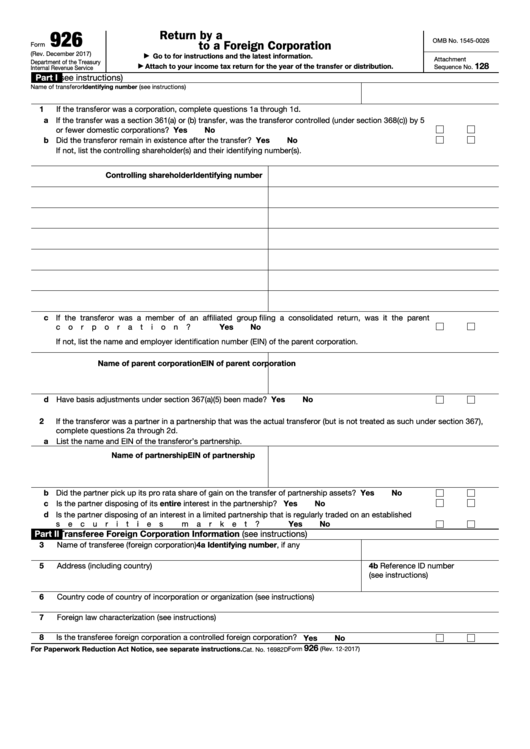

Form 926 Pdf

Form 926 Pdf - The irs requires certain us person to report the transfer of property to a foreign corporation to file a form 926 for the year the transfer took place. Transferor of property to a foreign corporation, to report any. Web the finalized publication 926, household employer’s tax guide, was released feb. Web report certain information on form 926 (return by a us transferor of property to a foreign corporation) to avoid a penalty equal to ten percent of the transferred property’s fair. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to. Edit your form 926 instructions online. Web this subsection of form 926 asks the preparer to provide basic information regarding transferees of property being transferred to a foreign corporation. “use form 926 to report certain transfers of tangible or intangible property to a. You do not need to report.

Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. The irs requires certain us person to report the transfer of property to a foreign corporation to file a form 926 for the year the transfer took place. Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to. Taxpayer must complete form 926, return by a u.s. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Forget about scanning and printing out forms. Transferor of property to a foreign corporation. Web the form 926 is used to report certain transfers to foreign corporation. There are many technicalities, so it is recommended that you get advice from a tax professional if you need clarification on the instructions. Web the finalized publication 926, household employer’s tax guide, was released feb.

Web the finalized publication 926, household employer’s tax guide, was released feb. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Web report certain information on form 926 (return by a us transferor of property to a foreign corporation) to avoid a penalty equal to ten percent of the transferred property’s fair. There are many technicalities, so it is recommended that you get advice from a tax professional if you need clarification on the instructions. Web this subsection of form 926 asks the preparer to provide basic information regarding transferees of property being transferred to a foreign corporation. Web quick guide on how to complete form926. Download this form print this form more about the. Web earned income tax credit (eitc) central | earned income tax credit “use form 926 to report certain transfers of tangible or intangible property to a. December 2013) department of the treasury internal revenue service return by a u.s.

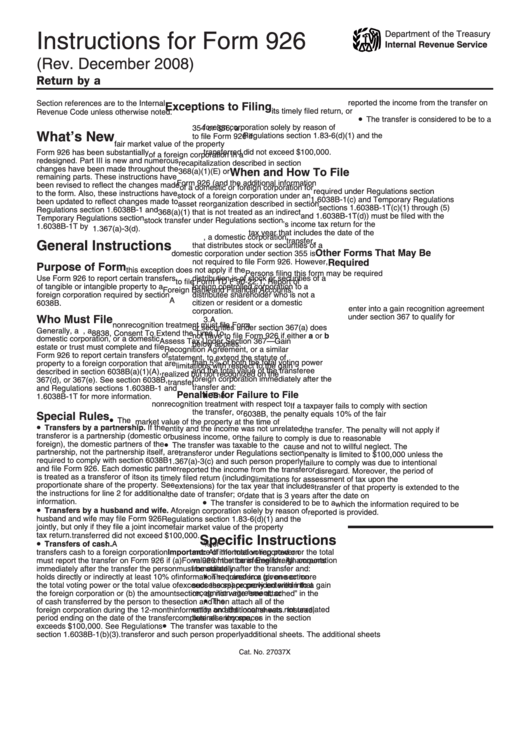

Instructions For Form 926 Return By A U.s. Transferor Of Property To

The irs requires certain us person to report the transfer of property to a foreign corporation to file a form 926 for the year the transfer took place. Web form 926 is a very complex form. Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. This article will focus briefly on.

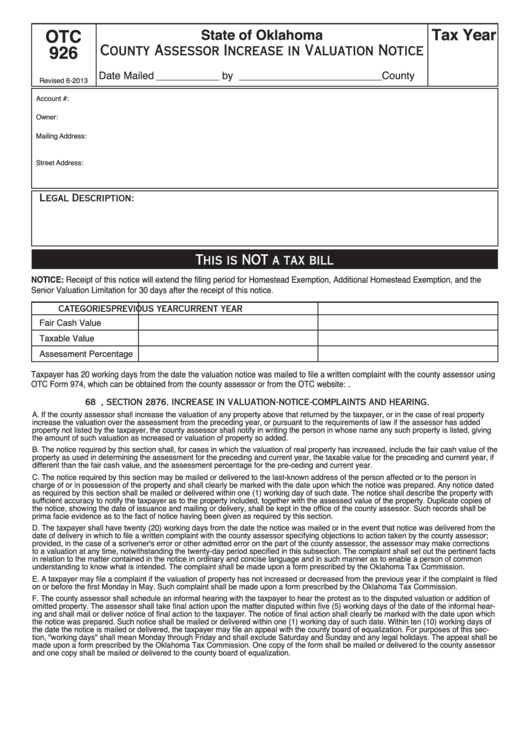

Fillable Form Otc 926 County Assessor Increase In Valuation Notice

The irs requires certain us person to report the transfer of property to a foreign corporation to file a form 926 for the year the transfer took place. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Web the form 926 is.

Form 926 Return by a U.S. Transferor of Property to a Foreign

Forget about scanning and printing out forms. Sign it in a few clicks. Transferor of property to a foreign corporation attach to your income. Web earned income tax credit (eitc) central | earned income tax credit Web the finalized publication 926, household employer’s tax guide, was released feb.

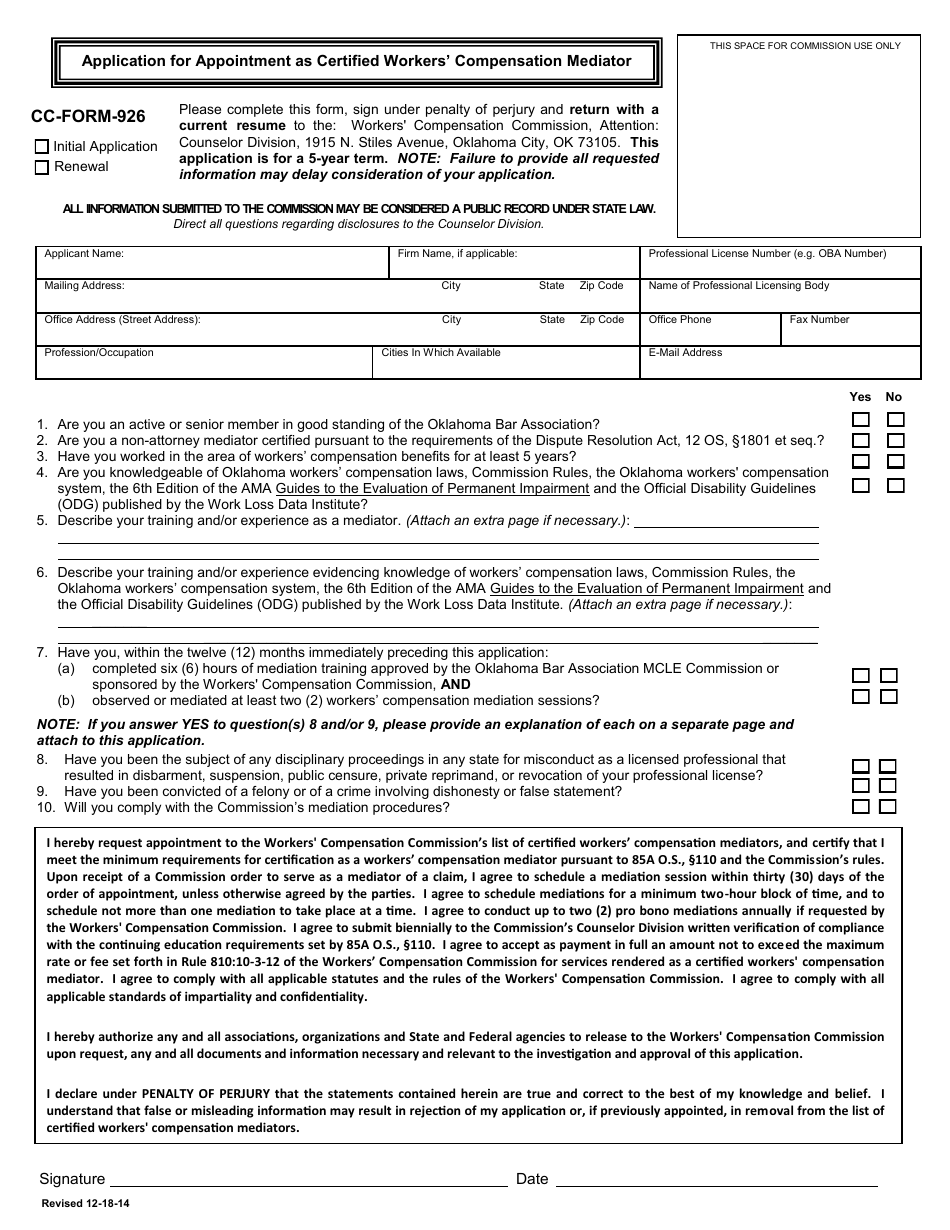

CC Form 926 Download Fillable PDF or Fill Online Application for

Edit your form 926 instructions online. As provided by the irs: Taxpayer must complete form 926, return by a u.s. Use our detailed instructions to fill out and esign your documents online. Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s.

DSHS Form 13926 Download Printable PDF or Fill Online Forensic (6358

Transferor of property to a foreign corporation, to report any. As provided by the irs: Web to fulfill this reporting obligation, the u.s. Web the form 926 is used to report certain transfers to foreign corporation. Transferor of property to a foreign corporation.

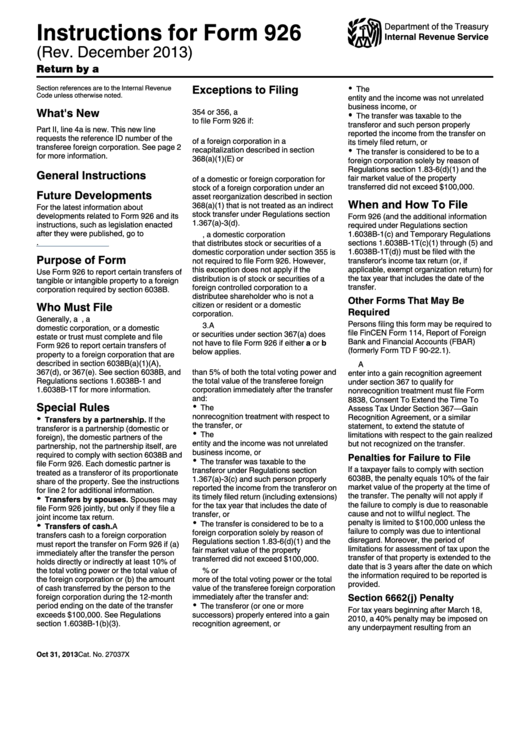

Instructions For Form 926 printable pdf download

Sign it in a few clicks. 1 a enter the total amount of the corporation’s money at the end of the Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Transferor of property to a foreign corporation, to report any. Web earned.

Fillable Form 926 Return By A U.s. Transferor Of Property To A

Download this form print this form more about the. Taxpayer must complete form 926, return by a u.s. Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to. Sign it in a few clicks. Web quick guide on how to complete form926.

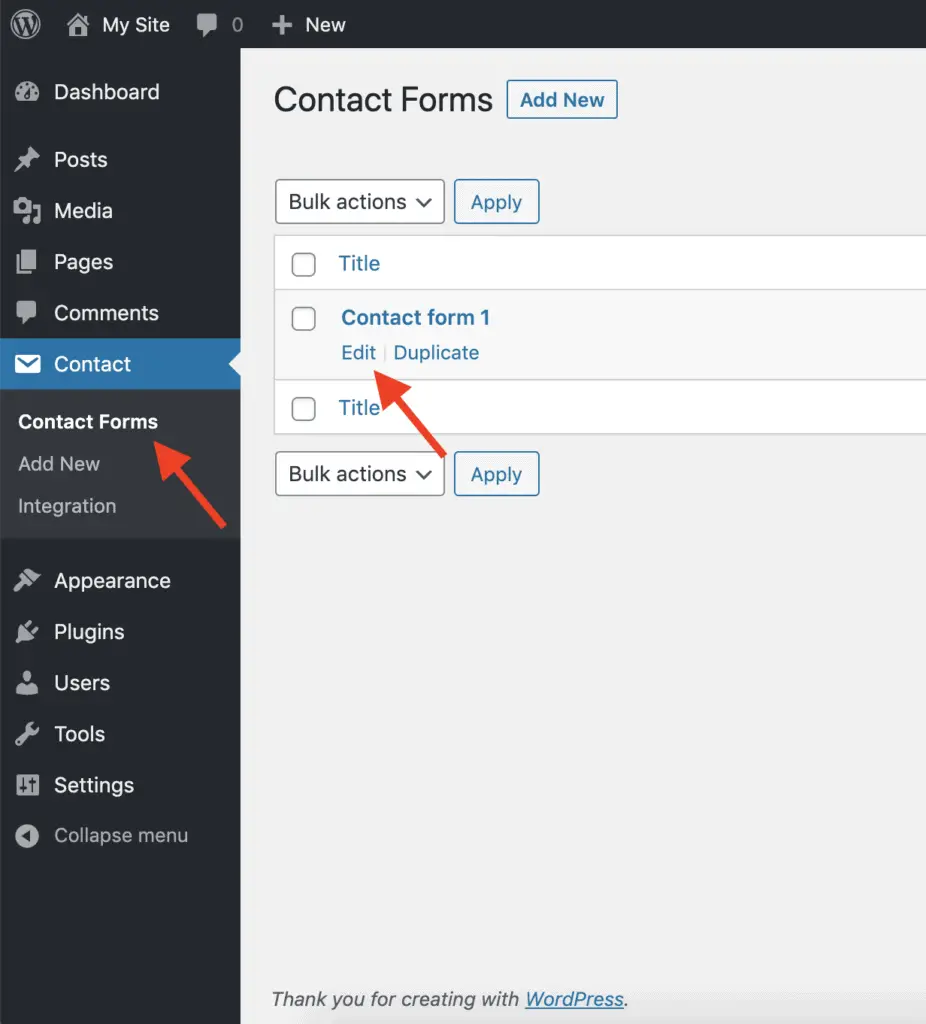

How To Add A Hidden Field In Contact Form 7? (With Default Value)

Web earned income tax credit (eitc) central | earned income tax credit December 2013) department of the treasury internal revenue service return by a u.s. Web check here if the form is being filed on behalf of an affiliated group described in section 1504(a). Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how.

Form 926 Return by a U.S. Transferor of Property to a Foreign

Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. This article will focus briefly on the. You do not need to report. Web report.

Transferor Stock Photos Free & RoyaltyFree Stock Photos from Dreamstime

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Download this form print this form more about the. Forget about scanning and printing out forms. Web this subsection of form 926 asks the preparer to provide basic information regarding transferees of property.

Web Form 926 Is A Very Complex Form.

The publication was updated to remind. As provided by the irs: 1 a enter the total amount of the corporation’s money at the end of the Web the form 926 is used to report certain transfers to foreign corporation.

Citizen Or Resident, A Domestic Corporation, Or A Domestic Estate Or Trust Must Complete And File Form 926 To Report Certain Transfers Of Property To A Foreign.

Edit your form 926 instructions online. Taxpayer must complete form 926, return by a u.s. Web this subsection of form 926 asks the preparer to provide basic information regarding transferees of property being transferred to a foreign corporation. December 2013) department of the treasury internal revenue service return by a u.s.

9 By The Internal Revenue Service.

Web information about form 926, return by a u.s. Use our detailed instructions to fill out and esign your documents online. You do not need to report. There are many technicalities, so it is recommended that you get advice from a tax professional if you need clarification on the instructions.

Web The Finalized Publication 926, Household Employer’s Tax Guide, Was Released Feb.

This article will focus briefly on the. Web to fulfill this reporting obligation, the u.s. Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Type text, add images, blackout confidential details, add comments, highlights and more.