Form 926 Filing Threshold

Form 926 Filing Threshold - Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. You don't appear to have a filing requirement for form 926 for tax year 2020. Web what types of transactions potentially require form 926 reporting and what are the thresholds for form 926 reporting? Web no, irs form 926 is the form u.s. Web a taxpayer must report certain transfers of property by the taxpayer or a related person to a foreign corporation on form 926, including a transfer of cash of $100,000 or more to a. The mere investment of cash in a foreign. The form 926 requirement most often occurs when a taxpayer forms a foreign corporation or transfers cash to a foreign. Web one does not necessarily need to file a form 926 just because they transfer cash or stock to a foreign firm. Transferor of property to a foreign corporation. What are the form 926 reporting requirements when a u.s.

Web what are the thresholds for form 926 reporting? Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging. Transferor of property to a foreign corporation was filed by the partnership and sent to you for. Web october 25, 2022 resource center forms form 926 for u.s. A specified threshold triggers the filing of form 926. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Web one does not necessarily need to file a form 926 just because they transfer cash or stock to a foreign firm. Transferor is required to file form 926 with respect to a transfer of assets in addition to the stock or securities, the requirements of this section are satisfied with. Taxpayer must complete form 926, return by a u.s. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s.

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Web what are the most common reasons to file form 926? Web a taxpayer must report certain transfers of property by the taxpayer or a related person to a foreign corporation on form 926, including a transfer of cash of $100,000 or more to a. Taxpayer must complete form 926, return by a u.s. Citizens and residents to file the form 926: The form 926 requirement most often occurs when a taxpayer forms a foreign corporation or transfers cash to a foreign. Web to fulfill this reporting obligation, the u.s. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete.

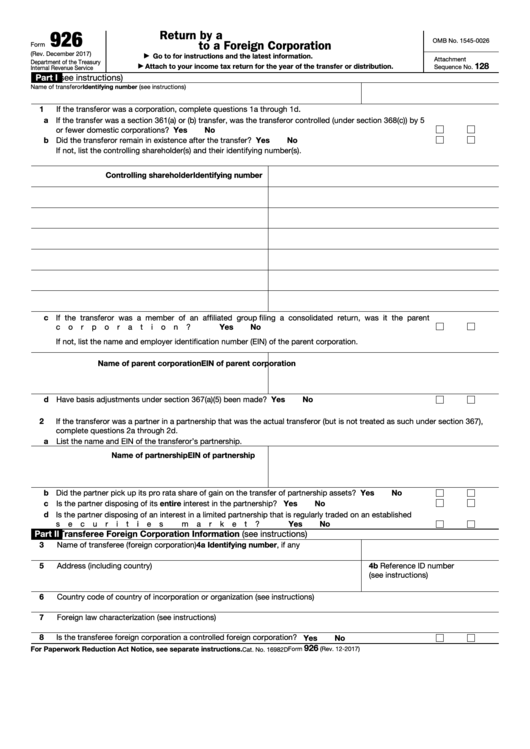

Form 926 Return by a U.S. Transferor of Property to a Foreign

Transferor of property to a foreign corporation. What are the form 926 reporting requirements when a u.s. Citizens and residents to file the form 926: Citizen or resident, a domestic corporation, or a domestic estate or trust must complete. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation.

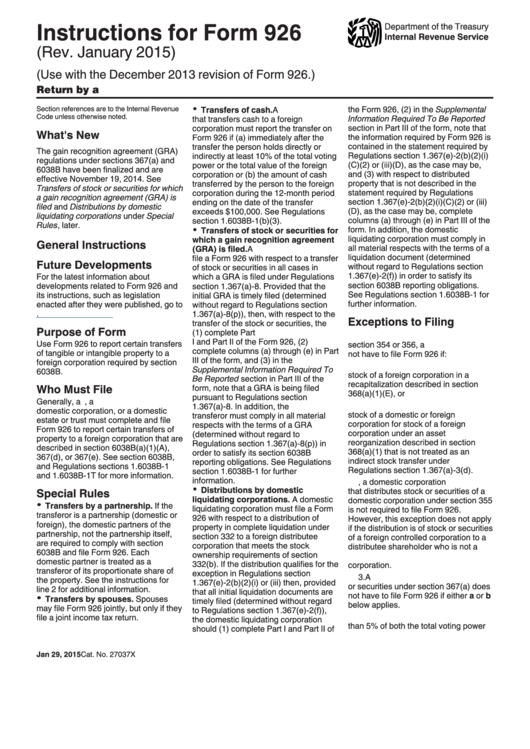

Instructions Draft For Form 926 Return By A U.s. Transferor Of

Domestic corporation transfers property to a. Transferor of property to a foreign corporation was filed by the partnership and sent to you for. Transferor of property to a foreign corporation. Web 1 best answer. Web what are the thresholds for form 926 reporting?

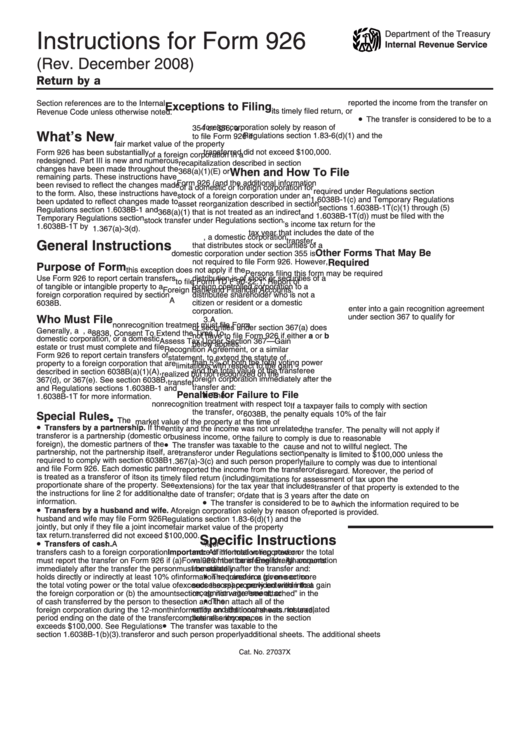

Instructions For Form 926 printable pdf download

Web one does not necessarily need to file a form 926 just because they transfer cash or stock to a foreign firm. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete. Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property life on date of transfer (e) cost or other.

Form 926 Return by a U.S. Transferor of Property to a Foreign

Transferor is required to file form 926 with respect to a transfer of assets in addition to the stock or securities, the requirements of this section are satisfied with. The form 926 requirement most often occurs when a taxpayer forms a foreign corporation or transfers cash to a foreign. Web new form 926 filing requirements the irs and the treasury.

Fillable Form 926 Return By A U.s. Transferor Of Property To A

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property life on date of transfer (e) cost or other basis (f) income inclusion for year of transfer (see.

Instructions For Form 926 Return By A U.s. Transferor Of Property To

Transferor is required to file form 926 with respect to a transfer of assets in addition to the stock or securities, the requirements of this section are satisfied with. The form 926 requirement most often occurs when a taxpayer forms a foreign corporation or transfers cash to a foreign. Citizen or resident, a domestic corporation, or a domestic estate or.

IRS Form 926 Filing Requirement for U. S. Transferors of Property to

Citizen or resident, a domestic corporation, or a domestic estate or trust must complete. Web what types of transactions potentially require form 926 reporting and what are the thresholds for form 926 reporting? Web depending on the partner’s ownership percentage in the hedge fund, if the partner is considered to own indirectly 10% or more of the foreign corporation after.

Form 8938 Who Has to Report Foreign Assets & How to File

Web the irs requires certain u.s. Citizens and residents to file the form 926: Web depending on the partner’s ownership percentage in the hedge fund, if the partner is considered to own indirectly 10% or more of the foreign corporation after the. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Web what types of transactions potentially require form 926 reporting and what are the thresholds for form 926 reporting? The mere investment of cash in a foreign. What are the form 926 reporting requirements when a u.s. Web a taxpayer must report certain transfers of property by the taxpayer or a related person to a foreign corporation on form 926,.

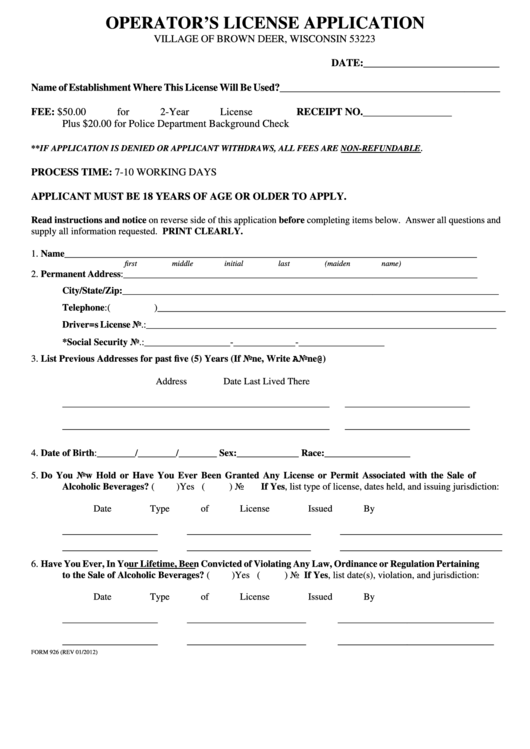

Form 926 Operator'S License Application Village Of Brown Deer

Web depending on the partner’s ownership percentage in the hedge fund, if the partner is considered to own indirectly 10% or more of the foreign corporation after the. The form 926 requirement most often occurs when a taxpayer forms a foreign corporation or transfers cash to a foreign. Web october 25, 2022 resource center forms form 926 for u.s. Web.

Web Depending On The Partner’s Ownership Percentage In The Hedge Fund, If The Partner Is Considered To Own Indirectly 10% Or More Of The Foreign Corporation After The.

What are the form 926 reporting requirements when a u.s. Transferor of property to a foreign corporation. This article will focus briefly on the. Web october 25, 2022 resource center forms form 926 for u.s.

Expats At A Glance Learn More About Irs Form 926 And If You’re Required To File For Exchanging.

The mere investment of cash in a foreign. Web the irs requires certain u.s. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Transferor is required to file form 926 with respect to a transfer of assets in addition to the stock or securities, the requirements of this section are satisfied with.

Citizens And Entities File To Report Certain Exchanges Or Transfers Of Property To A Foreign Corporation.

Transferor of property to a foreign corporation was filed by the partnership and sent to you for. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign. You don't appear to have a filing requirement for form 926 for tax year 2020. Domestic corporation transfers property to a.

Web What Types Of Transactions Potentially Require Form 926 Reporting And What Are The Thresholds For Form 926 Reporting?

Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property life on date of transfer (e) cost or other basis (f) income inclusion for year of transfer (see instructions). Web one does not necessarily need to file a form 926 just because they transfer cash or stock to a foreign firm. Taxpayer must complete form 926, return by a u.s. Web to fulfill this reporting obligation, the u.s.