Form 8979 Instructions

Form 8979 Instructions - Then enter the amount of excluded (nontaxable) gain as a negative number. If the form 8985 you are submitting is related to an aar filing, the form 8979 should be included with the form. Web information about all forms, instructions, and pubs is at irs.gov/forms. Use this form 8879 (rev. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. Filers should rely on this update when filing form 8979. Any year that you have to report a capital asset transaction, you’ll need to prepare form 8949 before filling out schedule d unless. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Complete part ii, section a and part iii, section b.

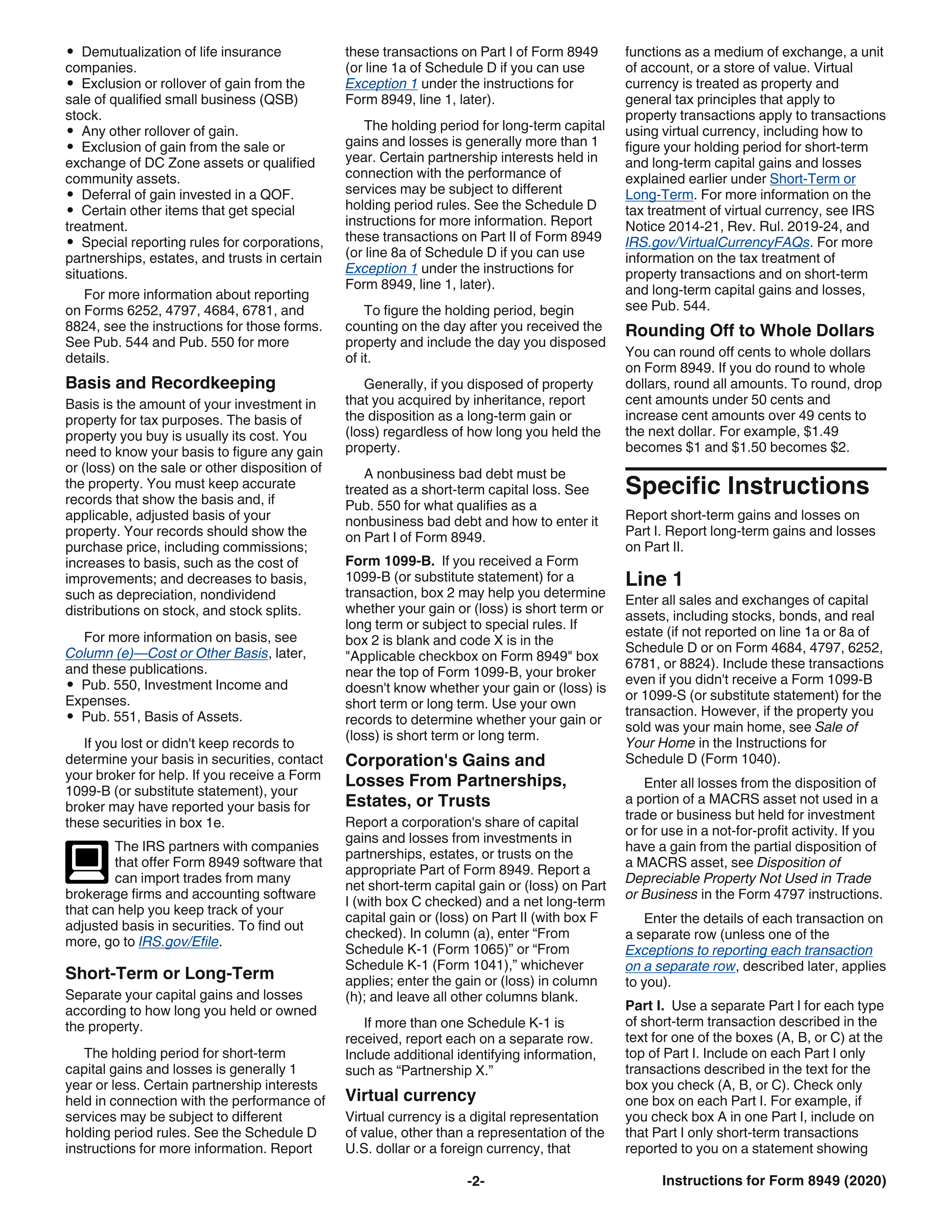

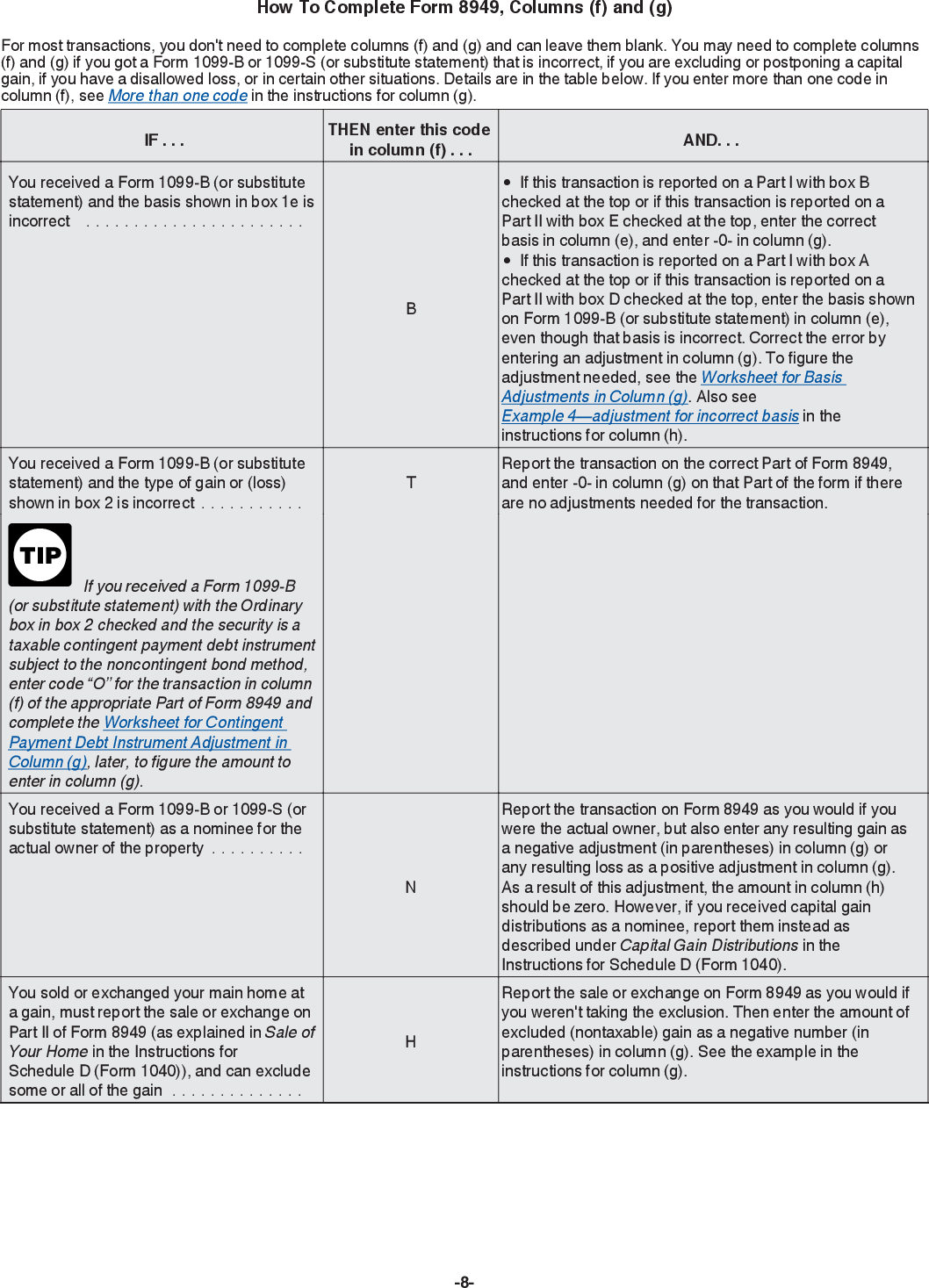

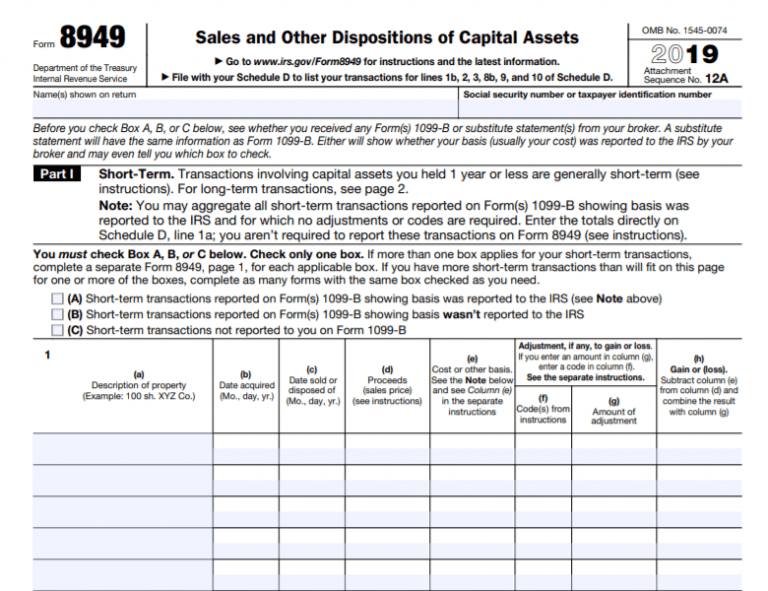

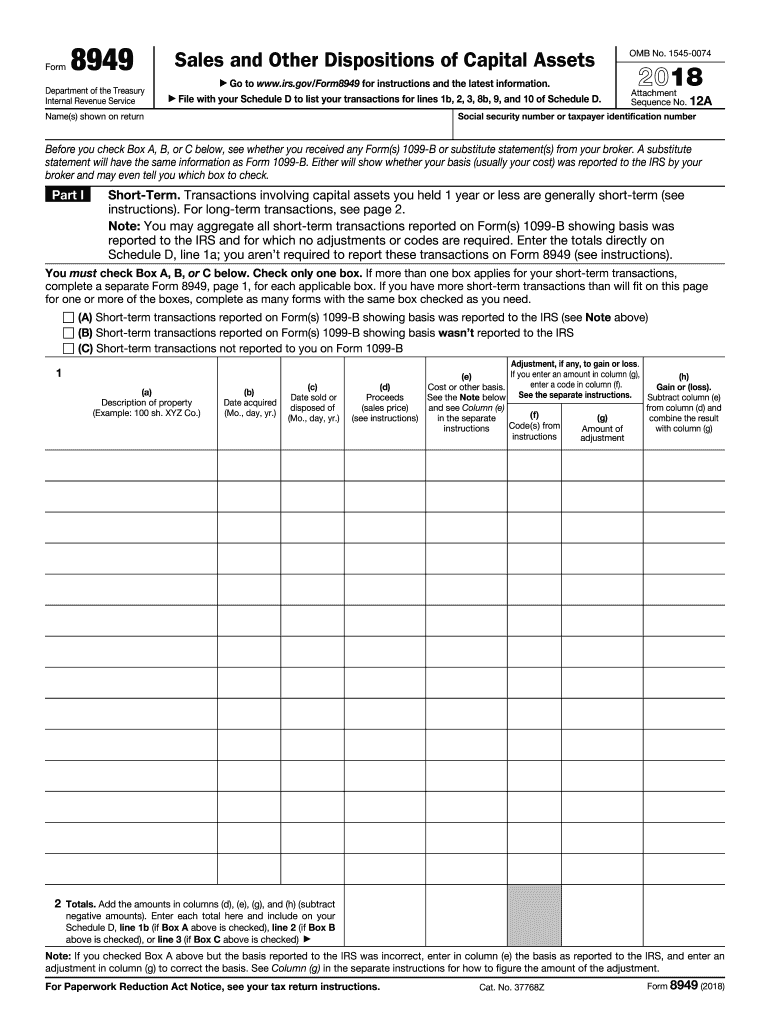

Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Web general instructions file form 8949 with the schedule d for the return you are filing. Then enter the amount of excluded (nontaxable) gain as a negative number. Use this form 8879 (rev. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. Web form 8949 is used to list all capital gain and loss transactions. Web to make a change, submit a form 8979 authorizing the change. For example, the form 1040 page is. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Web preparing schedule d and 8949.

Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. Web form 8949 is used to list all capital gain and loss transactions. Web general instructions file form 8949 with the schedule d for the return you are filing. Web designating an individual partnership representative. Any year that you have to report a capital asset transaction, you’ll need to prepare form 8949 before filling out schedule d unless. Web to make a change, submit a form 8979 authorizing the change. Complete part ii, section a and part iii, section b. These changes will be included in the next revision. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Web use form 8949 to report sales and exchanges of capital assets.

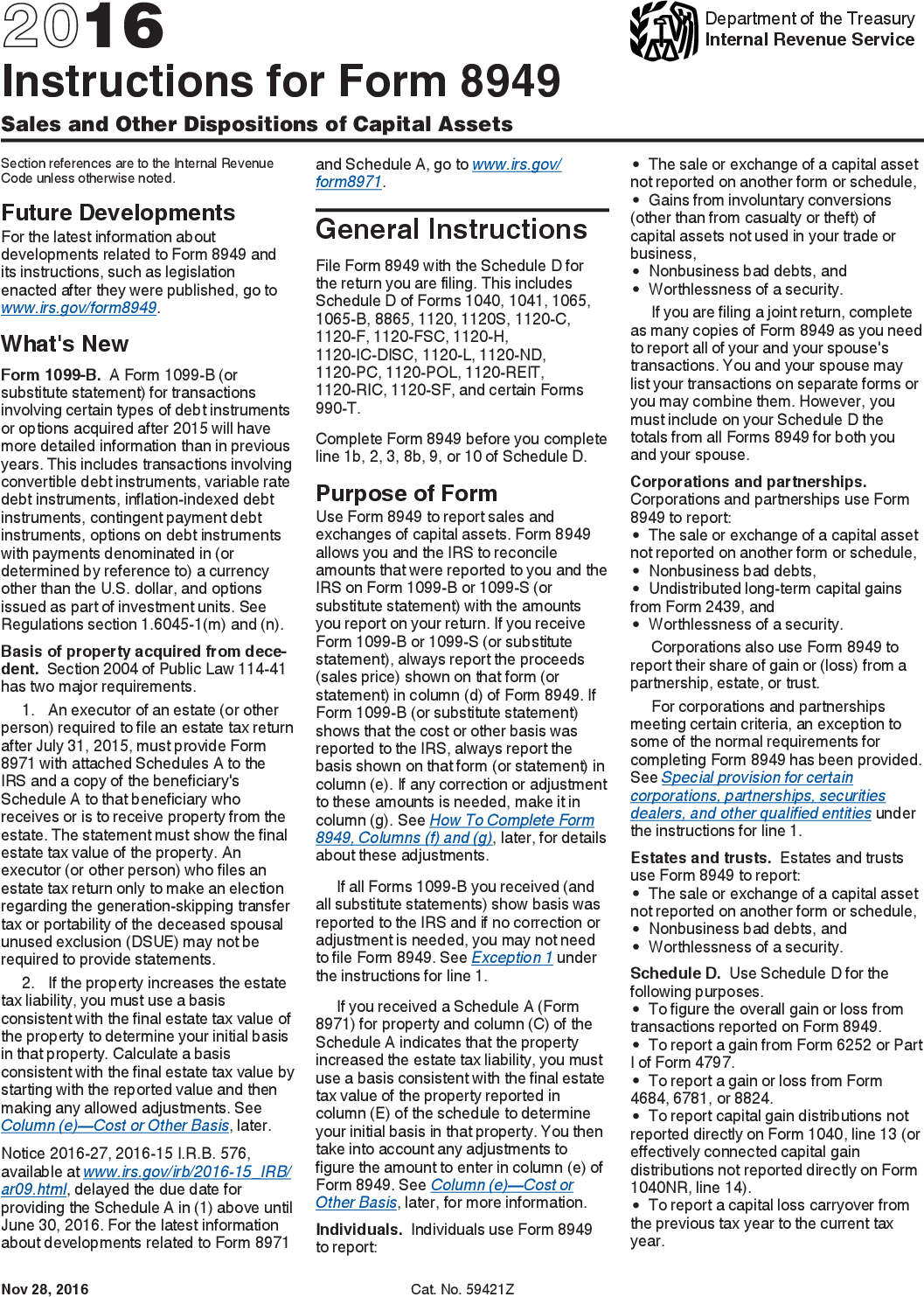

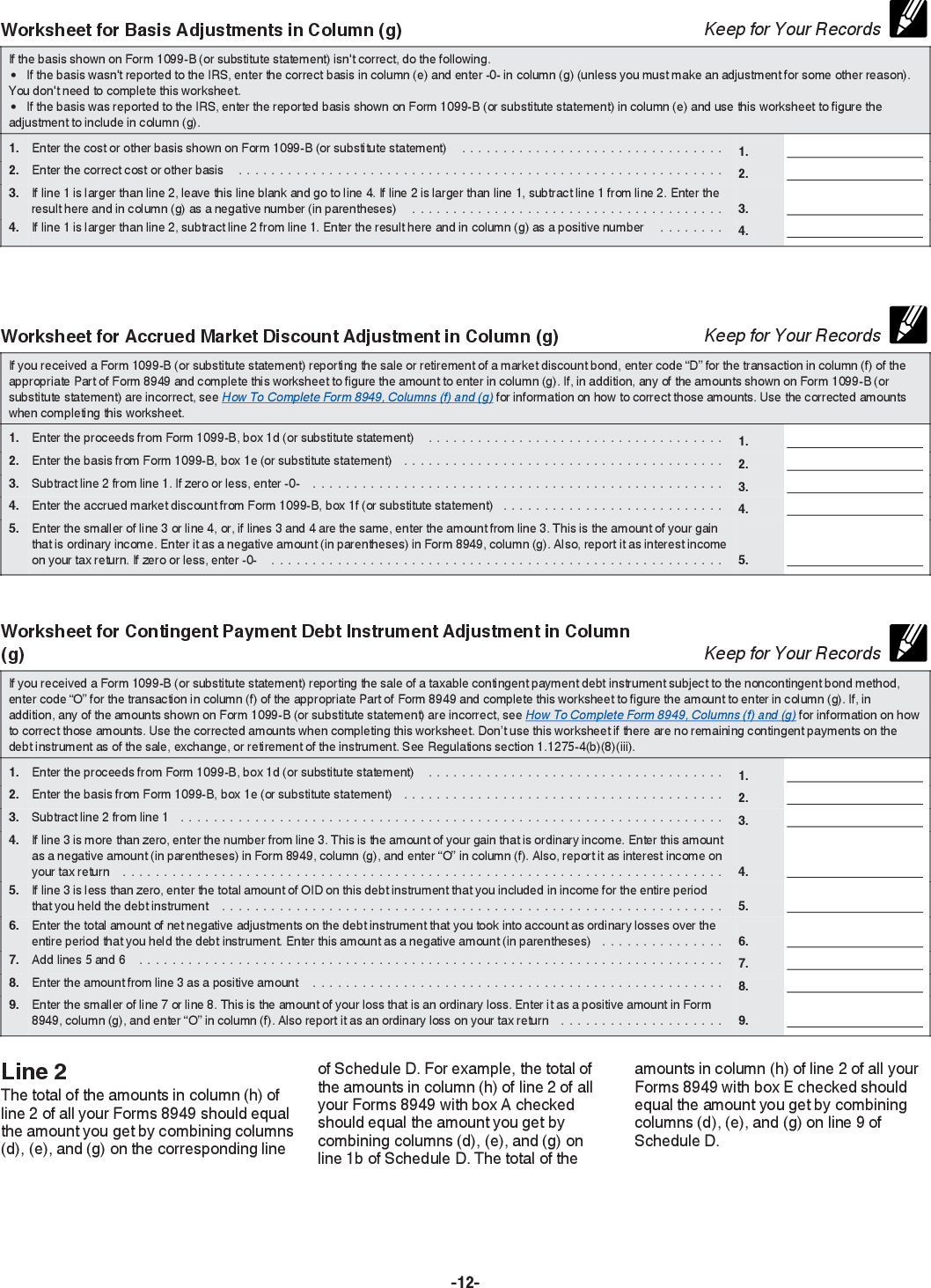

IRS Form 8949 instructions.

Almost every form and publication also has its own page on irs.gov. Web designating an individual partnership representative. Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. These changes will be included in the next revision. Use this form 8879 (rev.

In the following Form 8949 example,the highlighted section below shows

Web preparing schedule d and 8949. Filers should rely on this update when filing form 8979. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. Web information about all forms, instructions, and pubs is at irs.gov/forms. Use this form 8879 (rev.

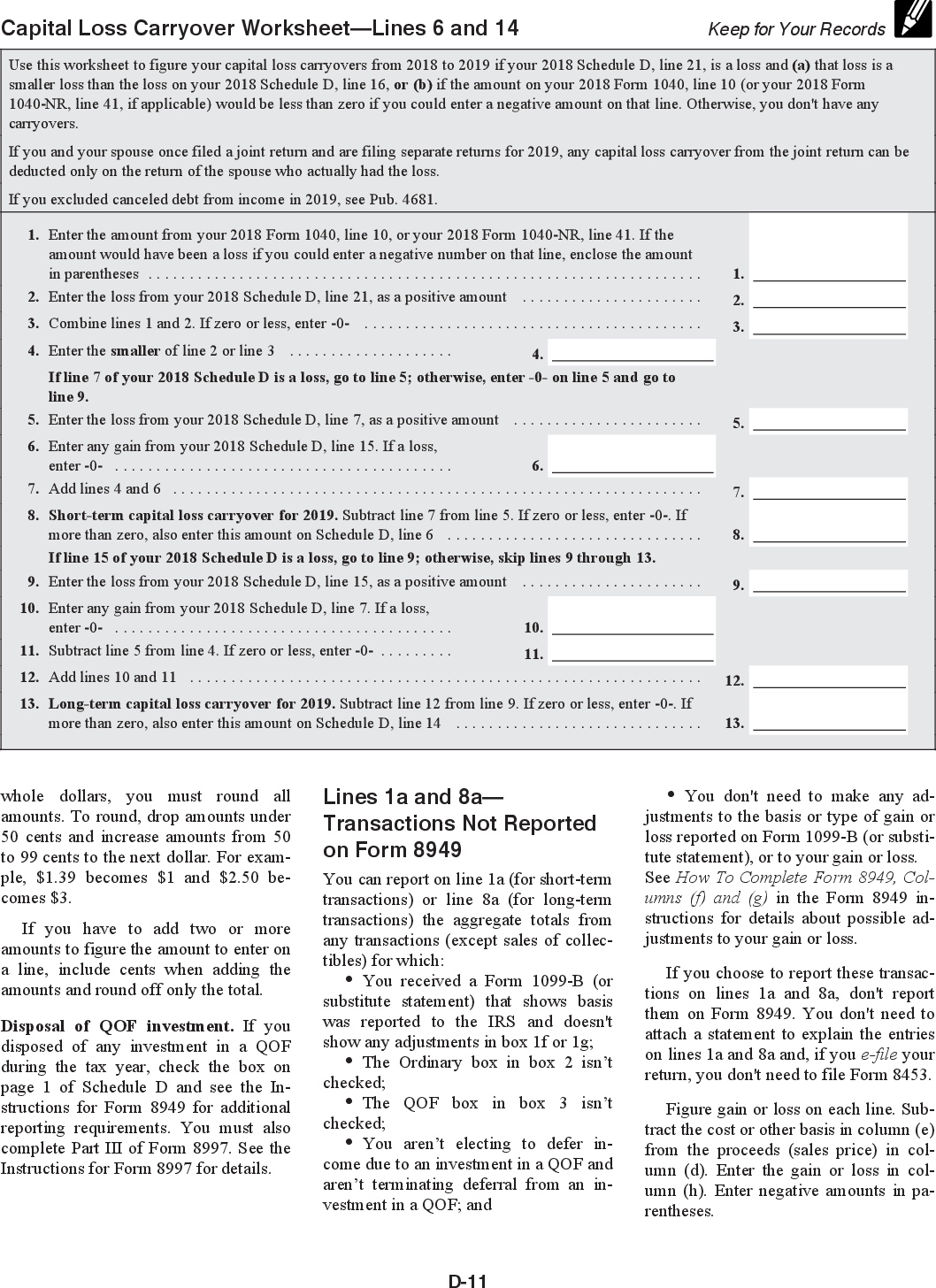

IRS Schedule D instructions.

Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. Web form 8949 is used to list all capital gain and loss transactions. You will need to enter it as two. Web information about all forms, instructions, and pubs is at irs.gov/forms. Web report.

irs form 8949 instructions 2022 Fill Online, Printable, Fillable

Complete part ii, section a and part iii, section b. Almost every form and publication also has its own page on irs.gov. Use this form 8879 (rev. These changes will be included in the next revision. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion.

IRS Form 8949 instructions.

Web information about all forms, instructions, and pubs is at irs.gov/forms. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Filers should rely on this update when filing form 8979. If the form 8985 you are submitting is related to an aar filing, the form 8979 should be included with.

Online generation of Schedule D and Form 8949 for 10.00

Then enter the amount of excluded (nontaxable) gain as a negative number. Web information about all forms, instructions, and pubs is at irs.gov/forms. Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Complete part ii, section a and part iii, section b. You will need to enter it as two.

Online generation of Schedule D and Form 8949 for 10.00

Web form 8949 is used to list all capital gain and loss transactions. Web to make a change, submit a form 8979 authorizing the change. Web information about all forms, instructions, and pubs is at irs.gov/forms. Any year that you have to report a capital asset transaction, you’ll need to prepare form 8949 before filling out schedule d unless. Web.

Online generation of Schedule D and Form 8949 for 10.00

For the main home sale exclusion, the code is h. Web use form 8949 to report sales and exchanges of capital assets. Complete part ii, section a and part iii, section b. Filers should rely on this update when filing form 8979. Web general instructions file form 8949 with the schedule d for the return you are filing.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Web general instructions file form 8949 with the schedule d for the return you are filing. Complete part ii, section a and part iii, section b. Any year that you have to report a capital asset transaction, you’ll need to prepare form 8949 before filling out schedule d unless. For the main home sale exclusion, the code is h. Web.

Form 8949 Fill Out and Sign Printable PDF Template signNow

Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership. These changes will be included in the next revision. Sign part iv, section a. Complete part ii, section a and part iii, section b. Web designating an individual partnership representative.

Any Year That You Have To Report A Capital Asset Transaction, You’ll Need To Prepare Form 8949 Before Filling Out Schedule D Unless.

Web report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Filers should rely on this update when filing form 8979. Web this update supplements the instructions for form 8979. Web form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated individual, or designate a partnership.

Web Designating An Individual Partnership Representative.

Almost every form and publication also has its own page on irs.gov. Complete part ii, section a and part iii, section b. Web use form 8949 to report sales and exchanges of capital assets. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form.

For The Main Home Sale Exclusion, The Code Is H.

Web information about all forms, instructions, and pubs is at irs.gov/forms. Web general instructions file form 8949 with the schedule d for the return you are filing. Web preparing schedule d and 8949. Web form 8949 is used to list all capital gain and loss transactions.

Web Form 8979 Is Used To Revoke A Partnership Representative Or Designated Individual, Resign As A Partnership Representative Or Designated Individual, Or Designate A Partnership.

Web the workflow to enter an election to defer tax on eligible gain by investing in a qof in the program mirrors the form 8949 instructions. You will need to enter it as two. For example, the form 1040 page is. Then enter the amount of excluded (nontaxable) gain as a negative number.