Form 926 Instructions 2022

Form 926 Instructions 2022 - Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2021 12/14/2021 inst 940 It explains how to figure, pay, and report these taxes for your household employee. The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022. Web information about form 926, return by a u.s. Web october 25, 2022 resource center forms form 926 for u.s. Instructions for form 926, return by a u.s. Web yesno form 926 (rev. 9 by the internal revenue service. Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s.

It explains how to figure, pay, and report these taxes for your household employee. Web october 25, 2022 resource center forms form 926 for u.s. Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf: Web 01/03/2022 inst 926: Web the finalized publication 926, household employer’s tax guide, was released feb. Form 926 is used to report certain transfers of property to a foreign corporation. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging property to a foreign company. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: Instructions for form 926, return by a u.s. The experts at h&r block have your expat tax needs covered return by a u.s.

Web information about form 926, return by a u.s. Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2021 12/14/2021 inst 940 Instructions for form 941 (03/2023) instructions for form 941. The experts at h&r block have your expat tax needs covered return by a u.s. Citizen or resident, a domestic corporation, or a domestic estate or trust. Transferor of property to a foreign corporation It explains how to figure, pay, and report these taxes for your household employee. Web yesno form 926 (rev. Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. Web october 25, 2022 resource center forms form 926 for u.s.

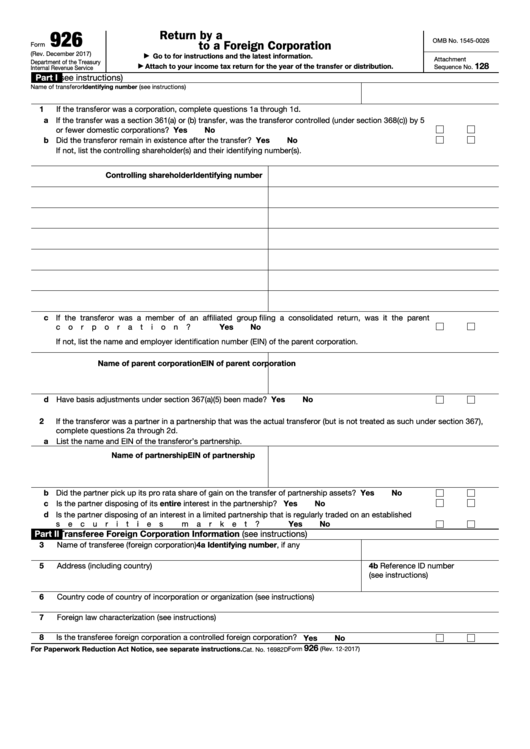

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Web yesno form 926 (rev. The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Transferor of property to a foreign corporation Citizen or resident, a domestic corporation, or.

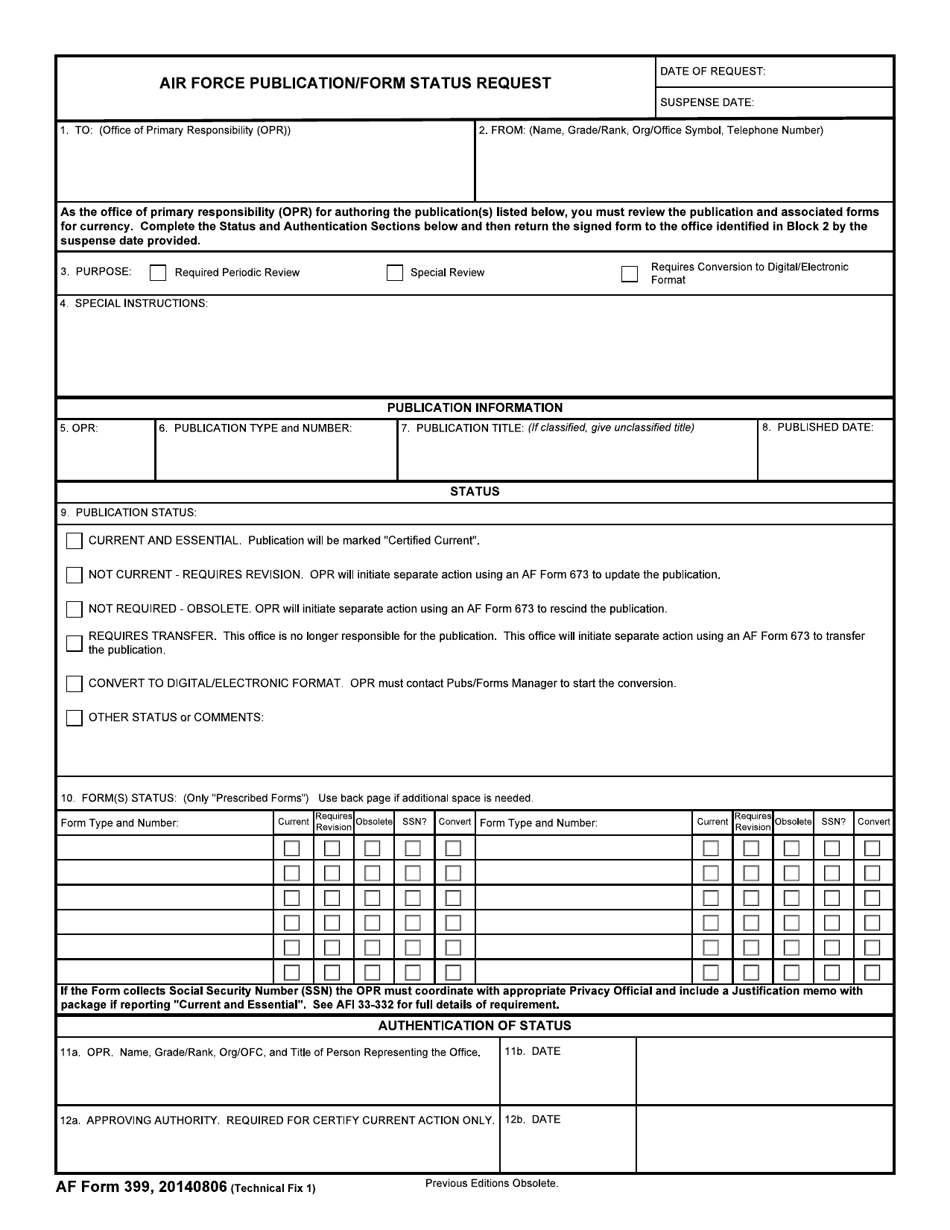

AF Form 399 Fill Out, Sign Online and Download Fillable PDF

Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf: Instructions for form 941 (03/2023) instructions for form 941. Web information about form 926, return by a u.s. Web this publication will help you decide whether you have a household employee and, if you do, whether you need to pay federal employment taxes (social security tax, medicare tax,.

Fillable Form 926 Return By A U.s. Transferor Of Property To A

Web information about form 926, return by a u.s. Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2021 12/14/2021 inst 940 Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report.

IRS Form 926 Everything You Need To Know

Web october 25, 2022 resource center forms form 926 for u.s. The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: The credits may only be claimed for wages paid for leave taken after march 31,..

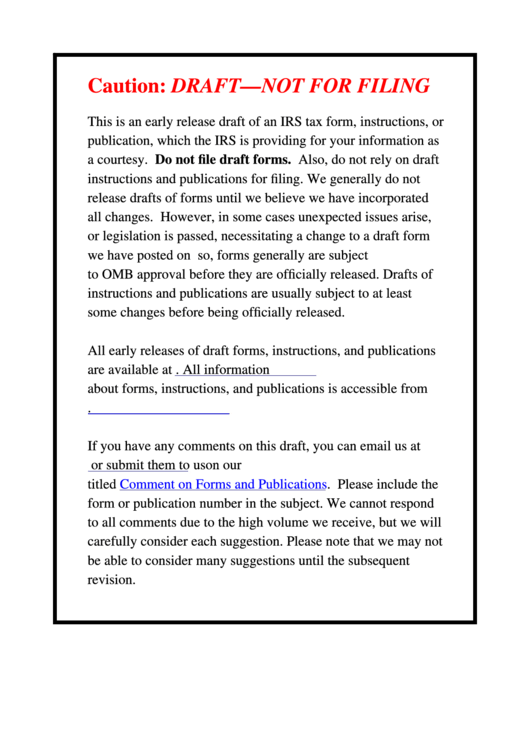

Instructions Draft For Form 926 Return By A U.s. Transferor Of

Web information about form 926, return by a u.s. Instructions for form 941 (03/2023) instructions for form 941. Transferor of property to a foreign corporation Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: The experts at h&r block have your expat tax needs covered return by a u.s.

Instructions For Form 926 2022 2023

Transferor of property to a foreign corporation Transferor of property to a foreign corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038b(a)(1)(a) of the internal revenue code to a foreign corporation. The credits may only be claimed for wages paid for leave taken after march 31,. Transferor of property to a.

926 instructions Fill out & sign online DocHub

Citizen or resident, a domestic corporation, or a domestic estate or trust. Transferor of property to a foreign corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038b(a)(1)(a) of the internal revenue code to a foreign corporation. Web the finalized publication 926, household employer’s tax guide, was released feb. Form 926 is.

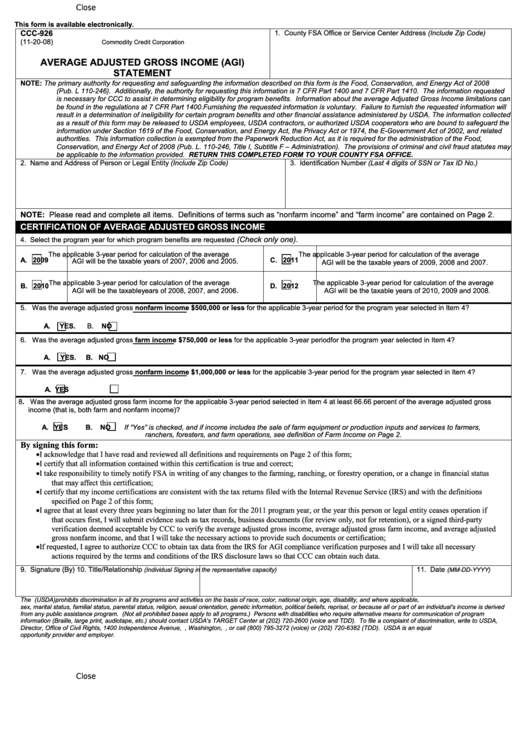

Fillable Form Ccc926 Average Adjusted Gross (Agi) Statement

The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022. 9 by the internal revenue service. The credits may only be claimed for wages paid for leave taken after march 31,. Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 (pr) instructions for form 940.

3911 Form 2022 2023 IRS Forms TaxUni

Instructions for form 926, return by a u.s. The credits may only be claimed for wages paid for leave taken after march 31,. Web this publication will help you decide whether you have a household employee and, if you do, whether you need to pay federal employment taxes (social security tax, medicare tax, futa tax, and federal income tax withholding)..

Form 926 Return by a U.S. Transferor of Property to a Foreign

Form 926 is used to report certain transfers of property to a foreign corporation. Web october 25, 2022 resource center forms form 926 for u.s. 9 by the internal revenue service. Transferor of property to a foreign corporation Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file.

Instructions For Form 926, Return By A U.s.

Web yesno form 926 (rev. Instructions for form 926, return by a u.s. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. It explains how to figure, pay, and report these taxes for your household employee.

Web October 25, 2022 Resource Center Forms Form 926 For U.s.

The credits may only be claimed for wages paid for leave taken after march 31,. Instructions for form 941 (03/2023) instructions for form 941. Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2021 12/14/2021 inst 940 Citizen or resident, a domestic corporation, or a domestic estate or trust.

Web Instructions For Form 926 (11/2018) Instructions For Form 926 (11/2018) I926.Pdf:

9 by the internal revenue service. Transferor of property to a foreign corporation Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. Web information about form 926, return by a u.s.

Web The Finalized Publication 926, Household Employer’s Tax Guide, Was Released Feb.

Transferor of property to a foreign corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038b(a)(1)(a) of the internal revenue code to a foreign corporation. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign corporation that are described in section 6038b (a) (1) (a), 367 (d), or 367 (e).