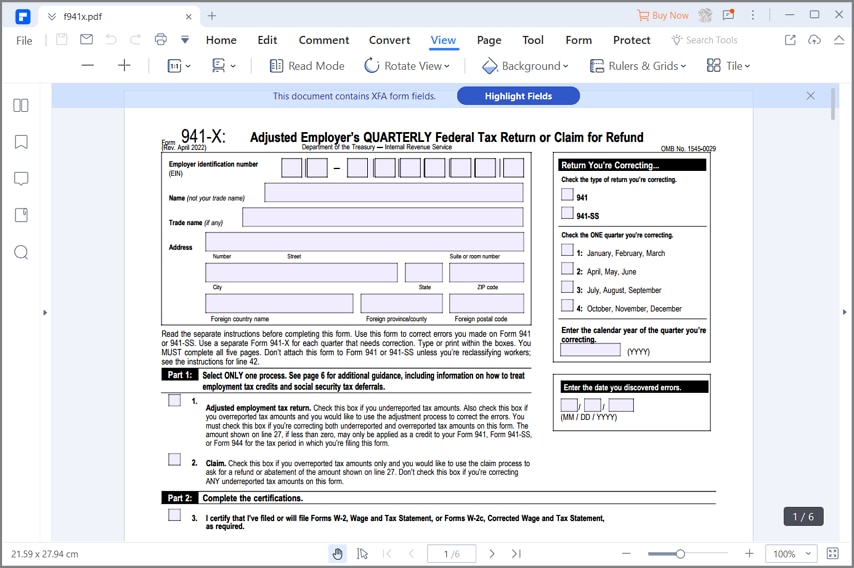

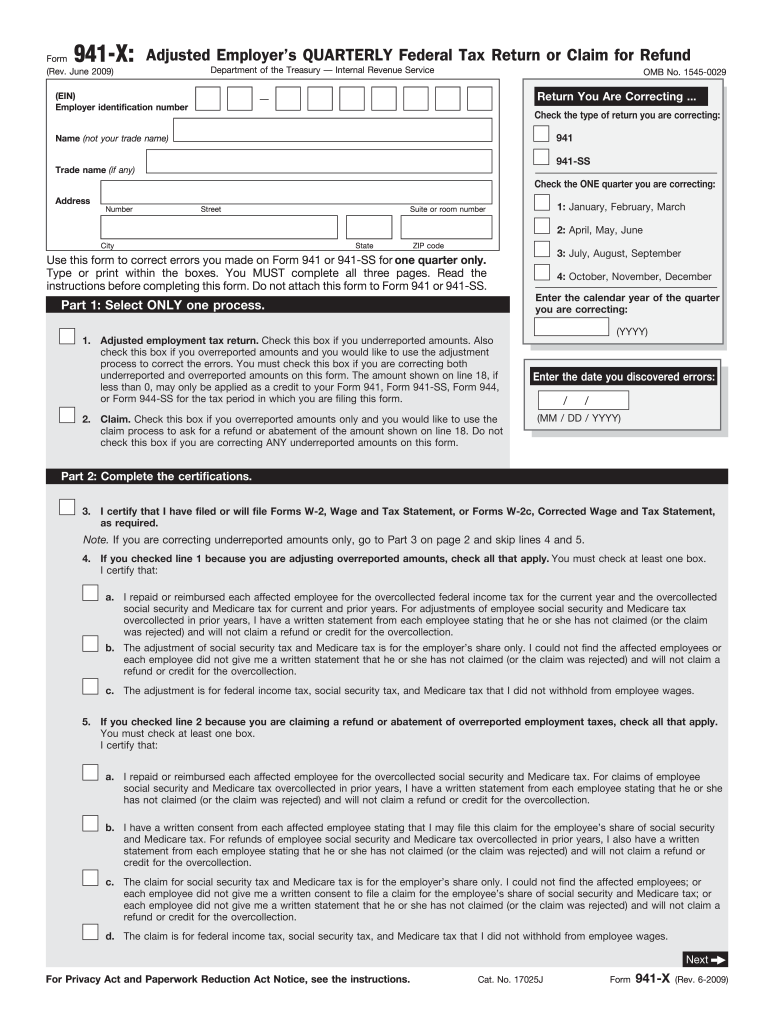

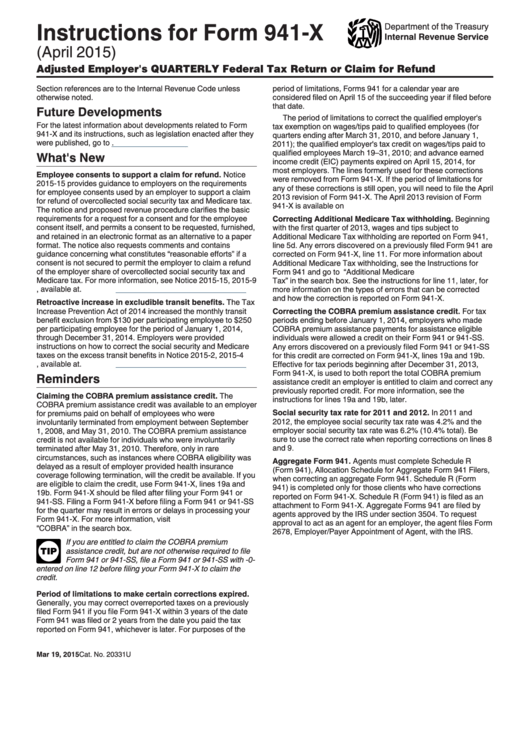

Form 941-X Instructions

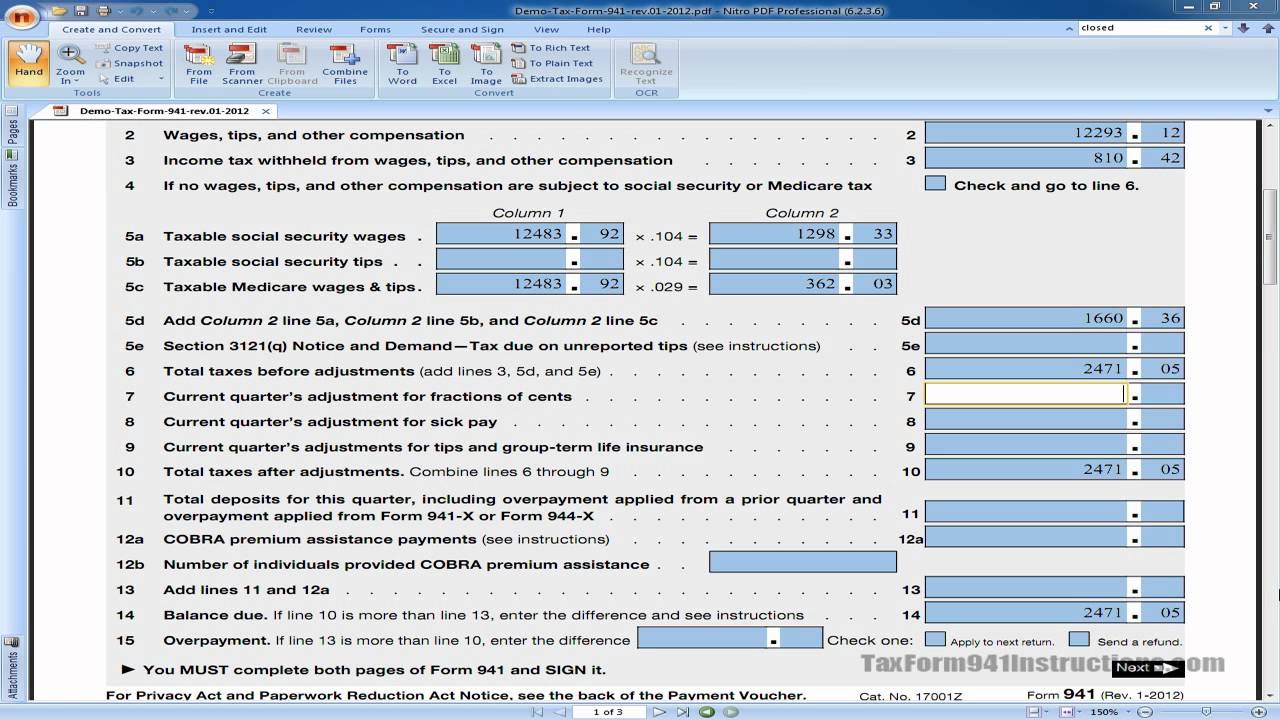

Form 941-X Instructions - Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. The irs will revise forms 941 and Type or print within the boxes. You will use the claim process if you overreported employment taxes and are requesting a refund or abatement of the overreported amount. See the instructions for line 42. Determine which payroll quarters in 2020 and 2021 your business qualifies for. If changes in law require additional changes to form 941, the form and/or these instructions may be revised. Is there a deadline for. For all quarters you qualify for, get your original 941, a. Web the june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021.

Type or print within the boxes. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. The irs will revise forms 941 and If changes in law require additional changes to form 941, the form and/or these instructions may be revised. For all quarters you qualify for, get your original 941, a. Prior revisions of form 941 are available at irs.gov/form941 (select the link for “all form 941 revisions” under “other items you may See the instructions for line 42. You must complete all five pages. Where can you get help? Determine which payroll quarters in 2020 and 2021 your business qualifies for.

Determine which payroll quarters in 2020 and 2021 your business qualifies for. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Is there a deadline for. If changes in law require additional changes to form 941, the form and/or these instructions may be revised. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Prior revisions of form 941 are available at irs.gov/form941 (select the link for “all form 941 revisions” under “other items you may The irs will revise forms 941 and For all quarters you qualify for, get your original 941, a. 15, or go to irs.gov/correctingemploymenttaxes. Where can you get help?

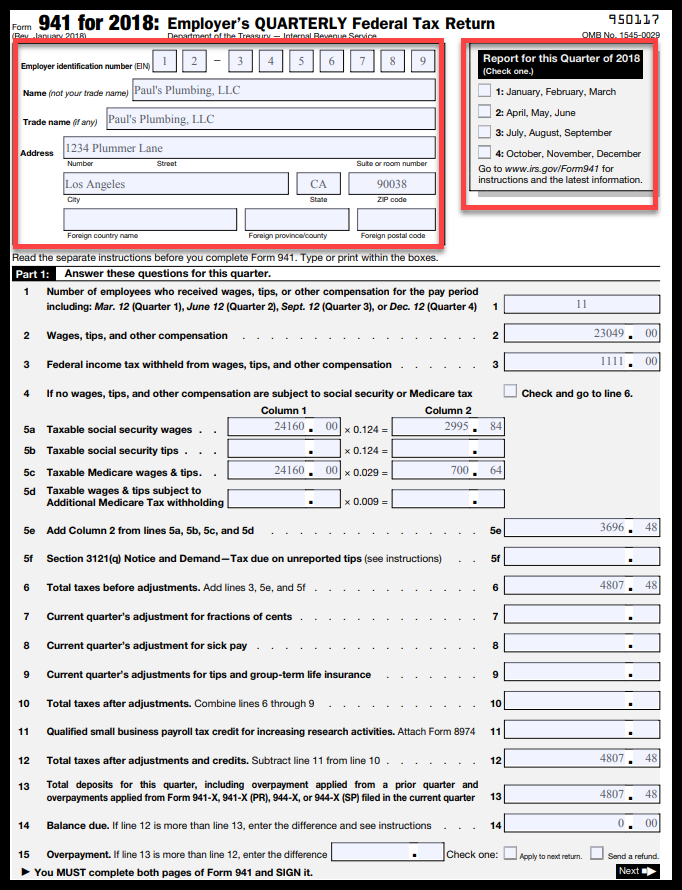

Example 13 Form Filled Out What I Wish Everyone Knew About Example 13

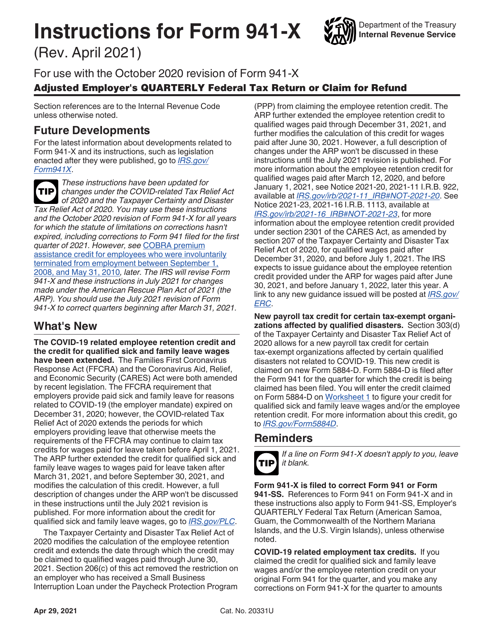

The irs will revise forms 941 and If changes in law require additional changes to form 941, the form and/or these instructions may be revised. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web the june 2021 revision of form 941 should be used for the.

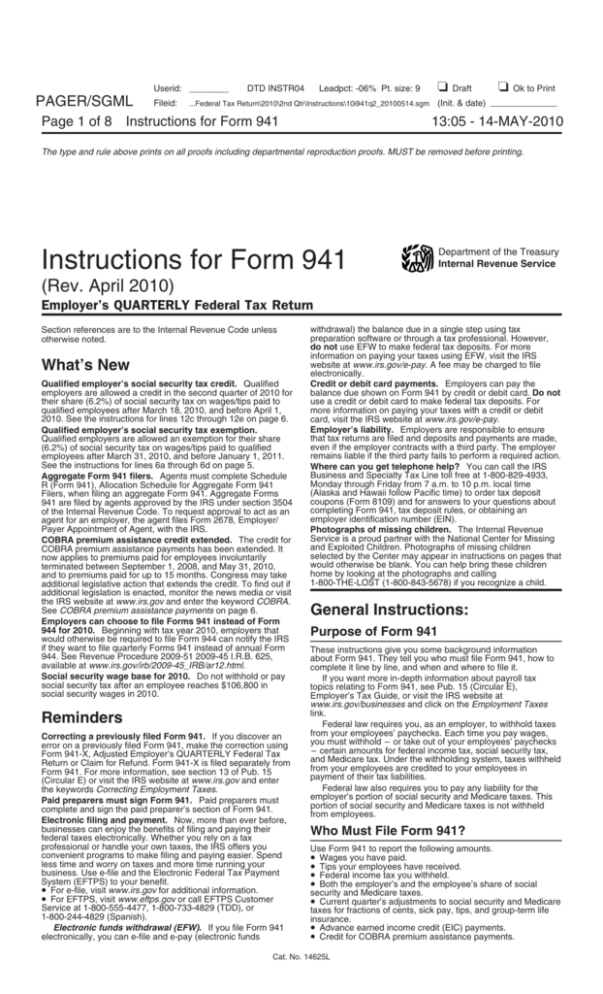

941 instructions 2023 Fill online, Printable, Fillable Blank

15, or go to irs.gov/correctingemploymenttaxes. Is there a deadline for. Where can you get help? Determine which payroll quarters in 2020 and 2021 your business qualifies for. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding.

Irs Form 941 Instructions 2016

15, or go to irs.gov/correctingemploymenttaxes. Is there a deadline for. You will use the claim process if you overreported employment taxes and are requesting a refund or abatement of the overreported amount. For all quarters you qualify for, get your original 941, a. See the instructions for line 42.

Irs.gov Form 941 X Instructions Form Resume Examples 86O7Vo75BR

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Where can you get help? See the instructions for line 42. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional.

IRS Form 941X Learn How to Fill it Easily

You must complete all five pages. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. You will use the claim process if you overreported employment taxes and are requesting a refund or abatement of the overreported amount. Prior revisions of form 941 are available at irs.gov/form941 (select.

Form 941 X Fill Out and Sign Printable PDF Template signNow

If changes in law require additional changes to form 941, the form and/or these instructions may be revised. Web the june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. The irs will revise forms 941 and Is there a deadline for. You must complete all five pages.

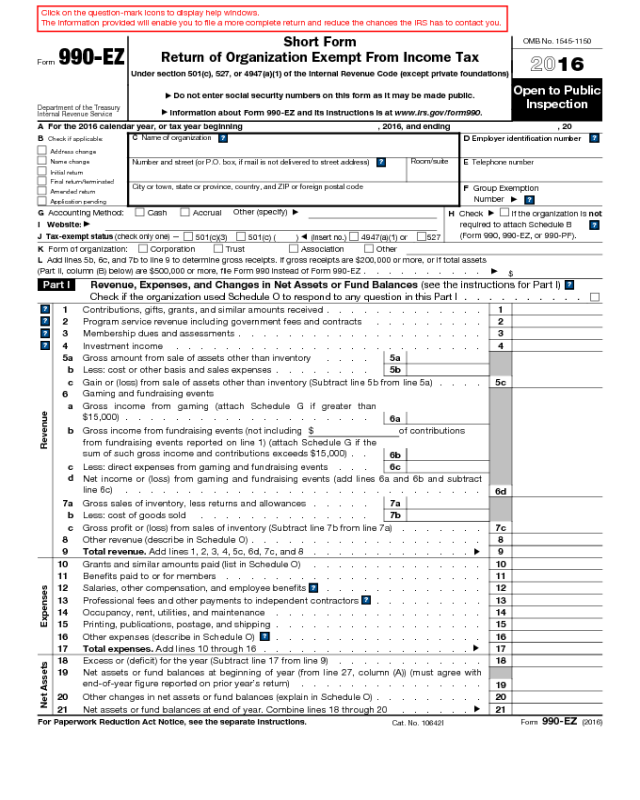

Instructions for Form 941

Prior revisions of form 941 are available at irs.gov/form941 (select the link for “all form 941 revisions” under “other items you may 15, or go to irs.gov/correctingemploymenttaxes. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Determine which payroll.

Download Instructions for IRS Form 941X Adjusted Employer's Quarterly

Web the june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Where can you get help? For all quarters you qualify for, get your original 941, a. 15, or.

Tax Form 941 Line 7 Video YouTube

See the instructions for line 42. 15, or go to irs.gov/correctingemploymenttaxes. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Determine which payroll quarters in 2020 and 2021 your business qualifies for. If changes in law require additional changes to form 941, the form and/or these instructions.

Instructions For Form 941x Adjusted Employer's Quarterly Federal Tax

Prior revisions of form 941 are available at irs.gov/form941 (select the link for “all form 941 revisions” under “other items you may If changes in law require additional changes to form 941, the form and/or these instructions may be revised. The irs will revise forms 941 and You must complete all five pages. Determine which payroll quarters in 2020 and.

Therefore, You May Need To Amend Your Income Tax Return (For Example, Forms 1040, 1065, 1120, Etc.) To Reflect That Reduced Deduction.

If changes in law require additional changes to form 941, the form and/or these instructions may be revised. For all quarters you qualify for, get your original 941, a. See the instructions for line 42. Type or print within the boxes.

Where Can You Get Help?

Web the june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Is there a deadline for. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Prior revisions of form 941 are available at irs.gov/form941 (select the link for “all form 941 revisions” under “other items you may

Determine Which Payroll Quarters In 2020 And 2021 Your Business Qualifies For.

You must complete all five pages. 15, or go to irs.gov/correctingemploymenttaxes. You will use the claim process if you overreported employment taxes and are requesting a refund or abatement of the overreported amount. The irs will revise forms 941 and