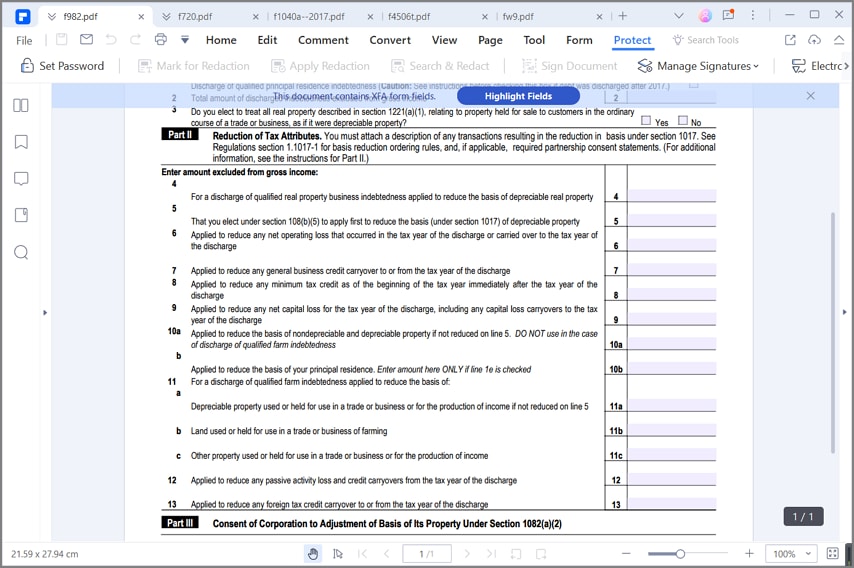

Form 982 Example

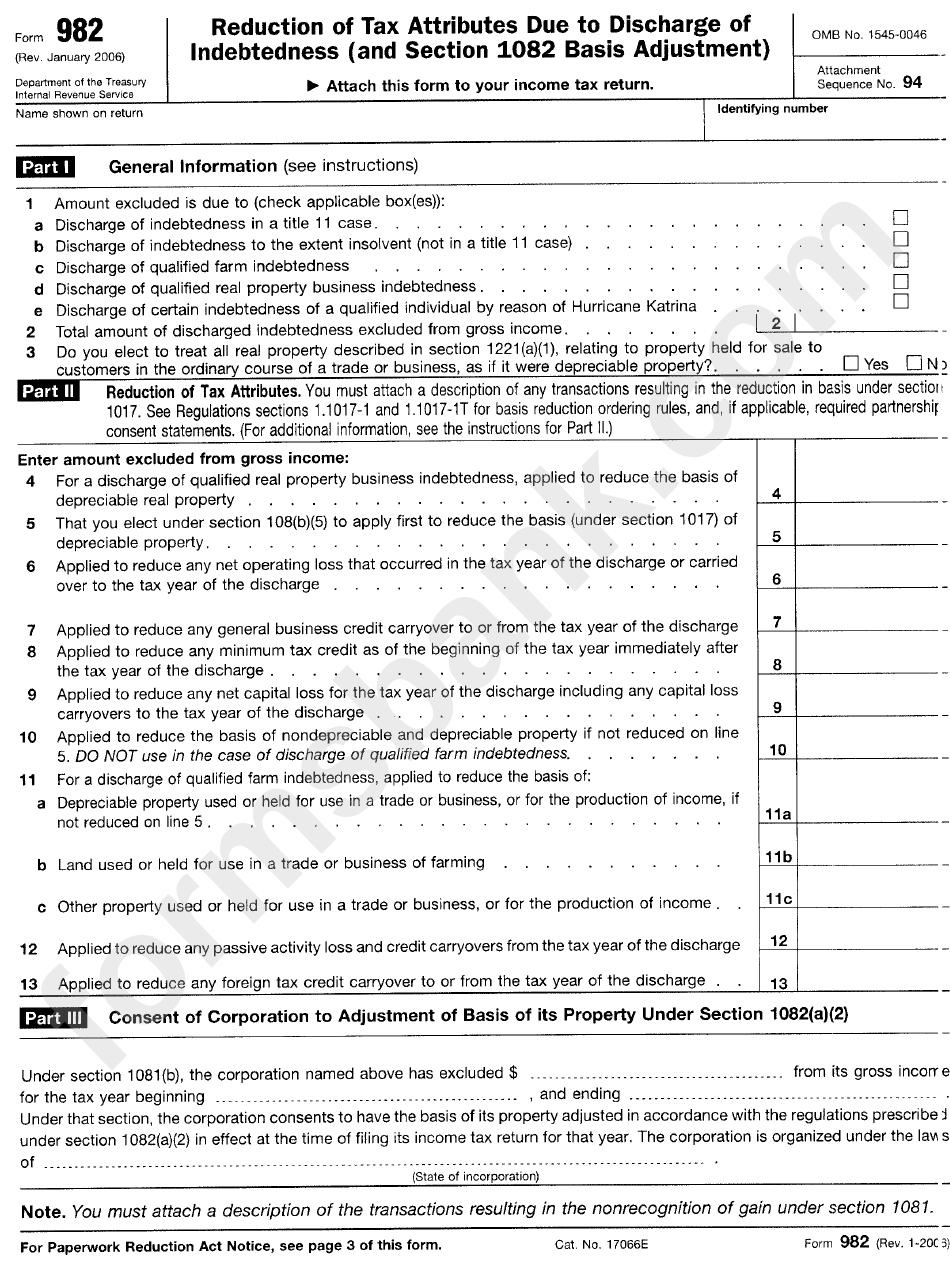

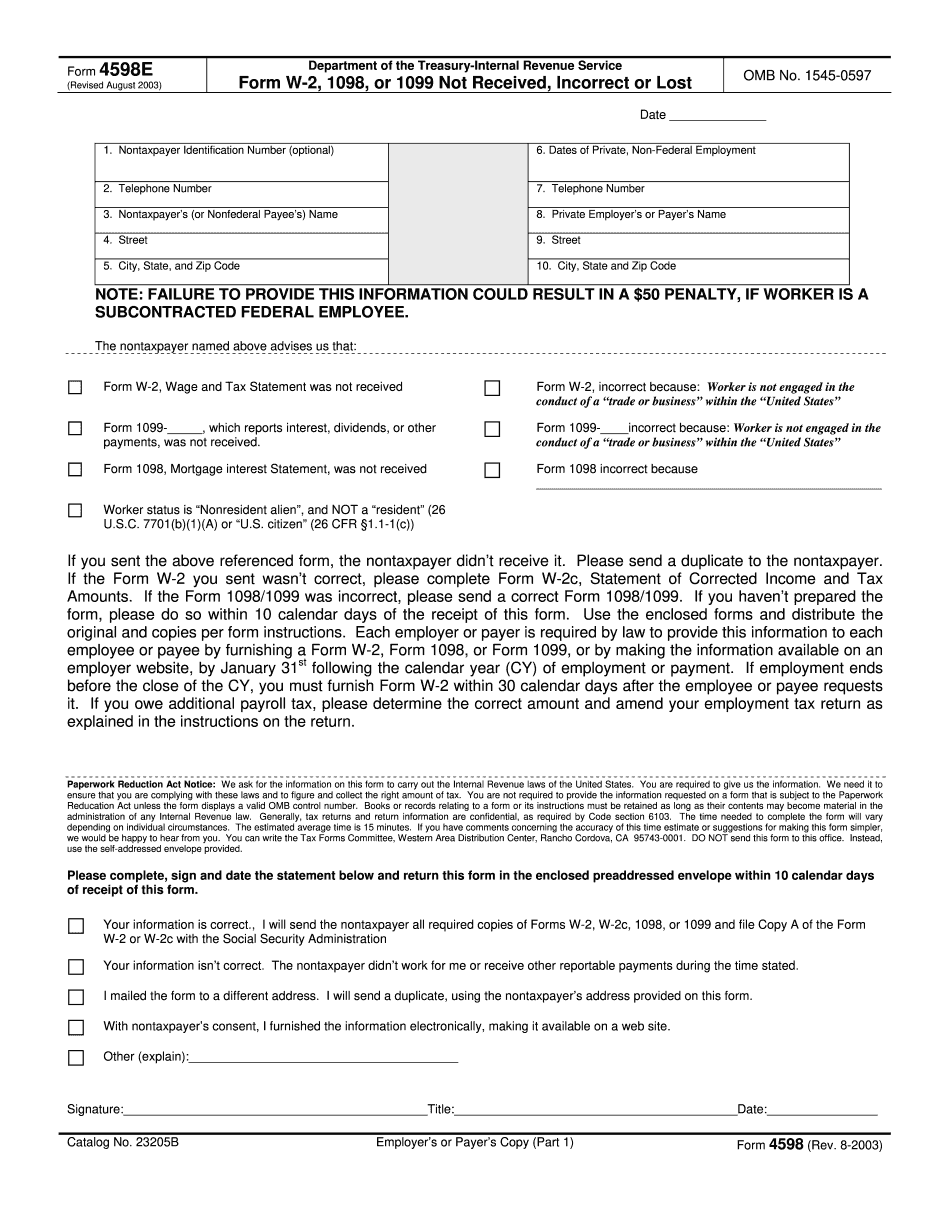

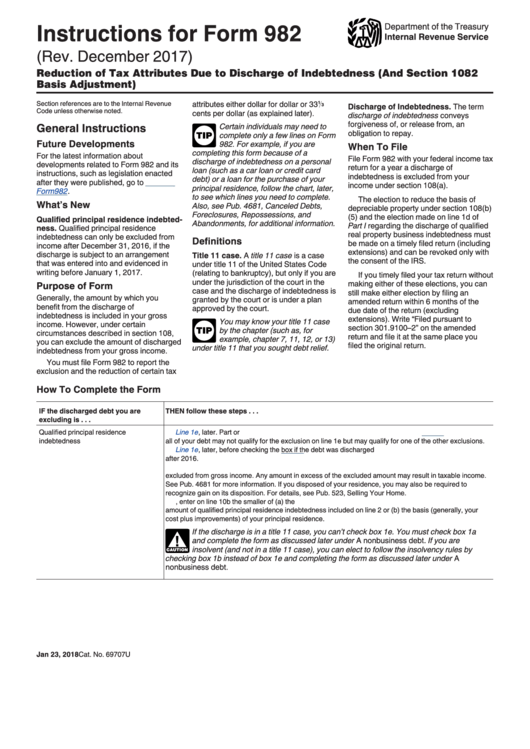

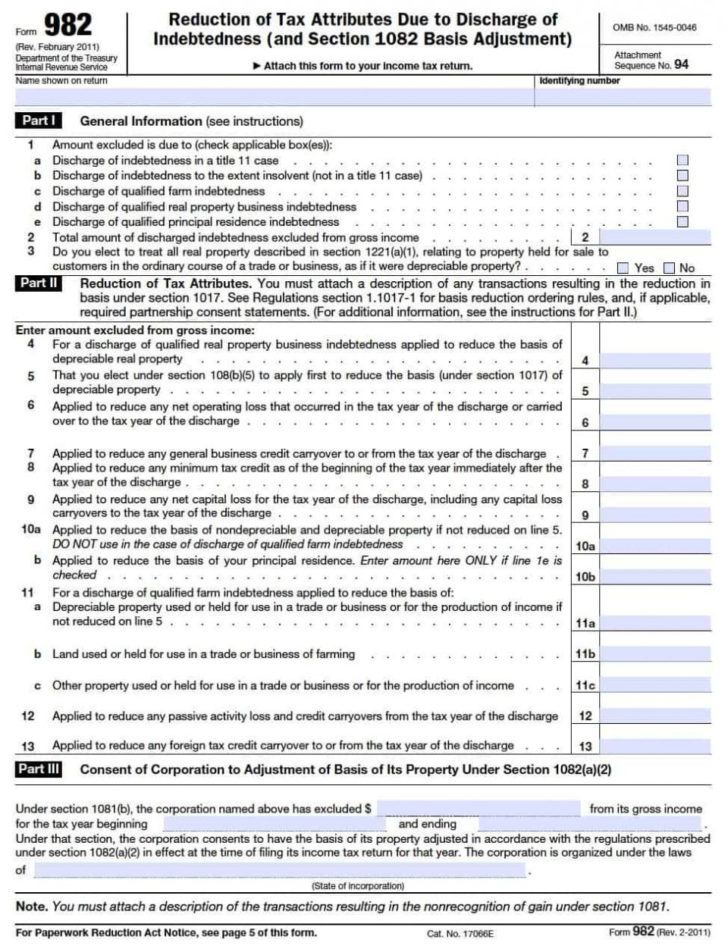

Form 982 Example - About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form 982, fully updated for tax year 2022. For example, if you are completing this form because of a discharge of indebtedness on a personal loan (such as a car loan or credit card debt) or a loan for the purchase of your principal residence, follow the chart, earlier, to see which lines you need to complete. Web introduction this publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. This form is used to determine under the circumstances described in section 108 the amount of discharged indebtedness that can be excluded from a person's gross income. Web lines on form 982. Web the amount of debt forgiven must be reported on a irs form 982 (pdf) and this form must be attached to your tax return. For instructions and the latest information. Web program entry to locate form 982, go to: In order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982 and mark the box that says, “discharge of indebtedness to the extent insolvent.”

Under certain conditions, you can file form 982 to exclude or reduce the amount of the cancellation of debt from your income. Keep the insolvency worksheet and all of your supporting documentation in the event that you are audited and the irs/state tax authority wants to see it. For example, if you are completing this form because of a discharge of indebtedness on a personal loan (such as a car loan or credit card debt) or a loan for the purchase of your principal residence, follow the chart, earlier, to see which lines you need to complete. Web amount of the canceled debt (amount forgiven) $1,463.68 debt description. Pay attention to the software and hardware. You were released from your obligation to pay your credit card debt in the amount of $5,000. Attach this form to your income tax return. Web the amount of debt forgiven must be reported on a irs form 982 (pdf) and this form must be attached to your tax return. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax purposes as having income and may have to pay tax on this. Certain individuals may need to complete only a few lines on form 982.

Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). More about the federal form 982 Web what is form 982? Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax purposes as having income and may have to pay tax on this. For instructions and the latest information. Attach this form to your income tax return. This form is used to determine under the circumstances described in section 108 the amount of discharged indebtedness that can be excluded from a person's gross income. How to generate form 6252 for a current year installment sale in lacerte. Certain individuals may need to complete only a few lines on form 982. Web you will then report the insolvency on form 982.

IRS Form 982 How to Fill it Right

Web what is form 982? Attach this form to your income tax return. For example, if you are completing this form because of a discharge of indebtedness on a personal loan (such as a car loan or credit card debt) or a loan for the purchase of your principal residence, follow the chart, earlier, to see which lines you need.

Debt Form 982 Form 982 Insolvency Worksheet —

Web the irs form 982 is the reduction of tax attributes due to the discharge of indebtedness. Web as an example, signnow electronic signatures are recognized in the majority of countries around the world. Web few lines on form 982. Your best solution to fill out irs form 982 Web the amount of debt forgiven must be reported on a.

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). For instructions and the latest information. Web few lines on form 982. Web amount of the canceled debt (amount forgiven) $1,463.68 debt description. Web for example, if you are completing this.

Worksheet Form 10 Insolvency Worksheet Worksheet Fun —

Web below are five scenarios where an exclusion from taxable income could be applicable by utilizing a properly reported form 982: For example, if you are completing this form because of a discharge of indebtedness on a personal loan (such as a car loan or credit card debt) or a loan for the purchase of your principal residence, follow the.

understanding irs form 982 Fill Online, Printable, Fillable Blank

Open (continue) your return, if it's not already open. Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form 982, fully updated for tax year 2022. Attach this form to your income tax return. Web check form 982. Web amount.

Solved I need to know about the insolvency exception for 1099c. Do I

How to generate form 6252 for a current year installment sale in lacerte. Web introduction this publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Under certain conditions, you can file form 982 to exclude or reduce the amount of the cancellation of debt from your income. Generally, if you owe a debt to someone else.

Form 982 Reduction of Tax Attributes Due to Discharge of Indebtedness

About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service The fmv of your total assets immediately before the discharge was $7,000 and your liabilities were $10,000. Keep the insolvency worksheet and all of your supporting documentation in the event that you are audited and the irs/state tax authority.

Sample Of Completed Form 982 for Insolvency Glendale Community

Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web program entry to locate form 982, go to: Web you will then report the insolvency on form 982. Qualified real property business indebtedness Generally, if you owe a debt to someone else and they cancel or.

Instructions For Form 982 Reduction Of Tax Attributes Due To

Web the irs form 982 is the reduction of tax attributes due to the discharge of indebtedness. Open (continue) your return, if it's not already open. You were insolvent to the extent of $3,000 ($10,000 of total liabilities minus $7,000 of total assets). Generally, if you owe a debt to someone else and they cancel or forgive that debt for.

Form 982 Insolvency Worksheet —

Debt cancelled in a title 11 bankruptcy; Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. For example, if you are completing this form because of a discharge of indebtedness on a personal loan (such as a car loan or credit card debt) or a loan.

This Is Because You Received A Benefit From Having The Debt Discharged.

Web program entry to locate form 982, go to: Web the amount of debt forgiven must be reported on a irs form 982 (pdf) and this form must be attached to your tax return. The fmv of your total assets immediately before the discharge was $7,000 and your liabilities were $10,000. Select the type of canceled debt (main home or other) and then click or tap.

We'll Automatically Generate Form 982 If Your Cancelled Debt Is Due To:

Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. About form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) | internal revenue service Debt cancelled in a title 11 bankruptcy; Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form 982, fully updated for tax year 2022.

Web What Is Form 982?

Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Open (continue) your return, if it's not already open. Cancellation of qualified principal residence indebtedness, aka mortgage debt relief; Web few lines on form 982.

For Example, If You Are Completing This Form Because Of A Discharge Of Indebtedness On A Personal Loan (Such As A Car Loan Or Credit Card Debt) Or A Loan For The Purchase Of Your Principal Residence, Follow The Chart, Earlier, To See Which Lines You Need To Complete.

Web as an example, signnow electronic signatures are recognized in the majority of countries around the world. Pay attention to the software and hardware. More about the federal form 982 Your best solution to fill out irs form 982