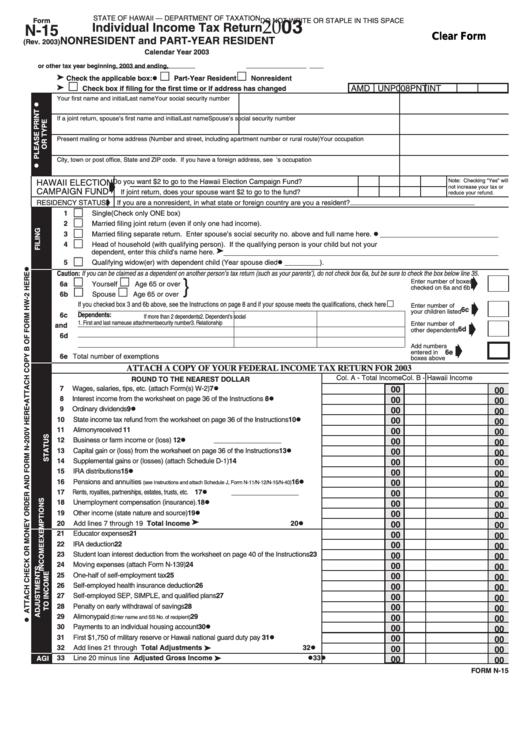

Form N-15

Form N-15 - Computation of tax for children under age 14 who have unearned income of more than $1,000. = state of hawaii — department of taxation individual income tax return. See this turbotax support faq for state forms. Otherwise go to page 21 of the. To begin the document, use the fill camp; 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. For information and guidance in. Naturally, you'll also need to. 2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. §3912 and §321.62, wisconsin statutes this form shall not be modified.

Naturally, you'll also need to. 2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web the report doesn’t offer many specifics about apple’s interest in partnering with disney in some form or fashion for espn. For more information about the hawaii income tax, see the hawaii income tax page. = state of hawaii — department of taxation individual income tax return. For information and guidance in. Computation of tax for children under age 14 who have unearned income of more than $1,000. See this turbotax support faq for state forms. §3912 and §321.62, wisconsin statutes this form shall not be modified. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a.

Naturally, you'll also need to. For information and guidance in its preparation, we have helpful. See this turbotax support faq for state forms. = state of hawaii — department of taxation individual income tax return. Web how to complete the hawaii 2011 form n 15 fillable online: For more information about the hawaii income tax, see the hawaii income tax page. Otherwise go to page 22 of the. Otherwise go to page 21 of the. Web the report doesn’t offer many specifics about apple’s interest in partnering with disney in some form or fashion for espn. Computation of tax for children under age 14 who have unearned income of more than $1,000.

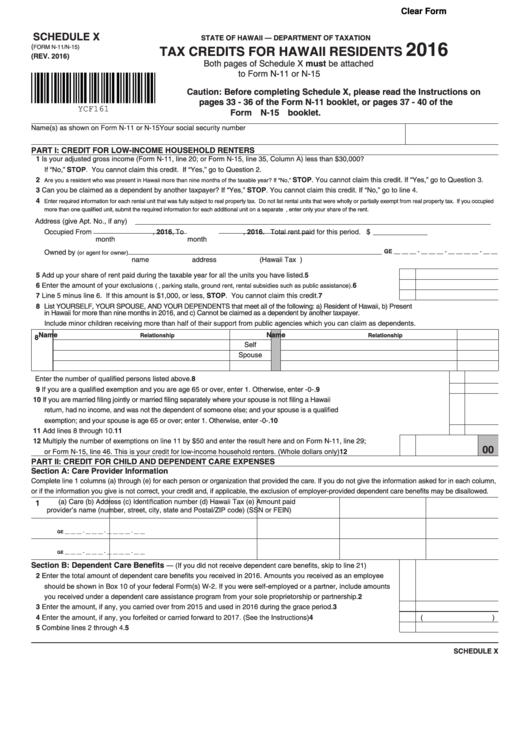

Fillable Form N11/n15 Tax Credits For Hawaii Residents printable

2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web pdf • form used when a foreign qualified nonprofit corporation wishes to change its period of duration, state of formation, or name on record with our office. 2020) page 3 of 4 38 if you do.

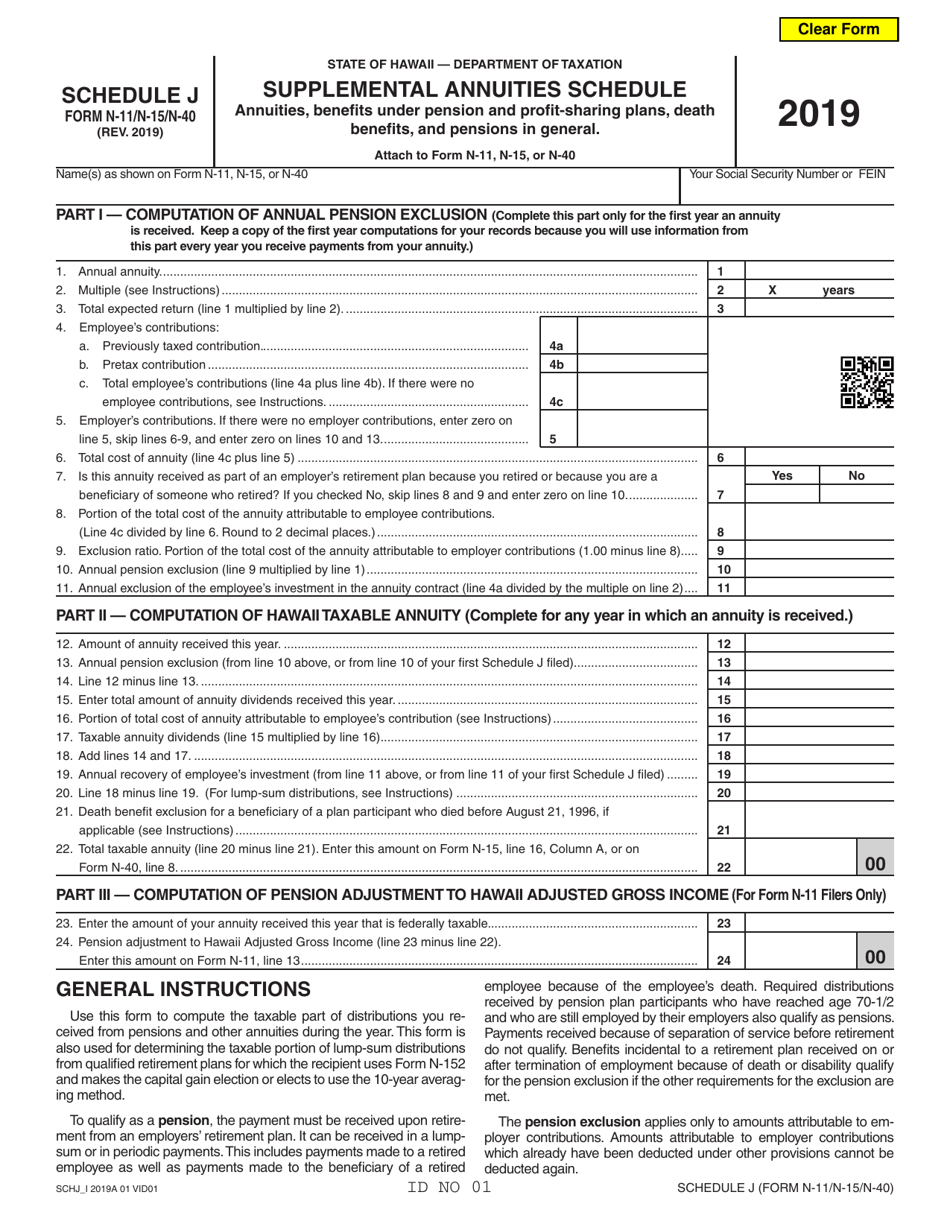

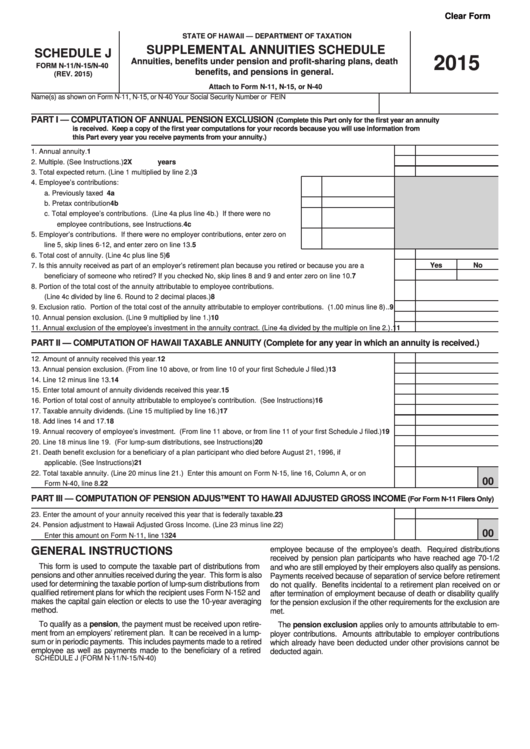

Form N11 (N15; N40) Schedule J Download Fillable PDF or Fill Online

Otherwise go to page 22 of the. Naturally, you'll also need to. Computation of tax for children under age 14 who have unearned income of more than $1,000. See this turbotax support faq for state forms. Otherwise go to page 21 of the.

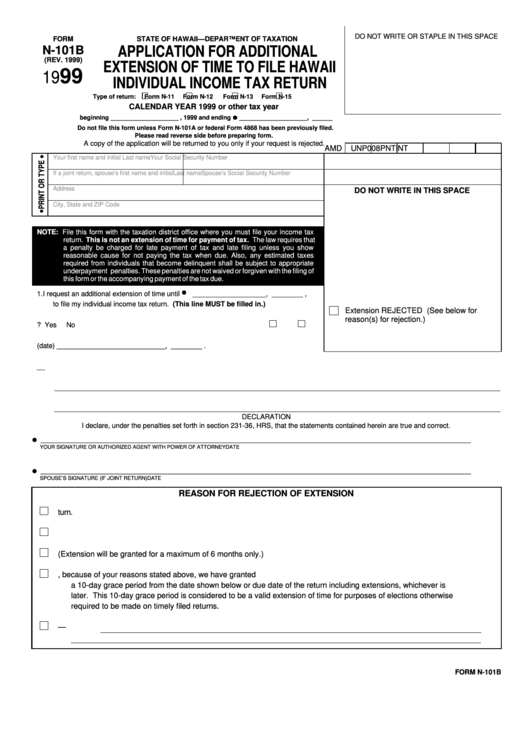

Form N101b Application For Additional Extension Of Time To File

2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Naturally, you'll also need to. See this turbotax support faq for state forms. Otherwise go to page 21 of the. §3912 and §321.62, wisconsin statutes this form shall not be modified.

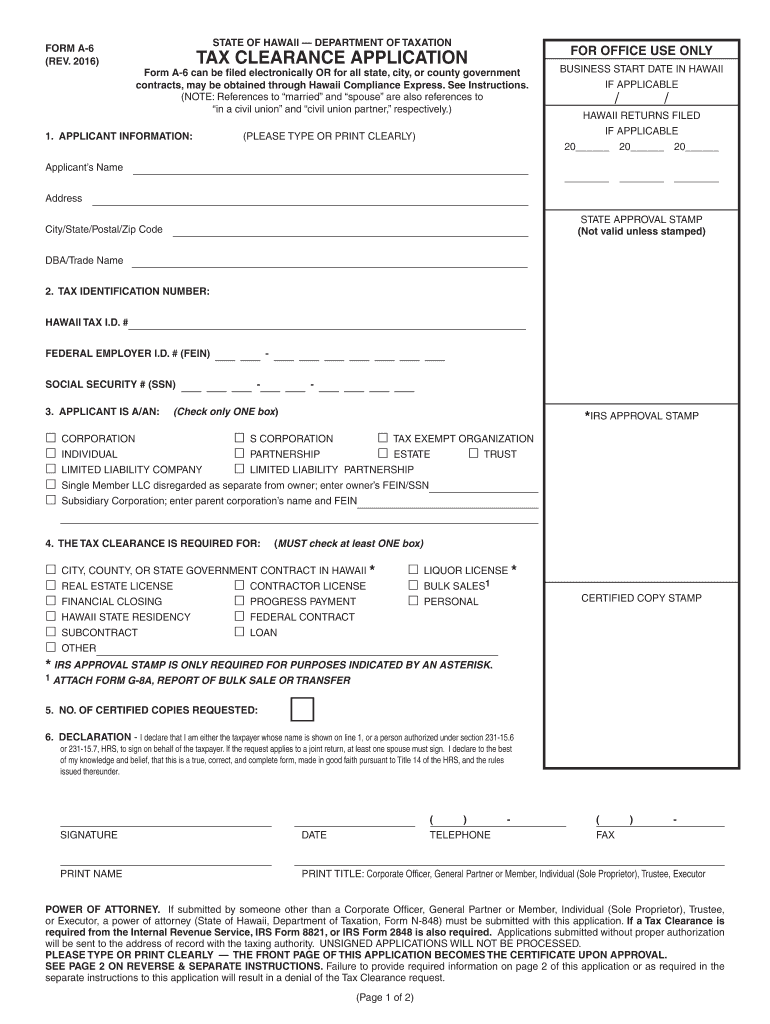

Hawaii Form A 6 Fill Out and Sign Printable PDF Template signNow

Web how to complete the hawaii 2011 form n 15 fillable online: §3912 and §321.62, wisconsin statutes this form shall not be modified. Naturally, you'll also need to. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Otherwise go to page 22 of the.

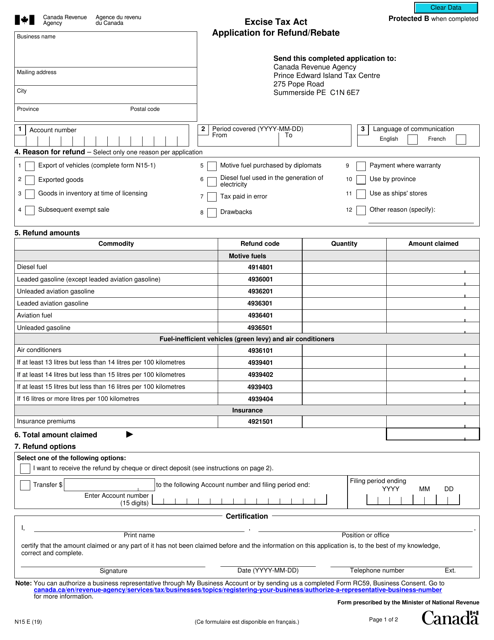

Form N15 Download Fillable PDF or Fill Online Excise Tax Act

Computation of tax for children under age 14 who have unearned income of more than $1,000. Sign online button or tick the preview image of the blank. 2013) = nol carryback fill in the applicable oval(s): §3912 and §321.62, wisconsin statutes this form shall not be modified. Otherwise go to page 21 of the.

Fillable Schedule J (Form N11/n15/n40) Supplemental Annuities

Otherwise go to page 22 of the. Web how to complete the hawaii 2011 form n 15 fillable online: Web pdf • form used when a foreign qualified nonprofit corporation wishes to change its period of duration, state of formation, or name on record with our office. The report doesn’t make it clear whether. §3912 and §321.62, wisconsin statutes this.

Fillable Form N15 Individual Tax Return Hawaii Department

= state of hawaii — department of taxation individual income tax return. Naturally, you'll also need to. Web the report doesn’t offer many specifics about apple’s interest in partnering with disney in some form or fashion for espn. Otherwise go to page 21 of the. Sign online button or tick the preview image of the blank.

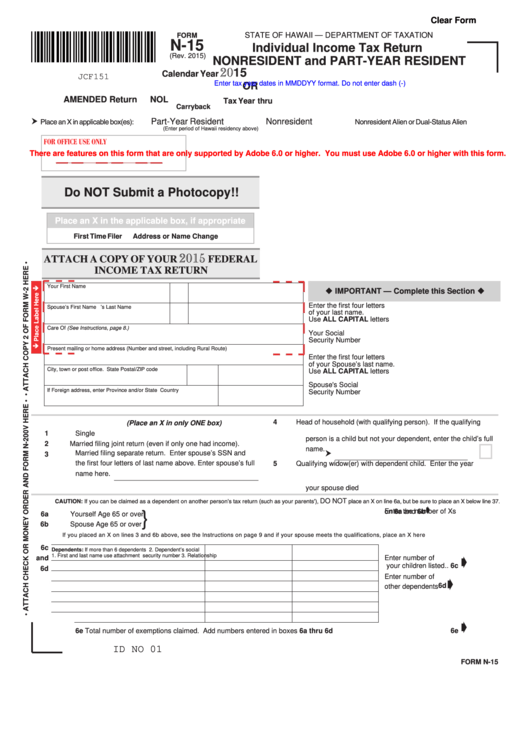

2015 Form HI N15 Fill Online, Printable, Fillable, Blank pdfFiller

The report doesn’t make it clear whether. Web the report doesn’t offer many specifics about apple’s interest in partnering with disney in some form or fashion for espn. This form is for income earned in tax year 2022, with tax returns due in april. = state of hawaii — department of taxation individual income tax return. For information and guidance.

Fillable Form N15 Individual Tax Return Nonresident And Part

This form is for income earned in tax year 2022, with tax returns due in april. See this turbotax support faq for state forms. Computation of tax for children under age 14 who have unearned income of more than $1,000. §3912 and §321.62, wisconsin statutes this form shall not be modified. = state of hawaii — department of taxation individual.

2015 Form USCIS N600 Fill Online, Printable, Fillable, Blank pdfFiller

For information and guidance in. This form is for income earned in tax year 2022, with tax returns due in april. Web how to complete the hawaii 2011 form n 15 fillable online: Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. For more information about.

Web Pdf • Form Used When A Foreign Qualified Nonprofit Corporation Wishes To Change Its Period Of Duration, State Of Formation, Or Name On Record With Our Office.

Sign online button or tick the preview image of the blank. See this turbotax support faq for state forms. For information and guidance in. Computation of tax for children under age 14 who have unearned income of more than $1,000.

Web The Report Doesn’t Offer Many Specifics About Apple’s Interest In Partnering With Disney In Some Form Or Fashion For Espn.

To begin the document, use the fill camp; Otherwise go to page 21 of the. Otherwise go to page 22 of the. 2013) = nol carryback fill in the applicable oval(s):

§3912 And §321.62, Wisconsin Statutes This Form Shall Not Be Modified.

This form is for income earned in tax year 2022, with tax returns due in april. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. For more information about the hawaii income tax, see the hawaii income tax page. The report doesn’t make it clear whether.

Naturally, You'll Also Need To.

Web how to complete the hawaii 2011 form n 15 fillable online: For information and guidance in its preparation, we have helpful. = state of hawaii — department of taxation individual income tax return. 2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a.