Form Il-1040-Ptr

Form Il-1040-Ptr - Enter your name, address, and social security number at the top of the form. Taxpayers eligible for both rebates will receive one. If you were not required to file a 2021. Taxpayers eligible for both rebates will receive one. 2023 estimated income tax payments for individuals. This form is for income earned in tax year 2022, with tax returns due in april. Web filing online is quick and easy! A hard copy of the form can be. Enter your filing status in the appropriate box. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their.

Web filing online is quick and easy! Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Enter your filing status in the appropriate box. Taxpayers eligible for both rebates will receive one. This makes it important for taxpayers to file their 2021 il. A hard copy of the form can be. Enter your name, address, and social security number at the top of the form. Processing of rebates and issuance of payments will continue after october 17, until all have been issued by the illinois comptroller’s office. This form is for income earned in tax year 2022, with tax returns due in april. Taxpayers eligible for both rebates will receive one.

Enter your total income from all. This form is for income earned in tax year 2022, with tax returns due in april. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Taxpayers eligible for both rebates will receive one. Figure your 2021 illinois property tax rebate. Enter your filing status in the appropriate box. Taxpayers eligible for both rebates will receive one. Web no filing extensions are allowed. If you were not required to file a 2021. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and.

Form 1040 R.I.P. Internal Revenue Service United States Economic Policy

Enter your total income from all. Figure your 2021 illinois property tax rebate. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Taxpayers eligible for both rebates will receive one. Taxpayers eligible for both rebates will receive one.

IRS Instructions 1040A 20172022 Fill and Sign Printable Template

Taxpayers eligible for both rebates will receive one. Web no filing extensions are allowed. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. If you were not required to file a 2021. Taxpayers eligible for both rebates will receive one.

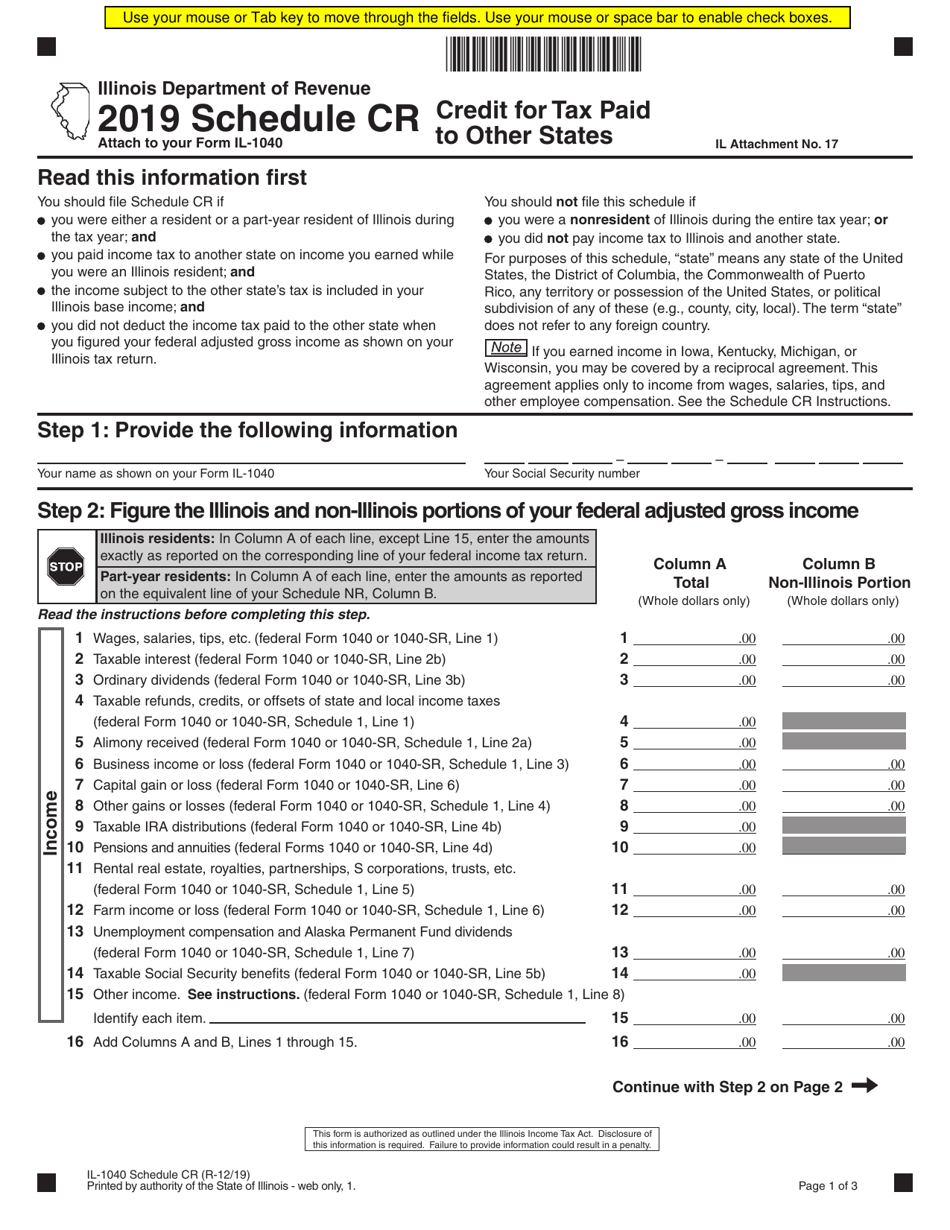

Form IL1040 Schedule CR Download Fillable PDF or Fill Online Credit

Taxpayers eligible for both rebates will receive one. A hard copy of the form can be. Enter your total income from all. Enter your filing status in the appropriate box. If you were not required to file a 2021.

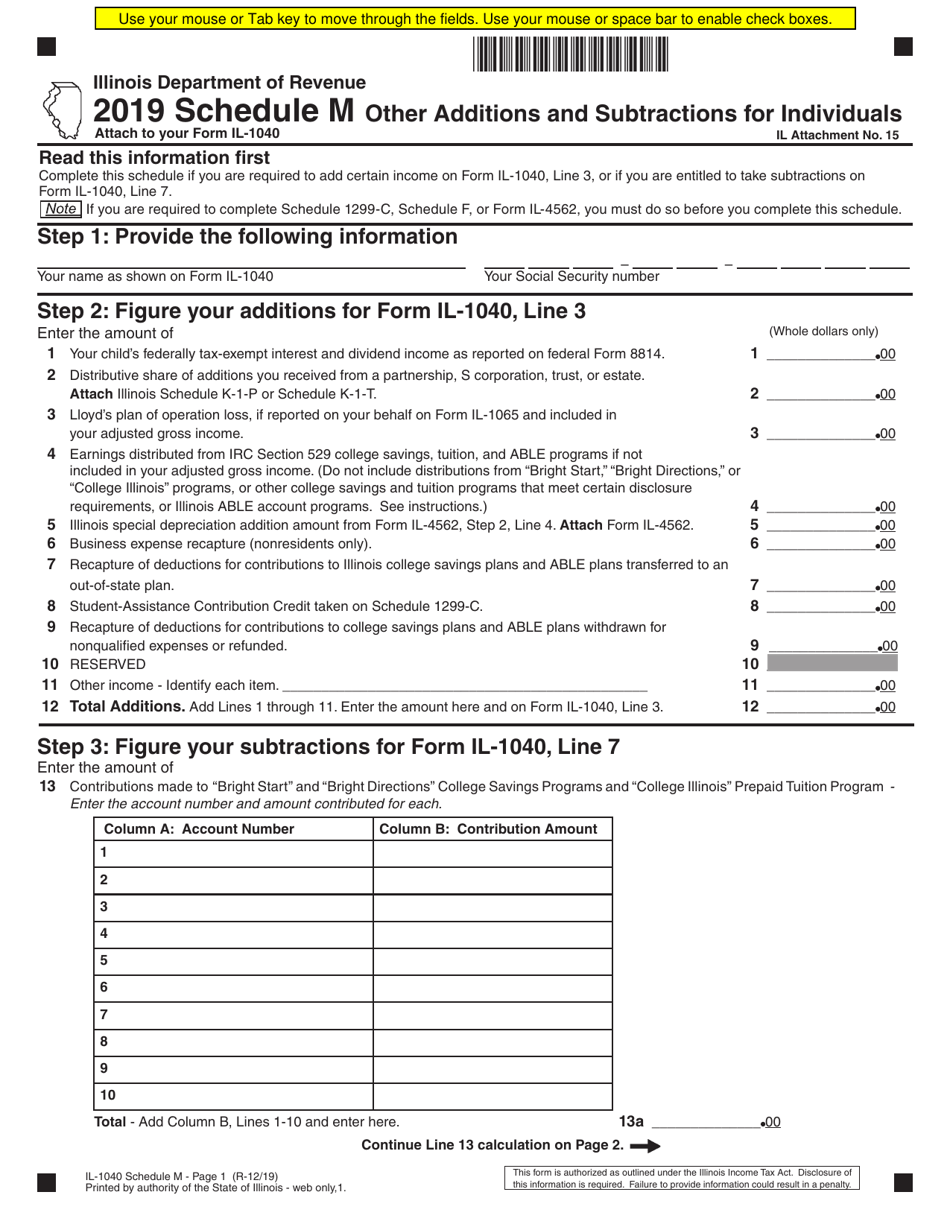

Form IL1040 Schedule M Download Fillable PDF or Fill Online Other

Web filing online is quick and easy! Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Figure your 2021 illinois property tax rebate. Federal adjusted gross income from. This form is for income earned in tax year 2022, with tax returns due in april.

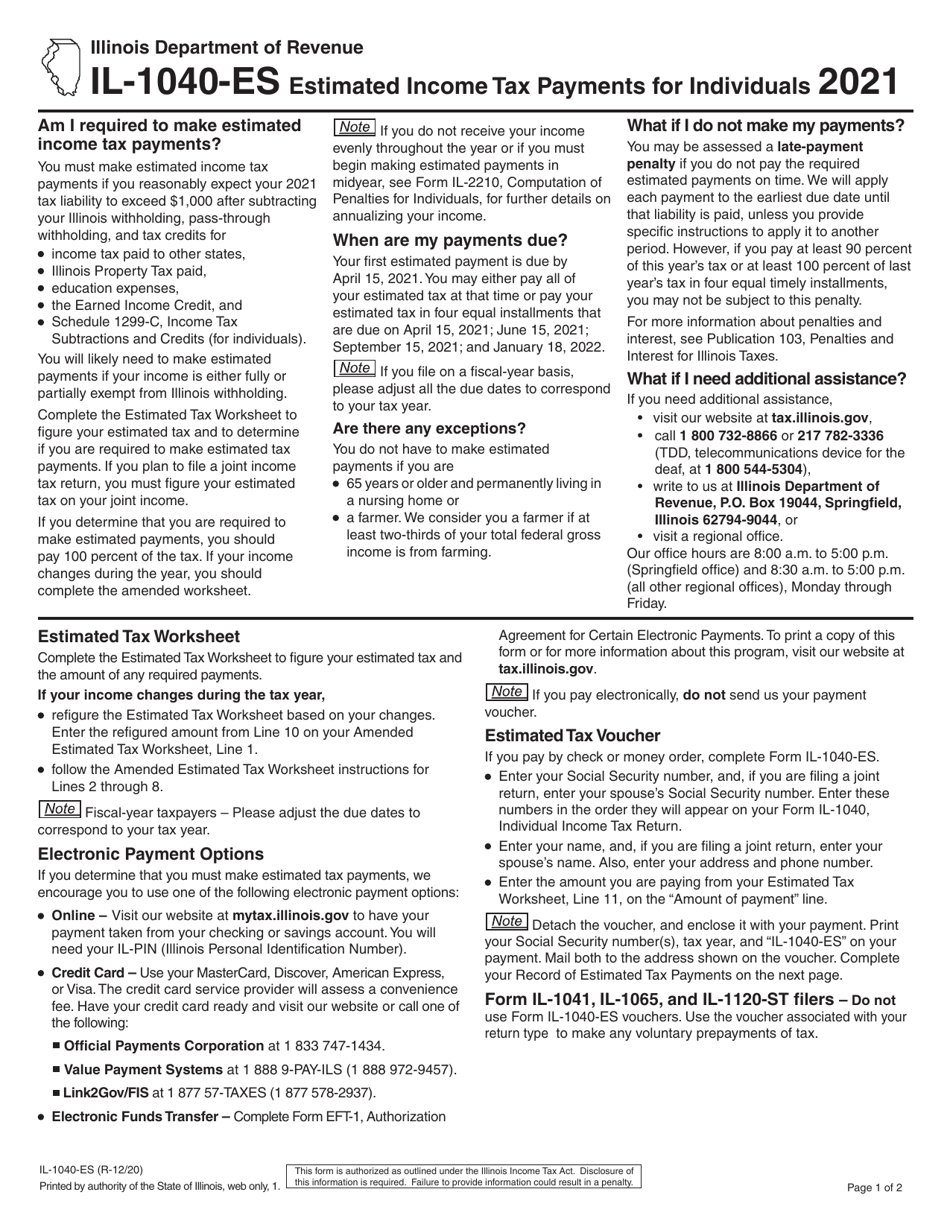

Form IL1040ES Download Fillable PDF or Fill Online Estimated

2023 estimated income tax payments for individuals. Taxpayers eligible for both rebates will receive one. Taxpayers eligible for both rebates will receive one. A hard copy of the form can be. Enter your total income from all.

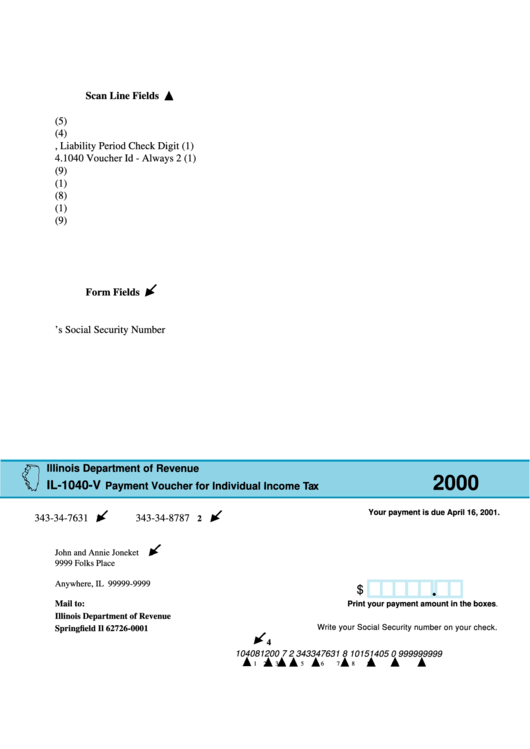

Form Il1040V Payment Voucher For Individual Tax Illinois

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Enter your filing status in the appropriate box. Federal adjusted gross income from. This form is for income earned in tax year 2022, with tax returns due in april. Taxpayers eligible for both rebates will receive one.

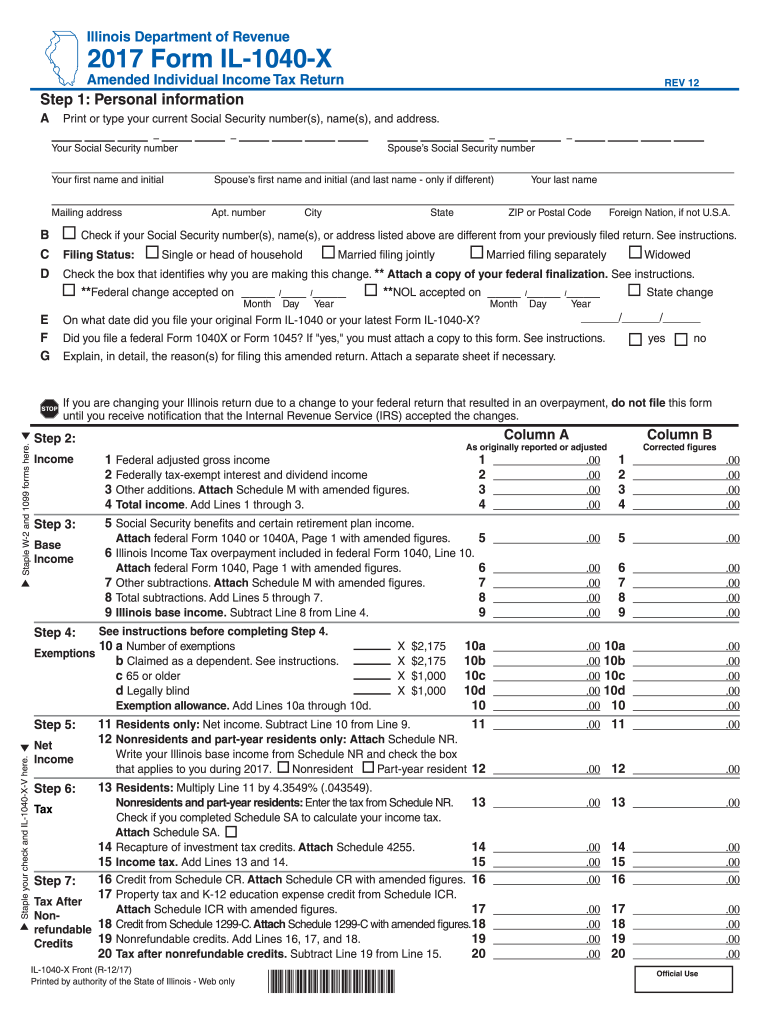

2017 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax returns due in april. If you were not required to file a 2021. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web filing online is quick and easy! Enter your total income from all.

Irs Fillable Form 1040 il1040es 2019 Fill Online, Printable

Processing of rebates and issuance of payments will continue after october 17, until all have been issued by the illinois comptroller’s office. Taxpayers eligible for both rebates will receive one. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Enter your name, address, and social security number at the top.

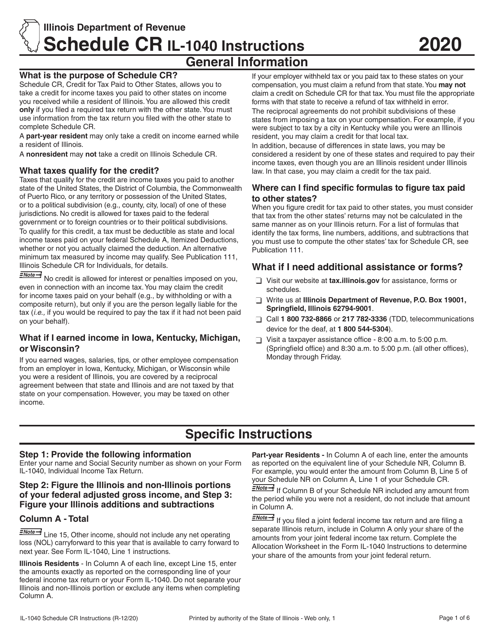

Download Instructions for Form IL1040 Schedule CR Credit for Tax Paid

A hard copy of the form can be. 2023 estimated income tax payments for individuals. Enter your filing status in the appropriate box. If you were not required to file a 2021. Enter your name, address, and social security number at the top of the form.

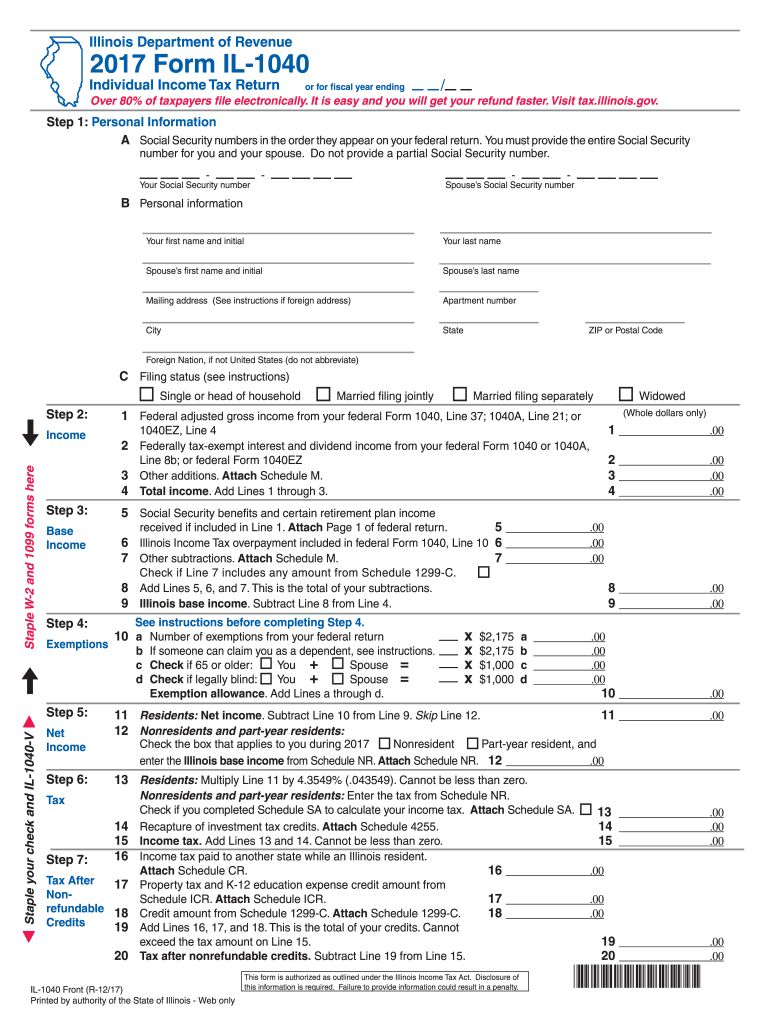

20172019 Form IL DoR IL1040 Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax returns due in april. This makes it important for taxpayers to file their 2021 il. Web filing online is quick and easy! Taxpayers eligible for both rebates will receive one. Taxpayers eligible for both rebates will receive one.

This Makes It Important For Taxpayers To File Their 2021 Il.

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. A hard copy of the form can be. Enter your filing status in the appropriate box. Figure your 2021 illinois property tax rebate.

Processing Of Rebates And Issuance Of Payments Will Continue After October 17, Until All Have Been Issued By The Illinois Comptroller’s Office.

Enter your total income from all. Web no filing extensions are allowed. Taxpayers eligible for both rebates will receive one. Taxpayers eligible for both rebates will receive one.

2023 Estimated Income Tax Payments For Individuals.

If you were not required to file a 2021. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Web filing online is quick and easy! Federal adjusted gross income from.

Taxpayers Eligible For Both Rebates Will Receive One.

Taxpayers eligible for both rebates will receive one. This form is for income earned in tax year 2022, with tax returns due in april. Enter your name, address, and social security number at the top of the form.