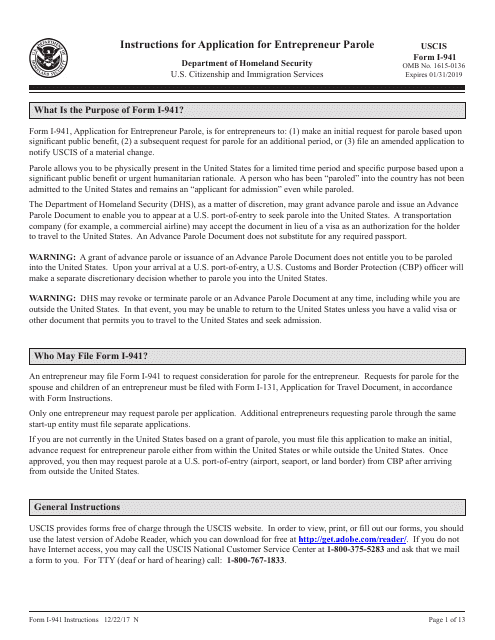

Form I-941

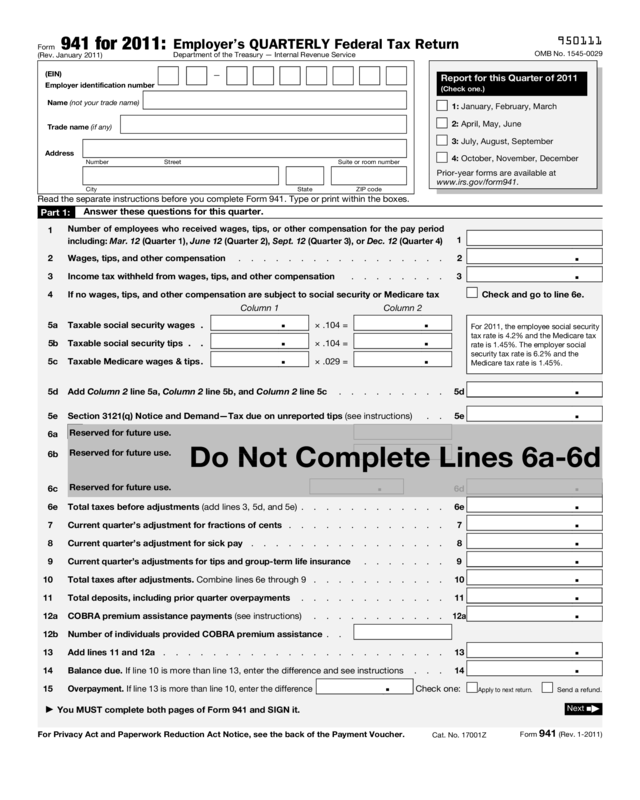

Form I-941 - The typical quarterly due date for the form is 30 days following the end of each calendar quarter as follows: Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Web form 941 is a tax report due on a quarterly basis. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web understanding tax credits and their impact on form 941. The form can use the entrepreneur. The request for mail order forms may be used to order one copy or. Employers use this form to report income taxes, social security. This form reports withholding of federal income taxes from employees’ wages or salaries, as well as. Form 941 is used by employers.

Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Web the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web mailing addresses for forms 941. Web form 941 is a tax report due on a quarterly basis. Form 941 is used by employers. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. The typical quarterly due date for the form is 30 days following the end of each calendar quarter as follows: Web irs form 941 is the form your business uses to report income taxes and payroll taxes that you withheld from your employees’ wages. Those returns are processed in. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

Web form 941 is a tax report due on a quarterly basis. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Employers use this form to report income taxes, social security. Web payroll tax returns. The form can use the entrepreneur. If you operate a business and have employees working for you, then you likely need to file irs form 941, employer’s quarterly federal tax return, four. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Businesses that withhold taxes from their employee's. The information returns intake system (iris) taxpayer portal is a system that provides a no cost online method for taxpayers to electronically file form.

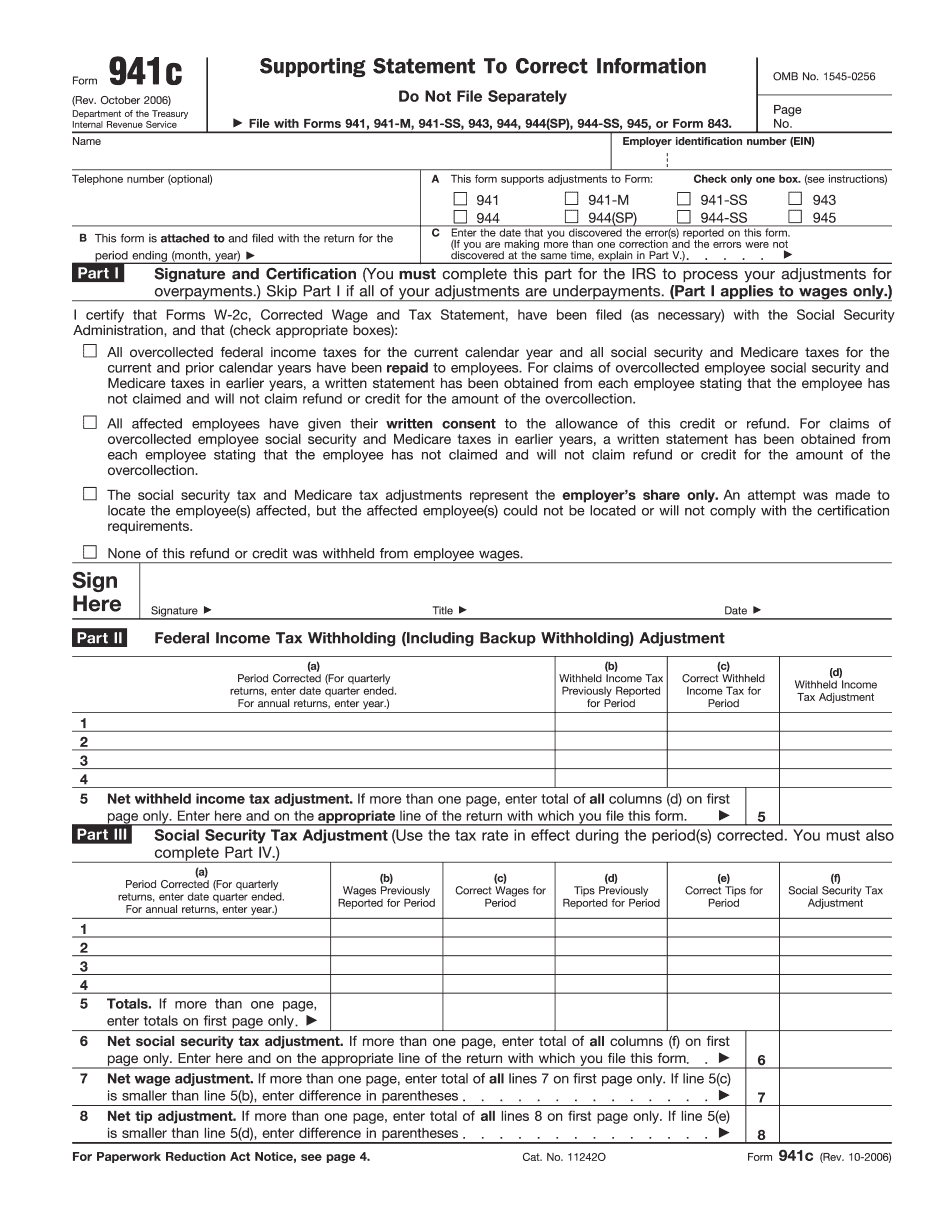

Irs.gov Forms 941c Form Resume Examples 0g27pRz9Pr

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Parole allows you to physically stay in. Businesses that withhold taxes from their employee's. Those returns are processed in. Complete the form completely and accurately.

Form 941 YouTube

Web form 941 employer's quarterly federal tax return. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Complete the form completely and accurately. Web track income & expenses. The request for mail order forms may be used to order one copy or.

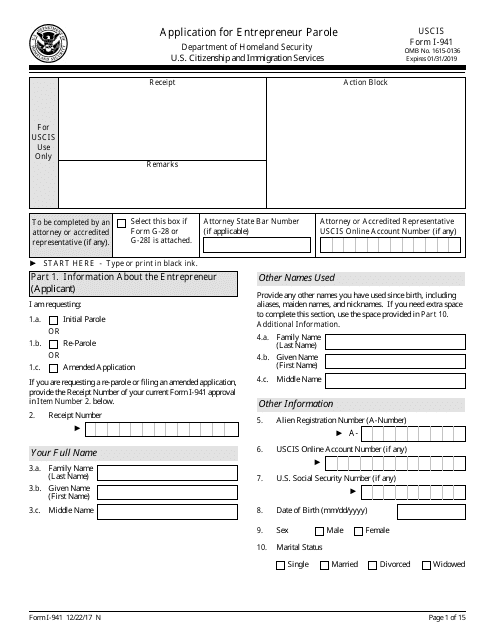

Form I941 Application for Entrepreneur Parole Stock Photo Image of

This form reports withholding of federal income taxes from employees’ wages or salaries, as well as. Complete the form completely and accurately. Those returns are processed in. Don't use an earlier revision to report taxes for 2023. Businesses that withhold taxes from their employee's.

Form 941 YouTube

Web form 941 employer's quarterly federal tax return. Web the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. The request for mail order forms may be used to order one copy or. Businesses that withhold taxes from their employee's. This form reports withholding of federal income taxes from employees’.

Form 941 (Rev. January 2011) Edit, Fill, Sign Online Handypdf

Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. The typical quarterly due date for the form is 30 days following the end of each calendar quarter as follows: As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Track sales & sales tax. At this time,.

Form 941 Employer's Quarterly Federal Tax Return Definition

Web track income & expenses. Web form 941 is a tax report due on a quarterly basis. Web the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web understanding tax credits and their impact on form 941. Web use the march 2023 revision of form 941 to report taxes.

Form 941c Fillable Fillable and Editable PDF Template

Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. Web payroll tax returns. Web irs form 941 is the form your business uses to report income taxes and payroll taxes that you withheld from your employees’ wages. Don't use an earlier revision to report taxes for 2023. Web irs form 941 is the.

Form 941

If you operate a business and have employees working for you, then you likely need to file irs form 941, employer’s quarterly federal tax return, four. Those returns are processed in. At this time, the irs. Parole allows you to physically stay in. Web use the march 2023 revision of form 941 to report taxes for the first quarter of.

Download Instructions for USCIS Form I941 Application for Entrepreneur

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Don't use an earlier revision to report taxes for 2023. Web make sure all information is accurate and up to date. Complete the form completely and accurately. Track sales & sales tax.

USCIS Form I941 Download Fillable PDF or Fill Online Application for

Web payroll tax returns. At this time, the irs. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Form 941 is used by employers. Don't use an earlier revision to report taxes for 2023.

Web Form 941 Is A Internal Revenue Service (Irs) Tax Form For Employers In The U.s.

You need to pay attention that the fees you will pay are not. The request for mail order forms may be used to order one copy or. Web make sure all information is accurate and up to date. Web mailing addresses for forms 941.

Web Information About Form 941, Employer's Quarterly Federal Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Those returns are processed in. Businesses that withhold taxes from their employee's. Parole allows you to physically stay in. Connecticut, delaware, district of columbia, georgia,.

Web Understanding Tax Credits And Their Impact On Form 941.

Web irs form 941 is the employer’s quarterly tax return. Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Web payroll tax returns. The form can use the entrepreneur.

This Form Reports Withholding Of Federal Income Taxes From Employees’ Wages Or Salaries, As Well As.

Form 941 is used by employers. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Track sales & sales tax. Web form 941 employer's quarterly federal tax return.

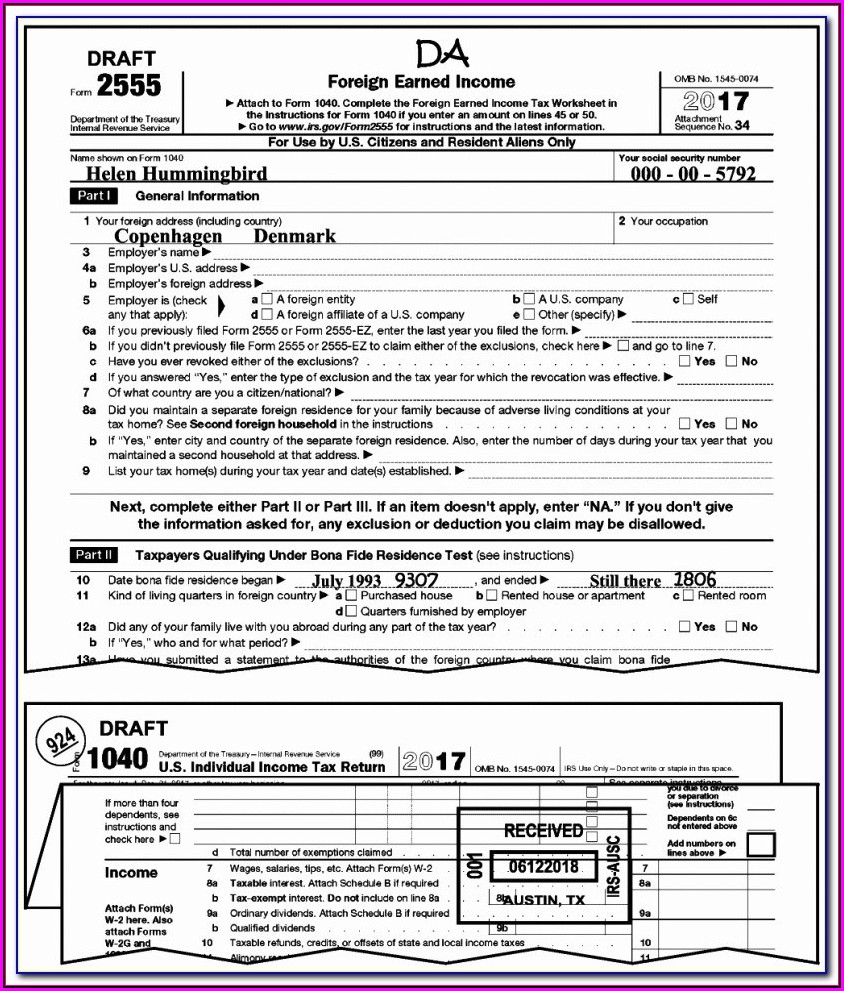

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)