Form 990 Pf Instructions

Form 990 Pf Instructions - Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. As required by section 3101 of the taxpayer first. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. It is an information return used to calculate the tax based on. The instructions include a reminder that form. Get ready for tax season deadlines by completing any required tax forms today. If the return is not. The form consists of sixteen sections. Our matrices include comments and recommendations while indicating the.

See the schedule b instructions to determine the requirements for filing. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Below are solutions to frequently asked questions about entering form 990, form 990. It is an information return used to calculate the tax based on. The instructions include a reminder that form. If the return is not. The form consists of sixteen sections. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Get ready for tax season deadlines by completing any required tax forms today.

As required by section 3101 of the taxpayer first. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. It is an information return used to calculate the tax based on. See the schedule b instructions to determine the requirements for filing. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Get ready for tax season deadlines by completing any required tax forms today. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Below are solutions to frequently asked questions about entering form 990, form 990. Our matrices include comments and recommendations while indicating the. The form consists of sixteen sections.

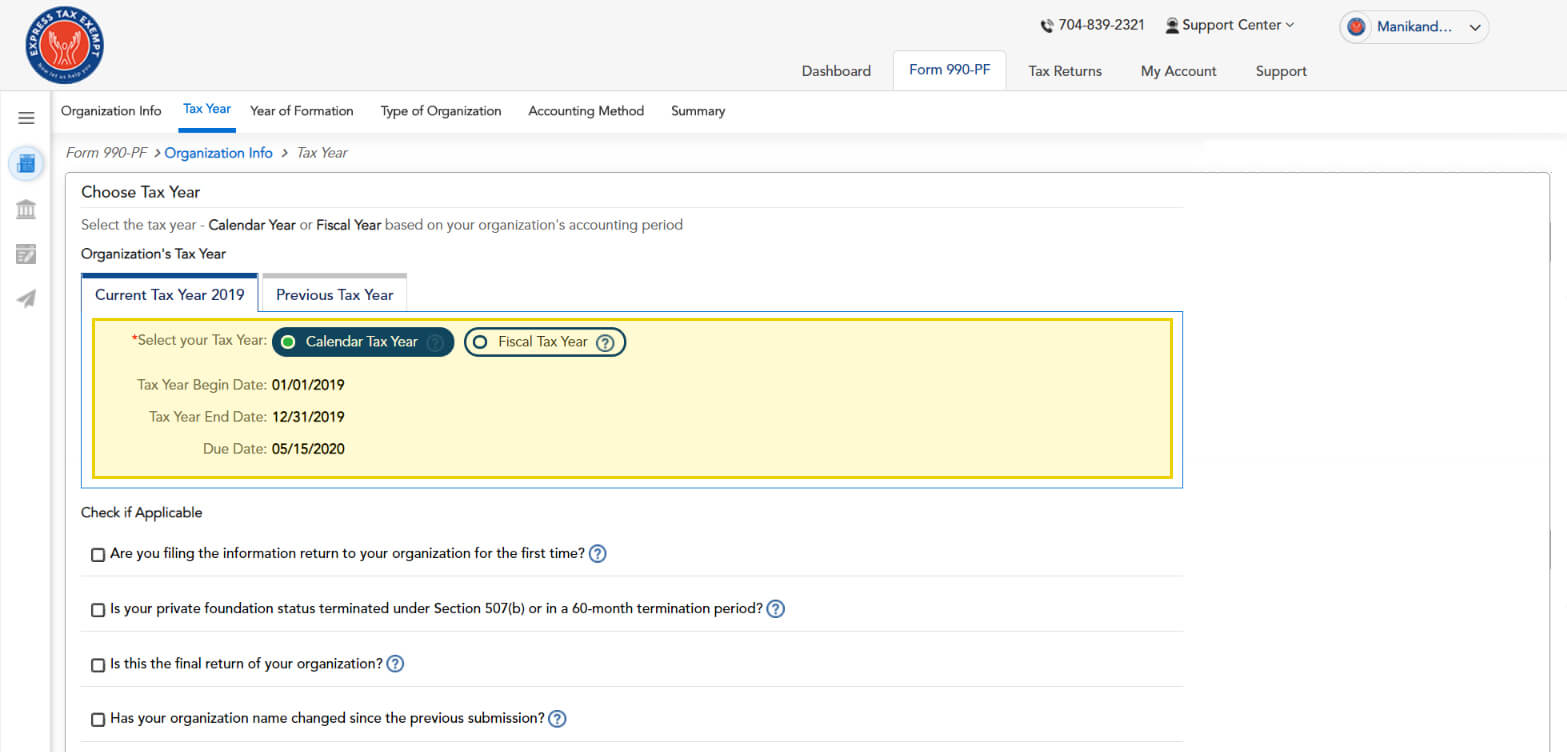

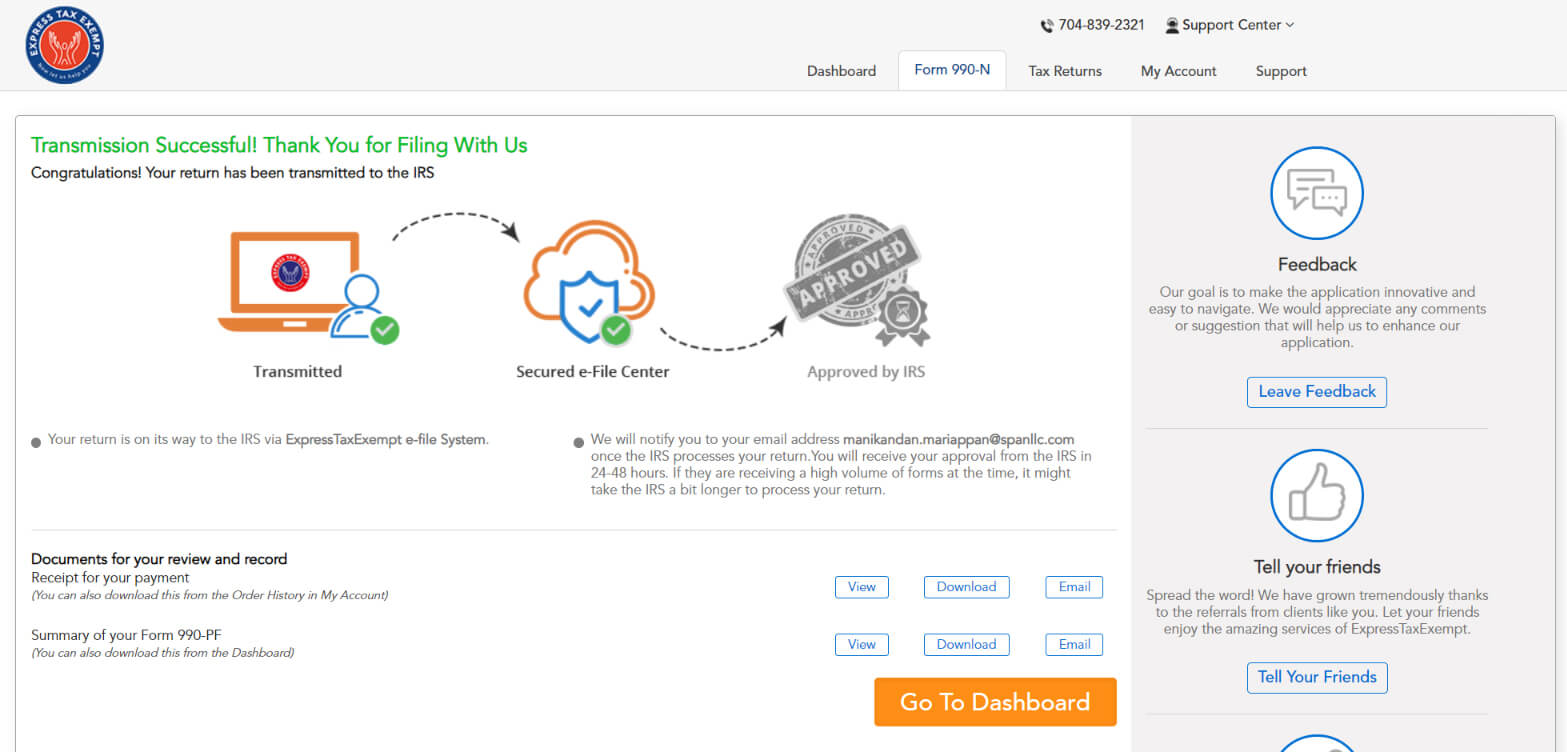

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Get ready for tax season deadlines by completing any required tax forms today. It is an information return used to calculate the tax based on. See the schedule b instructions to determine the requirements for filing. The instructions include a reminder that form. As required by section 3101 of the taxpayer first.

Form 990PF Return of Private Foundation (2014) Free Download

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Web.

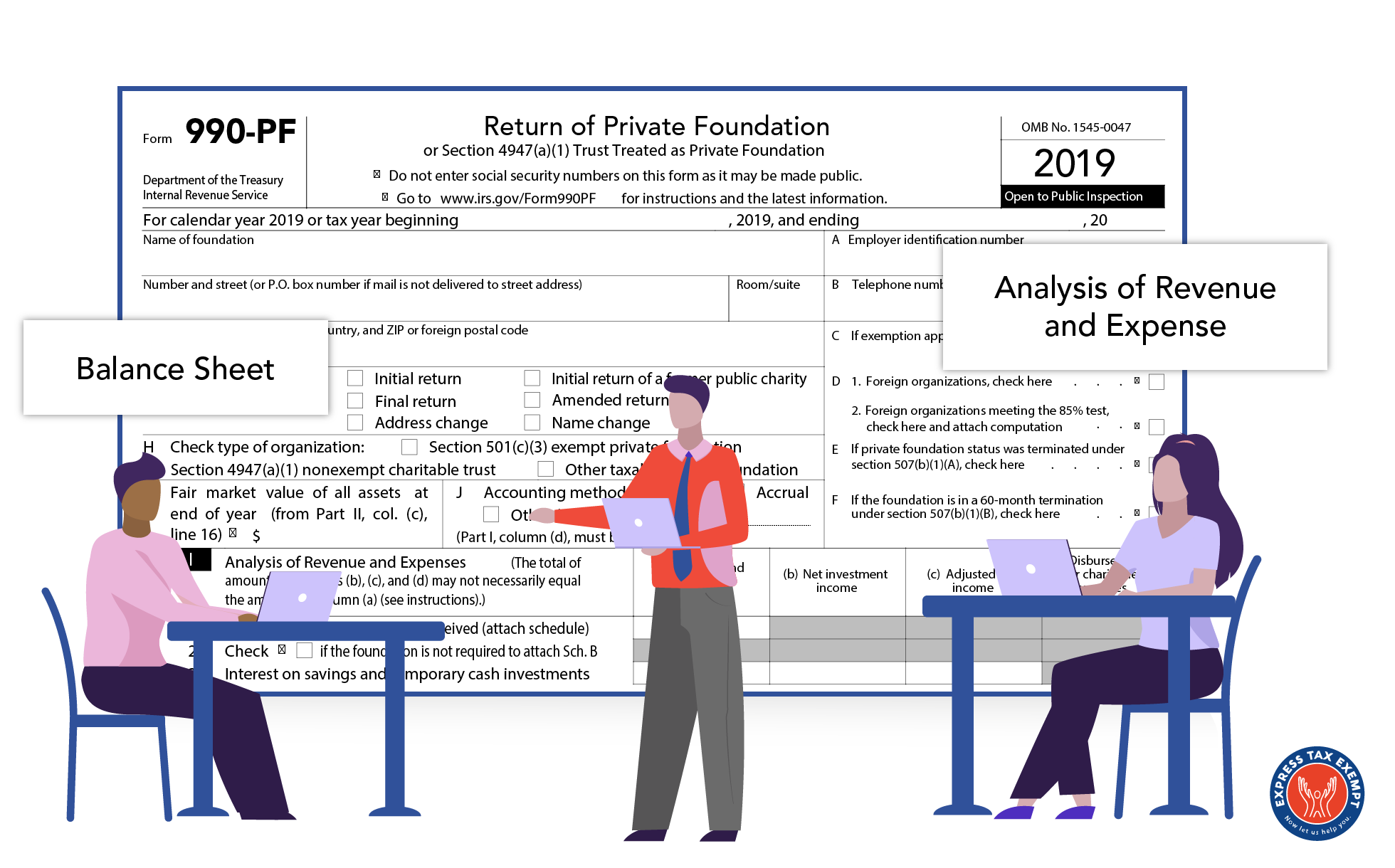

Instructions to file your Form 990PF A Complete Guide

It is an information return used to calculate the tax based on. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: See the schedule b instructions to determine the requirements for filing. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under.

Form 990 Filing Instructions Fill Out and Sign Printable PDF Template

The form consists of sixteen sections. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. As required by section 3101 of the taxpayer first. It is an information return used to calculate the tax based on. Our matrices include comments and recommendations while indicating the.

Form 990PF Return of Private Foundation (2014) Free Download

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Below are solutions to frequently asked questions about entering form 990, form 990. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of.

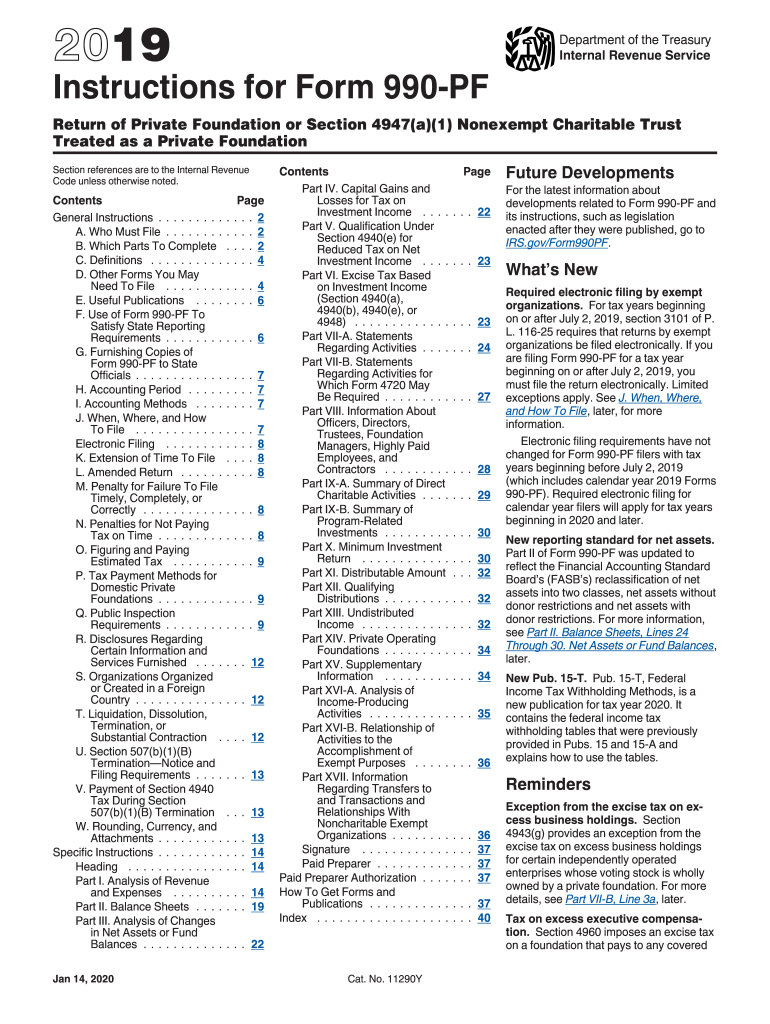

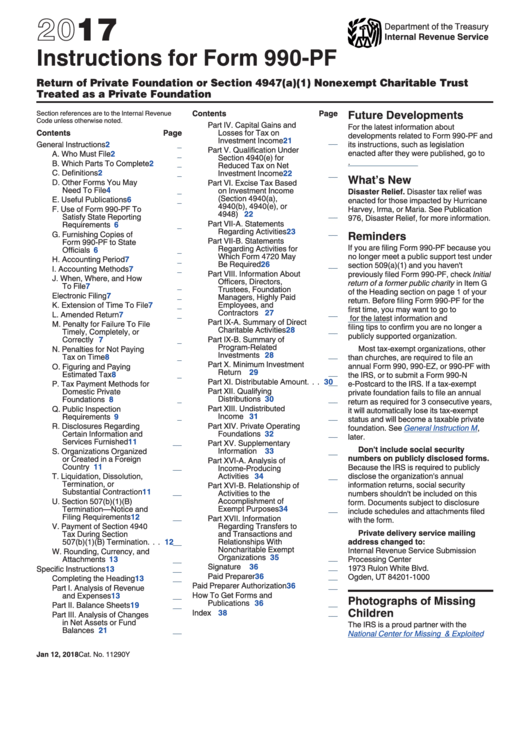

Instructions For Form 990Pf Return Of Private Foundation Or Section

The form consists of sixteen sections. See the schedule b instructions to determine the requirements for filing. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. The instructions include a reminder that form. Web the 2020.

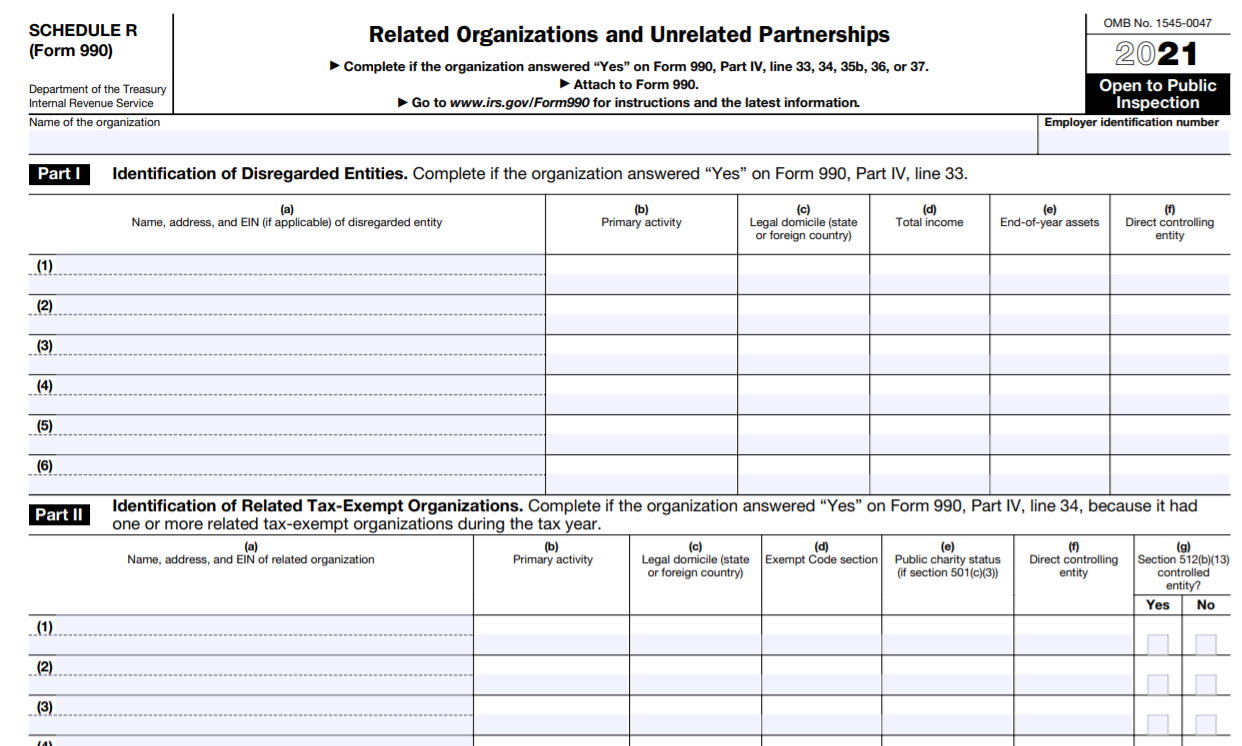

IRS Form 990 Schedule R Instructions Related Organizations and

If the return is not. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Below are solutions to frequently asked questions about entering form 990, form 990. It is an information return used to calculate the tax based on. As required by section 3101 of the taxpayer first.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. If the return is.

File 990PF online Form 990PF efiling Software

It is an information return used to calculate the tax based on. The form consists of sixteen sections. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file..

Form 990PF Return of Private Foundation (2014) Free Download

As required by section 3101 of the taxpayer first. The instructions include a reminder that form. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Get ready for tax season deadlines by completing any required tax.

Web The 2020 Form 990, Return Of Organization Exempt From Income Tax, And Instructions Contain The Following Notable Changes:

See the schedule b instructions to determine the requirements for filing. Our matrices include comments and recommendations while indicating the. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file.

Web Form 990 Department Of The Treasury Internal Revenue Service Return Of Organization Exempt From Income Tax Under Section 501(C), 527, Or 4947(A)(1) Of The Internal.

Below are solutions to frequently asked questions about entering form 990, form 990. It is an information return used to calculate the tax based on. If the return is not. The instructions include a reminder that form.

The Form Consists Of Sixteen Sections.

As required by section 3101 of the taxpayer first. Get ready for tax season deadlines by completing any required tax forms today.