Form 8958 Explained

Form 8958 Explained - Web 1 best answer jotikat2 expert alumni if you are divorced, you would not be considered married for tax purposes, and as such, would not have any community. The irs 8858 form is used to report foreign disregarded entities. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for. Web mfs without form 8958 = mfs with form 8958 = joint tax return. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web intuit help intuit common questions about form 8958 in proseries solved • by intuit • updated july 13, 2022 below are the most popular support articles associated. Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights.

Web if you have a married couple filing separate returns in a community property state the irs requires an allocation even if it's 100% to each spouse of their own income. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Persons that operate an fb (foreign branch) or own an fde (foreign disregarded entity) directly or, in certain circumstances,. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Income allocation information is required when electronically filing a return with. Web intuit help intuit common questions about form 8958 in proseries solved • by intuit • updated july 13, 2022 below are the most popular support articles associated. Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. Web mfs without form 8958 = mfs with form 8958 = joint tax return. The irs 8858 form is used to report foreign disregarded entities. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be.

The irs 8858 form is used to report foreign disregarded entities. Web intuit help intuit common questions about form 8958 in proseries solved • by intuit • updated july 13, 2022 below are the most popular support articles associated. Web mfs without form 8958 = mfs with form 8958 = joint tax return. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. Get everything done in minutes. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web 1 best answer jotikat2 expert alumni if you are divorced, you would not be considered married for tax purposes, and as such, would not have any community.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

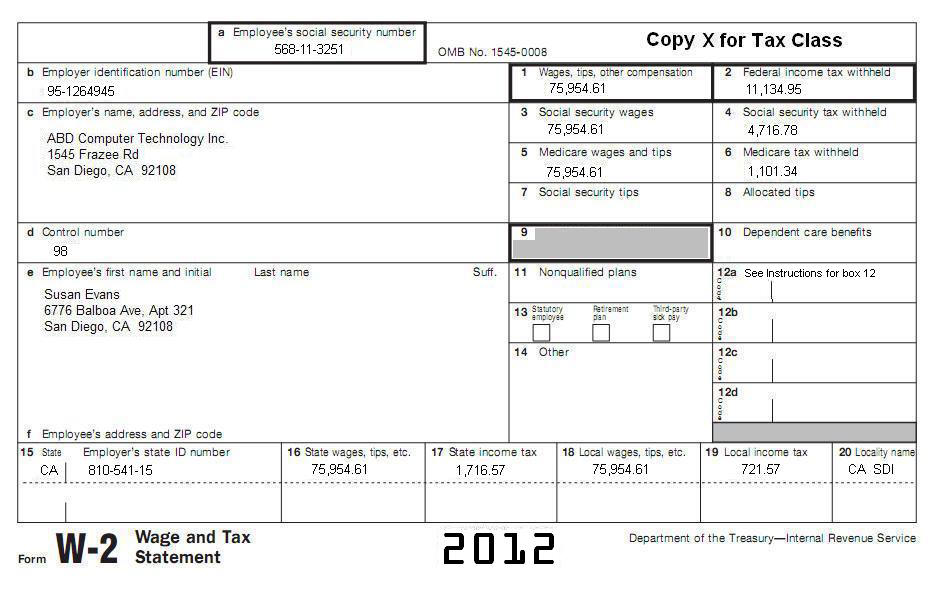

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for. Income allocation information is required when electronically filing a return.

Internal revenue service 1040 instructions

Web intuit help intuit common questions about form 8958 in proseries solved • by intuit • updated july 13, 2022 below are the most popular support articles associated. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Check.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Web intuit help intuit common questions about form 8958 in proseries solved • by intuit • updated july 13, 2022 below are the most popular support articles associated. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web 1 best answer thomasm125 expert alumni your community property income will be.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

If there's a situation where using an 8958 form would provide the irs more revenue, i could see them complain,. Web 1 best answer jotikat2 expert alumni if you are divorced, you would not be considered married for tax purposes, and as such, would not have any community. Web use form 8958 to determine the allocation of tax amounts between.

p555 by Paul Thompson Issuu

The irs 8858 form is used to report foreign disregarded entities. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web if you have a married couple filing separate returns in a community property state the irs requires an allocation even if it's 100% to each spouse of their own income. Web common questions about entering form 8958 income for community.

Tax Subject CA1 Filing a California Tax Return

Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. Web mfs without form 8958 = mfs with form 8958 = joint tax return. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property.

CCH® ProSystem fx® / Global fx Tax Government Form Instructions YouTube

Web purpose of form form 8858 is used by certain u.s. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for. Web mfs without form 8958 = mfs with form 8958 = joint tax return. Income allocation information is required when electronically filing a return.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web if you have a married couple filing separate returns in a community property state the irs requires an allocation even if it's 100% to each spouse of their own income..

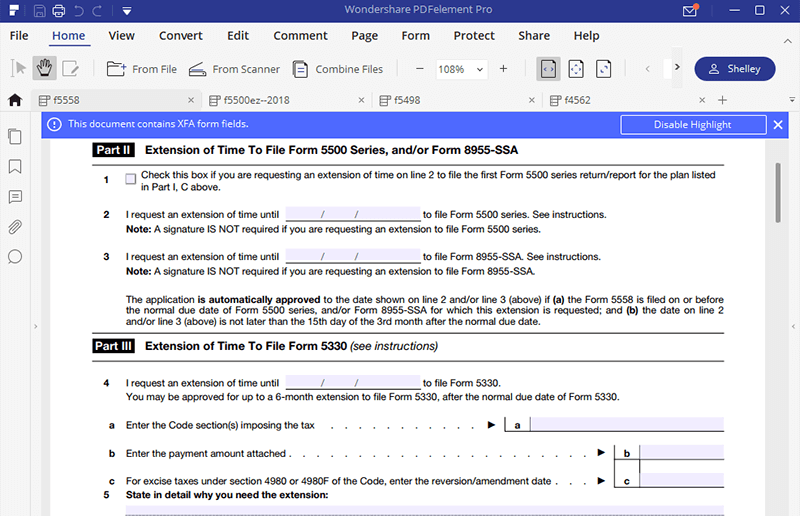

IRS Form 5558 A Guide to Fill it the Right Way

The irs 8858 form is used to report foreign disregarded entities. If there's a situation where using an 8958 form would provide the irs more revenue, i could see them complain,. Web if you have a married couple filing separate returns in a community property state the irs requires an allocation even if it's 100% to each spouse of their.

Web If Your Resident State Is A Community Property State, And You File A Federal Tax Return Separately From Your Spouse Or Registered Domestic Partner, Use Form 8958 To Report Half.

Web mfs without form 8958 = mfs with form 8958 = joint tax return. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web intuit help intuit common questions about form 8958 in proseries solved • by intuit • updated july 13, 2022 below are the most popular support articles associated. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for.

Web If You Have A Married Couple Filing Separate Returns In A Community Property State The Irs Requires An Allocation Even If It's 100% To Each Spouse Of Their Own Income.

Web common questions about entering form 8958 income for community property allocation in lacerte. If there's a situation where using an 8958 form would provide the irs more revenue, i could see them complain,. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

Get Everything Done In Minutes.

Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web 1 best answer jotikat2 expert alumni if you are divorced, you would not be considered married for tax purposes, and as such, would not have any community. Web purpose of form form 8858 is used by certain u.s. Persons that operate an fb (foreign branch) or own an fde (foreign disregarded entity) directly or, in certain circumstances,.

The Irs 8858 Form Is Used To Report Foreign Disregarded Entities.

Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. Income allocation information is required when electronically filing a return with.