Form 966 Certified Copy Of Resolution

Form 966 Certified Copy Of Resolution - Please tell me more, so we can help you best. The form says to attach a certified copy of the ask an expert tax questions i'm filing a form 966 corporate dissolution for a small… i'm a form accountant's assistant: The undersigned, corporate secretary of _____ _____, a _____corporation, does hereby certify that the following is a true and correct copy of a resolution unanimously adopted at a special meeting of the board of directors and. Web liquidate any of its stock. Exempt organizations and qualified subchapter s subsidiaries should not file form 966. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Web i'm filing a form 966 corporate dissolution for a small business. What do you do when you have a client who doesn't want to make any. Web what is a certified copy of the resolution or plan to liquidate? You can print other federal tax forms here.

The additional form will be sufficient if the date the earlier form was filed is entered on line 11 and a certified copy of the amendment or supplement is. Form 966 is filed with the internal revenue service center at the address where the corporation or cooperative files its income tax return. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web liquidate any of its stock. Exempt organizations and qualified subchapter s subsidiaries should not file form 966. Ad download or email irs 966 & more fillable forms, register and subscribe now! The form says to attach a certified copy of the ask an expert tax questions i'm filing a form 966 corporate dissolution for a small… i'm a form accountant's assistant: Attach a certified copy of the resolution or plan and all amendments or supplements not previously filed. Please tell me more, so we can help you best. Web the previous form 966 was filed attach a certified copy of the resolution or plan and all amendments or supplements not previously filed.

The form says to attach a certified copy of the ask an expert tax questions i'm filing a form 966 corporate dissolution for a small… i'm a form accountant's assistant: Would a plan of liquidation suffice or do we need to get a certified copy of the certificate of dissolution from secretary of state? Web (a) requirement of returns. You can print other federal tax forms here. Complete, edit or print tax forms instantly. Not every corporation that is undergoing liquidation or dissolution must file the form 966. “a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. There are several exceptions to using this form: Within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the corporation shall file a return on form 966, containing the information required by paragraph (b) of this section and by such form. Irs form 966 certified copy resolution get irs form 966 certified copy resolution how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save irs form 966 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

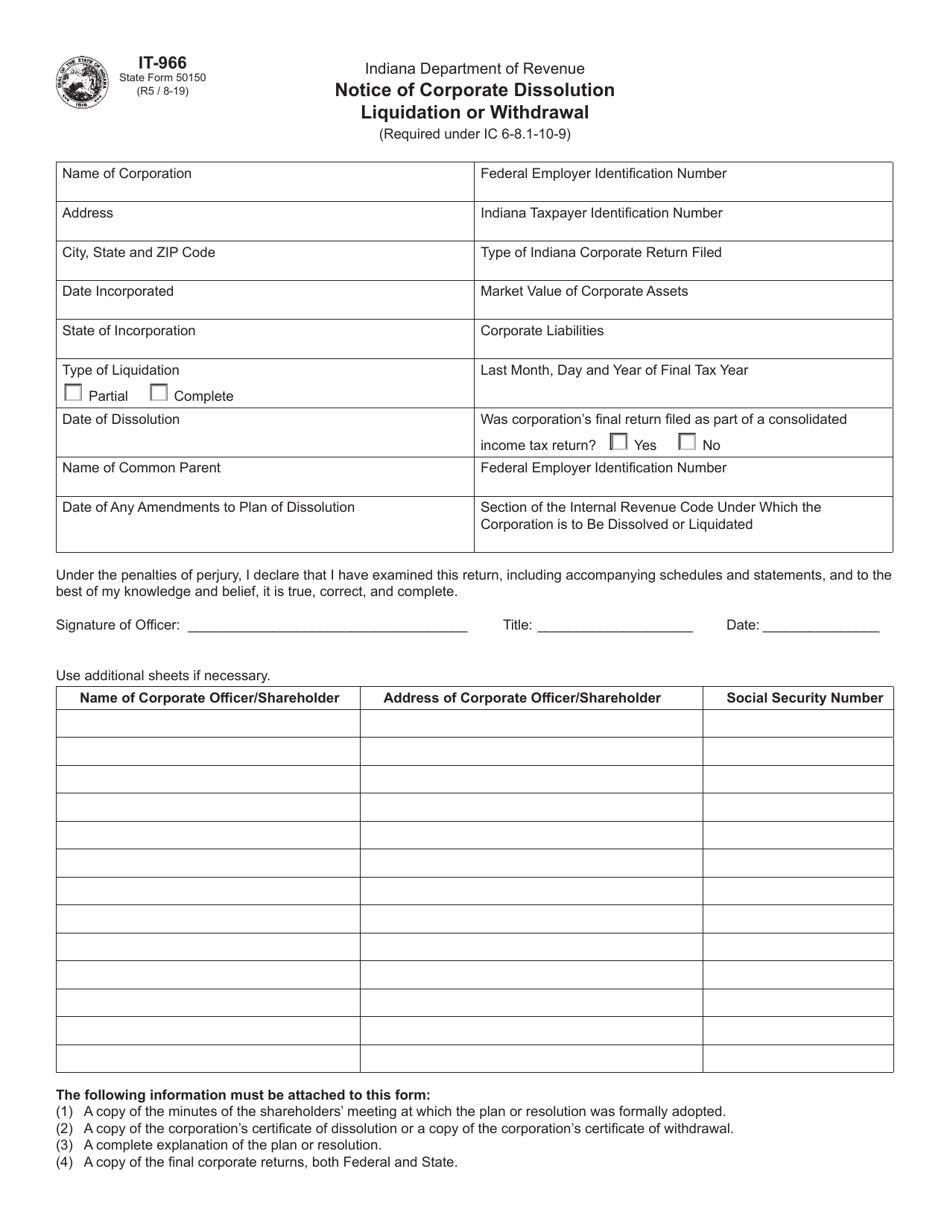

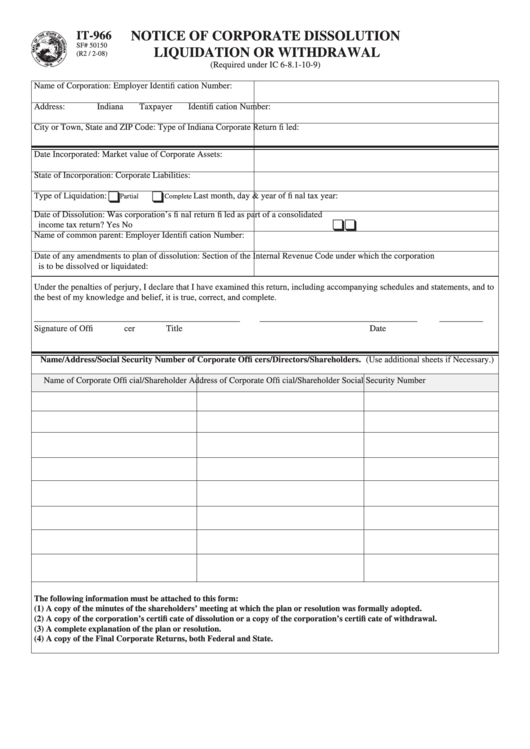

Form IT966 (State Form 50150) Download Fillable PDF or Fill Online

Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the corporation shall file a return on form 966, containing the information required by paragraph (b) of this section and by such form. The form.

Fillable Form It966 Notice Of Corporate Dissolution Liquidation Or

Form 966 is filed with the internal revenue service center at the address where the corporation or cooperative files its income tax return. “a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Right before the officer signs. An affirmative vote of the.

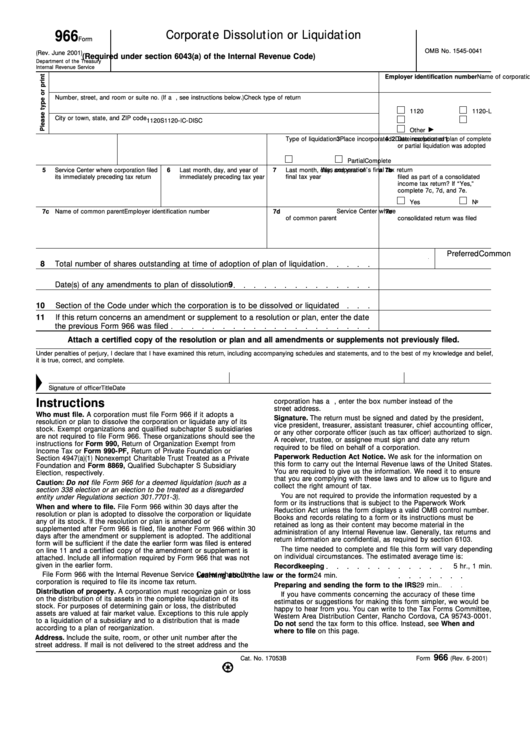

Form 966 Corporate Dissolution Or Liquidation Department Of The

What do you do when you have a client who doesn't want to make any. The additional form will be sufficient if the date the earlier form was filed is entered on line 11 and a certified copy of the amendment or supplement is. Web we last updated the corporate dissolution or liquidation in february 2023, so this is the.

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the corporation shall file a return on form 966, containing the information required by paragraph (b) of this section and by such form. Web instructions.

(966) Army lists > Hart's Army Lists > Hart's annual army list

“a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Web instructions section references are to the internal revenue code unless otherwise noted. Under penalties of perjury, i declare that i have examined this return, including accompanying schedules and statements, and to the.

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. If the resolution or plan is amended or supplemented after form 966 is filed, file another form 966 within 30 days after the amendment or supplement is adopted. Irs form 966.

I received a letter from the IRS saying I filed a frivolous tax return

Web i'm filing a form 966 corporate dissolution for a small business. Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made to dissolve a corporation. The form says to attach a certified copy of the ask an.

Form 966 (Rev Tax Return (United States) S Corporation

You can print other federal tax forms here. Complete, edit or print tax forms instantly. Web liquidate any of its stock. Would a plan of liquidation suffice or do we need to get a certified copy of the certificate of dissolution from secretary of state? Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts.

IRS Form 966 For New Banker YouTube

Right before the officer signs. Web what is a certified copy of the resolution or plan to liquidate? Attach a certified copy of the resolution or plan and all amendments or supplements not previously filed. You can print other federal tax forms here. Web form 966 must be filed within 30 days after the resolution or plan is adopted to.

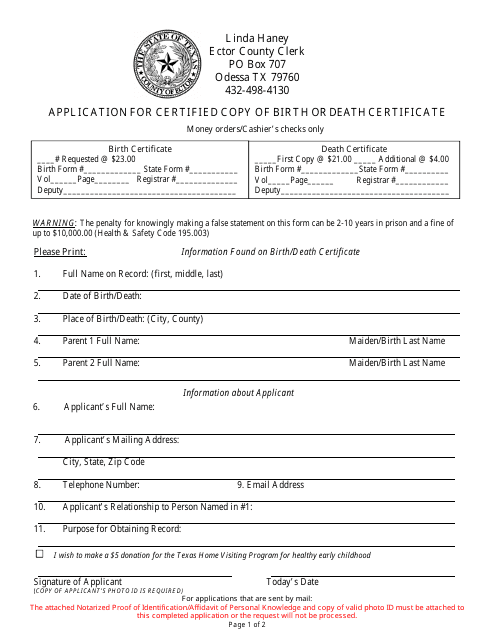

County of Ector, Texas Application Form for Certified Copy of Birth or

I don't have any official resolution or plan. There are several exceptions to using this form: Web the previous form 966 was filed attach a certified copy of the resolution or plan and all amendments or supplements not previously filed. The accountant will know how to help. Such return shall be filed.

As Provided By The Irs:

Web (a) requirement of returns. Within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the corporation shall file a return on form 966, containing the information required by paragraph (b) of this section and by such form. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Not every corporation that is undergoing liquidation or dissolution must file the form 966.

Ad Download Or Email Irs 966 & More Fillable Forms, Register And Subscribe Now!

Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the corporation shall file a return on form 966, containing the information required by paragraph (b) of this section and by such form. Web certified copy of resolution of the board of directors and shareholders of _____. Complete, edit or print tax forms instantly. Such return shall be filed.

An Affirmative Vote Of The Shareholders Is Generally Required To Authorize Dissolution.

Web what is a certified copy of the resolution or plan to liquidate? Would a plan of liquidation suffice or do we need to get a certified copy of the certificate of dissolution from secretary of state? The additional form will be sufficient if the date the earlier form was filed is entered on line 11 and a certified copy of the amendment or supplement is. Web i'm filing a form 966 corporate dissolution for a small business.

If The Resolution Or Plan Is Amended Or Supplemented After Form 966 Is Filed, File Another Form 966 Within 30 Days After The Amendment Or Supplement Is Adopted.

Under penalties of perjury, i declare that i have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief Web liquidate any of its stock. The accountant will know how to help. Right before the officer signs.