Form Mo 2210

Form Mo 2210 - With us legal forms the entire process of submitting legal documents is. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Complete, edit or print tax forms instantly. The irs will generally figure your penalty for you and you should not file form 2210. Enjoy smart fillable fields and interactivity. Web how to fill out and sign missouri underpayment tax online? Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. The irs will generally figure your penalty for you and you should not file form 2210. • for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

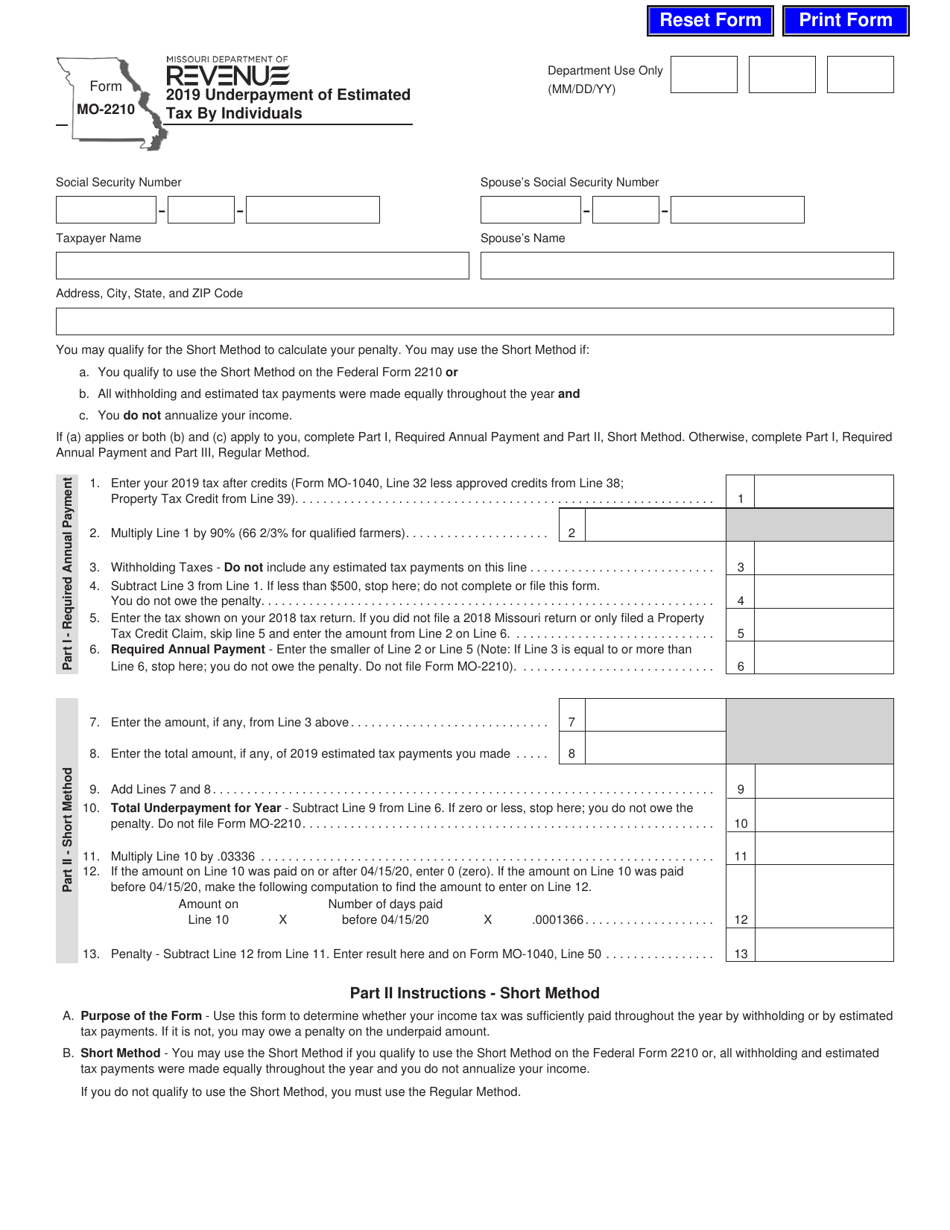

Get your online template and fill it in using progressive features. You can download or print. The irs will generally figure your penalty for you and you should not file form 2210. This form is for income earned in tax year 2022, with tax returns due in april. You may qualify for the short method to calculate your penalty. Complete, edit or print tax forms instantly. Use get form or simply click on the template preview to open it in the editor. Web form mo 2210 is a powerful tool for business owners that can improve their operations, streamline financial procedures, and ultimately boost efficiency. The days of terrifying complex tax and legal forms have ended. Web follow the simple instructions below:

Start completing the fillable fields and carefully. The irs will generally figure your penalty for you and you should not file form 2210. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Get your online template and fill it in using progressive features. You may use the short method if: Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Web form mo 2210 is a powerful tool for business owners that can improve their operations, streamline financial procedures, and ultimately boost efficiency. Edit your mo 2210 form online type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax year 2022, with tax returns due in april. Web how to fill out and sign missouri underpayment tax online?

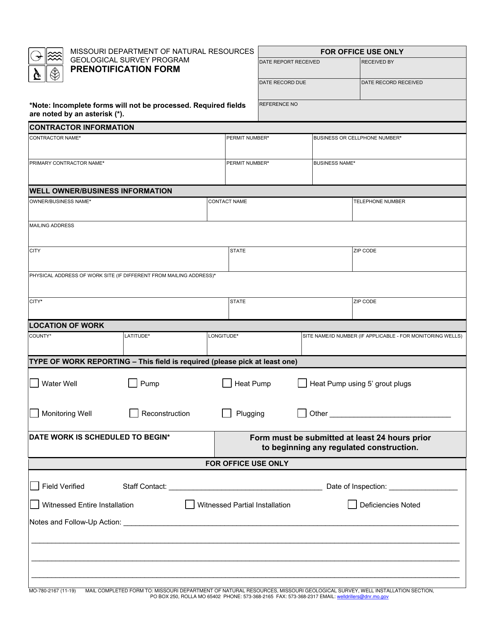

Form MO7802167 Download Fillable PDF or Fill Online Prenotification

The irs will generally figure your penalty for you and you should not file form 2210. Complete, edit or print tax forms instantly. Start completing the fillable fields and carefully. This form is for income earned in tax year 2022, with tax returns due in april. The irs will generally figure your penalty for you and you should not file.

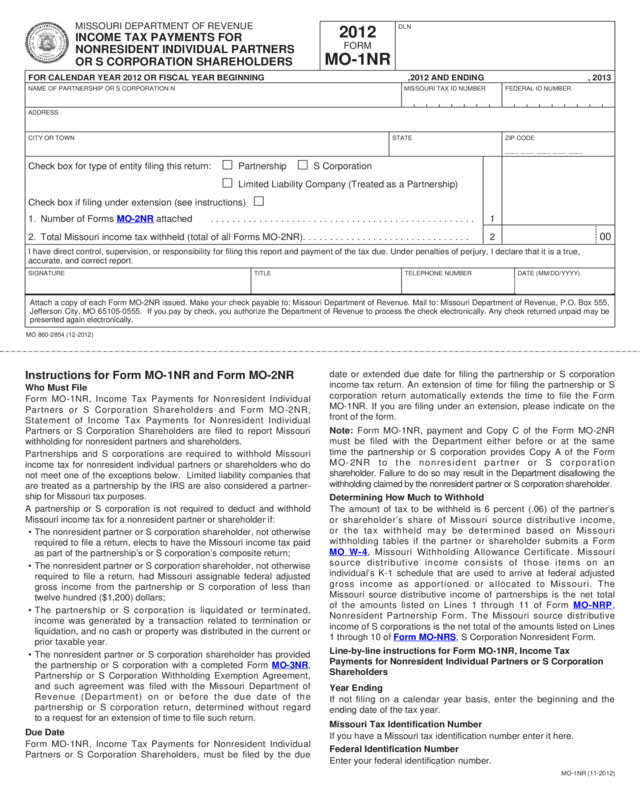

Form Mo1Nr Tax Payments For Nonresident Individual Partners

All withholding and estimated tax payments were made. You may qualify for the short method to calculate your penalty. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were..

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Complete, edit or print tax forms instantly. The irs will generally figure your penalty for you and you should not file form 2210. This form is for income earned in tax year 2022, with tax returns due in april. Start completing the fillable fields.

Form MO2210 Download Fillable PDF or Fill Online Underpayment of

With us legal forms the entire process of submitting legal documents is. Start completing the fillable fields and carefully. Complete, edit or print tax forms instantly. Web follow the simple instructions below: The irs will generally figure your penalty for you and you should not file form 2210.

Instructions for Federal Tax Form 2210 Sapling

You may qualify for the short method to calculate your penalty. • for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. You can download or print. With us legal forms the entire process of submitting legal documents is. The days.

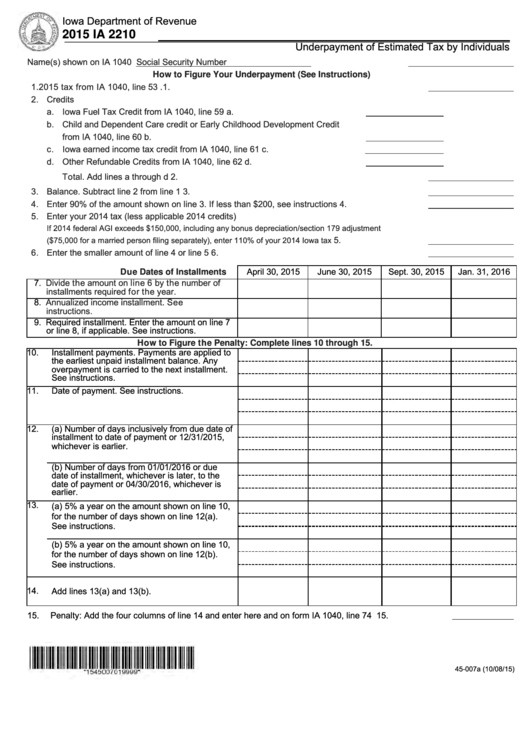

Fillable Form Ia 2210 Underpayment Of Estimated Tax By Individuals

You can download or print. Edit your mo 2210 form online type text, add images, blackout confidential details, add comments, highlights and more. Web how to fill out and sign missouri underpayment tax online? You may use the short method if: Get your online template and fill it in using progressive features.

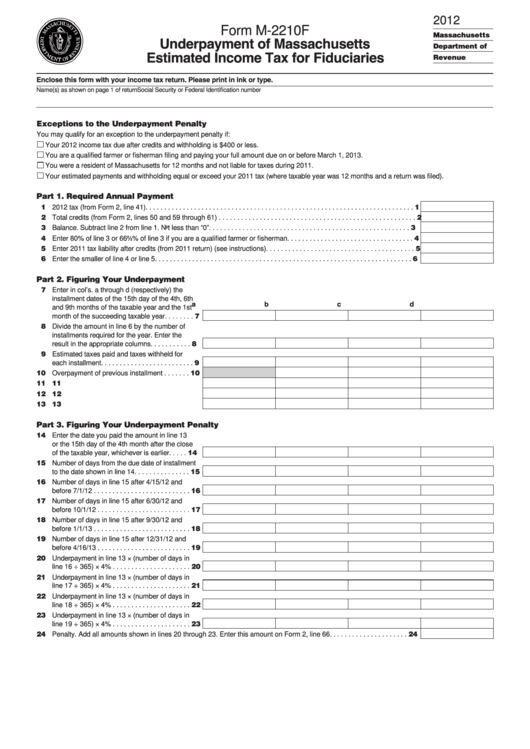

Fillable Form M2210f Underpayment Of Massachusetts Estimated

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web follow the simple instructions below: Enjoy smart fillable fields and interactivity. Web how to fill out and sign missouri underpayment tax online? Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation.

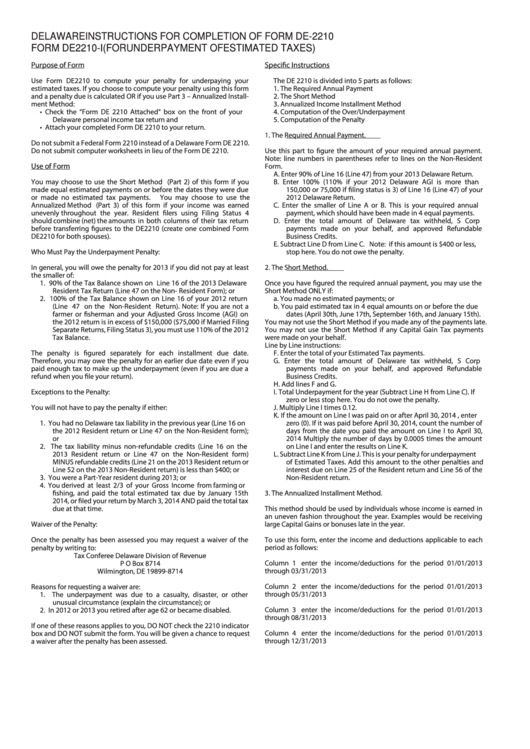

Instructions For Completion Of Form De2210 Form De2210I (For

Enjoy smart fillable fields and interactivity. Use get form or simply click on the template preview to open it in the editor. Sign it in a few clicks draw your signature, type it,. Web how to fill out and sign missouri underpayment tax online? Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

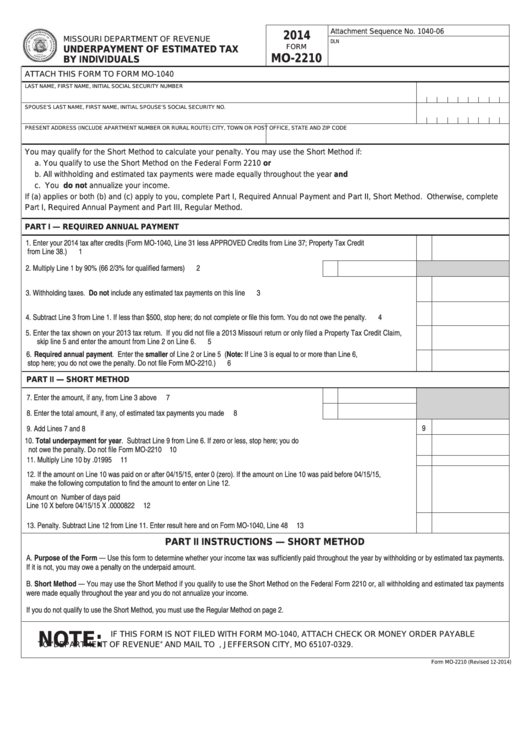

Fillable Form Mo2210 Underpayment Of Estimated Tax By Individuals

Web general instructions future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Use get form or simply click on the template preview to open it in the editor. Web form mo.

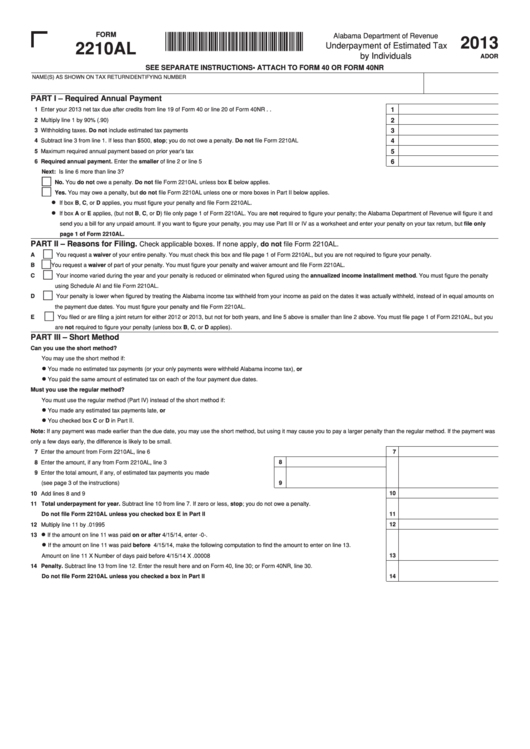

Fillable Form 2210al Underpayment Of Estimated Tax By Individuals

• for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. Use get form or simply click on the template preview to open it in the editor. Get your online template and fill it in using progressive features. All withholding and.

Complete, Edit Or Print Tax Forms Instantly.

Edit your mo 2210 form online type text, add images, blackout confidential details, add comments, highlights and more. The irs will generally figure your penalty for you and you should not file form 2210. Web follow the simple instructions below: You can download or print.

Sign It In A Few Clicks Draw Your Signature, Type It,.

The irs will generally figure your penalty for you and you should not file form 2210. • for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. With us legal forms the entire process of submitting legal documents is. All withholding and estimated tax payments were made.

Web Use Form 2210 To See If You Owe A Penalty For Underpaying Your Estimated Tax.

Use get form or simply click on the template preview to open it in the editor. Get your online template and fill it in using progressive features. The days of terrifying complex tax and legal forms have ended. Enjoy smart fillable fields and interactivity.

You May Use The Short Method If:

Complete, edit or print tax forms instantly. Start completing the fillable fields and carefully. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. You may qualify for the short method to calculate your penalty.