Form 8919 Turbotax

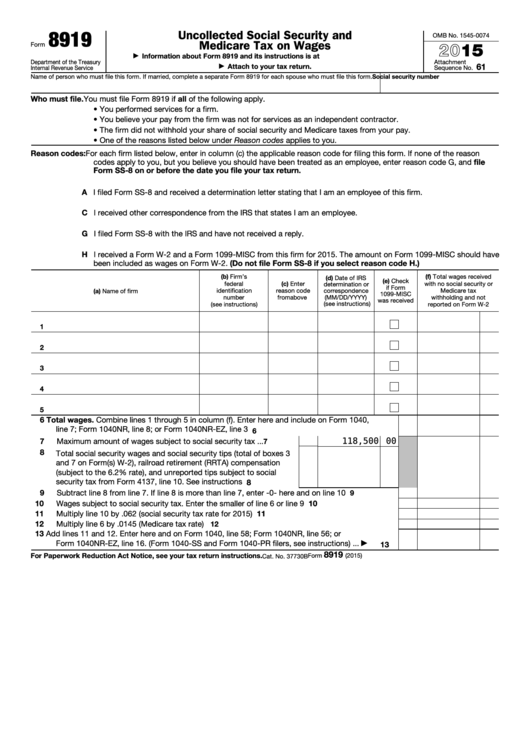

Form 8919 Turbotax - The taxpayer performed services for an individual or a firm. The taxpayer believes that the work conducted for the organization was not in line with the services of an independent contractor. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Easily sort by irs forms to find the product that best fits your tax situation. You performed services for a firm. Meet irs form 8919 jim buttonow, cpa, citp. • if the election is made on behalf of a noncontrolled section 902 corporation or branch of a. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web a go to www.irs.gov/form8919 for the latest information. Web corporation, form 8819 must be filed by an authorized officer or director of the corporation.

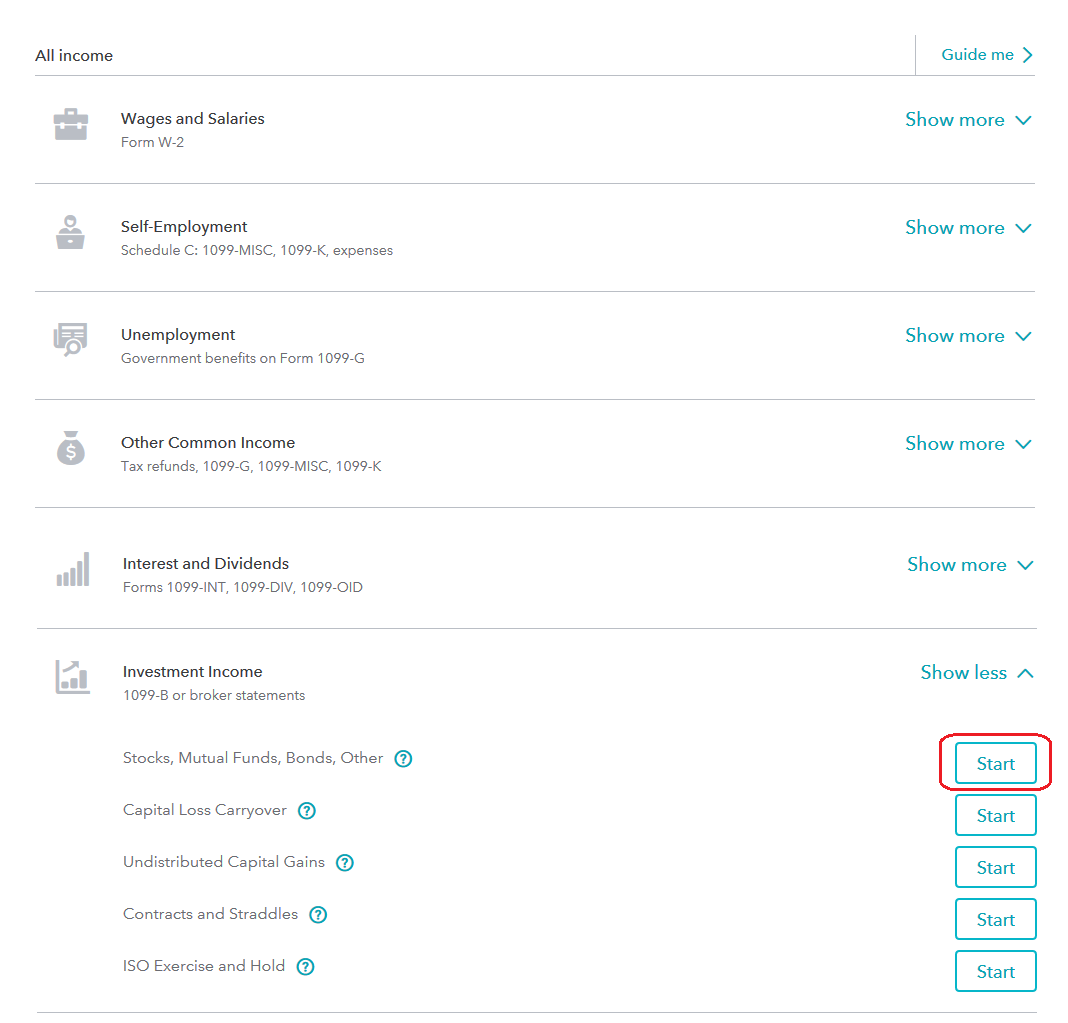

A firm paid them for services provided. In the left menu, select tax tools and then tools. Web open or continue your return in turbotax. Meet irs form 8919 jim buttonow, cpa, citp. Web you still owe your share of employment taxes, which you should report on your federal tax return using form 8919, uncollected social security and medicare tax on wage. 61 name of person who must file this. • if the election is made on behalf of a noncontrolled section 902 corporation or branch of a. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Easily sort by irs forms to find the product that best fits your tax situation. Web so when i do a final review in 2020 online turbotax online web it states this upon review:

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web so when i do a final review in 2020 online turbotax online web it states this upon review: Form 8919, uncollected ss and medicare tax on wages (spouse) form 8919, uncollected ss. Easily sort by irs forms to find the product that best fits your tax situation. • if the election is made on behalf of a noncontrolled section 902 corporation or branch of a. A attach to your tax return. Web open or continue your return in turbotax. 61 name of person who must file this. The taxpayer believes that the work conducted for the organization was not in line with the services of an independent contractor. A firm paid them for services provided.

Fill Form 8919 Uncollected Social Security and Medicare Tax

61 name of person who must file this. In the left menu, select tax tools and then tools. You performed services for a firm. Web open or continue your return in turbotax. Form 8919, uncollected ss and medicare tax on wages (spouse) form 8919, uncollected ss.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web corporation, form 8819 must be filed by an authorized officer or director of the corporation. A attach to your tax return. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. You performed services for a firm. • if the election is made on behalf of a noncontrolled section 902 corporation.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web you still owe your share of employment taxes, which you should report on your federal tax return using form 8919, uncollected social security and medicare tax on wage. Web a go to www.irs.gov/form8919 for the latest information. Meet irs form 8919 jim buttonow, cpa, citp. Web so when i do a final review in 2020 online turbotax online web.

IRS Form 8919 Uncollected Social Security & Medicare Taxes

The taxpayer performed services for an individual or a firm. Meet irs form 8919 jim buttonow, cpa, citp. Form 8919, uncollected ss and medicare tax on wages (spouse) form 8919, uncollected ss. Web corporation, form 8819 must be filed by an authorized officer or director of the corporation. In the left menu, select tax tools and then tools.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web open or continue your return in turbotax. A attach to your tax return. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Form 8919, uncollected ss and medicare tax on wages (spouse) form 8919, uncollected ss. Web so when i do a final review in 2020 online turbotax online web.

What is Form 8919 Uncollected Social Security and Medicare Tax on

You performed services for a firm. Web you still owe your share of employment taxes, which you should report on your federal tax return using form 8919, uncollected social security and medicare tax on wage. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web information.

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: • if the election is made on behalf of a noncontrolled section 902 corporation or branch of a. The.

Entering Form 8949 Totals Into TurboTax® TradeLog Software

A attach to your tax return. In the left menu, select tax tools and then tools. You performed services for a firm. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web corporation, form 8819 must be filed by an authorized officer or director of the corporation.

Fill Free fillable F8919 2018 Form 8919 PDF form

61 name of person who must file this. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web open or continue your return in turbotax. The taxpayer believes that the work conducted for the organization was not in line with the services of an independent contractor..

Form 8919 Uncollected Social Security and Medicare Tax on Wages

Web corporation, form 8819 must be filed by an authorized officer or director of the corporation. A firm paid them for services provided. Easily sort by irs forms to find the product that best fits your tax situation. Meet irs form 8919 jim buttonow, cpa, citp. Web so when i do a final review in 2020 online turbotax online web.

Easily Sort By Irs Forms To Find The Product That Best Fits Your Tax Situation.

A attach to your tax return. The taxpayer believes that the work conducted for the organization was not in line with the services of an independent contractor. In the left menu, select tax tools and then tools. Web you still owe your share of employment taxes, which you should report on your federal tax return using form 8919, uncollected social security and medicare tax on wage.

Web Form 8919, Uncollected Social Security And Medicare Tax On Wages, Will Need To Be Filed If All Of The Following Are True:

Web a go to www.irs.gov/form8919 for the latest information. Web open or continue your return in turbotax. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web so when i do a final review in 2020 online turbotax online web it states this upon review:

• If The Election Is Made On Behalf Of A Noncontrolled Section 902 Corporation Or Branch Of A.

Meet irs form 8919 jim buttonow, cpa, citp. 61 name of person who must file this. Web corporation, form 8819 must be filed by an authorized officer or director of the corporation. The taxpayer performed services for an individual or a firm.

Form 8919, Uncollected Ss And Medicare Tax On Wages (Spouse) Form 8919, Uncollected Ss.

You performed services for a firm. A firm paid them for services provided. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software.