Form 9465 Instructions

Form 9465 Instructions - To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Most installment agreements meet our streamlined installment agreement criteria. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Then, mail the form to the irs. For instructions and the latest information. Complete, edit or print tax forms instantly. If you are filing form 9465 with your return, attach it to the front of your return when you file. Web use form 9465 if you’re an individual:

Complete, edit or print tax forms instantly. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Web where to file your taxes for form 9465. Then, mail the form to the irs. Ad access irs tax forms. Web who can file form 9465: Web use form 9465 if you’re an individual: Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Pay as much of the tax as possible with your return (or notice).

Taxpayers who can't pay their tax obligation can file form 9465 to set up a monthly installment payment plan if they meet certain conditions. Complete, edit or print tax forms instantly. For instructions and the latest information. Pay as much of the tax as possible with your return (or notice). For electronically filed returns with no electronic funds withdrawal, the form. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your. Get ready for tax season deadlines by completing any required tax forms today. All • who owes income tax on form 1040, payments received will be applied to your account in the best • who may be responsible for a trust fund recovery penalty, interests of the united states. If you are filing form 9465 with your return, attach it to the front of your return when you file. Ad access irs tax forms.

IRS Form 9465 Instructions Your Installment Agreement Request

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). If you are filing form 9465 with your return, attach it to the front of your return when you file. For electronically filed returns with no electronic.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

Web where to file your taxes for form 9465. However, using this form is not the only way taxpayers may set up an irs payment plan. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Then, mail the form to the irs.

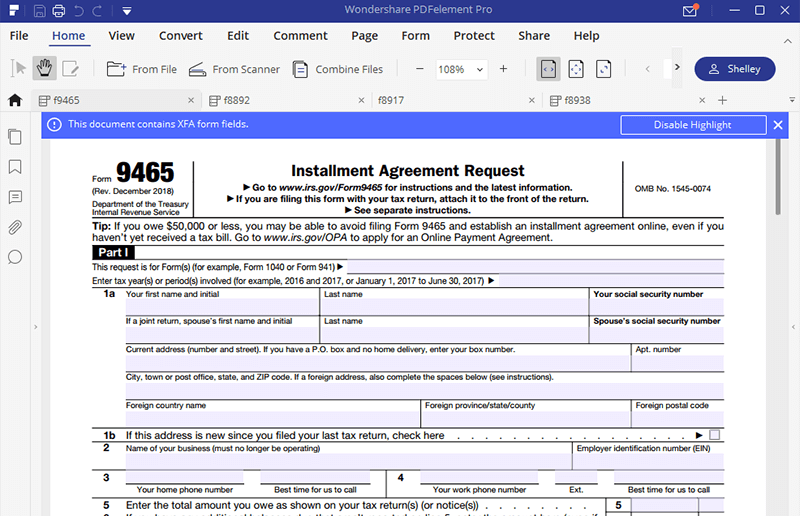

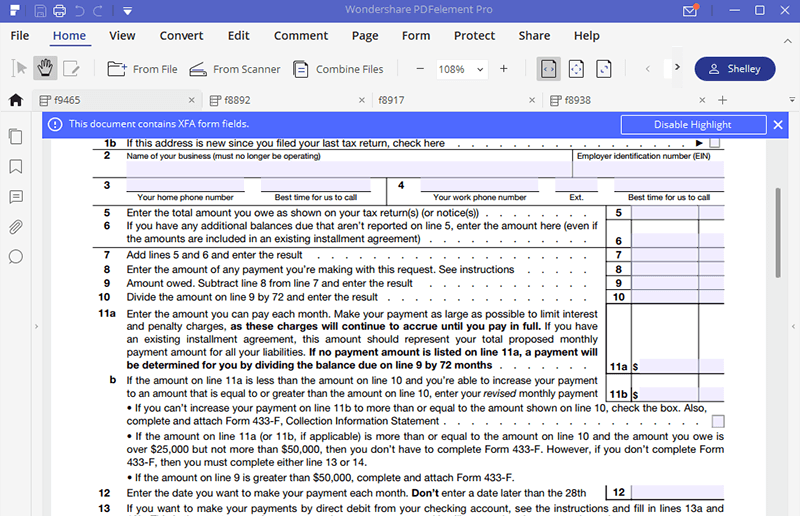

Irs form 9465 Fillable How to Plete Irs form 9465 Installment Agreement

Most installment agreements meet our streamlined installment agreement criteria. If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Who owes income tax on form 1040, who is or may be responsible for a trust fund recovery penalty, who owes employment taxes (for example, as reported on forms 941,.

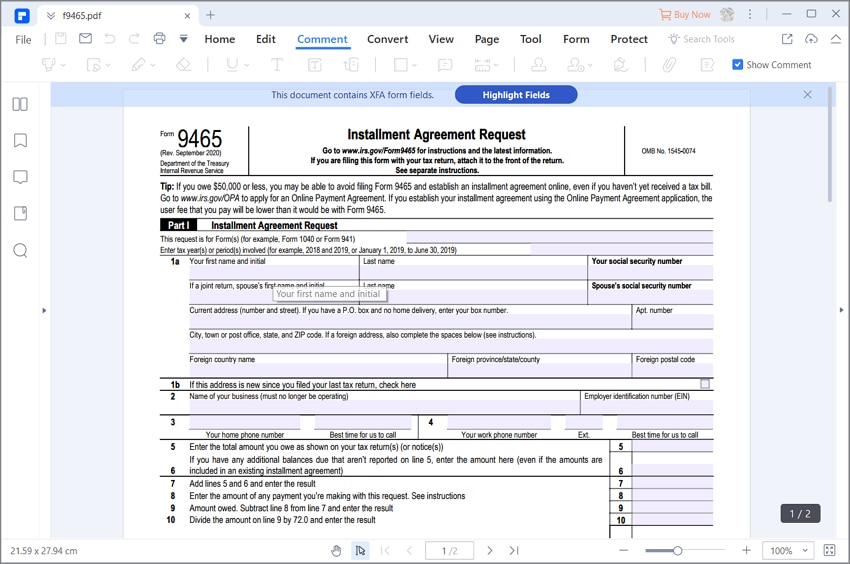

IRS Form 9465 Instructions for How to Fill it Correctly File

Then, mail the form to the irs. Most installment agreements meet our streamlined installment agreement criteria. If you are filing form 9465 with your return, attach it to the front of your return when you file. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. If you are filing this.

940 Form 2021

Web irs form 9465, installment agreement request, is a federal form that an individual taxpayer may use when requesting permission to pay down their tax liabilities in monthly installments. Web use form 9465 if you’re an individual: Complete, edit or print tax forms instantly. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on.

28 Irs form 9465 Fillable in 2020 Irs forms, Letter templates free

Complete, edit or print tax forms instantly. However, using this form is not the only way taxpayers may set up an irs payment plan. If you are filing this form with your tax return, attach it to the front of the return. Get ready for tax season deadlines by completing any required tax forms today. Taxpayers who can't pay their.

9465 Form Instructions 2022 IRS Forms TaxUni

For instructions and the latest information. Web how to file form 9465 & address to send to. Complete, edit or print tax forms instantly. Who owes income tax on form 1040, who is or may be responsible for a trust fund recovery penalty, who owes employment taxes (for example, as reported on forms 941, 943, or 940) related to a.

IRS Form 9465 Instructions for How to Fill it Correctly File

Ad download or email irs 9465 & more fillable forms, register and subscribe now! For instructions and the latest information. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot.

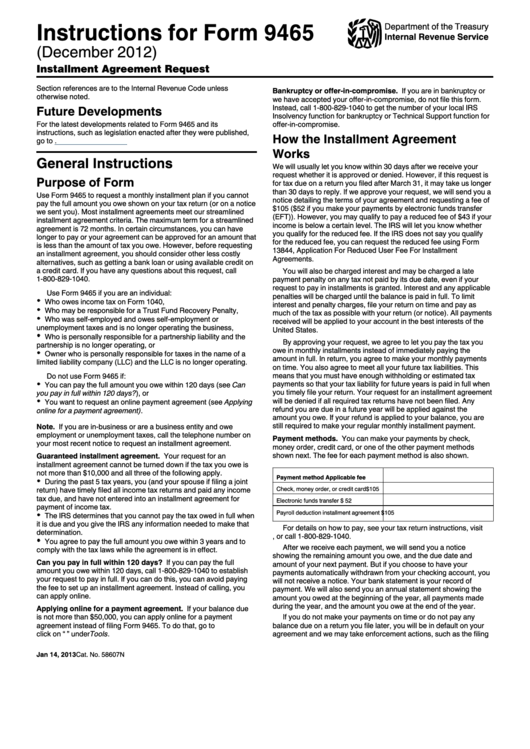

Instructions For Form 9465 (Rev. December 2012) printable pdf download

Ad access irs tax forms. Web how to file form 9465 & address to send to. Get ready for tax season deadlines by completing any required tax forms today. All • who owes income tax on form 1040, payments received will be applied to your account in the best • who may be responsible for a trust fund recovery penalty,.

IRS Form 9465 Instructions for How to Fill it Correctly File

Web where to file your taxes for form 9465. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web who can file form 9465: December 2018) department of the treasury internal revenue service. Web information about.

However, Using This Form Is Not The Only Way Taxpayers May Set Up An Irs Payment Plan.

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web where to file your taxes for form 9465. Web irs form 9465, installment agreement request, is a federal form that an individual taxpayer may use when requesting permission to pay down their tax liabilities in monthly installments. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand.

Form 9465 Is Used By Taxpayers To Request A Monthly Installment Plan If They Cannot Pay The Full Amount Of Tax They Owe.

All • who owes income tax on form 1040, payments received will be applied to your account in the best • who may be responsible for a trust fund recovery penalty, interests of the united states. Then, mail the form to the irs. Taxpayers who can't pay their tax obligation can file form 9465 to set up a monthly installment payment plan if they meet certain conditions. For electronically filed returns with no electronic funds withdrawal, the form.

Pay As Much Of The Tax As Possible With Your Return (Or Notice).

Who owes income tax on form 1040, who is or may be responsible for a trust fund recovery penalty, who owes employment taxes (for example, as reported on forms 941, 943, or 940) related to a sole proprietor business that is no longer in operation, or who owes an individual shared responsibility payment Ad download or email irs 9465 & more fillable forms, register and subscribe now! Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. If you are filing form 9465 with your return, attach it to the front of your return when you file.

If You Are Filing Form 9465 Separate From Your Return, Refer To The Tables Below To Determine The Correct Filing Address.

December 2018) department of the treasury internal revenue service. For instructions and the latest information. Web use form 9465 if you’re an individual: Get ready for tax season deadlines by completing any required tax forms today.

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/tax-time-calculator-tax-form-form-9465-instructions-ss-Featured.jpg)