Form 8949 Exception To Reporting

Form 8949 Exception To Reporting - In the send pdf attachment with federal return. Form 8949 is not required for certain transactions. In field return select tax return. Go to edit > electronic filing attachments. The transactions taxpayers must report on form 8949. In field product select federal. Form 8949 is a list of every transaction, including its cost basis,. The sale or exchange of a capital asset not reported on another form or schedule, gains from involuntary conversions (other than from. Web see exception 1 under the instructions for line 1. Web to attach the statement for form 8949 do the following:

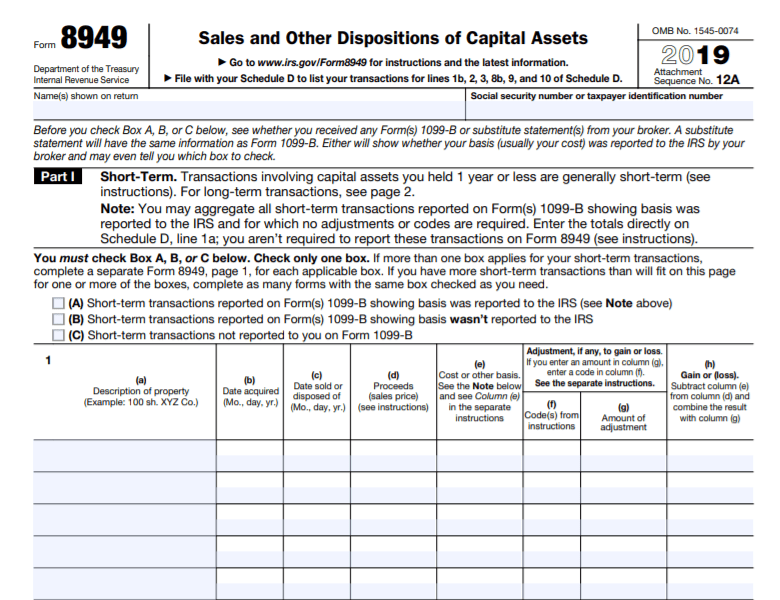

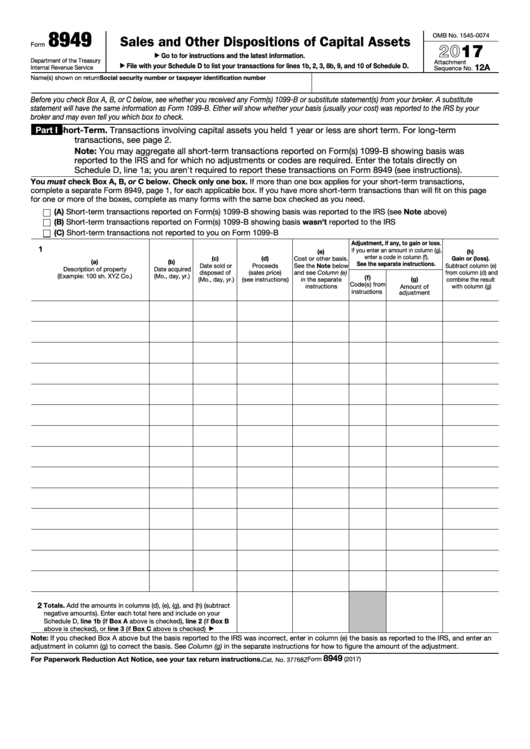

Web schedule d, line 1a; Web but before you can enter the net gain or loss on schedule d, you have to fill out the irs form 8949. Web to attach the statement for form 8949 do the following: Form 8949 isn't required for certain transactions. Web individuals use form 8949 to report: Form 8949 is a list of every transaction, including its cost basis,. Web select form 8949 exception reporting statement. You aren’t required to report these transactions on form 8949 (see instructions). Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). Web click the add button.

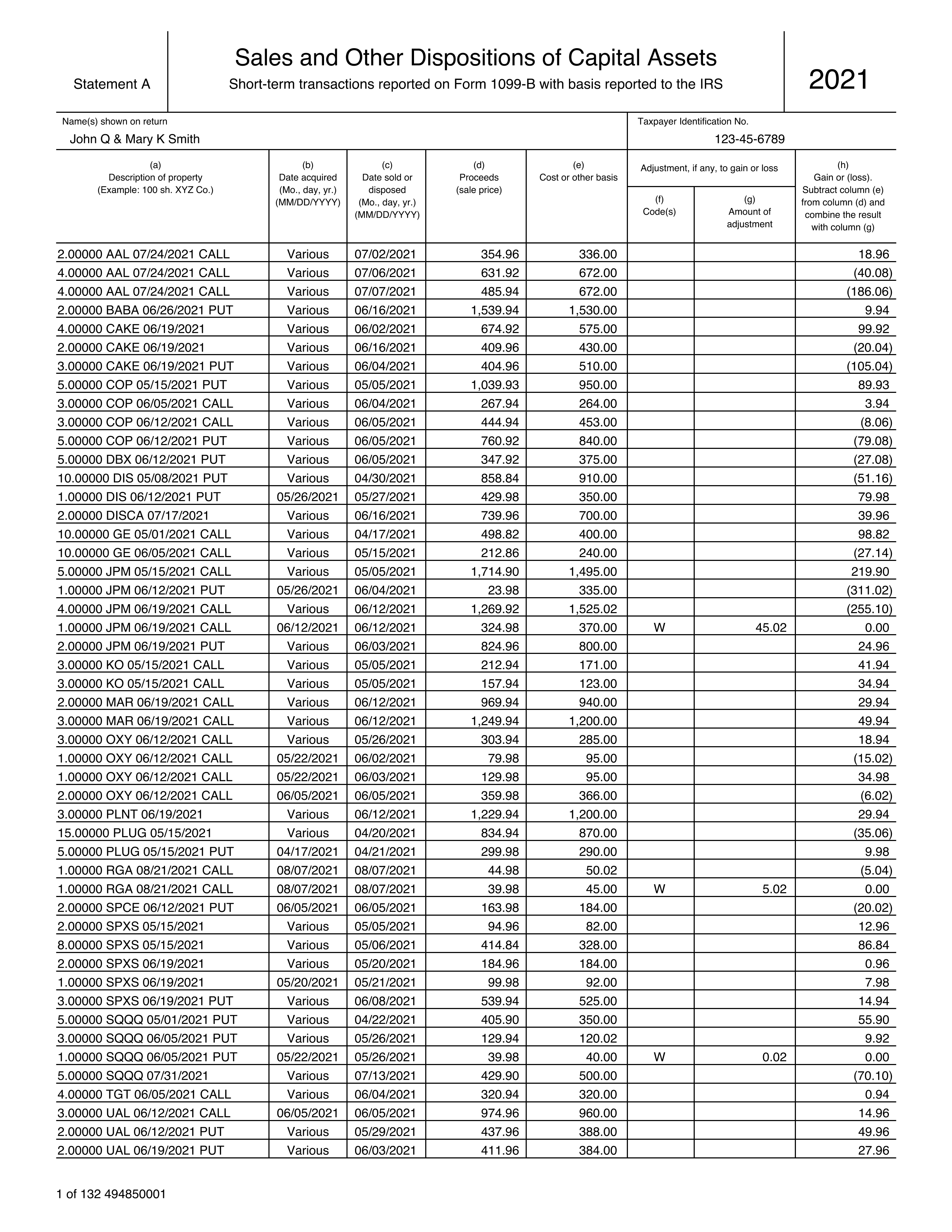

Web schedule d, line 1a; Web click the add button. Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. The sale or exchange of any capital asset that’s not reported on another form or schedule gains. Check box (a), (b) or (c) to indicate if basis was. In the return field, select tax return, if not already entered. In field product select federal. Go to edit > electronic filing attachments. Rather than using the actual form 8949, exception 2 of the irs instructions for form 8949 allows taxpayers to attach a. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss.

In the following Form 8949 example,the highlighted section below shows

The sale or exchange of any capital asset that’s not reported on another form or schedule gains. Once you have attached the pdf documents and linked to form 8949 exception reporting. Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). In field product select federal. Form 8949 exception reporting statement.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Web to attach the statement for form 8949 do the following: The sale or exchange of a capital asset not reported on another form or schedule, gains from involuntary conversions (other than from. You aren’t required to report these transactions on form 8949 (see instructions). Web make sure it's ok to bypass form 8949. In field product select federal.

Online IRS Instructions 8949 2018 2019 Fillable and Editable PDF

Form 8949 is not required for certain transactions. In the send pdf attachment with federal return. Once you have attached the pdf documents and linked to form 8949 exception reporting. You aren’t required to report these transactions on form 8949 (see instructions). Web per the irs, you'll use form 8949 to report the following:

Form 8949 Sales and Other Dispositions of Capital Assets (2014) Free

Web individuals use form 8949 to report: In the return field, select tax return, if not already entered. Web to attach the statement for form 8949 do the following: Web select form 8949 exception reporting statement. The transactions taxpayers must report on form 8949.

Form 8949 Exception 2 When Electronically Filing Form 1040

Form 8949 isn't required for certain transactions. Web per the irs, you'll use form 8949 to report the following: You aren’t required to report these transactions on form 8949 (see instructions). You may be able to. The sale or exchange of a capital asset not reported on another form or schedule, gains from involuntary conversions (other than from.

2016 Form 8949 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8949 isn't required for certain transactions. Form 8949 exception reporting statement. The sale or exchange of any capital asset that’s not reported on another form or schedule gains. Web schedule d, line 1a; Web individuals use form 8949 to report:

Form 8949 and Sch. D diagrams How are capital gains taxed when I sell

Web see exception 1 under the instructions for line 1. Web per the irs, you'll use form 8949 to report the following: When i requested a csv file, i see just little less than 2000 lines. Form 8949 isn't required for certain transactions. Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added).

Fillable Form 8949 Sales And Other Dispositions Of Capital Assets

Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. Web make sure it's ok to bypass form 8949. Web click the add button. Web but before you can enter the net gain or loss on schedule d, you have to fill out the irs form 8949. Check box (a), (b).

File IRS Form 8949 to Report Your Capital Gains or Losses

Form 8949 is a list of every transaction, including its cost basis,. In the return field, select tax return, if not already entered. Web but before you can enter the net gain or loss on schedule d, you have to fill out the irs form 8949. Web in the link to form (defaults to main form) field, click on sch.

Form 8949 Instructions & Information on Capital Gains/Losses Form

Form 8949 is not required for certain transactions. Check box a, b, or. Web select form 8949 exception reporting statement. When i requested a csv file, i see just little less than 2000 lines. Once you have attached the pdf documents and linked to form 8949 exception reporting.

Web 2 I Have Been Trading In 2017 On Robinhood.

Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. Covered activities (showing basis on the 1099b) only need to be reported in total and not broken. Form 8949 exception reporting statement. Go to edit > electronic filing attachments.

When I Requested A Csv File, I See Just Little Less Than 2000 Lines.

Once you have attached the pdf documents and linked to form 8949 exception reporting. Web in the link to form (defaults to main form) field, click on sch d/form 8949. The sale or exchange of any capital asset that’s not reported on another form or schedule gains. Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added).

You May Be Able To.

Rather than using the actual form 8949, exception 2 of the irs instructions for form 8949 allows taxpayers to attach a. Form 8949 is not required for certain transactions. Web click the add button. In field return select tax return.

The Sale Or Exchange Of A Capital Asset Not Reported On Another Form Or Schedule, Gains From Involuntary Conversions (Other Than From.

Check box a, b, or. Web see exception 1 under the instructions for line 1. Web schedule d, line 1a; Web but before you can enter the net gain or loss on schedule d, you have to fill out the irs form 8949.