Form Il1040 Instructions

Form Il1040 Instructions - If you made this election on your. It is free to file. Schedule 1 has new lines. Web information you need to complete form 8962. It is easy and you will get your refund faster. Changes to the earned income credit (eic). Payment voucher for amended individual income tax. Web information you need to complete form 8962. 2023 estimated income tax payments for individuals. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in.

It is easy and you will get your refund faster. The illinois income tax rate is 4.95 percent (.0495). Use this form for payments. Check the box if this applies to you during 2020: Filing online is quick and easy! Complete form 8962 to claim the credit and to reconcile your advance. If you made this election on your. Payment voucher for amended individual income tax. What if i was a nonresident of illinois for the entire tax year? Web information you need to complete form 8962.

Amended individual income tax return. Use this form for payments. Filing online is quick and easy! It is easy and you will get your refund faster. The illinois income tax rate is 4.95 percent (.0495). Web instructions form 1040 has new lines. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. The enhancements for taxpayers without a qualifying child. Check the box if this applies to you during 2020: 2023 estimated income tax payments for individuals.

Form IL 1040 Individual Tax Return YouTube

Web information you need to complete form 8962. Web for more information, see the instructions for schedule 8812 (form 1040). Schedule 1 has new lines. Filing online is quick and easy! If you made this election on your.

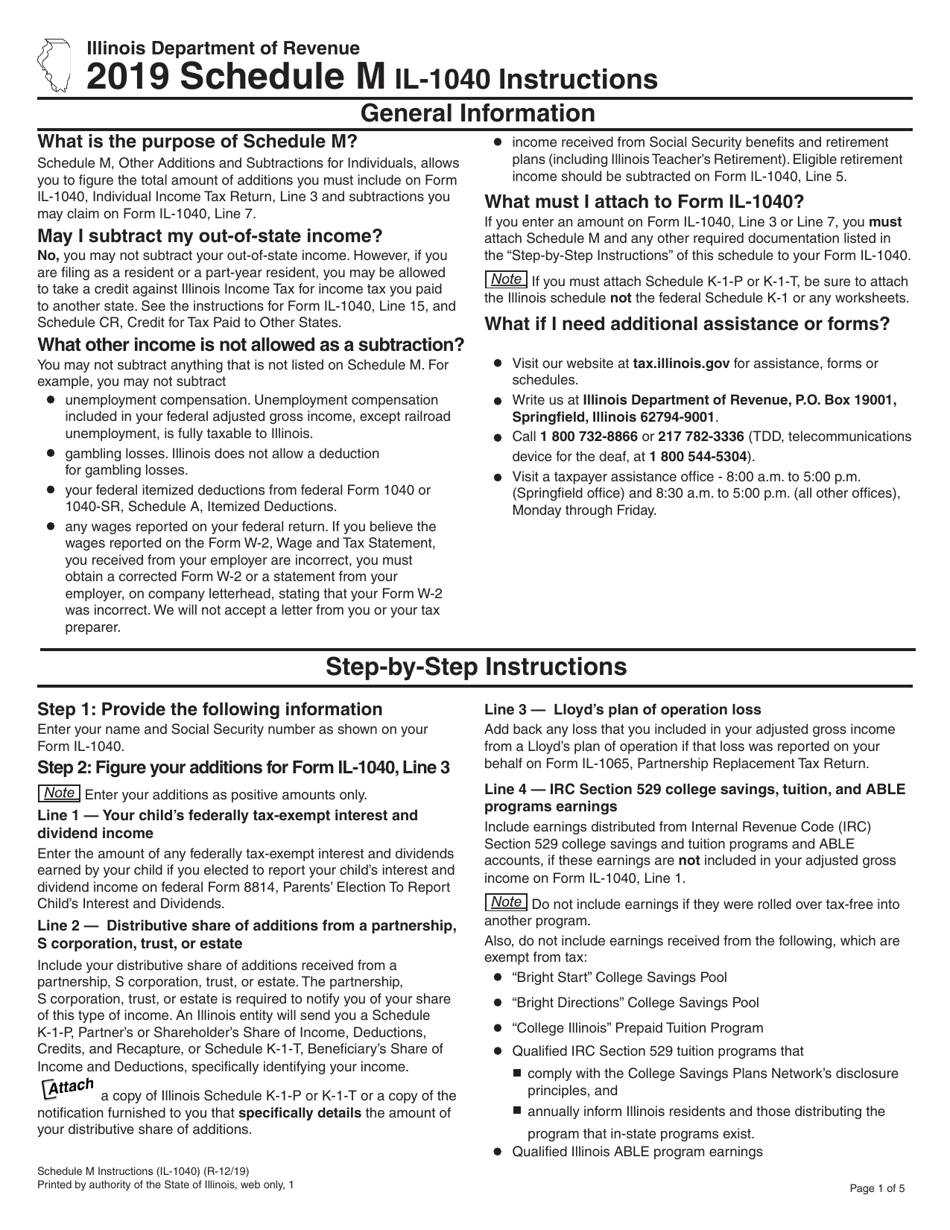

Download Instructions for Form IL1040 Schedule M Other Additions and

2023 estimated income tax payments for individuals. Filing online is quick and easy! It is free to file. Amended individual income tax return. The illinois income tax rate is 4.95 percent (.0495).

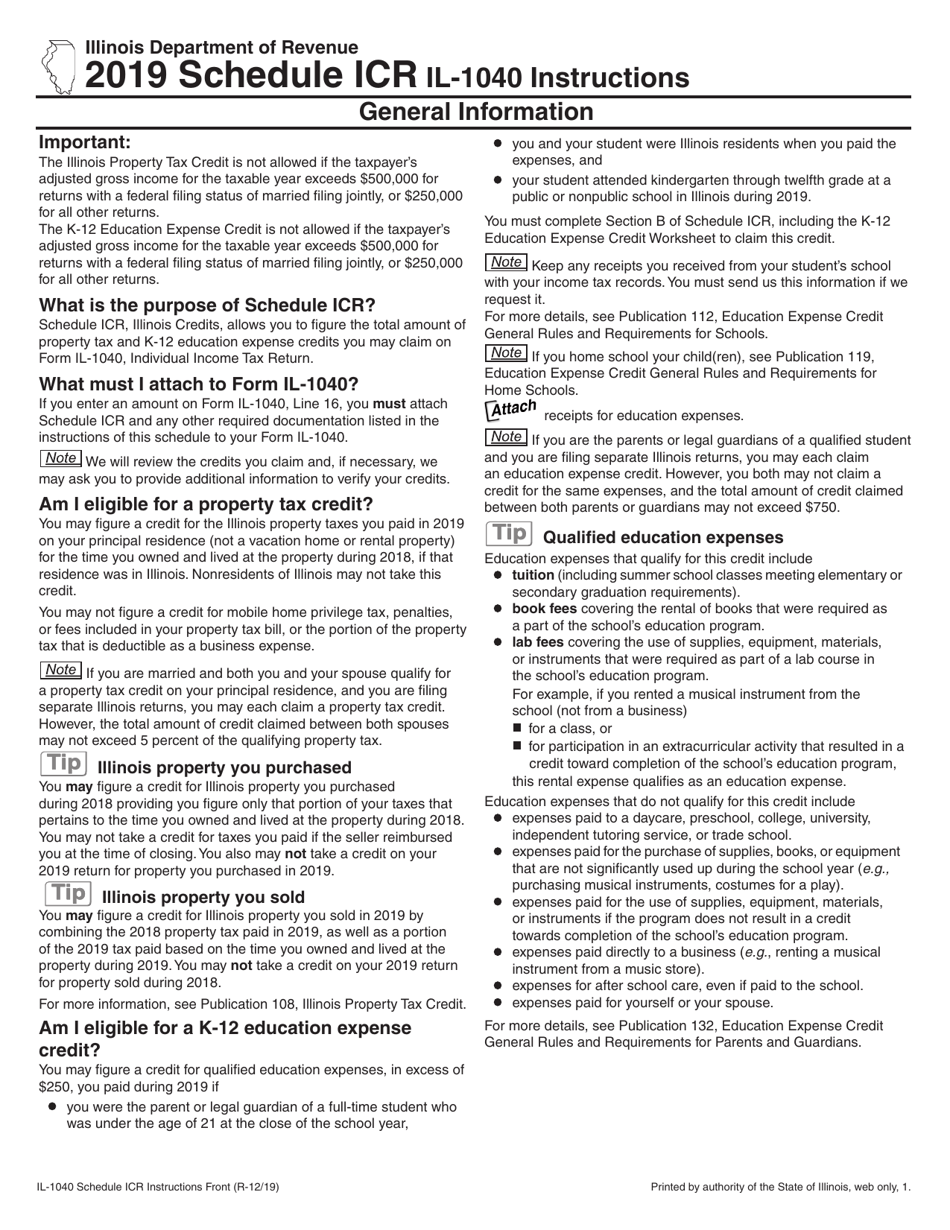

Download Instructions for Form IL1040 Schedule ICR Illinois Credits

It is free to file. Filing online is quick and easy! Web instructions form 1040 has new lines. Web for more information, see the instructions for schedule 8812 (form 1040). The illinois income tax rate is 4.95 percent (.0495).

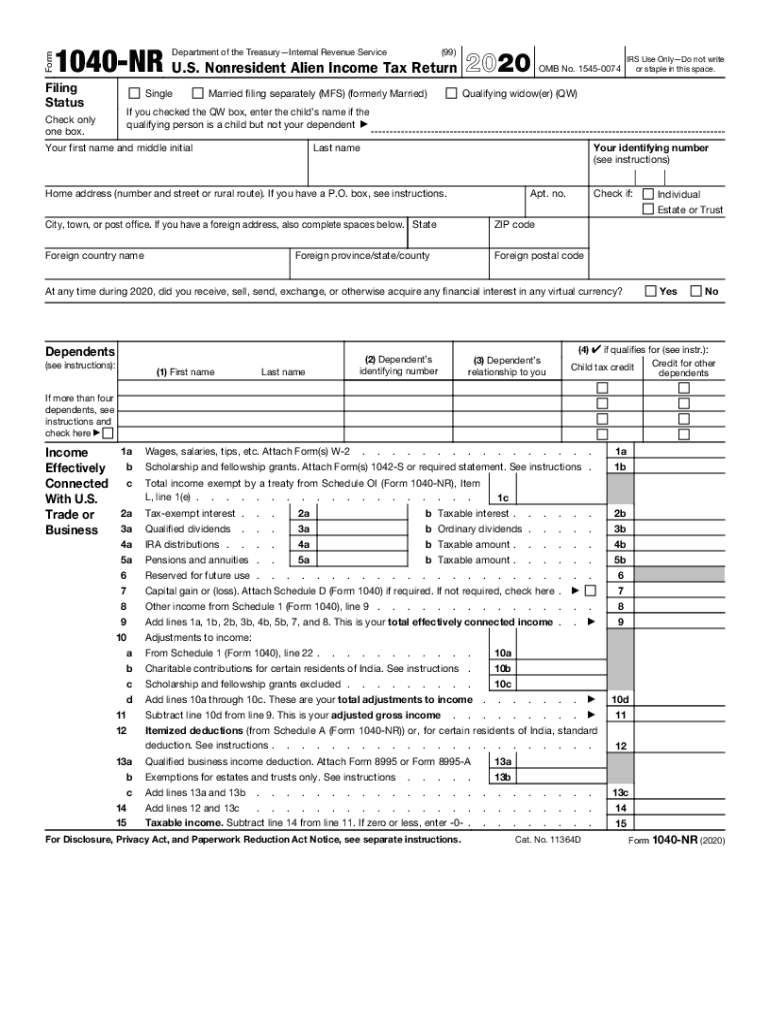

IRS 1040NR 2020 Fill out Tax Template Online US Legal Forms

Web information you need to complete form 8962. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Schedule 1 has new lines. Amended individual income tax return. Web for more information, see the instructions for schedule 8812 (form 1040).

Form 1040 R.I.P. Internal Revenue Service United States Economic Policy

Web information you need to complete form 8962. If you made this election on your. Web instructions form 1040 has new lines. Schedule 1 has new lines. You must attach a copy of your federal form 1040nr, u.s.

IL IL1040 Schedule ICR 20202021 Fill out Tax Template Online US

Filing status name changed from qualifying widow(er) to quali ying surviving spouse. The enhancements for taxpayers without a qualifying child. The illinois income tax rate is 4.95 percent (.0495). Web information you need to complete form 8962. 2023 estimated income tax payments for individuals.

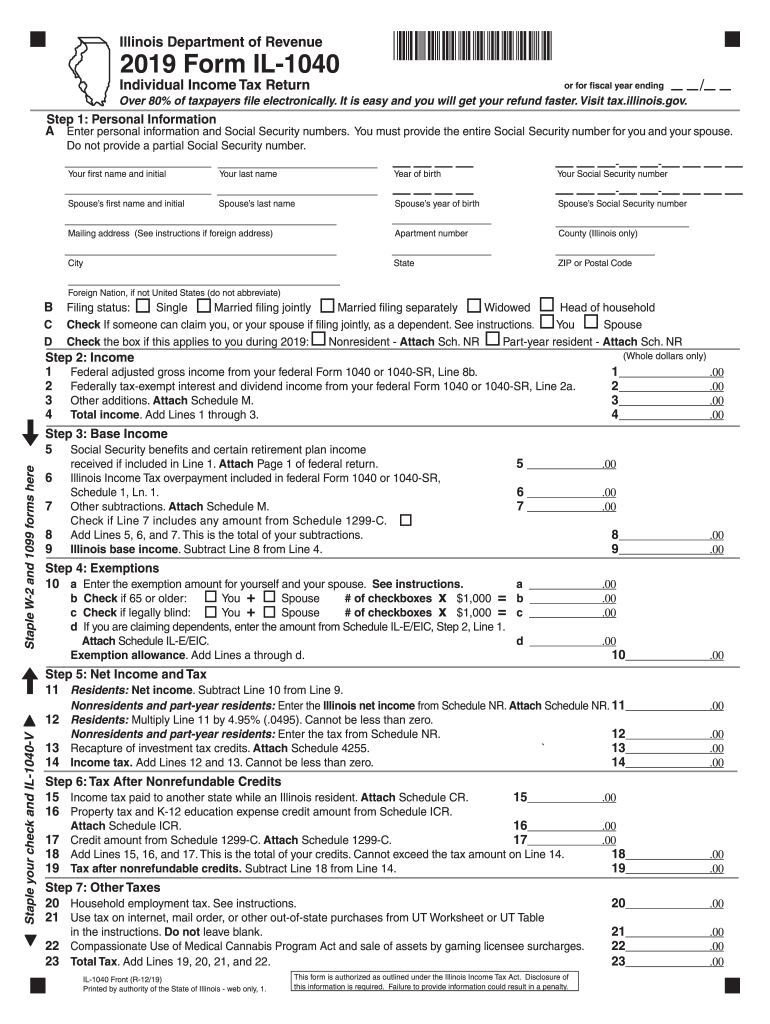

Illinois tax forms Fill out & sign online DocHub

Filing status name changed from qualifying widow(er) to quali ying surviving spouse. If you were a nonresident of illinois during the entire tax. Web instructions form 1040 has new lines. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. Complete.

2021 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

Payment voucher for amended individual income tax. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. It is free to file. Complete form 8962 to claim the credit and to reconcile your advance. Web instructions form 1040 has new lines.

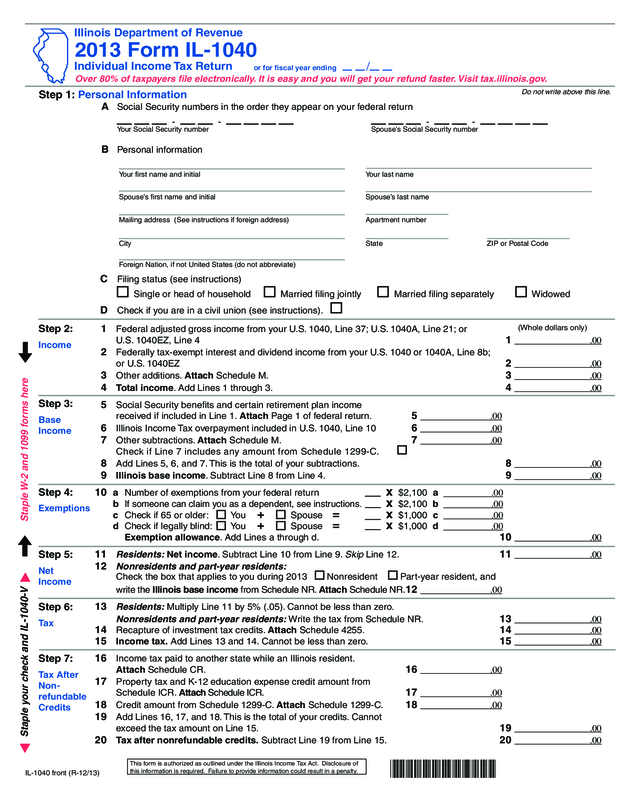

2013 Form Il1040, Individual Tax Return Edit, Fill, Sign

Payment voucher for amended individual income tax. Amended individual income tax return. Complete form 8962 to claim the credit and to reconcile your advance. Filing online is quick and easy! Web information you need to complete form 8962.

Changes To The Earned Income Credit (Eic).

Web information you need to complete form 8962. Schedule 1 has new lines. Payment voucher for amended individual income tax. Amended individual income tax return.

Use This Form For Payments.

2023 estimated income tax payments for individuals. Web information you need to complete form 8962. What if i was a nonresident of illinois for the entire tax year? Complete form 8962 to claim the credit and to reconcile your advance.

Web For More Information, See The Instructions For Schedule 8812 (Form 1040).

You must attach a copy of your federal form 1040nr, u.s. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. If you were a nonresident of illinois during the entire tax. If you made this election on your.

Web Most Taxpayers Are Required To File A Yearly Income Tax Return In April To Both The Internal Revenue Service And Their State's Revenue Department, Which Will Result In.

Complete form 8962 to claim the credit and to reconcile your advance. It is free to file. The enhancements for taxpayers without a qualifying child. Filing online is quick and easy!