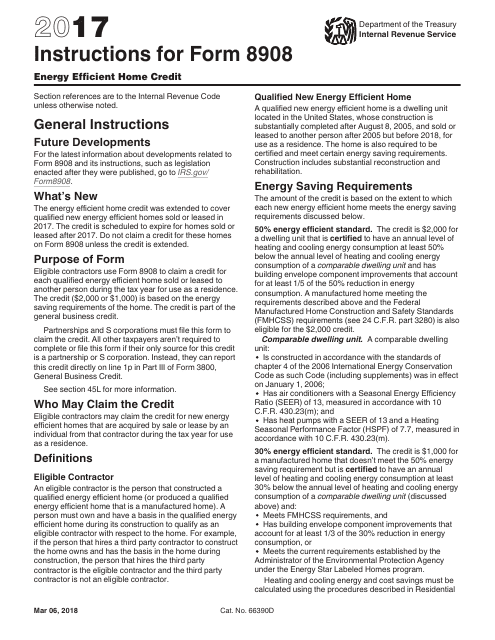

Form 8908 Instructions

Form 8908 Instructions - All revisions are available at irs.gov/form8908. The credit is part of the general business credit. Web how do i complete irs form 8908? Form 8908 and its instructions will no longer be updated annually. Number of homes meeting the 50% standard General instructions future developments for the latest information about developments related to form 8908 and its instructions, such as legislation Web don't claim the credit for homes sold or leased after 2021 unless the credit is extended again. (see the instructions for form 8908). Form 8908 is used by eligible contractors to claim a credit for each qualified energy efficient home sold or leased to another person for use as a residence. Web form 8908 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8908.

Before going to line 1, there are a couple of notes. For tax year 2022, only use lines 1, 2, 7, and 8, as applicable. What’s new the energy efficient home credit was extended to cover qualified new energy efficient homes sold or leased in 2018, 2019, and 2020. All revisions are available at irs.gov/form8908. Form 8908 and its instructions will no longer be updated annually. The credit is based on the energy saving requirements of the home. (see the instructions for form 8908). Use prior revisions of the form and instructions for earlier tax years. Web 1a b multiply line 1a by $2,000. For example, use the 2017 form 8908 with the 2017 instructions for form 8908 for tax year ending december 31, 2017.

Web information about form 8908, energy efficient home credit, including recent updates, related forms, and instructions on how to file. Form 8908 is used by eligible contractors to claim a credit for each qualified energy efficient home sold or leased to another person for use as a residence. General instructions future developments for the latest information about developments related to form 8908 and its instructions, such as legislation Web don't claim the credit for homes sold or leased after 2021 unless the credit is extended again. Form 8908 and its instructions will no longer be updated annually. Web use these instructions and the form 8908 (rev. For example, use the 2017 form 8908 with the 2017 instructions for form 8908 for tax year ending december 31, 2017. Number of homes meeting the 50% standard Before going to line 1, there are a couple of notes. The credit is based on the energy saving requirements of the home.

IRS Form 8582 Instructions A Guide to Passive Activity Losses

Web use the january 2023 revision of form 8908 for tax years beginning in 2022 or later, until a later revision is issued. Web the irs will use form 8908 to monitor and validate claims for the new energy efficient home credit for homes. (see the instructions for form 8908). Web how do i complete irs form 8908? February 2020).

IRS Form 8826 Instructions Claiming the Disabled Access Credit

February 2020) for tax years beginning after 2017. Form 8908 is used by eligible contractors to claim a credit for each qualified energy efficient home sold or leased to another person for use as a residence. Web use the january 2023 revision of form 8908 for tax years beginning in 2022 or later, until a later revision is issued. Number.

Download Instructions for IRS Form 8908 Energy Efficient Home Credit

Web don't claim the credit for homes sold or leased after 2021 unless the credit is extended again. Web how do i complete irs form 8908? The credit is part of the general business credit. Web form 8908 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8908. Credits for lines 3 through 6 are.

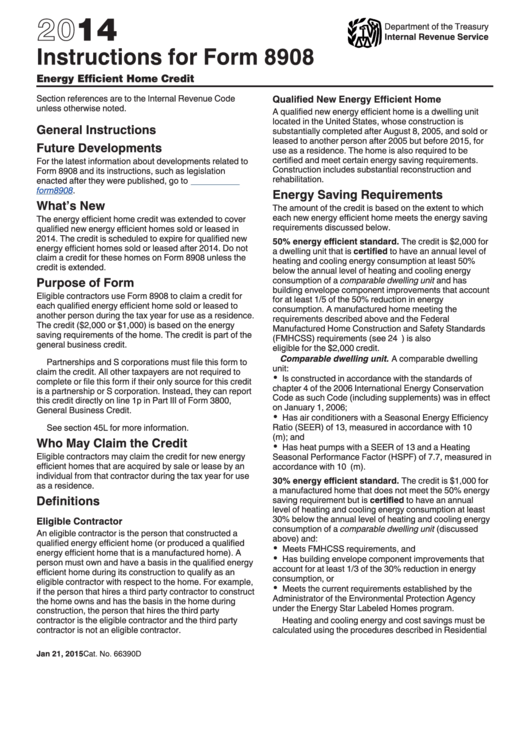

Instructions For Form 8908 Energy Efficient Home Credit 2014

What’s new the energy efficient home credit was extended to cover qualified new energy efficient homes sold or leased in 2018, 2019, and 2020. Web 1a b multiply line 1a by $2,000. The credit is based on the energy saving requirements of the home. Form 8908 and its instructions will no longer be updated annually. The credit is part of.

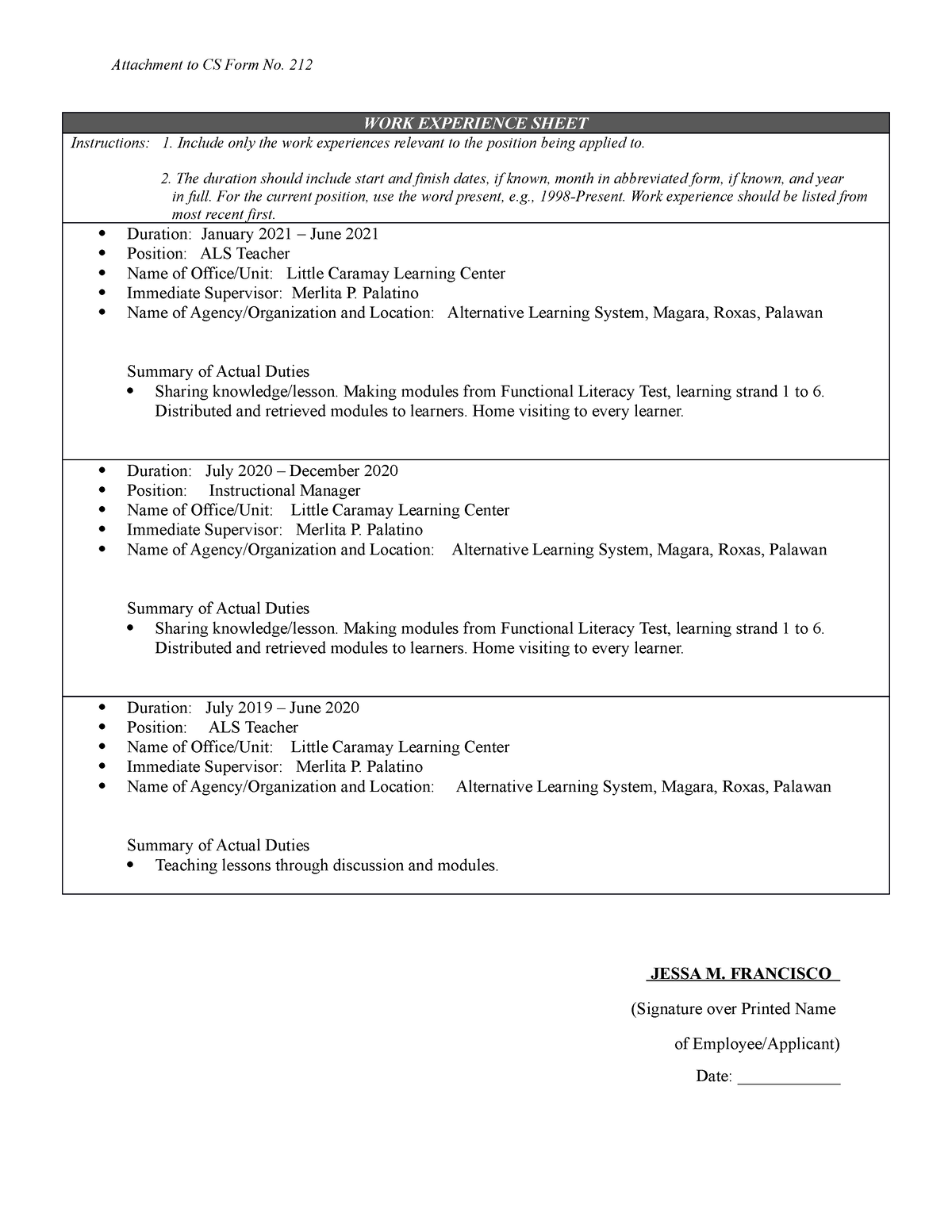

WORK Experience Sheet Form. Attachment to CS Form No. 212

For tax year 2022, only use lines 1, 2, 7, and 8, as applicable. Web form 8908 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8908. All revisions are available at irs.gov/form8908. For example, use the 2017 form 8908 with the 2017 instructions for form 8908 for tax year ending december 31, 2017. For.

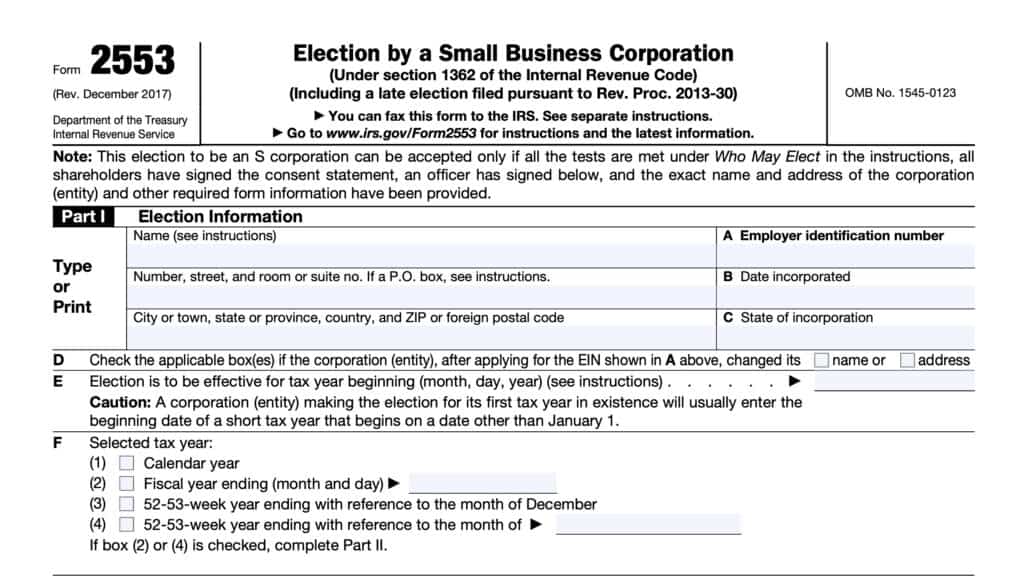

Form 12 Filing Instructions Ten Great Lessons You Can Learn From Form

(see the instructions for form 8908). The credit is based on the energy saving requirements of the home. Eligible contractors may claim the credit for new energy efficient homes that are acquired by sale or lease by an individual from that contractor during the tax year for use as a residence. Use prior revisions of the form and instructions for.

Fill Free fillable Form 8908 Energy Efficient Home Credit 2020 PDF form

What’s new the energy efficient home credit was extended to cover qualified new energy efficient homes sold or leased in 2018, 2019, and 2020. General instructions future developments for the latest information about developments related to form 8908 and its instructions, such as legislation Web information about form 8908, energy efficient home credit, including recent updates, related forms, and instructions.

IRS Form 8396 Instructions Claiming the Mortgage Interest Credit

Web information about form 8908, energy efficient home credit, including recent updates, related forms, and instructions on how to file. Web use the january 2023 revision of form 8908 for tax years beginning in 2022 or later, until a later revision is issued. For example, use the 2017 form 8908 with the 2017 instructions for form 8908 for tax year.

Instructions for Completing Course Data Entry Form 1 The following

The credit is part of the general business credit. For previous tax years, see the applicable form 8908 and instructions. Form 8908 is used by eligible contractors to claim a credit for each qualified energy efficient home sold or leased to another person for use as a residence. Before going to line 1, there are a couple of notes. Form.

Form 8908 Energy Efficient Home Credit Editorial Photography Image of

Web 1a b multiply line 1a by $2,000. Web use the january 2023 revision of form 8908 for tax years beginning in 2022 or later, until a later revision is issued. Form 8908 and its instructions will no longer be updated annually. Web information about form 8908, energy efficient home credit, including recent updates, related forms, and instructions on how.

1B 2 A Enter The Total Number Of Qualified Energy Efficient Manufactured Homes Meeting The 30% Standard That Were Sold Or Leased Before 2023 To Another Person For Use As A Residence During The Tax Year.

Before going to line 1, there are a couple of notes. Web 1a b multiply line 1a by $2,000. What’s new the energy efficient home credit was extended to cover qualified new energy efficient homes sold or leased in 2018, 2019, and 2020. Web form 8908 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8908.

(See The Instructions For Form 8908).

The credit is part of the general business credit. For example, use the 2017 form 8908 with the 2017 instructions for form 8908 for tax year ending december 31, 2017. For previous tax years, see the applicable form 8908 and instructions. Credits for lines 3 through 6 are for homes sold or leased after 2022.

Web Use The January 2023 Revision Of Form 8908 For Tax Years Beginning In 2022 Or Later, Until A Later Revision Is Issued.

Web don't claim the credit for homes sold or leased after 2021 unless the credit is extended again. Web how do i complete irs form 8908? Eligible contractors may claim the credit for new energy efficient homes that are acquired by sale or lease by an individual from that contractor during the tax year for use as a residence. Energy saving requirements 50% energy efficient standard the allowable credit is $2,000.

General Instructions Future Developments For The Latest Information About Developments Related To Form 8908 And Its Instructions, Such As Legislation

Form 8908 and its instructions will no longer be updated annually. The credit is based on the energy saving requirements of the home. Web use these instructions and the form 8908 (rev. Form 8908 is used by eligible contractors to claim a credit for each qualified energy efficient home sold or leased to another person for use as a residence.