Form 8949 Code H

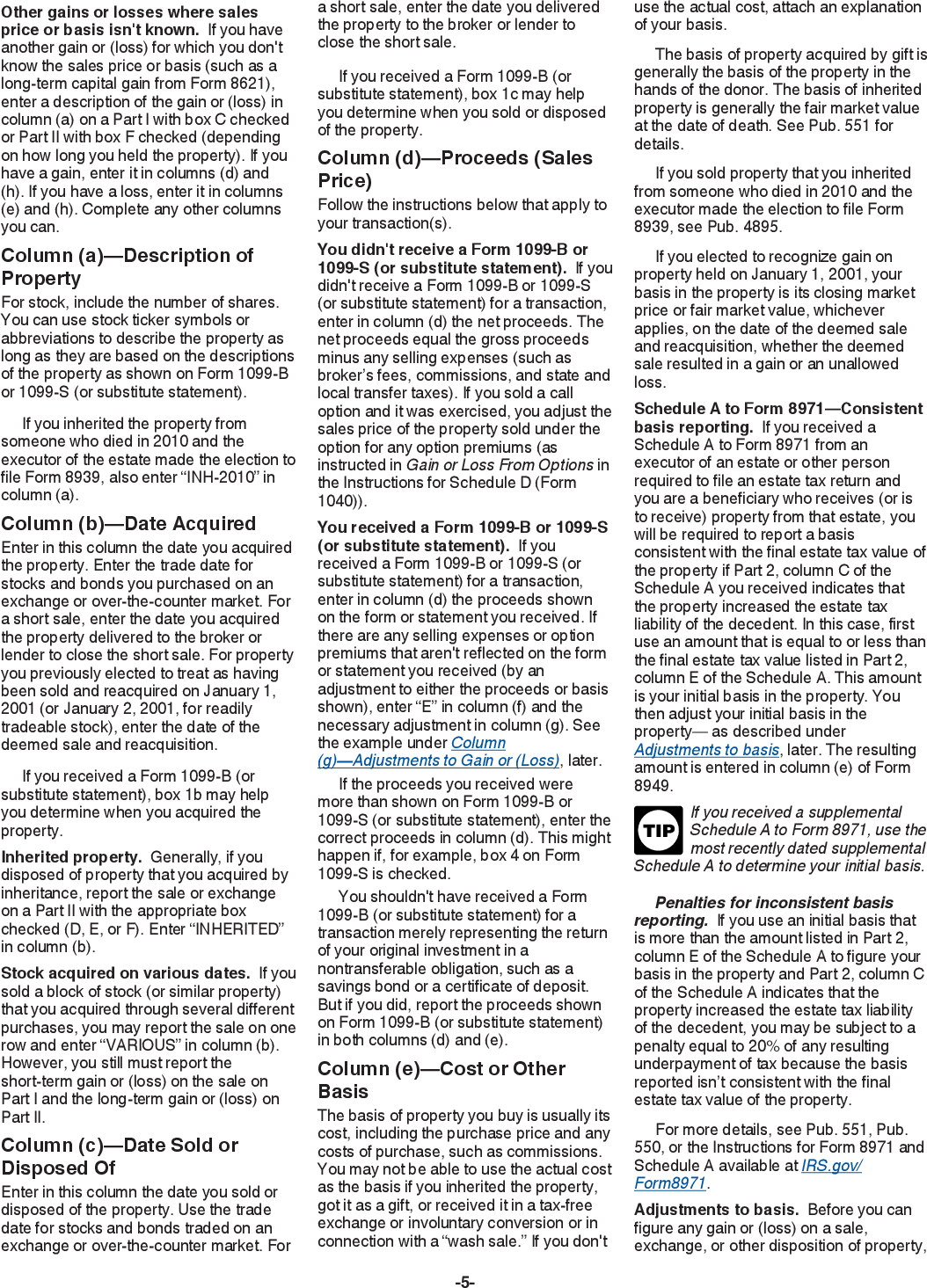

Form 8949 Code H - Individuals use form 8949 to report the following. The same information should be entered in part ii for any long. Report the sale or exchange on form 8949 as you would if you weren't. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any. File form 8949 with the schedule d for the return you are filing. Web for the main home sale exclusion, the code is h. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web to include a code h for the sale of home on schedule d, form 8949, column (f) code (s), do the following: Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and can exclude some or all of the gain… h:

Web download or print the 2022 federal form 8949 (sales and other dispositions of capital assets) for free from the federal internal revenue service. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. The adjustment amount will also be listed on form 8949 and will transfer over to. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Web to include a code h for the sale of home on schedule d, form 8949, column (f) code (s), do the following: Web overview of form 8949: Web for the main home sale exclusion, the code is h. Moreover, while reporting cryptocurrency transactions a taxpayer must keep these irs. The same information should be entered in part ii for any long. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g.

Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Web to include a code h for the sale of home on schedule d, form 8949, column (f) code (s), do the following: Web these adjustment codes will be included on form 8949, which will print along with schedule d. Report the sale or exchange on form 8949 as you would if you weren't. Web overview of form 8949: Web thus, on irs form 8949, a taxpayer has to report capital gains and losses. Moreover, while reporting cryptocurrency transactions a taxpayer must keep these irs. Report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and can exclude some or all of the gain… h:

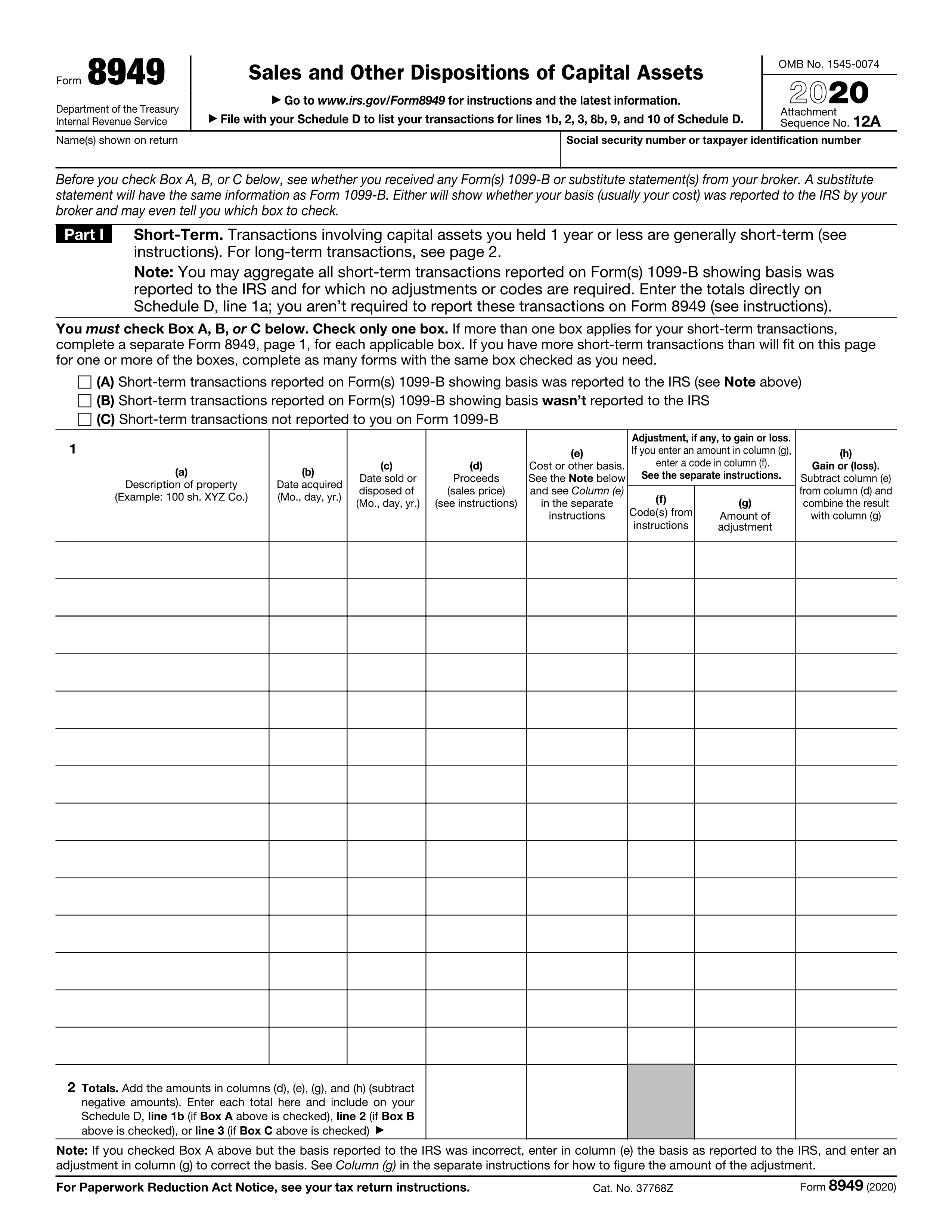

Online IRS Instructions 8949 2019 Fillable and Editable PDF Template

Follow the instructions for the code you need to generate below. The same information should be entered in part ii for any long. •the sale or exchange of a capital asset not reported on another form or schedule. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code.

IRS Form 8949.

Follow the instructions for the code you need to generate below. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Moreover, while reporting cryptocurrency transactions a taxpayer must keep these irs. Web download or print the 2022 federal.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and can exclude some or all of the gain… h: Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Report the sale or exchange on form 8949 as you.

Form 8949 problems YouTube

Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Web use.

Check boxes D and E refer to longterm transactions displayed on Part II.

Report the sale or exchange on form 8949 as you would if you weren't. Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Web use form 8949 to report sales and exchanges of capital assets. Individuals use form 8949 to report the following. Web these adjustment.

In the following Form 8949 example,the highlighted section below shows

Follow the instructions for the code you need to generate below. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any. Individuals use form 8949 to report the following. Web form 8949 department of the treasury internal.

Form 8949 Edit, Fill, Sign Online Handypdf

Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Moreover, while reporting cryptocurrency transactions a taxpayer must keep these irs. Report the sale or exchange on form 8949 as you would if you were not taking the exclusion..

How to Report the Sale of a U.S. Rental Property Madan CA

Web download or print the 2022 federal form 8949 (sales and other dispositions of capital assets) for free from the federal internal revenue service. File form 8949 with the schedule d for the return you are filing. Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and.

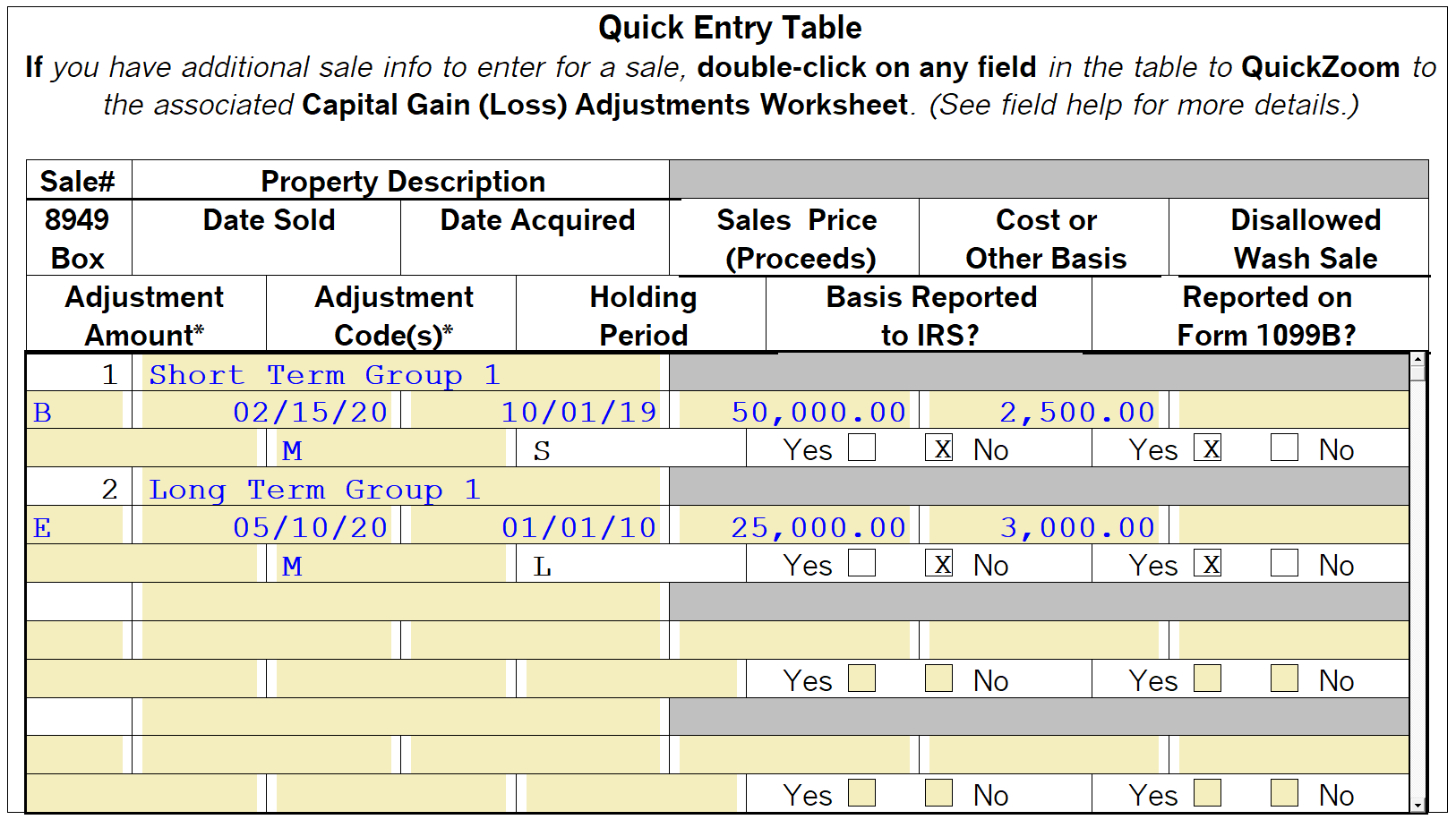

Attach a summary to the Schedule D and Form 8949 in ProSeries

Web download or print the 2022 federal form 8949 (sales and other dispositions of capital assets) for free from the federal internal revenue service. Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Web to include a code h for the sale of home on schedule.

Online generation of Schedule D and Form 8949 for 10.00

Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. Web thus, on irs form 8949, a taxpayer has to report capital gains and losses. Web download or print the 2022 federal form.

Web Use Form 8949 To Report Sales And Exchanges Of Capital Assets.

Web thus, on irs form 8949, a taxpayer has to report capital gains and losses. Report the sale or exchange on form 8949 as you would if you weren't. Moreover, while reporting cryptocurrency transactions a taxpayer must keep these irs. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest.

Report The Sale Or Exchange On Form 8949 As You Would If You Were Not Taking The Exclusion.

The same information should be entered in part ii for any long. Web 12 rows you sold or exchanged your main home at a gain, must report the sale or exchange on form 8949, and can exclude some or all of the gain… h: Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g.

Web These Adjustment Codes Will Be Included On Form 8949, Which Will Print Along With Schedule D.

•the sale or exchange of a capital asset not reported on another form or schedule. The adjustment amount will also be listed on form 8949 and will transfer over to. Web overview of form 8949: File form 8949 with the schedule d for the return you are filing.

Web For The Main Home Sale Exclusion, The Code Is H.

Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Follow the instructions for the code you need to generate below. Web download or print the 2022 federal form 8949 (sales and other dispositions of capital assets) for free from the federal internal revenue service.