Free Printable 2290 Tax Form

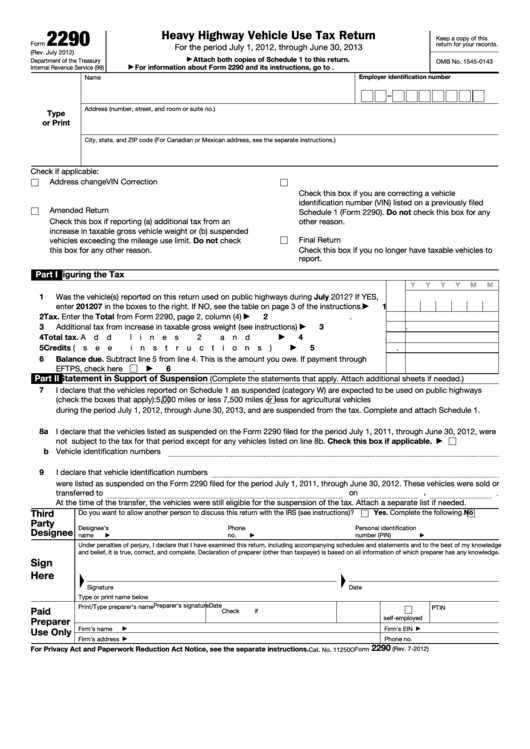

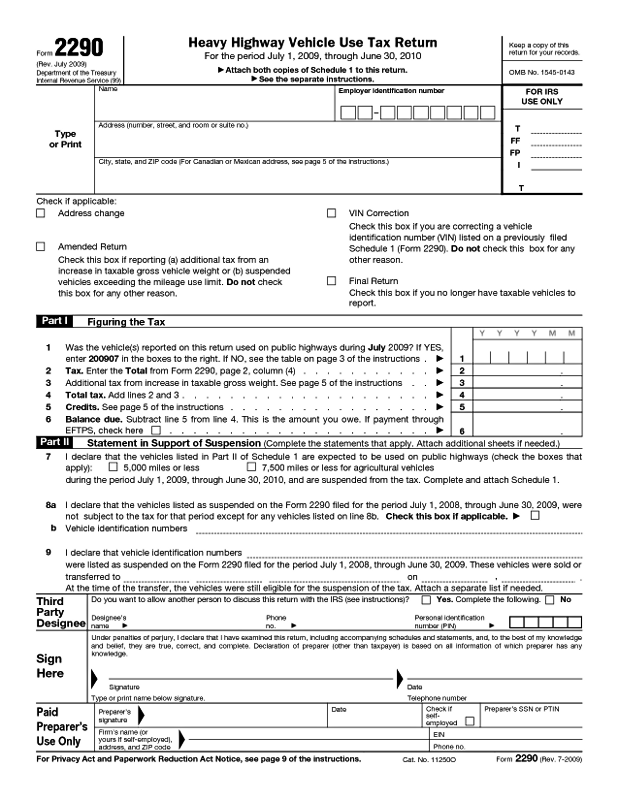

Free Printable 2290 Tax Form - Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Get irs stamped schedule 1 in minutes; July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of schedule 1 to this return. Download or print 2290 for your records; Review and transmit the form directly to the irs; Keep a copy of this return for your records. The tax is paid by owners of heavy highway vehicles with a taxable gross weight. Detailed instructions & samples to fill out the template correctly. Heavy vehicle tax filing made simple irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file.

Review and transmit the form directly to the irs; Web form 2290 or the heavy highway vehicle use tax return is available for electronic filing. Heavy vehicle tax filing made simple irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file. The irs form 2290 is used to report and pay this tax. A highway motor vehicle for use tax purposes is defined inside the instructions booklet. Web what is form 2290? Keep a copy of this return for your records. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of schedule 1 to this return. Expert tips for a smooth submission. One step from beginning to end.

Get irs stamped schedule 1 in minutes; Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. The irs form 2290 is used to report and pay this tax. Go to www.irs.gov/form2290 for instructions and the latest information. The heavy highway vehicle use tax (hvut) is an annual tax imposed on heavy vehicles that operate on public highways. Download the 2290 form to print & file to the irs via mail. One step from beginning to end. Web fill online, printable, fillable, blank f2290 form 2290 (rev. Heavy highway vehicle use tax return if you are a user of a heavy highway vehicle, chances are high that you will need to fill out and submit irs form 2290 at some point. Your schedule 1 will be available almost immediately (once your return.

2290 Heavy Highway Tax Form 2017 Universal Network

Web fill online, printable, fillable, blank f2290 form 2290 (rev. One step from beginning to end. It's never been this easy. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Go to www.irs.gov/form2290 for instructions and the latest information.

Free Printable Form 2290 Printable Templates

Heavy vehicle tax filing made simple irs form 2290, also known as the heavy highway vehicle use tax return, is an essential tax document that truck owners and operators in the united states must file. Web irs form 2290 printable 📝 get 2290 tax form & instructions for 2023: The irs form 2290 is used to report and pay this.

Printable 2290 Form Customize and Print

Efile and pay today, all in one easy step one charge to your credit card. Credit card have you been wishing that you could pay your 2290taxes with your credit card? The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. It takes.

Fillable Form 2290 20232024 Create, Fill & Download 2290

Web one such form is the irs form 2290, also known as the heavy highway vehicle use tax return. One step from beginning to end. Keep a copy of this return for your records. You must file credit card payments by august 27th to be on time. The relevant guide for 2023

form 2290 20182022 Fill Online, Printable, Fillable Blank

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of schedule 1 to this return. Form 2290 is.

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Keep a copy of this return for your records. All forms are printable and downloadable. Easy2290 is an irs authorized and approved hvut provider for irs form 2290. Check out our comprehensive hvut guideline The tax is paid by owners of heavy highway vehicles with a taxable gross weight.

Building Strong Independent Dealers Deadline Draws Near for FHUT 2290

Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. All forms are printable and downloadable. Once completed you can sign your fillable form or send for signing. The relevant guide for 2023 Form 2290 is used to figure and.

14 Form Irs Seven Signs You’re In Love With 14 Form Irs AH STUDIO Blog

The heavy highway vehicle use tax (hvut) is an annual tax imposed on heavy vehicles that operate on public highways. Check out our comprehensive hvut guideline Our team of tax professionals have the expertise and experience to give you professional help. Form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing.

Printable IRS Form 2290 for 2020 Download 2290 Form

It's never been this easy. Web irs form 2290 printable 📝 get 2290 tax form & instructions for 2023: Web form 2290 or the heavy highway vehicle use tax return is available for electronic filing. Web printable form the 2290 form is a form used to file an heavy highway vehicle use tax. The heavy highway vehicle use tax (hvut).

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Once completed you can sign your fillable form or send for signing. Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms,.

See Month Of First Use Under Schedule 1 (Form 2290), Later, For More Information.

Keep a copy of this return for your records. The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. Check out our comprehensive hvut guideline Irs form 2290 instructions can be found on the irs website.

Your Schedule 1 Will Be Available Almost Immediately (Once Your Return.

Web irs form 2290 printable 📝 get 2290 tax form & instructions for 2023: Download or print 2290 for your records; Expert tips for a smooth submission. Easy2290 is an irs authorized and approved hvut provider for irs form 2290.

Web Printable Form The 2290 Form Is A Form Used To File An Heavy Highway Vehicle Use Tax.

Once completed you can sign your fillable form or send for signing. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period and the. Web here’s how to download the printable form 2290: Our team of tax professionals have the expertise and experience to give you professional help.

One Step From Beginning To End.

Heavy highway vehicle use tax return if you are a user of a heavy highway vehicle, chances are high that you will need to fill out and submit irs form 2290 at some point. Web one such form is the irs form 2290, also known as the heavy highway vehicle use tax return. See when to file form 2290 for more details. The tax is paid by owners of heavy highway vehicles with a taxable gross weight.