Franchise And Excise Tax Tennessee Form

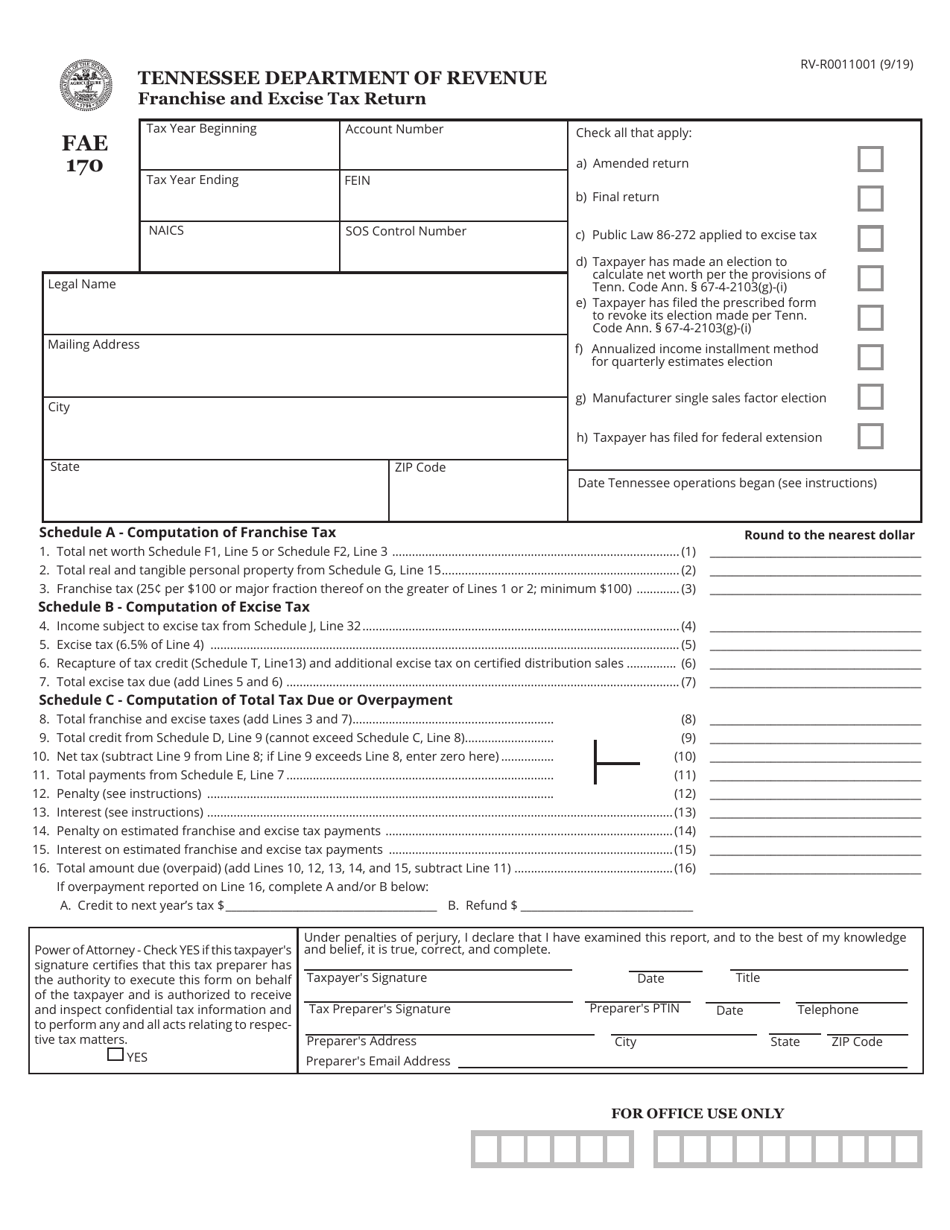

Franchise And Excise Tax Tennessee Form - Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Web when filing the franchise and excise tax return on tntap, a taxpayer should check “yes” when asked “have you filed for an extension?” taxpayers who qualify for an. Web franchise tax (25¢ per $100.00 or major fraction thereof on the greater of lines 1 or 2; Web 3 | page overview.45 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Taxpayers with a franchise, excise tax liability of $5,000 or more in the prior tax year who expect a franchise, excise tax. Web 2 | page contents chapter 1: Get ready for tax season deadlines by completing any required tax forms today. Who must make estimated tax payments: Web in general, the franchise tax is based on the greater of tennessee apportioned.

Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Web 3 | page overview.45 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Web the following entity types may be required to file the franchise and excise tax return: Complete, edit or print tax forms instantly. Who must make estimated tax payments: Web when filing the franchise and excise tax return on tntap, a taxpayer should check “yes” when asked “have you filed for an extension?” taxpayers who qualify for an. Web in general, the franchise tax is based on the greater of tennessee apportioned. Net worth (assets less liabilities) or; Web the franchise tax rate is 0.25% times the greater of a business’s net worth or real and tangible property.

Get ready for tax season deadlines by completing any required tax forms today. Web income tax due for partnerships tennessee forms and schedules form inc 250—individual income tax return form inc 251—application for extension of time to file individual. Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Tennessee taxes | form fae 170 | taxact support. Net worth (assets less liabilities) or; Web 3 | page overview.45 Web the following entity types may be required to file the franchise and excise tax return: Web when filing the franchise and excise tax return on tntap, a taxpayer should check “yes” when asked “have you filed for an extension?” taxpayers who qualify for an. Web any depreciation under the provisions of irc section 168 not permitted for excise tax purposes due to tennessee permanently decoupling from federal bonus depreciation. Who must make estimated tax payments:

Form FAE170 (RVR0011001) Download Printable PDF or Fill Online

Web the following entity types may be required to file the franchise and excise tax return: Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Web 2 | page contents chapter 1: Tennessee taxes | form fae 170 | taxact support. Web the franchise tax.

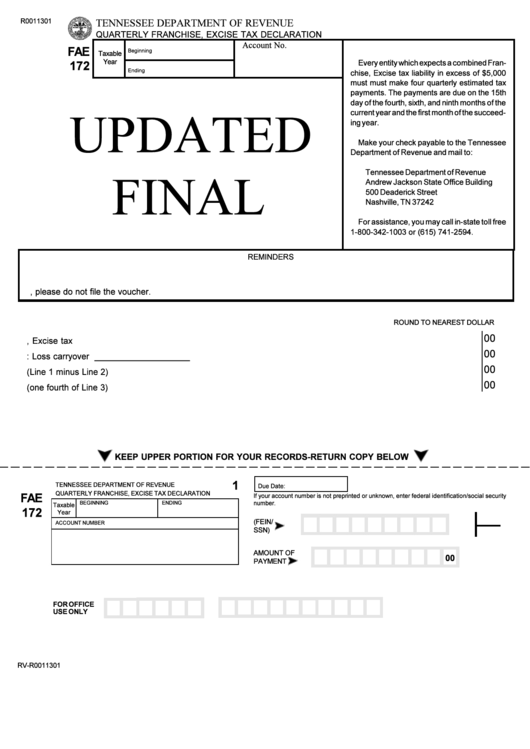

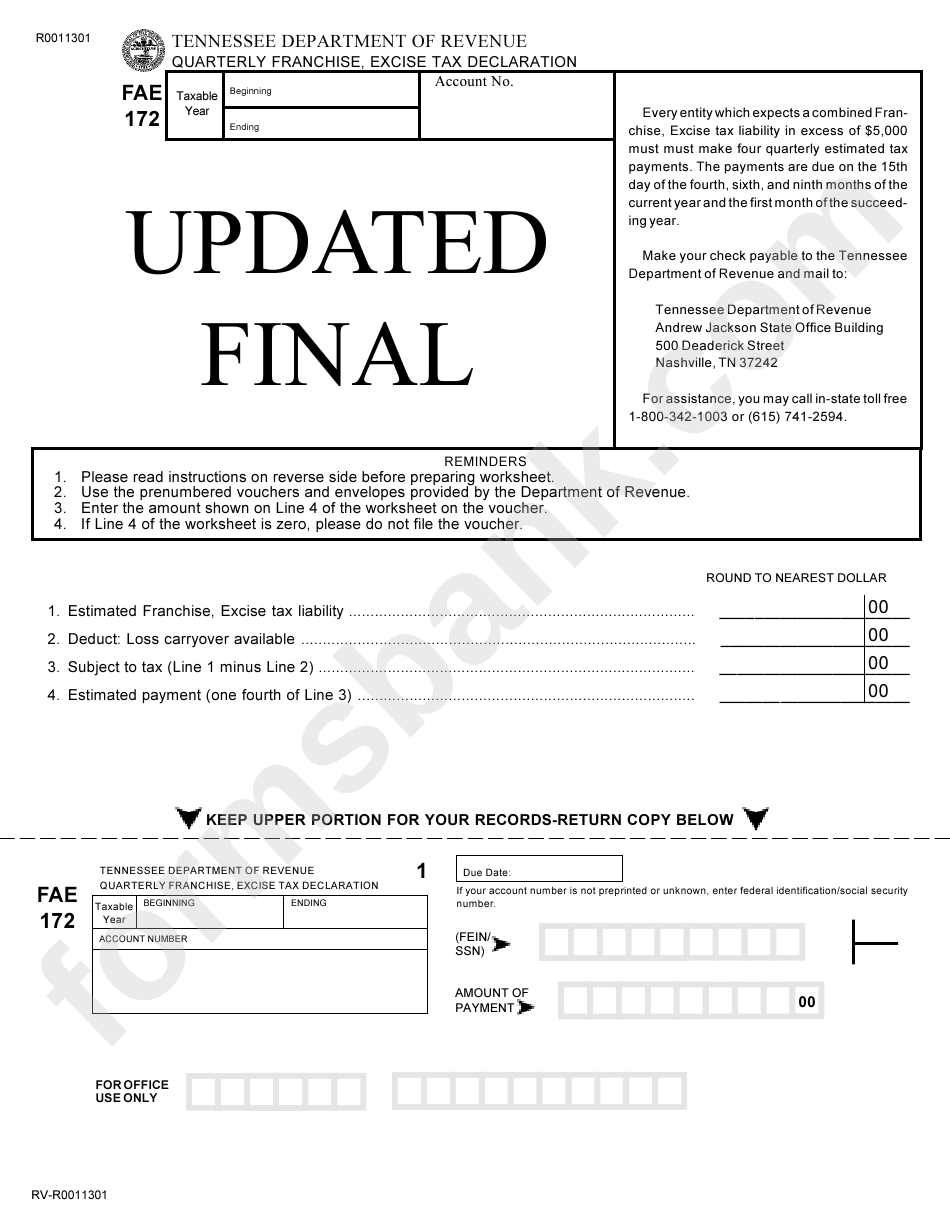

Form Fae 172 Quarterly Franchise, Excise Tax Declaration printable

Get ready for tax season deadlines by completing any required tax forms today. 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Web 3 | page overview.45 Web franchise tax (25¢ per $100.00 or major fraction thereof on the greater of lines 1 or 2; Tennessee taxes | form.

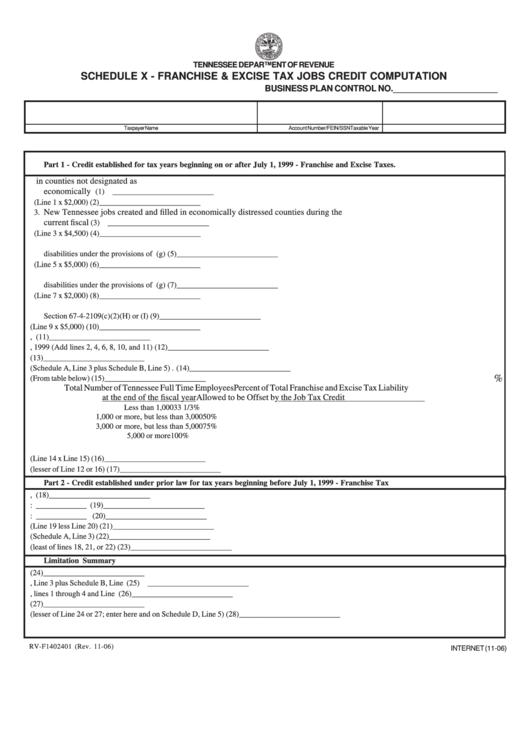

Fillable Form RvF1402401 Schedule X Franchise & Excise Tax Jobs

Ad register and subscribe now to work on your excise tax declaration & more fillable forms. Tennessee taxes | form fae 170 | taxact support. Web the franchise tax is based on the greater of: Who must make estimated tax payments: Web in general, the franchise tax is based on the greater of tennessee apportioned.

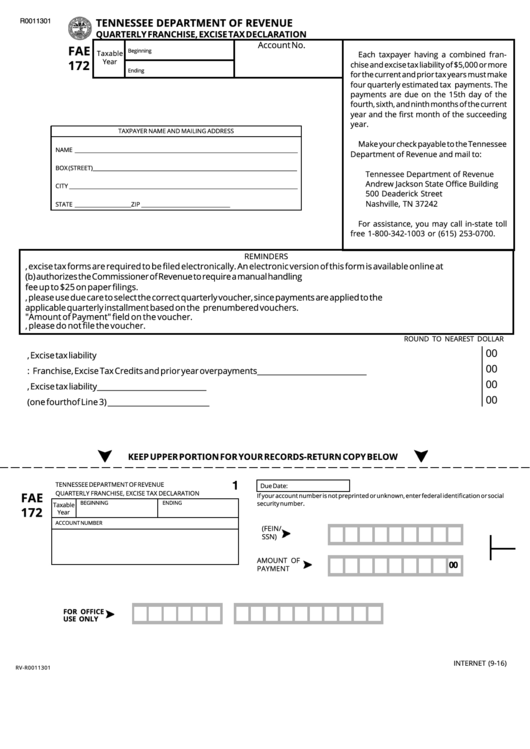

Form Fae 172 Quarterly Franchise, Excise Tax Declaration Tennessee

1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Get ready for tax season deadlines by completing any required tax forms today. Ad register and subscribe now to work on your excise tax declaration & more fillable forms. Web 3 | page overview.45 Net worth (assets less liabilities) or;

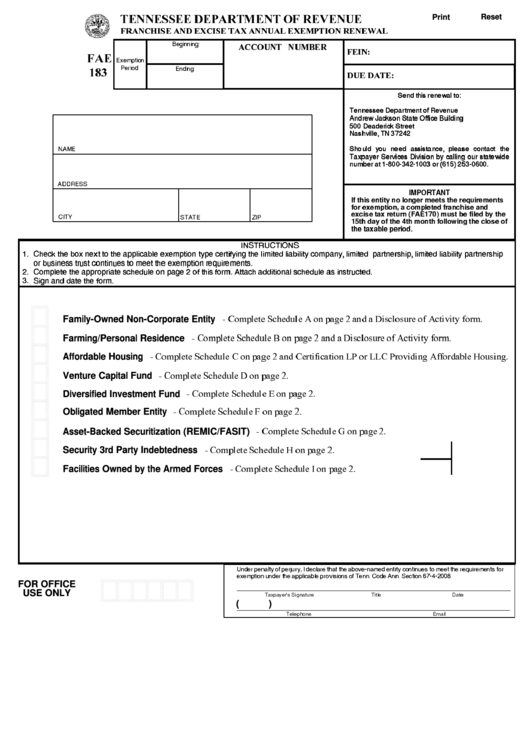

Fillable Form Fae 183 Franchise And Excise Tax Annual Exemption

Web the following entity types may be required to file the franchise and excise tax return: Ad register and subscribe now to work on your excise tax declaration & more fillable forms. Web 2 | page contents chapter 1: 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Web.

tn franchise and excise tax guide Deafening Bloggers Pictures

Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. The minimum tax is $100. Web income tax due for partnerships tennessee forms and schedules form inc 250—individual income tax return form inc 251—application for extension of time to file individual. Taxpayers with a franchise, excise.

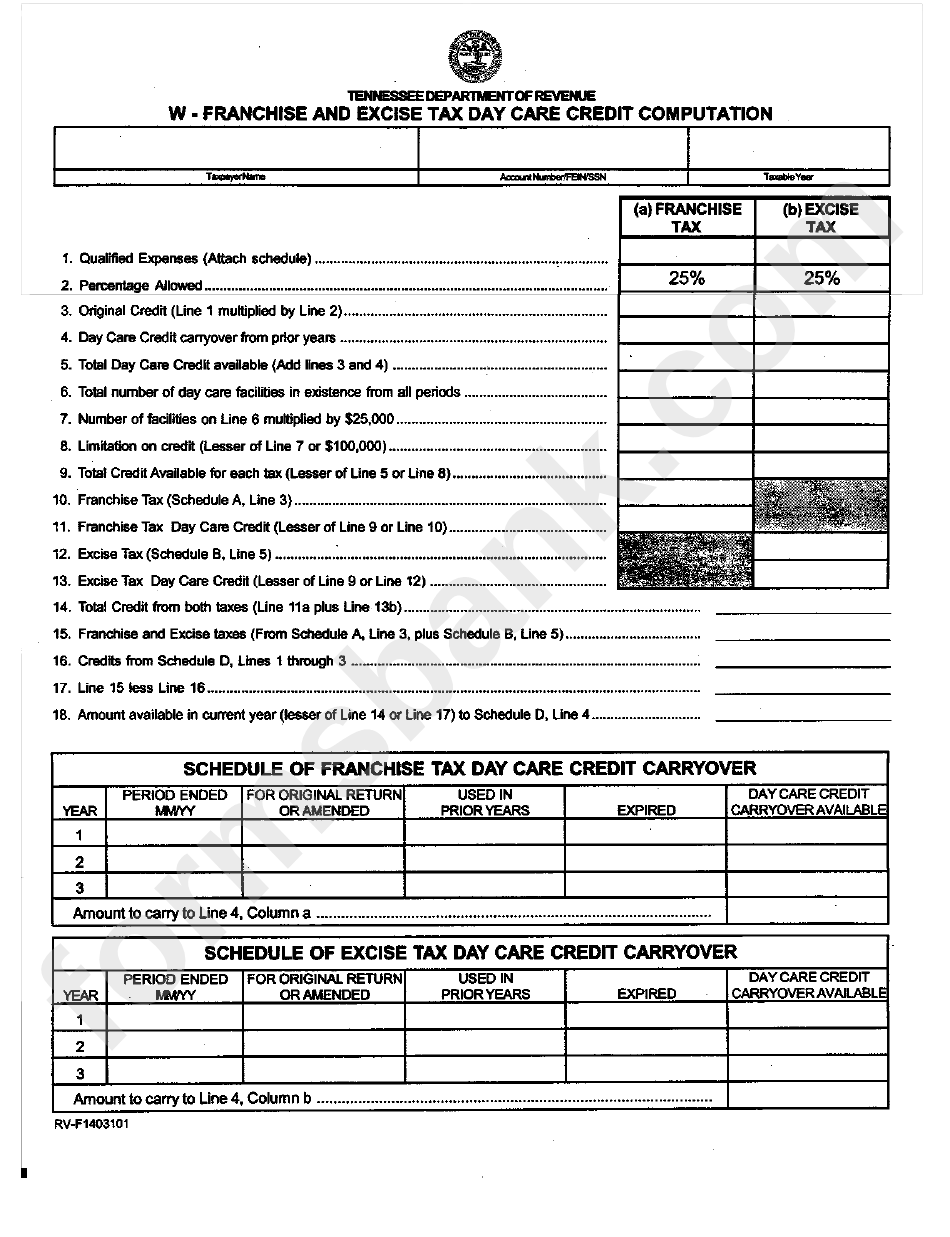

WFranchise And Excise Tax Day Care Credit Computation Form printable

Taxpayers with a franchise, excise tax liability of $5,000 or more in the prior tax year who expect a franchise, excise tax. Get ready for tax season deadlines by completing any required tax forms today. Ad register and subscribe now to work on your excise tax declaration & more fillable forms. Web 3 | page overview.45 1) net worth or.

Tn Franchise And Excise Tax Guide My Tax

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web 2 | page contents chapter 1: Web any depreciation under the provisions of irc section 168 not permitted for excise tax purposes due to tennessee permanently decoupling from federal bonus depreciation. Web franchise tax (25¢ per $100.00 or major.

Form Fae 172 Quarterly Franchise, Excise Tax Declaration printable

Get ready for tax season deadlines by completing any required tax forms today. Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Tennessee taxes | form fae 170 | taxact support. Web 3 | page overview.45 Web income tax due for partnerships tennessee forms and.

tn franchise and excise tax mailing address Blimp Microblog Custom

Net worth (assets less liabilities) or; Tennessee taxes | form fae 170 | taxact support. Please use the link below. 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Ad register and subscribe now to work on your excise tax declaration & more fillable forms.

Web The Taxpayer’s Initial Franchise And Excise Tax Exemption Application, And All Subsequent Exemption Renewal Applications, Should Be Submitted On Or Before The 15Th.

Web when filing the franchise and excise tax return on tntap, a taxpayer should check “yes” when asked “have you filed for an extension?” taxpayers who qualify for an. 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Complete, edit or print tax forms instantly. Taxpayers with a franchise, excise tax liability of $5,000 or more in the prior tax year who expect a franchise, excise tax.

Web Income Tax Due For Partnerships Tennessee Forms And Schedules Form Inc 250—Individual Income Tax Return Form Inc 251—Application For Extension Of Time To File Individual.

Web franchise tax (25¢ per $100.00 or major fraction thereof on the greater of lines 1 or 2; Please use the link below. Web 3 | page overview.45 Get ready for tax season deadlines by completing any required tax forms today.

The Book Value (Cost Less Accumulated.

Web the following entity types may be required to file the franchise and excise tax return: Tennessee taxes | form fae 170 | taxact support. Web the franchise tax rate is 0.25% times the greater of a business’s net worth or real and tangible property. Web the franchise tax is based on the greater of:

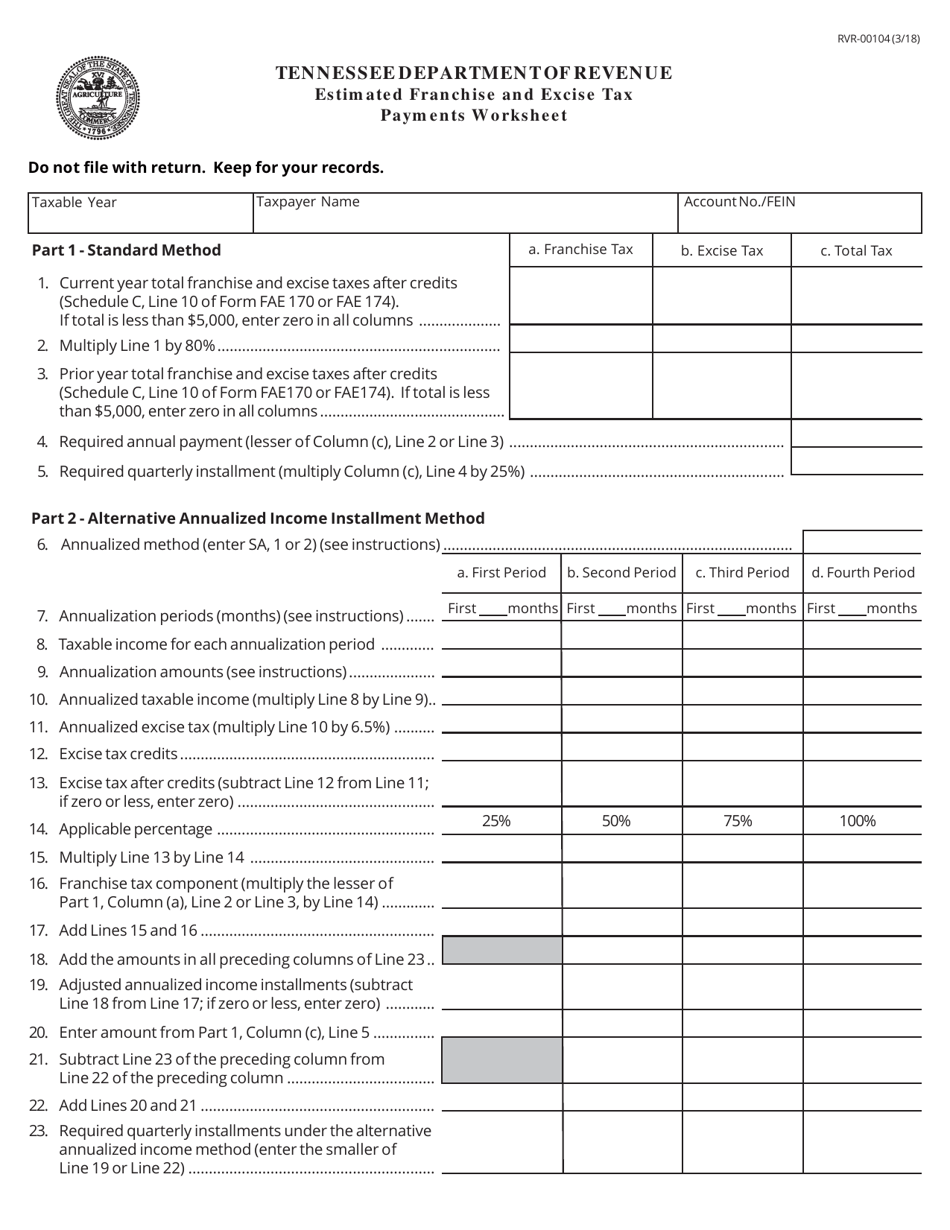

Who Must Make Estimated Tax Payments:

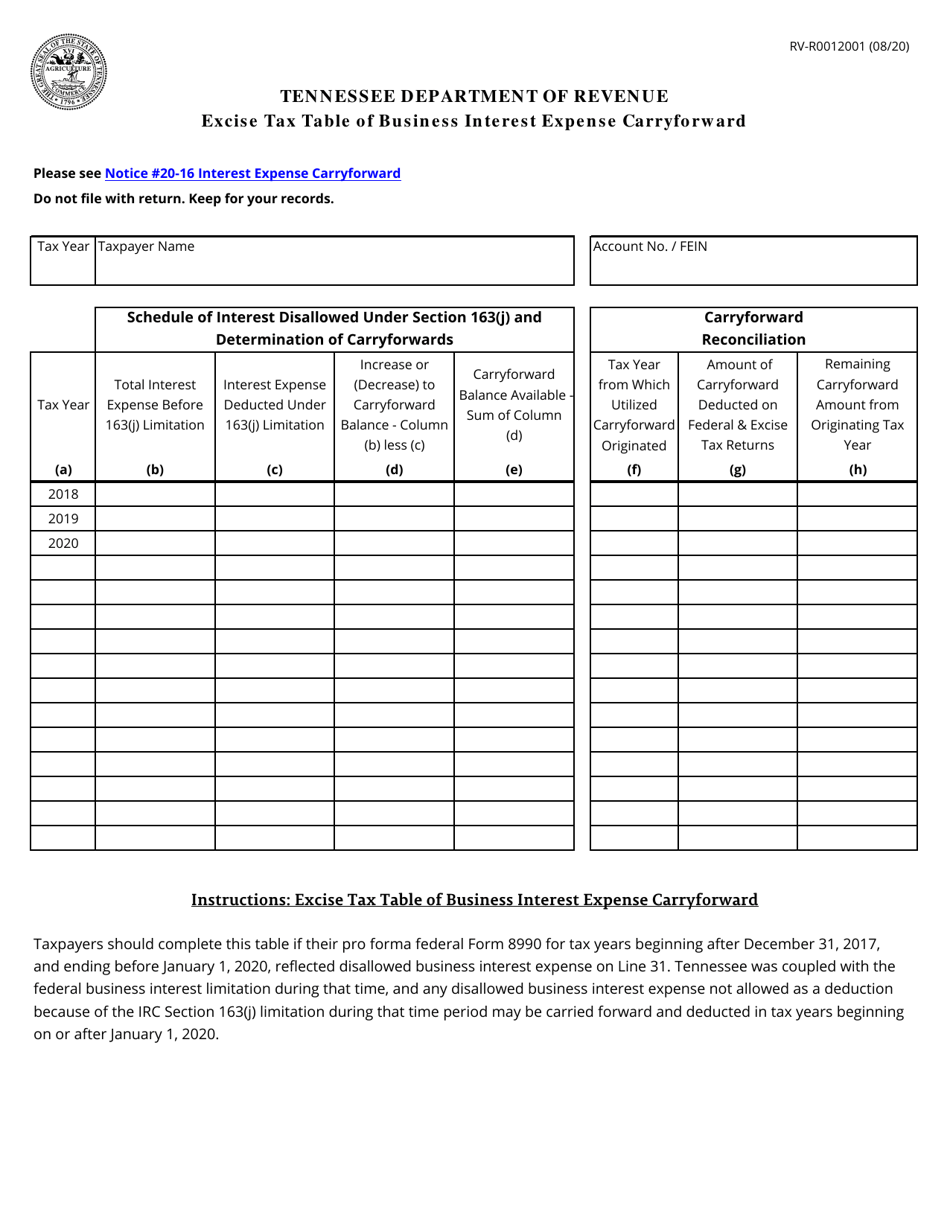

Web any depreciation under the provisions of irc section 168 not permitted for excise tax purposes due to tennessee permanently decoupling from federal bonus depreciation. The minimum tax is $100. Web in general, the franchise tax is based on the greater of tennessee apportioned. Net worth (assets less liabilities) or;