Form 8886 Threshold

Form 8886 Threshold - Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as an attachment to your income tax return or information return for the first tax year in which the threshold amount is reached and to any subsequent income tax return or. Web form 8886 reportable transactions: Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; To be considered complete, the information provided on form 8886 must: When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for each year that the affected transaction has an impact on the return. Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. Web the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold. Web losses that must be reported on forms 8886 and 8918.

Web form 8886 reportable transactions: When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal. Stated another way — riding the line is not illegal unless a taxpayer crosses the line. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Web the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold. Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as an attachment to your income tax return or information return for the first tax year in which the threshold amount is reached and to any subsequent income tax return or. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has participated in a loss transaction and must file form 8886. Web losses that must be reported on forms 8886 and 8918. Check all the boxes that apply. Does an individual with an irc § 165 loss in the current year that arose from a single irc § 988 transaction of $50,000 have a.

Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. Stated another way — riding the line is not illegal unless a taxpayer crosses the line. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web losses that must be reported on forms 8886 and 8918. The ftb may impose penalties if the organization fails to file federal form 8886, or any other required information. Web form 8886 reportable transactions: The penalty is due regardless of whether any tax deficiency results from the transaction. To be considered complete, the information provided on form 8886 must: When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal.

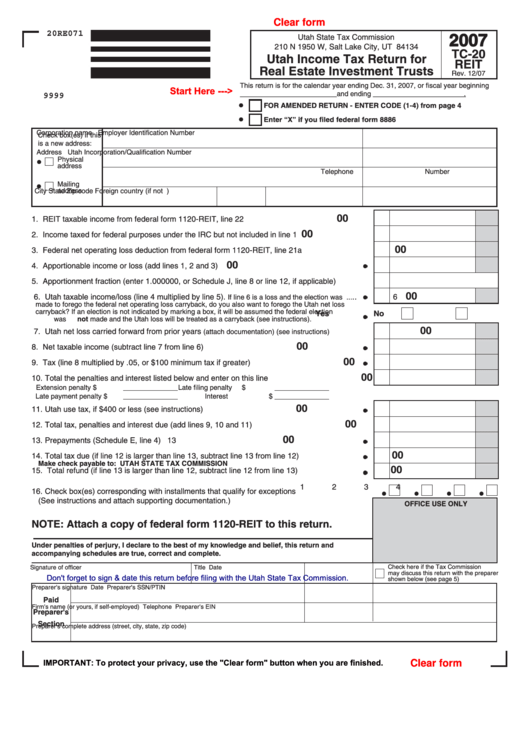

Fillable Form Tc20 Reit Utah Tax Return For Real Estate

Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as an attachment to your income tax return or information return for the first tax year in which the threshold amount is reached and to any subsequent income tax return or. Web form.

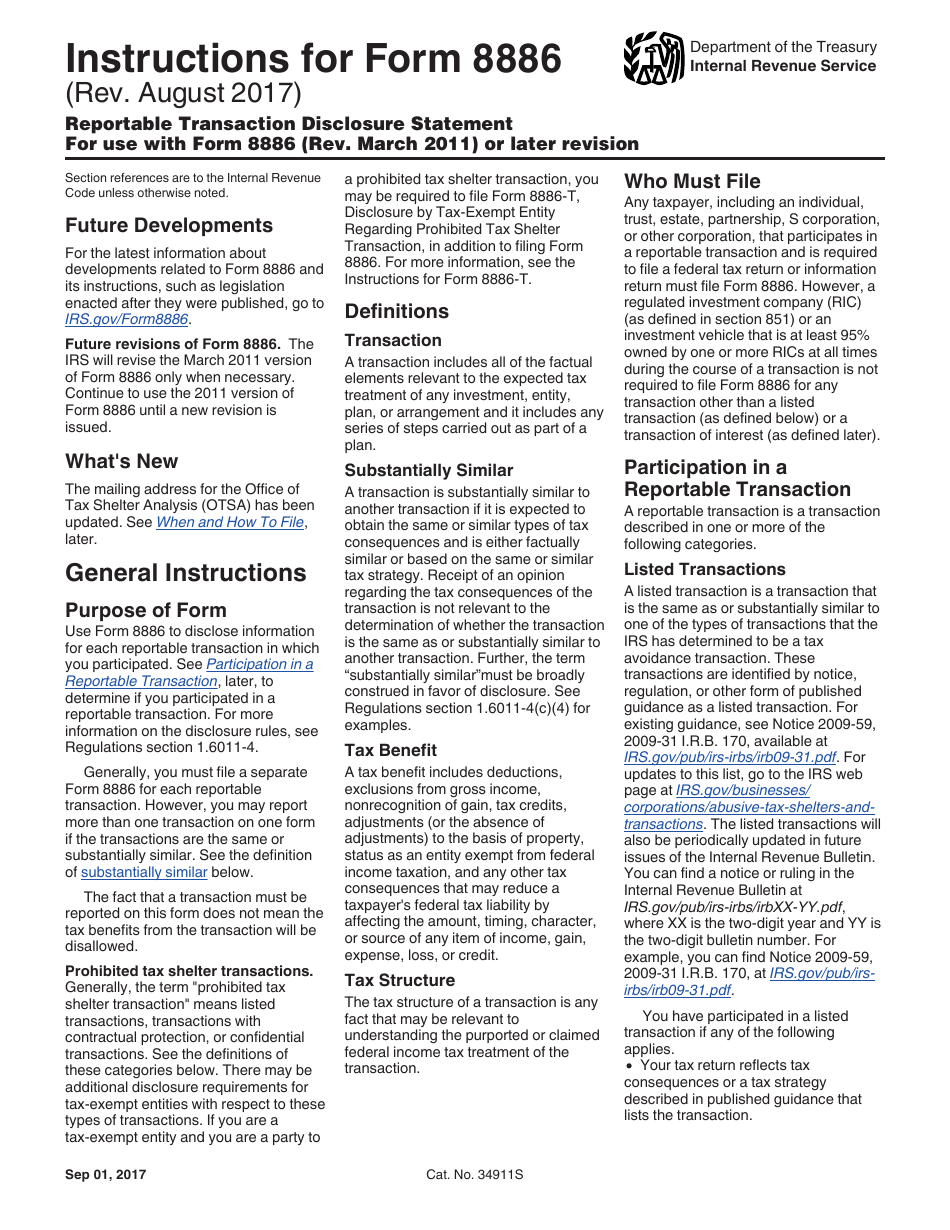

Download Instructions for IRS Form 8886 Reportable Transaction

Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as an attachment to your income tax return or information return for the first tax year in which the threshold amount is reached and to any subsequent income tax return or. Web information.

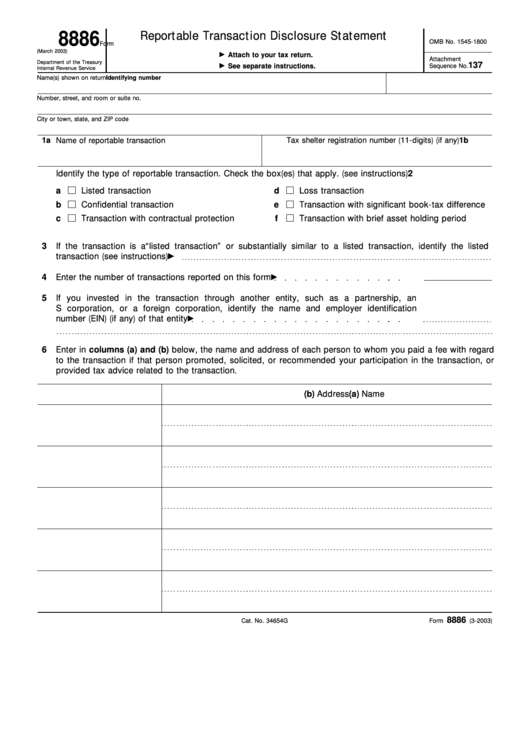

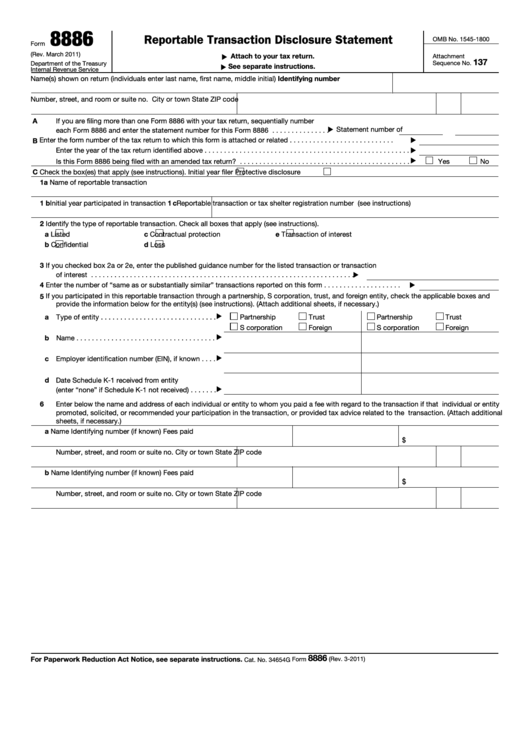

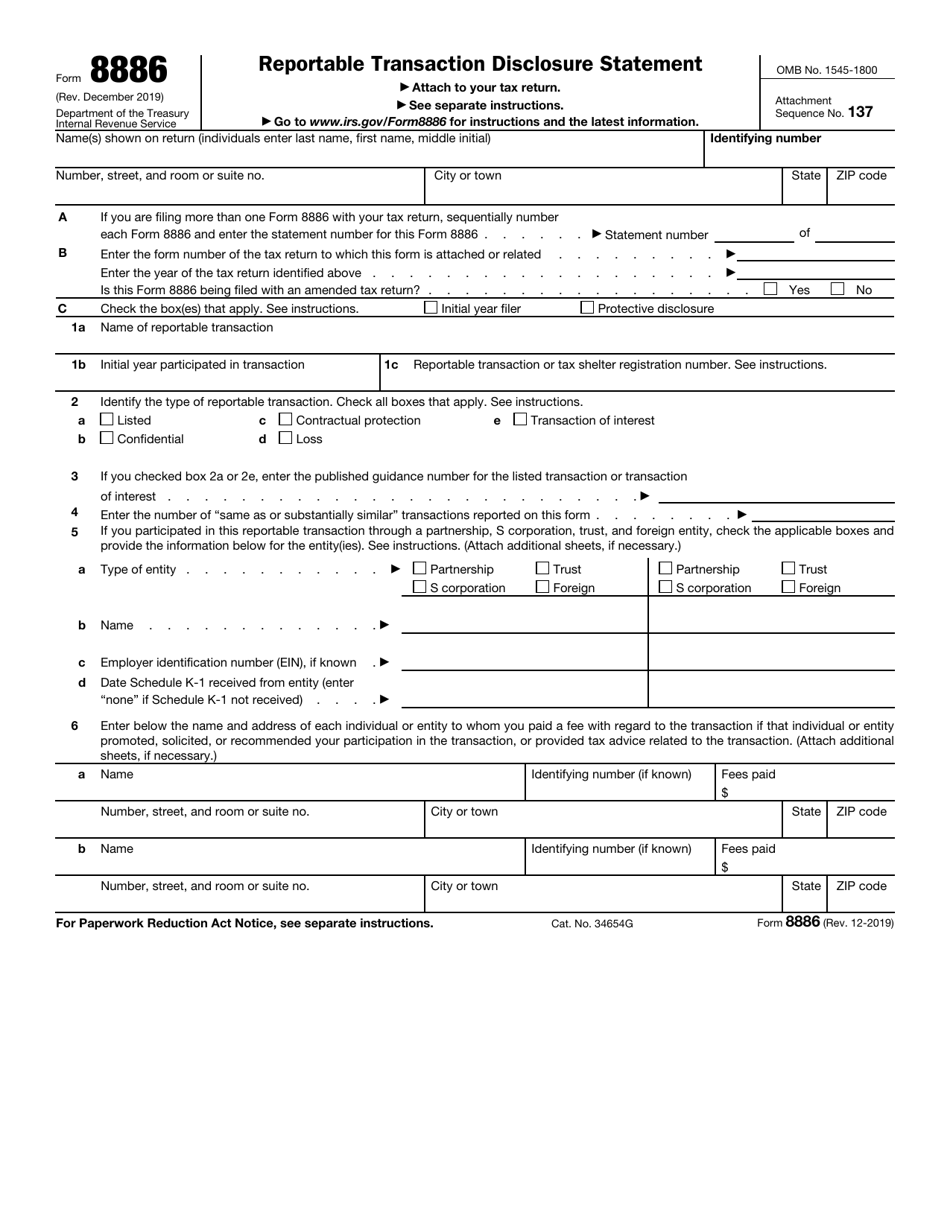

Fillable Form 8886 (Rev. March 2003) Reportable Transaction Disclosure

Web losses that must be reported on forms 8886 and 8918. When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original.

Form 8886 Reportable Transaction Disclosure Statement Editorial

Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. To be considered complete, the information provided on form 8886 must: Describe the expected tax treatment and all potential tax benefits expected to result.

Fillable Form 8886 Reportable Transaction Disclosure Statement

Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal. Stated another way — riding the line is not illegal unless a taxpayer.

IRS Form 8886 Download Fillable PDF or Fill Online Reportable

Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal..

Fill Free fillable F8886 Form 8886 (Rev. December 2019) PDF form

When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal. Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as an.

Section 79 Plans and Captive Insurance Form 8886

To be considered complete, the information provided on form 8886 must: Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for each year that the affected transaction has an impact on the return. Mail tax shelter filing abs 389 ms f340 franchise tax.

Form 8886 Instructions Fill Out and Sign Printable PDF Template signNow

Stated another way — riding the line is not illegal unless a taxpayer crosses the line. Web form 8886 reportable transactions: Check all the boxes that apply. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has participated in a loss transaction and must file.

Form 8886 Edit, Fill, Sign Online Handypdf

Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has participated in a loss transaction and must file form 8886. Web losses that must be reported on forms 8886 and 8918. Web.

When It Comes To Tax Avoidance, As Long As The Us Taxpayer Is Not Intentionally Seeking To Illegally Evade Tax, Then Seeking To Legally Avoid Or Minimize Tax Is Not Illegal.

If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has participated in a loss transaction and must file form 8886. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Does an individual with an irc § 165 loss in the current year that arose from a single irc § 988 transaction of $50,000 have a. Stated another way — riding the line is not illegal unless a taxpayer crosses the line.

Web If This Is The First Time The Reportable Transaction Is Disclosed On The Return, Send A Duplicate Copy Of The Federal Form 8886 To The Address Below.

To be considered complete, the information provided on form 8886 must: The penalty is due regardless of whether any tax deficiency results from the transaction. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for each year that the affected transaction has an impact on the return. Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions.

Web Losses That Must Be Reported On Forms 8886 And 8918.

Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web form 8886 reportable transactions: To be considered complete, the information provided on form 8886 must: Mail tax shelter filing abs 389 ms f340 franchise tax board po box 1673

Check All The Boxes That Apply.

Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as an attachment to your income tax return or information return for the first tax year in which the threshold amount is reached and to any subsequent income tax return or. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold. The ftb may impose penalties if the organization fails to file federal form 8886, or any other required information.