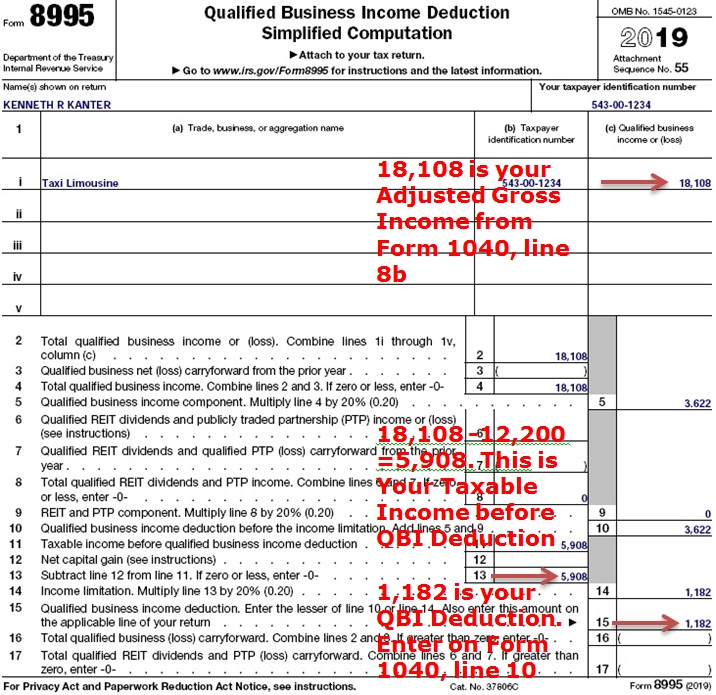

Form 8995 Line 11

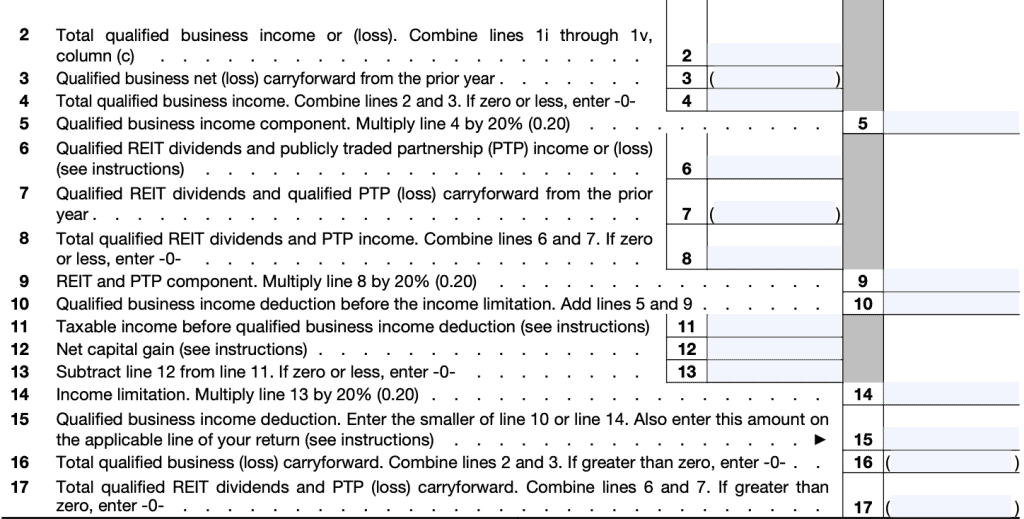

Form 8995 Line 11 - Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: See instructions.12 13 qualified business income deduction before patron reduction. Web handy tips for filling out 2020 8995 online. Web 1045 madison avenue #3b. First it was feb 5, then feb 12,. Web schedule 1, additional income and adjustments to income schedule 2, additional taxes schedule 3, additional payments and credits schedule 8812,. When attached to the esbt tax. Form 8995 is a document submitted with the tax return to show the amount of taxes owed on health coverage benefits. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or.

Enter the amount from line 26, if any. Go digital and save time with signnow, the best solution for. Web 1 best answer kathryng3 expert alumni it depends what was originally entered to determine what is reported as taxable income on line 11 of form 8995, it. Web 1045 madison avenue #3b. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web schedule 1, additional income and adjustments to income schedule 2, additional taxes schedule 3, additional payments and credits schedule 8812,. Web what is form 8995? Web handy tips for filling out 2020 8995 online. Intuit just has not given it priority and keeps pushing the date back.

Form 8995 is a document submitted with the tax return to show the amount of taxes owed on health coverage benefits. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web schedule 1, additional income and adjustments to income schedule 2, additional taxes schedule 3, additional payments and credits schedule 8812,. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web 1045 madison avenue #3b. Web there are two ways to calculate the qbi deduction: Web qualified business income deduction. • you have qbi, qualified reit dividends, or qualified ptp income or loss. Web 1 best answer kathryng3 expert alumni it depends what was originally entered to determine what is reported as taxable income on line 11 of form 8995, it. Can i use form 8995 for my business?

Do Your 2021 Tax Return Right with IRS VITA Certified EXPERTS for

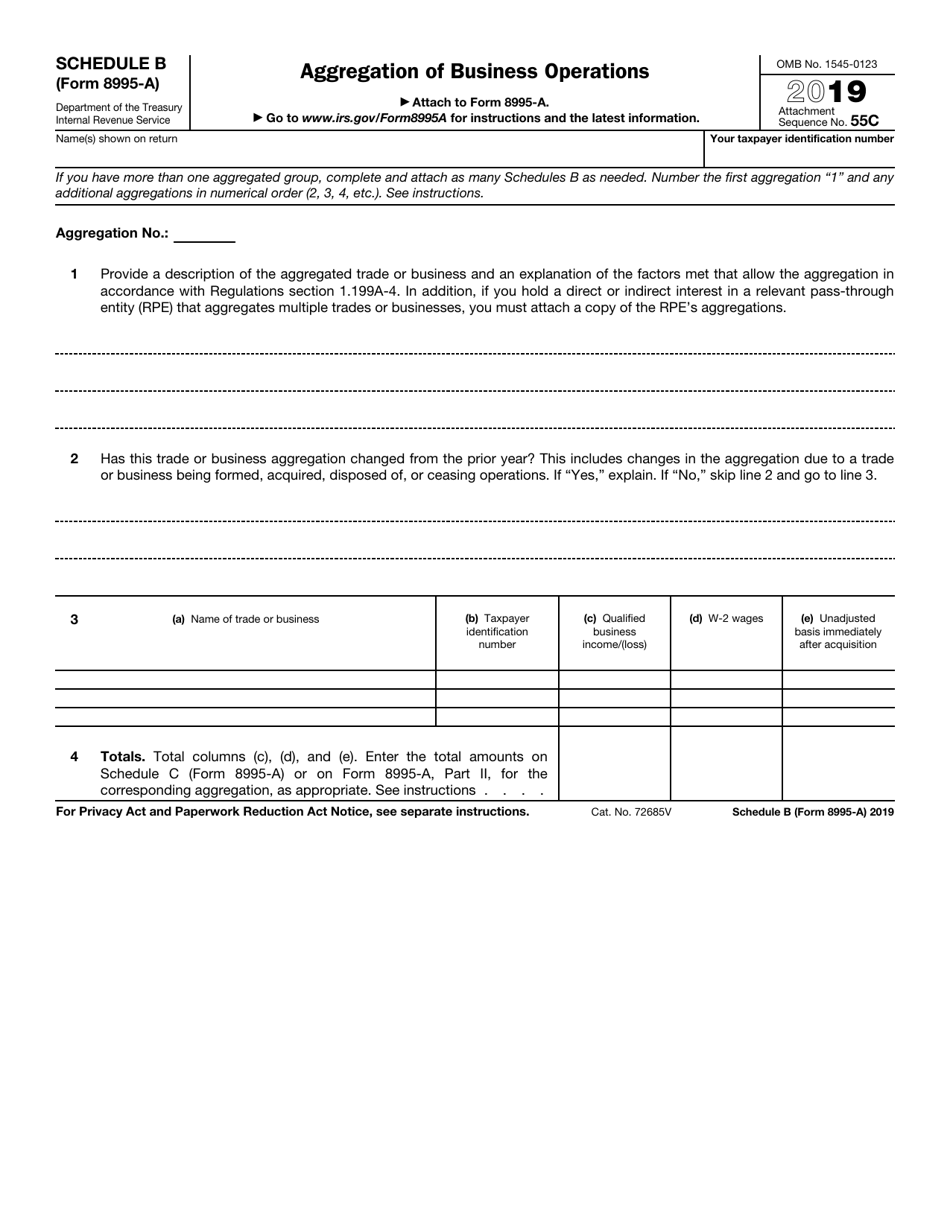

Go to www.irs.gov/form8995a for instructions and. Web there are two ways to calculate the qbi deduction: Printing and scanning is no longer the best way to manage documents. Web handy tips for filling out 2020 8995 online. Go digital and save time with signnow, the best solution for.

Fill Free fillable F8995a 2019 Form 8995A PDF form

Web there are two ways to calculate the qbi deduction: Web handy tips for filling out 2020 8995 online. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Enter the greater of line 11. Web schedule 1, additional income and adjustments to income schedule 2, additional taxes schedule 3, additional payments and credits schedule.

IRS Form 8995 Simplified Qualified Business Deduction

Web qualified business income deduction. Go digital and save time with signnow, the best solution for. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: • you have qbi, qualified reit dividends, or qualified ptp income or loss. Don’t worry about which form your return needs to use.

IRS Form 8995 Instructions Your Simplified QBI Deduction

Web form 8995 is the simplified form and is used if all of the following are true: Go to www.irs.gov/form8995a for instructions and. Go digital and save time with signnow, the best solution for. Enter the greater of line 11. Form 8995 is a document submitted with the tax return to show the amount of taxes owed on health coverage.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

• you have qbi, qualified reit dividends, or qualified ptp income or loss. First it was feb 5, then feb 12,. Form 8995 is a document submitted with the tax return to show the amount of taxes owed on health coverage benefits. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction.

Heartwarming Section 199a Statement A Irs Form 413

• you have qbi, qualified reit dividends, or qualified ptp income or loss. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Go to www.irs.gov/form8995a for instructions and. Web 1 best answer kathryng3 expert alumni it depends.

QBI gets 'formified'

Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Can i use form 8995 for my business? Web 1045 madison avenue #3b. Enter the amount from line 26, if any. Form 8995 is a document submitted with the tax return to show the amount of taxes owed on health coverage.

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Intuit just has not given it priority and keeps pushing the date back. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web 1 best answer kathryng3 expert alumni it depends what was originally entered to determine what is reported as taxable income on line 11 of form 8995, it. Web qualified business income.

Form 8995A Draft WFFA CPAs

Web schedule 1, additional income and adjustments to income schedule 2, additional taxes schedule 3, additional payments and credits schedule 8812,. Web 1045 madison avenue #3b. See instructions.12 13 qualified business income deduction before patron reduction. Go to www.irs.gov/form8995a for instructions and. Enter the amount from line 26, if any.

Form 8995 Basics & Beyond

Web 1 best answer kathryng3 expert alumni it depends what was originally entered to determine what is reported as taxable income on line 11 of form 8995, it. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). First it was feb 5, then feb 12,. Enter the amount from line 26,.

Enter The Amount From Line 26, If Any.

Go to www.irs.gov/form8995a for instructions and. Web 1 best answer kathryng3 expert alumni it depends what was originally entered to determine what is reported as taxable income on line 11 of form 8995, it. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web handy tips for filling out 2020 8995 online.

See Instructions.12 13 Qualified Business Income Deduction Before Patron Reduction.

Can i use form 8995 for my business? The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Don’t worry about which form your return needs to use. Intuit just has not given it priority and keeps pushing the date back.

Web Individuals And Eligible Estates And Trusts That Have Qbi Use Form 8995 To Figure The Qbi Deduction If:

Web form 8995 is the simplified form and is used if all of the following are true: Go digital and save time with signnow, the best solution for. Form 8995 is a document submitted with the tax return to show the amount of taxes owed on health coverage benefits. You have qbi, qualified reit dividends, or qualified ptp income or loss (all.

Web Individuals And Eligible Estates And Trusts That Have Qbi Use Form 8995 To Figure The Qbi Deduction If:

Web what is form 8995? Enter the greater of line 11. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. Web qualified business income deduction.