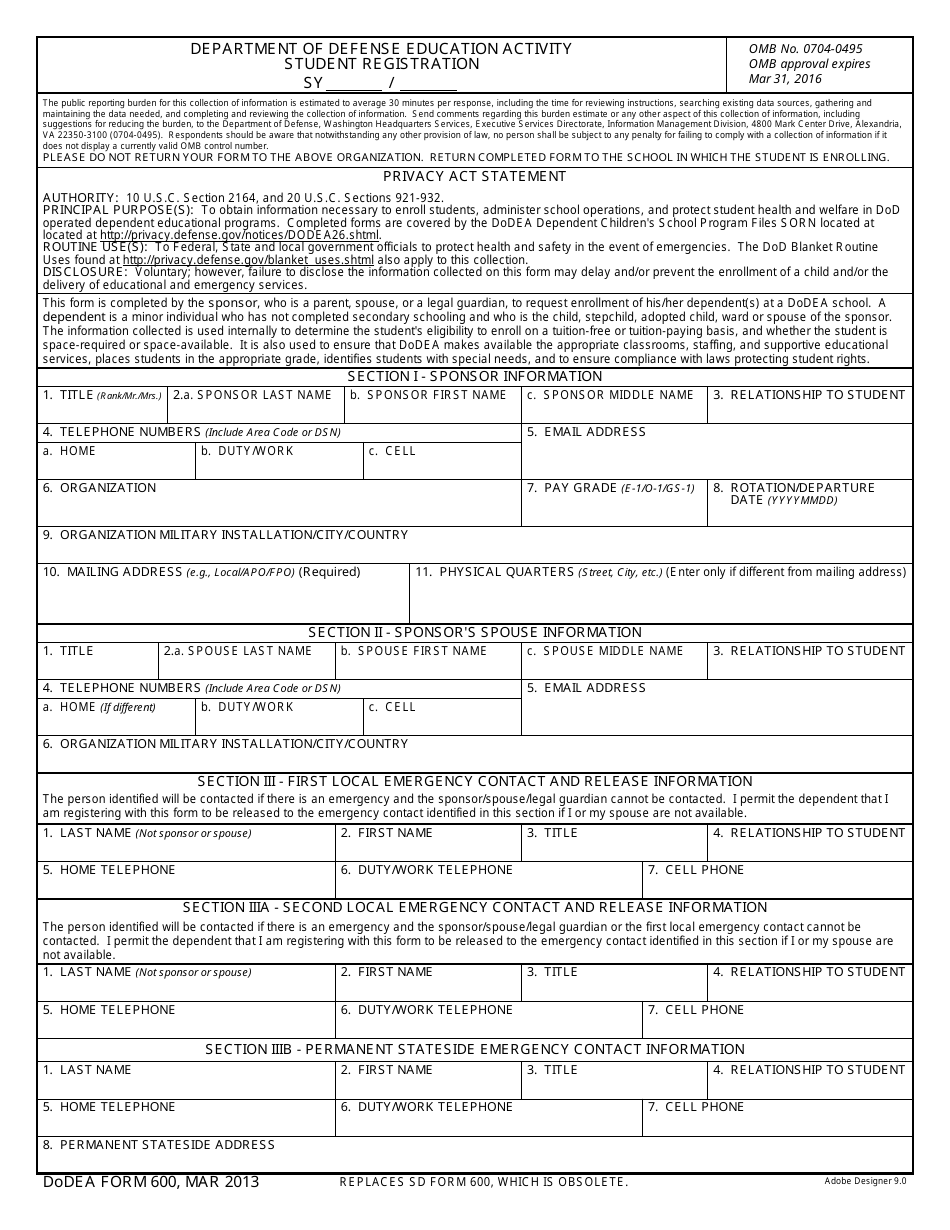

DoDEA Form 600 Download Fillable PDF or Fill Online Department of

Web georgia department of revenue (approved web2 version) 2022 income tax return 2023 net nworth tax return beginning ending 1. Georgia form 600/2020 apportionment of income schedule 6 subtractions from federal taxable income (round to nearest dollar) schedule 5 1. To successfully complete the form, you must download and use the current version of adobe acrobat reader. 07/20/22) corporation tax.

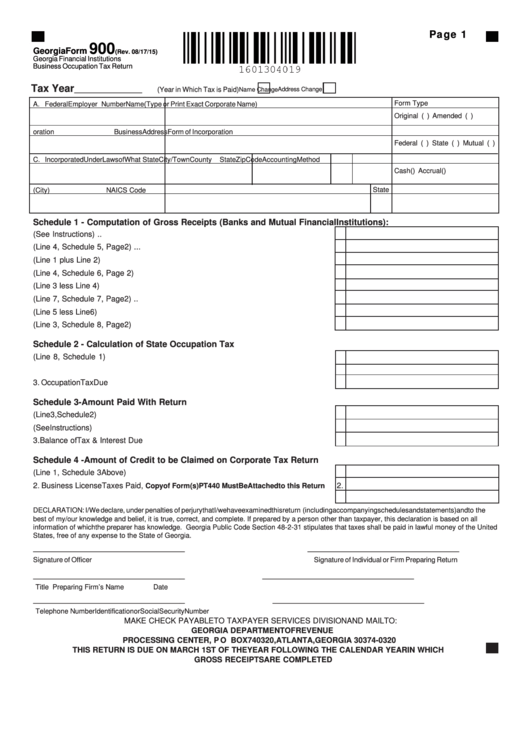

Fillable Form 900 Financial Institutions Business

Web georgia department of revenue (approved web2 version) 2022 income tax return 2023 net nworth tax return beginning ending 1. Federal taxable income (copy of federal return and supporting schedules must be attached). Computation of tax due or overpayment (round to nearest dollar) schedule 3. Business street address payroll wh number nonresident wh number Page 2 (corporation) name fein.

Additions To Federal Taxable Income (Round To Nearest Dollar) Schedule 4.

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Web complete, save and print the form online using your browser. Georgia taxable income (enter also on schedule 1, line 7). Page 2 (corporation) name fein.

Web Georgia Department Of Revenue (Approved Web2 Version) 2022 Income Tax Return 2023 Net Nworth Tax Return Beginning Ending 1.

Interest on obligations of united states (must be reduced by direct and indirect interest expense) 1. Federal taxable income (copy of federal return and supporting schedules must be attached). This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022.

Web Complete, Save And Print The Form Online Using Your Browser.

Web georgia form 600s (rev. To successfully complete the form, you must download and use the current version of adobe acrobat reader. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Business street address payroll wh number nonresident wh number

07/20/22) Corporation Tax Return 1.

Computation of tax due or overpayment (round to nearest dollar) schedule 3. Federal employer id number b. Name (corporate title) please give former name if applicable. See page 3 signature section for direct deposit options.